Do I Qualify For Heat Pump Rebate What Products are Eligible Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 10 Ductless mini splits

If you installed a qualifying heat pump HVAC system or water heater in 2022 or earlier you may be eligible for a tax credit of up to 300 But beginning in 2023 you could be eligible for a tax credit of up to 2 000 for qualifying heat pumps and heat pump water heaters under the new tax guidelines included in the Inflation Reduction Act According to data from the National Renewable Energy Laboratory switching to a heat pump can reduce annual heating and cooling bills anywhere from 100 to 1 300 per year with the average homeowner saving 667 per year by switching to a heat pump

Do I Qualify For Heat Pump Rebate

Do I Qualify For Heat Pump Rebate

https://cdn11.bigcommerce.com/s-ih6ina3dd8/product_images/uploaded_images/airconditionheatpump.png

Green Mountain Power Heat Pump Rebate PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-water-heater-rebate-green-mountain-power-8.jpg

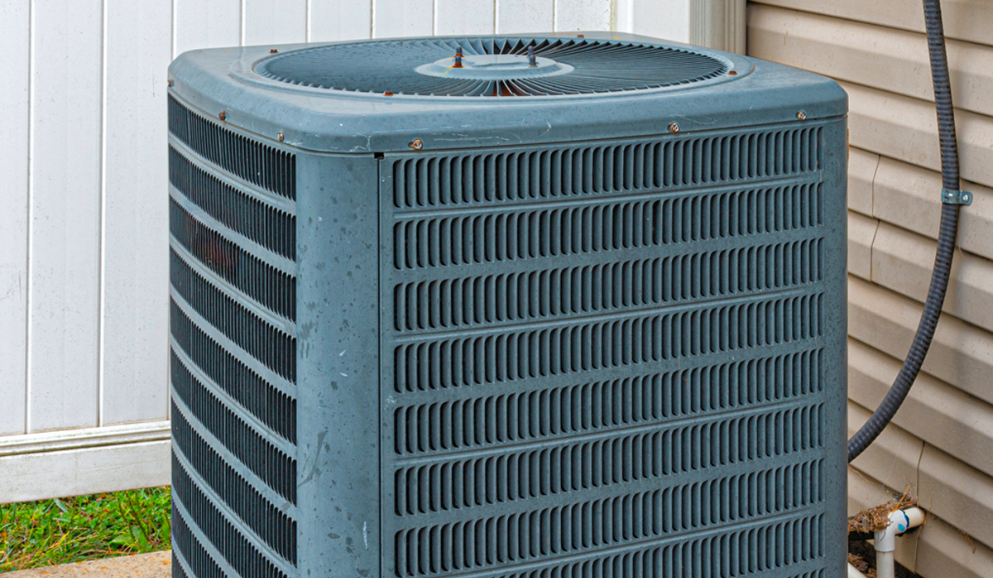

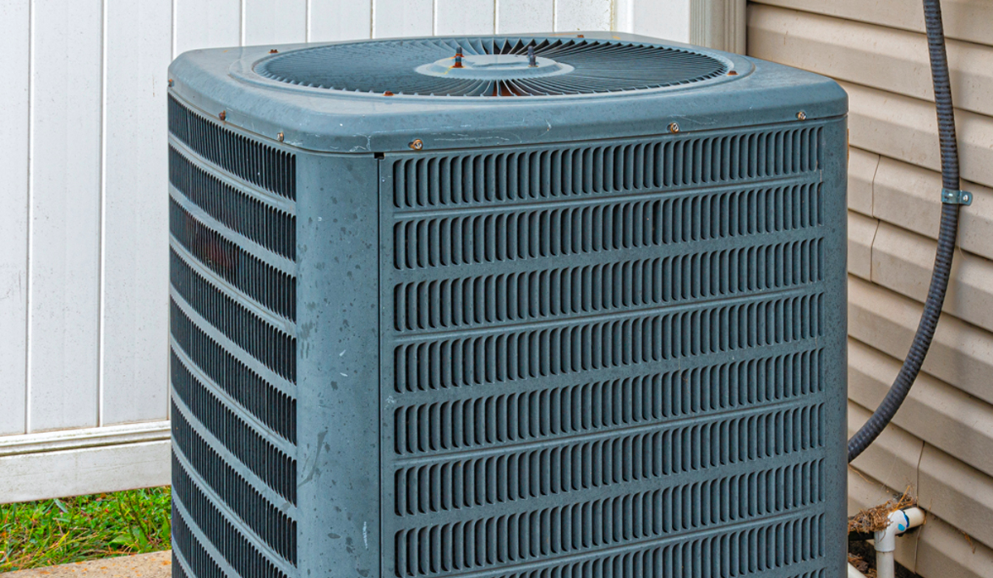

Getting A Heat Pump May Qualify You For A Rebate

https://www.tcsindy.com/wp-content/uploads/2023/05/heat-pump.jpg

Who Qualifies for a Heat Pump Tax Credit or Rebate Any taxpayer would qualify for the federal tax credits For the tax credit program the new incentives will apply to equipment installed 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

Yes states may allow consumers to receive a rebate for a qualifying kitchen appliance electric stove cooktop range or oven and an electric heat pump clothes dryer The rebate available for both appliances cannot exceed 840 in total Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related Resources How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032

Download Do I Qualify For Heat Pump Rebate

More picture related to Do I Qualify For Heat Pump Rebate

Conservation Residential Heat Pump Water Heater Rebate Form

https://grotonutilities.com/wp-content/uploads/2021/03/Hybrid-Heat-Pump-Water-Heater-Rebate-1280x319.png

Efficiency Nova Scotia Heat Pump Rebate Application PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/nova-scotia-heating-rebate-application-2016-18.png?fit=439%2C1024&ssl=1

What Is California Heat Pump Rebate How Can You Qualify HVACFAQ

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/what-is-california-heat-pump-rebate-how-can-you-qualify-hvacfaq.jpg?fit=1280%2C720&ssl=1

Eligibility To be eligible for this incentive you must have a combined household income of less than 210 000 per year before tax be an owner occupier of a home valued at under 3 million be replacing an existing hot water system that is Electric Vehicles Energy Saving Tips Home Upgrades From solar panels to stove tops you can get money back whether you re replacing an old appliance or installing new technology The money is returned to you in two ways a tax credit or a rebate How to claim a tax credit Make your upgrade

Eligible homeowners can get rebates as high as 8 000 for heat pump installation 1 750 for a heat pump water heater 840 to offset the cost of a heat pump clothes dryer or an electric stove Rebates for non appliance upgrades are also available up to the following amounts 4 000 for electrical panel upgrades Low and moderate income households might qualify for a heat pump rebate up to 8 000 but there are many restrictions Some state and local governments already offer significant incentives for choosing heat pumps as do many utility companies More incentives are available for other electric appliances and home energy efficiency upgrades

Smeco Heat Pump Rebates PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-124.png

Delmarva Heat Pump Rebate PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/750-rebate-for-heat-pump-with-efficiency-advantage-heating-and-cooling-83.png

https://www.energystar.gov/.../air-source-heat-pumps

What Products are Eligible Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 10 Ductless mini splits

https://sealed.com/resources/heat-pump-tax-credits-and-rebates

If you installed a qualifying heat pump HVAC system or water heater in 2022 or earlier you may be eligible for a tax credit of up to 300 But beginning in 2023 you could be eligible for a tax credit of up to 2 000 for qualifying heat pumps and heat pump water heaters under the new tax guidelines included in the Inflation Reduction Act

Heat Pump Water Heater Rebate Massachusetts PumpRebate

Smeco Heat Pump Rebates PumpRebate

Heat Pump Rebates Pennsylvania PumpRebate

Clay Electric Heat Pump Rebates PumpRebate

Fujitsu Canada Heat Pump Rebate PumpRebate

Heat Pump Rebate Pge PumpRebate

Heat Pump Rebate Pge PumpRebate

Government Rebate On Heat Pumps PumpRebate

Jan 2018 Lennox Rebate Email SMO Energy PumpRebate

2023 Heat Pump Rebate For Texas HEEHRA

Do I Qualify For Heat Pump Rebate - In fact many Americans will be eligible for a free heat pump to cool and heat their home in 2023 while other homeowners will qualify for other rebates or tax credits If you decide to purchase a heat pump HVAC can deliver a comprehensive HVAC quote within 24 hours giving you peace of mind to move forward with confidence