Nys Tax Rebate 2024 The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

Form IT 2104 is one of the forms your employer asks you to complete when you begin a new job in New York State And it s a powerful tool for managing what comes out of your pay check If you got married had a baby or experienced other big life changes in 2023 share the good news with us and your employer using Form IT 2104 Complete Form IT 2104 California Stimulus Colorado TABOR Refunds Georgia Tax Rebates Maine Energy Relief Payments Massachusetts 62F Refunds Michigan Working Famlies Tax Credit Minnesota Rebate Checks Montana

Nys Tax Rebate 2024

Nys Tax Rebate 2024

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Nys-Property-Tax-Rebate-Checks-2023.jpg?resize=768%2C555&ssl=1

NYS Property Tax Rebate 2023 Eligibility Criteria And Application Process Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Nys-Property-Tax-Rebate-2023.jpg?ssl=1

Homeowner Tax Rebate Credit Checks On Their Way To NYS Residents WWTI InformNNY

https://www.informnny.com/wp-content/uploads/sites/58/2022/06/GettyImages-985842598-2.jpg?w=1752&h=986&crop=1

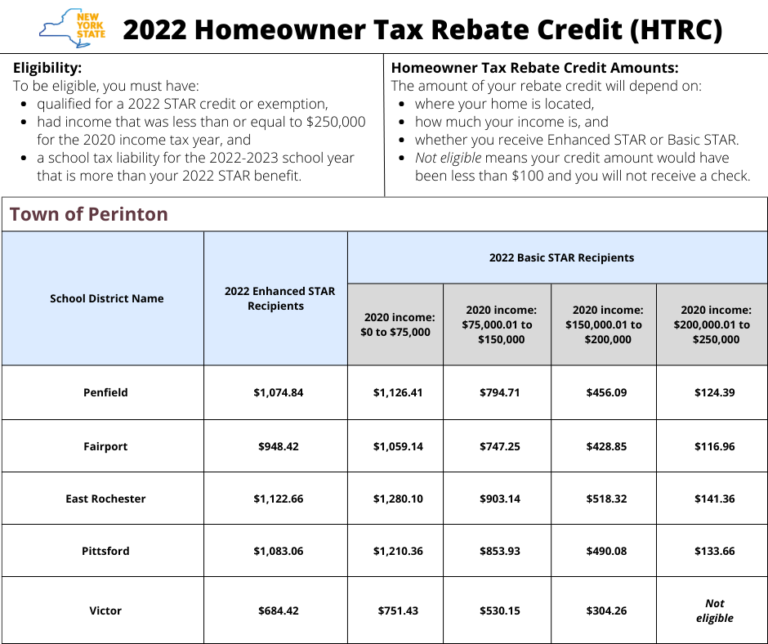

The standard deduction for a Married separate Filer in New York for 2024 is 8 000 00 New York Married separate Filer Tax Tables New York Head of Household Filer Standard Deduction The standard deduction for a Head of Household Filer in New York for 2024 is 8 000 00 New York Head of Household Filer Tax Tables 2022 Homeowner Tax Rebate Credit Check Lookup 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions

Heating Cooling and Water Heating Other Energy Efficiency Upgrades For additional information about the IRA NYSERDA recommends individual New York taxpayers to visit the following resources Information and updates on how the IRA is changing federal tax laws White House s Clean Energy For All Rewiring America s IRA map of New York The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns accelerated the distribution of 2 2 billion in tax relief to more than 2 million New Yorkers through the

Download Nys Tax Rebate 2024

More picture related to Nys Tax Rebate 2024

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In NYS 2023 Budget WRGB

https://cbs6albany.com/resources/media2/16x9/full/1015/center/80/6df365a4-868a-491a-b350-4442a687917a-large16x9_thumb_196074.png

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://perinton.org/wp-content/uploads/2022-Homeowner-Tax-Rebate-Credit-HTRC-1-768x644.png

Nys School Tax Relief Checks Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/NYS-Drive-Clean-Rebate-Form-1024x812.png

Definition of income for the homeowner tax rebate credit For the homeowner tax rebate credit income was defined as federal adjusted gross income FAGI from two years prior tax year 2020 modified so that the net amount of loss reported on federal Schedule C D E or F is 3 000 or less Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year

The plan will also accelerate the implementation of 1 2 billion in New York s existing Middle Class Tax Cut for 6 million New Yorkers which first began to be implemented in 2018 and establish a 1 billion property tax rebate program to put money back into the pockets of more than 2 million New Yorkers who have had to endure rising costs as Search Tax Search Tax Interest rates 2024 Periods covering 1 1 24 12 31 24 Title Period Tax Department Releases Interest Rates 11 24 23 1 01 24 3 31 24 Vaccinate NY Get the facts about the COVID 19 vaccine Donate Life Become an organ donor today Agencies App Directory

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Nys Tax Rebate Checks 2023 Tax Rebate

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-new-stimulus-checks-up-to-1-050-are-going-out-soon-to-nys-homeowners-from-nys-taxation-rebate-checks-2023-post.png?w=979&ssl=1

https://www.newsweek.com/stimulus-check-update-homeowners-this-state-can-apply-rebate-1852264

The income limit for this program for 2024 is 98 700 The Bulletin Seagulls swirl around the Statue of Liberty at the end of the day in New York City on December 7 2023 New York state

https://www.tax.ny.gov/

Form IT 2104 is one of the forms your employer asks you to complete when you begin a new job in New York State And it s a powerful tool for managing what comes out of your pay check If you got married had a baby or experienced other big life changes in 2023 share the good news with us and your employer using Form IT 2104 Complete Form IT 2104

Nys Tax Rebate Checks 2023 Tax Rebate

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Your Stories Q A Where Is My NYS Homeowner Tax Rebate Credit Check YouTube

Virginia Tax Rebate 2024

New York State Tax Exempt Form St 119 ExemptForm

Tax Rebate Checks Come Early This Year Yonkers Times

Tax Rebate Checks Come Early This Year Yonkers Times

Printable New York State Tax Forms Printable Forms Free Online

Nys Star Tax Rebate Checks 2022 StarRebate

Printable New York State Tax Forms Printable Forms Free Online

Nys Tax Rebate 2024 - 2022 Homeowner Tax Rebate Credit Check Lookup 2022 Homeowner Tax Rebate Credit Check Lookup Note The homeowner tax rebate credit was a one year program which ended in 2022 The credit is not available for future years If you have questions about the program or received a letter regarding your 2022 payment see Frequently asked questions