Do Llc Receive 1099 Learn when and how to file form 1099 for contractors or vendors who provide services or goods to your LLC Find out the differences between sole

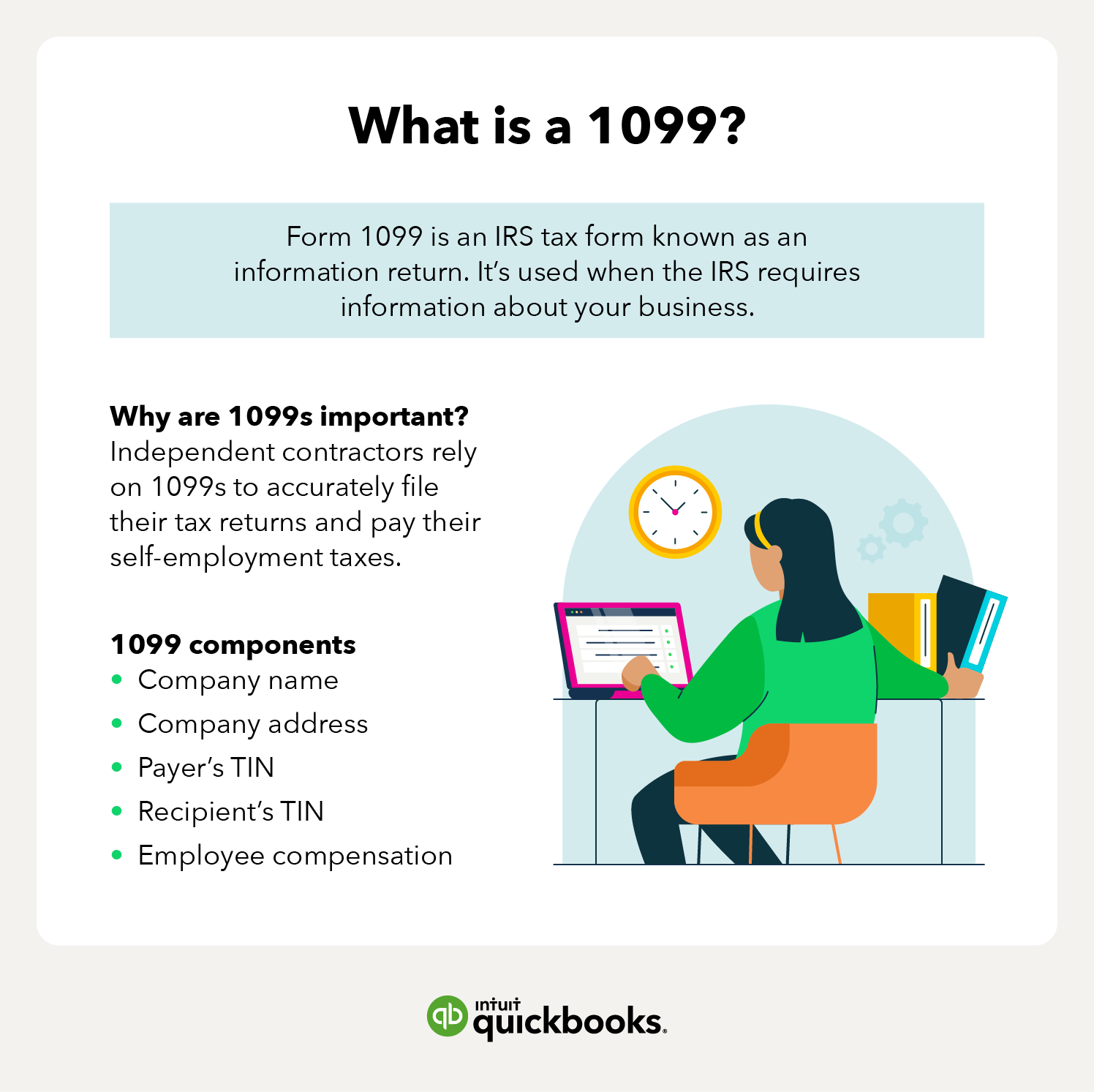

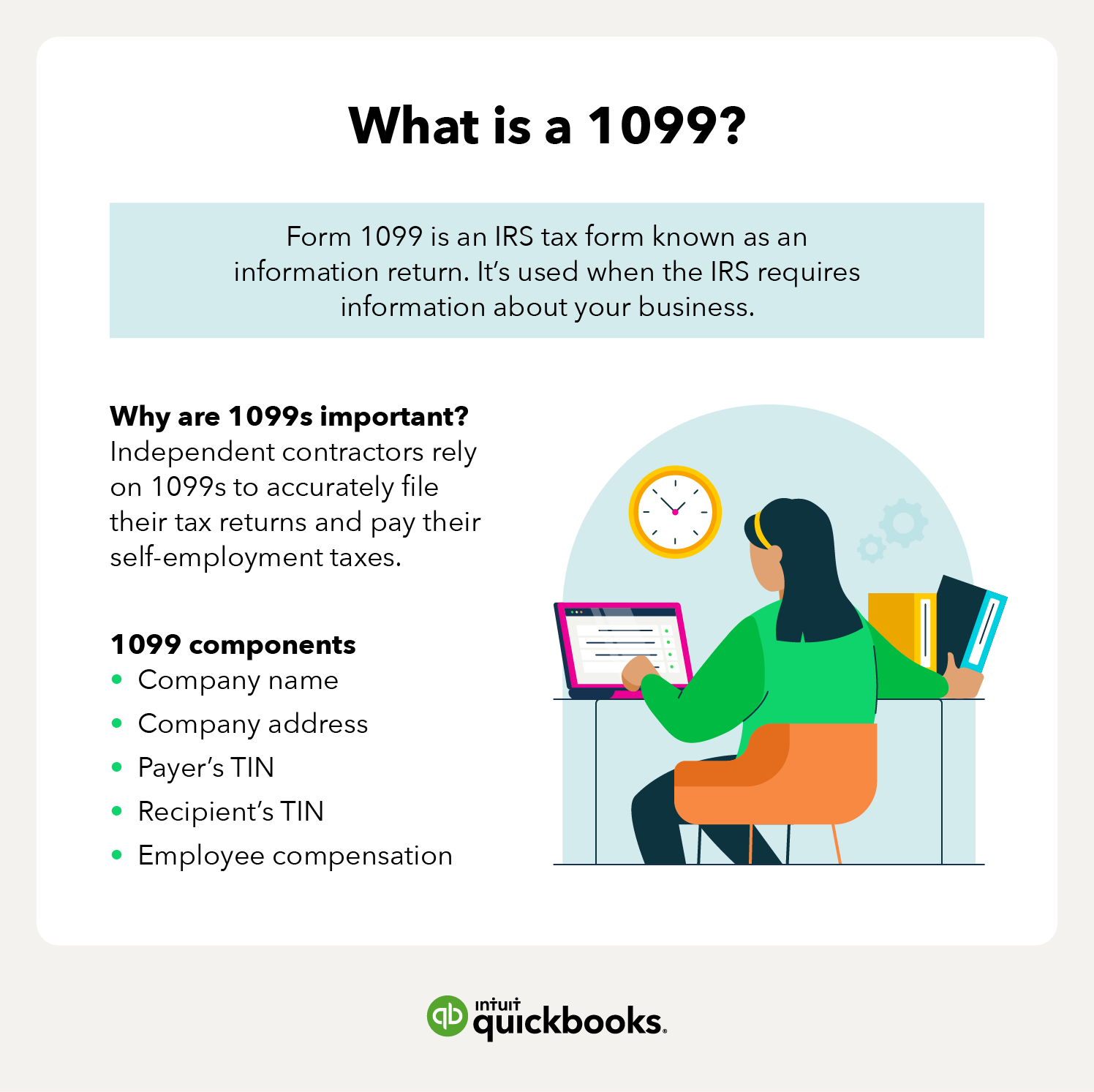

Do you need to send a 1099 to an LLC Whether you need to send a 1099 to an LLC will depend on its tax status since only some types of LLCs require a 1099 to be filed Do LLCs get a 1099 The answer is not a simple yes or no This article provides some guidelines for knowing when an LLC should get a 1099

Do Llc Receive 1099

Do Llc Receive 1099

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/1099-summary.png

Everything About Tax Form 1099 NEC PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2013/09/7K0A0032-1024x682.jpg

Your Free Guide To The 1099 Tax Form OPG Guides

https://cdn.opgguides.com/wp-content/uploads/sites/239/2022/04/Cover_1099-Tax-Form.jpg

Learn when and how an LLC receives a 1099 form for tax purposes depending on its tax status and the type of payment Find out the requirements Learn when and how LLCs receive and issue 1099 forms for different types of payments Find out the exceptions penalties and importance of reporting income

Understanding How to File a 1099 for Your LLC Filing a 1099 for your limited liability company LLC can seem overwhelming but it doesn t have to be With Learn how tax classification affects whether an LLC should get a 1099 and how to complete a Form W 9 correctly Find out the difference between disregarded entity S corp C corp and partnership

Download Do Llc Receive 1099

More picture related to Do Llc Receive 1099

Do You Receive 1099 MISC Forms ATax Center LLC

https://www.ataxcenterllc.com/wp-content/uploads/2015/02/tax-form_zJ002vvu.jpg

How To Use The New 1099 NEC Form For 2020 SWK Technologies Inc

https://www.dynamictechservices.com/wp-content/uploads/2020/11/1099-NEC-blog-header-Final-768x445.png

Business News 8 Feb 2014 15 Minute News Know The News

https://blogs-images.forbes.com/tomtaulli/files/2014/02/5512347305_20dda91167_b.jpg

Should an LLC receive 1099 Copies If your business makes payments to an LLC that are required to be reported to the IRS you may need to file a 1099 and Single member LLCs that have not elected to be treated as a corporation for tax purposes generally do not receive 1099 forms Instead the income and expenses of the LLC are reported on the

If your business pays an LLC more than 600 a year for rent or services you ll need to issue a 1099 Form to the LLC and file it with the Internal Revenue Service Issuing a 1099 isn t difficult but it s an If you re a single member LLC or taxed as a partnership you will receive a 1099 from a company that pays you 600 or more in annual income Meanwhile

E file Form 1099 DIV IRS Form 1099 DIV Dividends And Distributions

https://d2rcescxleu4fx.cloudfront.net/images/1099-DIV.jpg

What Is Form 1099 B Proceeds From Broker And Barter Exchange InfoComm

https://www.infocomm.ky/wp-content/uploads/2020/09/1600287592.jpeg

https://www.upcounsel.com/do-llc-get-1099

Learn when and how to file form 1099 for contractors or vendors who provide services or goods to your LLC Find out the differences between sole

https://www.marketwatch.com/guides/…

Do you need to send a 1099 to an LLC Whether you need to send a 1099 to an LLC will depend on its tax status since only some types of LLCs require a 1099 to be filed

A Step By Step Guide To Completing Form 1099 MISC With TaxBandits

E file Form 1099 DIV IRS Form 1099 DIV Dividends And Distributions

Selecting The Correct IRS Form 1099 R Box 7 Distribution Codes Ascensus

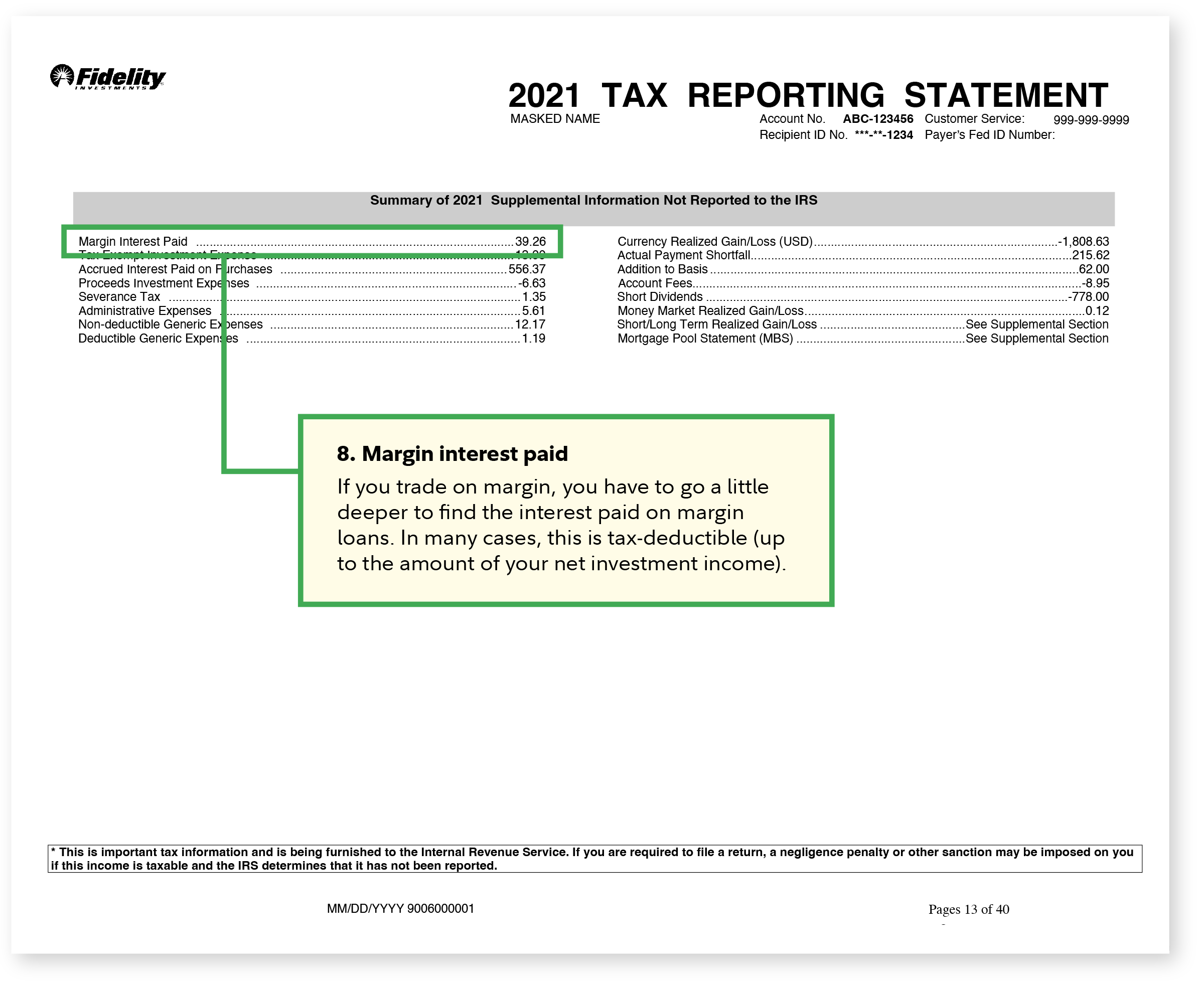

1099 Tax Form 1099 Fidelity

File 1099 5 Important Facts To Know Before Filing Your 1099s

What Do I Do If I Don t Receive A 1099

What Do I Do If I Don t Receive A 1099

Form 1099 E filing Requirements To IRS 1099 Reporting Requirements

Why The IRS Requires The Updated 1099 NEC Form For Contractors Small

Irs 1099 Forms Order Online Form Resume Examples aL71x693MX

Do Llc Receive 1099 - Learn when and how an LLC receives a 1099 form for tax purposes depending on its tax status and the type of payment Find out the requirements