Do Llc Require 1099 If an LLC operates as a sole proprietorship it has to file a 1099 with specific information required by the IRS Required information includes the following

If you own or run a Limited Liability Company LLC then it s very likely you ll receive 1099 forms that you need to include in your tax return and you might even need to send out Starting tax year 2023 if you have 10 or more information returns you must file them electronically This includes Forms W 2 e filed with the Social Security

Do Llc Require 1099

Do Llc Require 1099

https://cdn.opgguides.com/wp-content/uploads/sites/239/2022/04/Cover_1099-Tax-Form.jpg

1099 Vs W 2 What s The Difference QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/1099-worker.png

IMG 1099 Retrohen

https://retro-hen.com/wp-content/uploads/2019/01/IMG_1099.jpeg

If your business pays an LLC more than 600 a year for rent business services or independent contractors you ll need to issue a federal form 1099 to report those payments to the Internal Revenue Service The 1099 requirements for LLC entities are to give the IRS an information return The document serves as your business evidence of the expenses or costs of

When and why you should issue a 1099 to an LLC Issuing a 1099 form to an LLC is necessary when you have paid the LLC 600 or more in a tax year for Generally not required This table provides a concise summary of the 1099 reporting requirements for LLCs It gives an overview of the different types of payments

Download Do Llc Require 1099

More picture related to Do Llc Require 1099

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/1099-example.png

What Is Form 1099 B Proceeds From Broker And Barter Exchange InfoComm

https://www.infocomm.ky/wp-content/uploads/2020/09/1600287592.jpeg

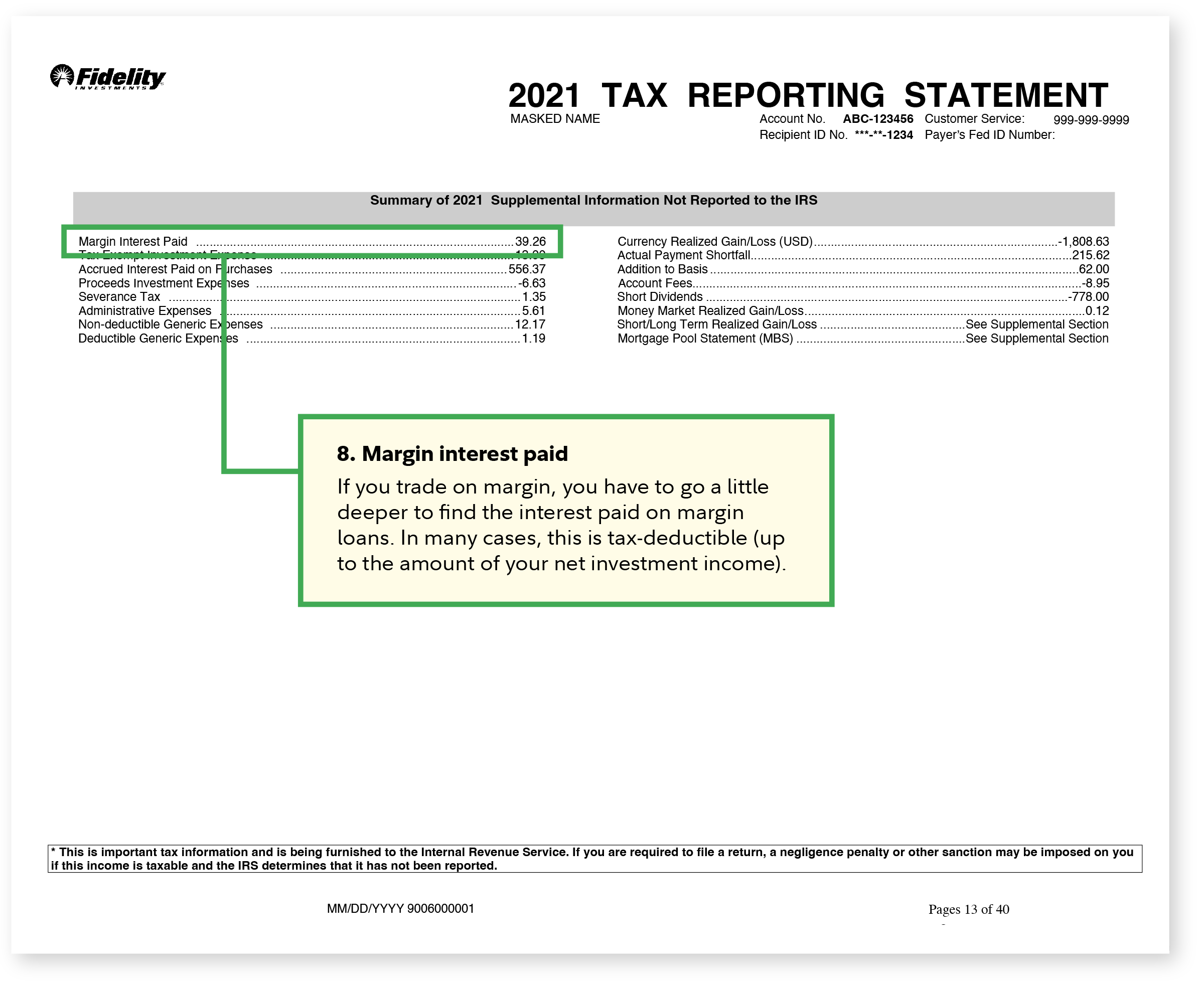

1099 Tax Form 1099 Fidelity

https://www.fidelity.com/bin-public/060_www_fidelity_com/images/Viewpoints/PF/1099taxforms_statement4.png

If you are paying an LLC taxed as a disregarded entity a 1099 is required This document must include the sole proprietor s name and Social Security number as Do LLCs Get 1099s Yes LLCs get 1099s There is nothing in the tax code that says LLCs specifically are exempt from 1099 reporting and many payers issue 1099s to LLCs whether they are required or not

However many LLC owners often wonder whether their company is subject to receiving a 1099 form In this article we will delve into the intricacies of tax This is the key takeaway Filing a 1099 for an LLC that doesn t require it carries no negative tax consequence whereas failing to file a required 1099 will result

1099 Nec Form 2022 Printable Printable Word Searches

https://i2.wp.com/www.efile4biz.com/images/1099-nec-instructions.jpg

Michigan Llc Operating Agreement Template Free Printable Form

https://i0.wp.com/eforms.com/images/2016/01/llc-operating-agreement-template.png?fit=1600%2C2070&ssl=1

https://www.upcounsel.com/do-llc-get-1099

If an LLC operates as a sole proprietorship it has to file a 1099 with specific information required by the IRS Required information includes the following

https://bizee.com/blog/post/do-llcs-get-1099

If you own or run a Limited Liability Company LLC then it s very likely you ll receive 1099 forms that you need to include in your tax return and you might even need to send out

Self directed Solo 401k Question Is A Form 1099 R Required For

1099 Nec Form 2022 Printable Printable Word Searches

Form 1099 E filing Requirements To IRS 1099 Reporting Requirements

Form 1099 Misc Printable Printable Forms Free Online

Printable 1099 Form 2023 Printable Forms Free Online

Irs 1099 Forms Order Online Form Resume Examples aL71x693MX

Irs 1099 Forms Order Online Form Resume Examples aL71x693MX

1099 MISC Form Reporting Requirements Chicago Accounting Company

1099 Software To Create Print And E file Forms 1098 1099 3921 3922

Free Printable 1099 Form Free Printable

Do Llc Require 1099 - When and why you should issue a 1099 to an LLC Issuing a 1099 form to an LLC is necessary when you have paid the LLC 600 or more in a tax year for