Do Ltd Companies Get A Tax Rebate Web trading losses Marginal Relief Your company or organisation may be entitled to Marginal Relief if its taxable profits from 1 April 2023 are between 163 50 000 and 163 250 000

Web 12 oct 2022 nbsp 0183 32 You can deduct some of these as part of your annual tax return to work out your taxable profit as long as they re allowable expense The list of tax deductible Web 14 janv 2022 nbsp 0183 32 14 January 2022 Getty Images Using a company to help you claim a tax rebate could end up costing you hundreds of pounds extra according to consumer group

Do Ltd Companies Get A Tax Rebate

Do Ltd Companies Get A Tax Rebate

https://www.integrationinc.com/wp-content/uploads/2021/10/benefits-good-rebate-processing-companies-offer-2.jpg

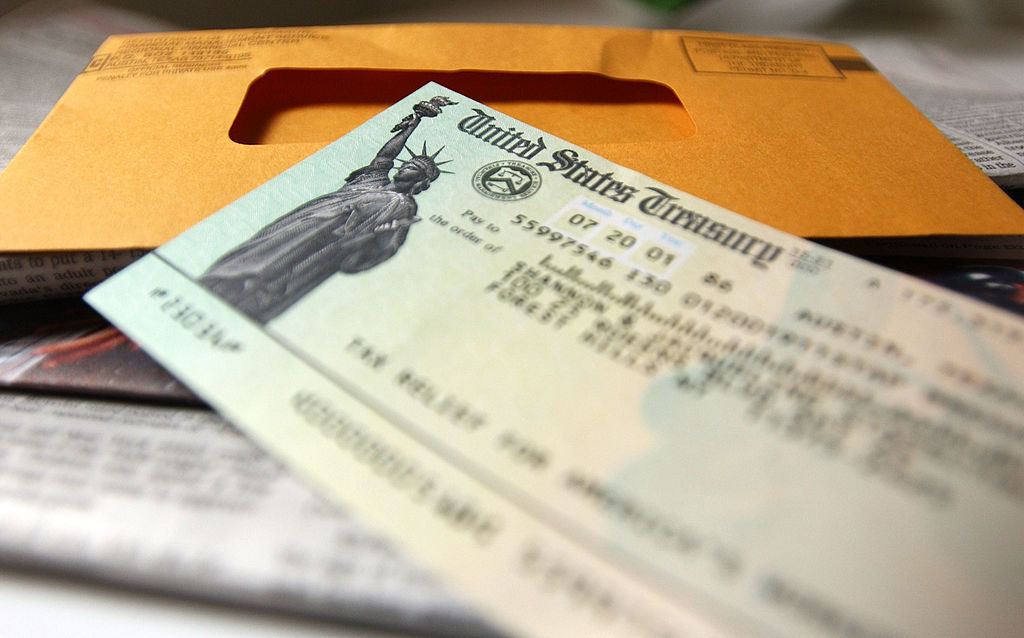

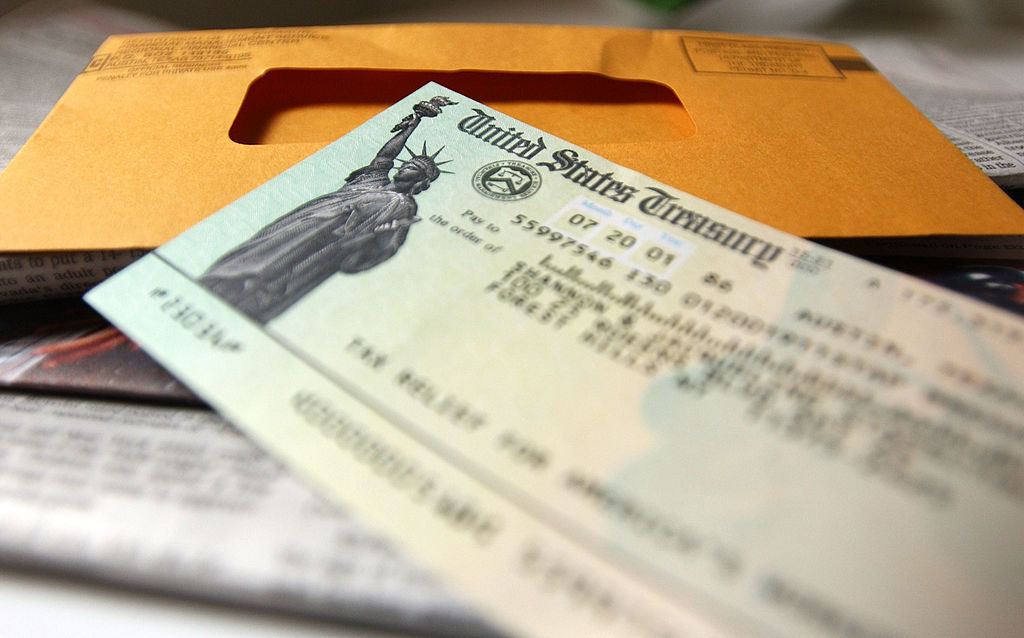

500 New Mexico Tax Rebate Checks Why Some May Not Get It

https://www.valuewalk.com/wp-content/uploads/2023/04/Tax-Rebates-from-Minnesota.jpeg

How Long Does It Take To Get A Tax Rebate

https://pearllemonaccountants.com/wp-content/uploads/2022/03/41.png

Web Business and self employed Business tax Get a refund or interest on your Corporation Tax If your company or organisation pays too much Corporation Tax HM Revenue and Web You can claim tax rebates for free by going directly to HMRC Danielle Richardson People are losing hundreds of pounds by opting to use third party companies to claim tax

Web 5 avr 2023 nbsp 0183 32 13 8 on salaries over 163 9 100 per year If your company is eligible the first 163 5 000 of Employers NICs can be written off thanks to the Employment Allowance Employees NI For 2023 4 Class 1 Employee s Web 18 juil 2022 nbsp 0183 32 The short answer is to go straight to HMRC It s free and all you need to do is fill in some details online whether you re claiming tax relief at gov uk tax relief for

Download Do Ltd Companies Get A Tax Rebate

More picture related to Do Ltd Companies Get A Tax Rebate

Irish Tax Rebates We Do The Checking You Get The Cheque YouTube

https://i.ytimg.com/vi/kULnmAVqClw/maxresdefault.jpg

Question No 03 B Chapter No 10 D K Goal 11 Class Tutor s Tips

https://i0.wp.com/tutorstips.com/wp-content/uploads/2021/05/Q-03B-CH-10-USHA-1-Book-2020-Solution-min.png?fit=1280%2C720&ssl=1

Starmer Zeroes In On The Windfall Tax For Oil And Gas Companies Saying

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1249346899255309&get_thumbnail=1

Web 9 f 233 vr 2019 nbsp 0183 32 HMRC have issue me a tax refund but it has gone through a company called ONLINE TAX REBATES LTD which charges a cheque processing fee additional Web 20 mars 2023 nbsp 0183 32 To be clear tax rebates cannot be generated by Total Tax Claims and Ensign Advisory without the receipt of an application which contains the unique

Web 12 janv 2023 nbsp 0183 32 When asked if they went on to use a third party company to claim a tax rebate a third 33 said yes Here Which takes a closer look at the changes HMRC Web The UK tax office is to refund 60 000 people that had tax rebates processed by Tax Credits Ltd The move comes after a MoneySavingExpert MSE investigation found that

Do Limited Companies Have Higher Mortgage Rates YouTube

https://i.ytimg.com/vi/8yflFguDJRM/maxresdefault.jpg

Ecommerce Sellers When Should You Convert Enterprise To Sdn Bhd

https://renderer-v2.vercel.app/_next/image?url=https:%2F%2Fapi.typedream.com%2Fv0%2Fdocument%2Fpublic%2Fa843cfa9-1ccf-43fd-b2a6-e37ac1831189_tax_rebate_pic_-_updated_2022_jpg.jpg&w=750&q=75

https://www.gov.uk/corporation-tax-rates/allowances-and-reliefs

Web trading losses Marginal Relief Your company or organisation may be entitled to Marginal Relief if its taxable profits from 1 April 2023 are between 163 50 000 and 163 250 000

https://www.gov.uk/guidance/tax-reliefs-and-allowances-for-businesses...

Web 12 oct 2022 nbsp 0183 32 You can deduct some of these as part of your annual tax return to work out your taxable profit as long as they re allowable expense The list of tax deductible

Tax Rebate For New Incorporated Company Malaysia With New T C Jan 07

Do Limited Companies Have Higher Mortgage Rates YouTube

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Got A Tax Rebate Top 3 Gear To Spend It On TF Tools Ltd

R D Tax Rebate Check Who Qualifies Business Owners 95 Of Eligible

Tax Rebates 2022 In New Mexico Here s Who s Qualified To Get Up To

Tax Rebates 2022 In New Mexico Here s Who s Qualified To Get Up To

Stamp Duty For Limited Companies The Complete Guide Stamp Duty Claims

A Simple Guide To Construction Industry Scheme Tax Rebates VW

Eligible Recipients To Get Tax Rebates Up To 1 000 Payments In New

Do Ltd Companies Get A Tax Rebate - Web Business and self employed Business tax Get a refund or interest on your Corporation Tax If your company or organisation pays too much Corporation Tax HM Revenue and