Do Military Spouses Pay State Taxes In Virginia Military personnel stationed inside or outside Virginia may be eligible to subtract up to 15 000 of military basic pay received during the taxable year provided they are on extended active duty for more than 90 days

The spouse only pays taxes on income in their state of legal residency when they meet the above conditions The Veterans Auto and Education Improvement Act of 2022 further amended tax residency laws in the SCRA What Form Should I File Military Spouse VA During the taxable year were you a military spouse covered under the provisions of the Military Spouse Tax Relief Act whose legal domiciliary residence is Virginia Yes No Get Virginia tax filing reminders and tax news for individuals and businesses

Do Military Spouses Pay State Taxes In Virginia

Do Military Spouses Pay State Taxes In Virginia

https://www.picnictax.com/wp-content/uploads/2020/10/x8266555568_76a0221632_k.jpg.pagespeed.ic_.7UZk5tRppC.jpg

State Taxes On Military Retired Pay The Official Army Benefits Website

https://myarmybenefits.us.army.mil/Images/slides/StateTaxMap-MAB-Feb2022.png

Virginia Military Retirement Taxes Carolyne Lu

https://themilitarywallet.com/wp-content/uploads/2008/01/GettyImages-1160636403-scaled.jpg

The new law opens the door to service members and their spouses to pick the state in which they pay income taxes from three options the legal residence or domicile of the service member The 2023 Veterans Auto and Education Improvement Act of 2022 allows the active duty service member and spouse to file state income taxes based on one of three choices The residence or domicile of the service member the residence or domicile of the spouse or the permanent duty station of the service member

Under the Servicemember Civil Relief Act as amended by the Military Spouses Residency Relief Act a spouse of a military servicemember may be exempt from Virginia income tax on wages if the servicemember is present in Virginia in compliance with military orders Under the Military Spouses Residency Relief Act income earned by a nonresident military spouse or dependent living in Virginia to be with a Servicemember spouse parent permanently stationed in the state does not have to pay Virginia income tax The spouse and dependents must reside in the same state as the Servicemember

Download Do Military Spouses Pay State Taxes In Virginia

More picture related to Do Military Spouses Pay State Taxes In Virginia

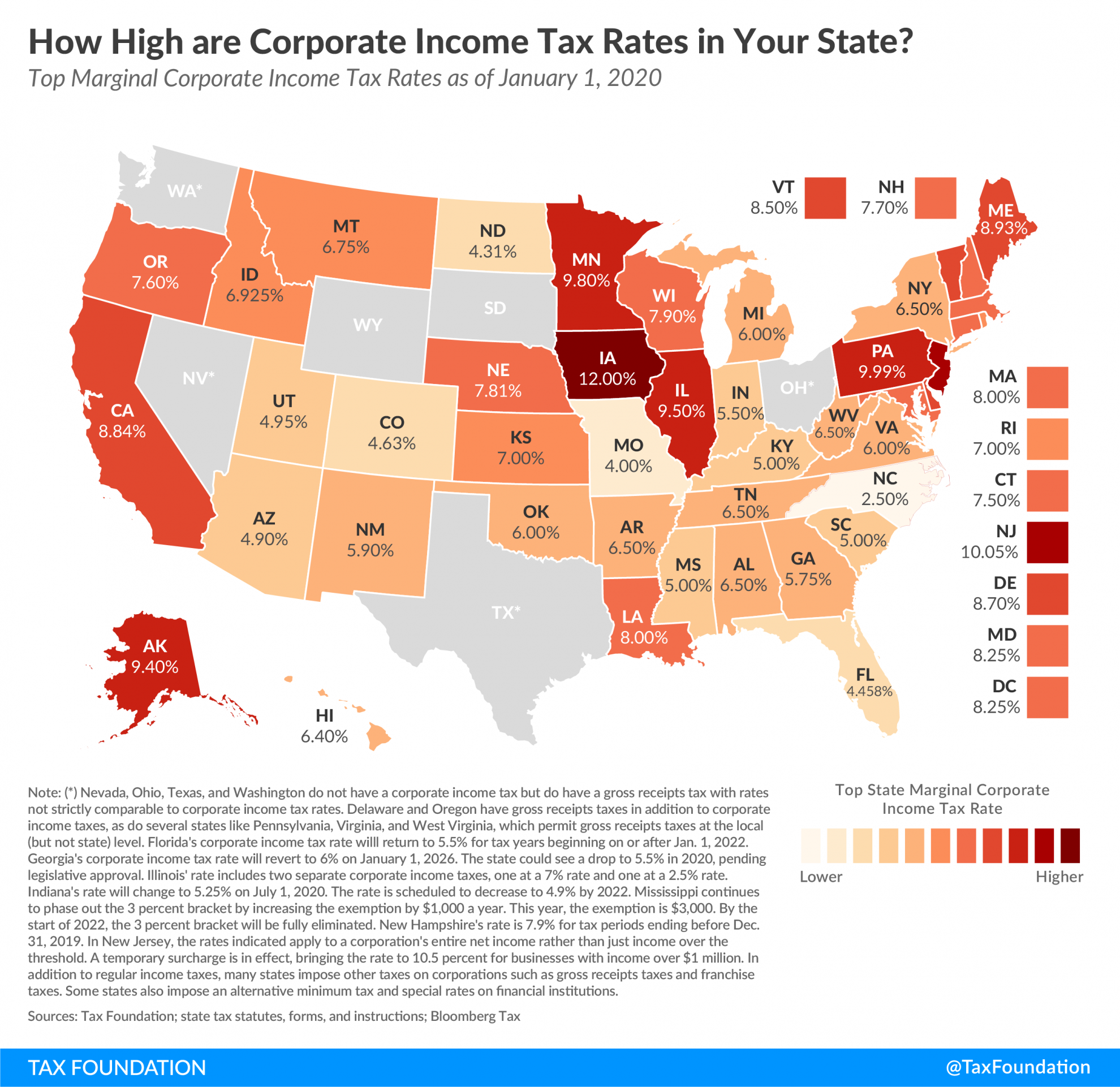

Can You Pay State Taxes Online Yes And Here s How

https://media.marketrealist.com/brand-img/NSu5ftslF/1024x536/can-you-pay-state-taxes-online-1618508768792.jpg

States With No Income Tax H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2019/01/Which-States-Have-No-Income-Tax-1080x675.jpg

What Do Military Spouses REALLY Want Military Spouse

https://www.militaryspouse.com/wp-content/uploads/2014/07/businesswomen.jpgprocessalways

The Military Spouses Residency Relief Act MSRRA lets you keep the same state of legal residence as your service member spouse This way multiple states and tax localities won t tax you when your spouse moves for military service If Joe is married and his wife works in a civilian job in Virginia she might have to file a state tax return in Virginia However if she qualifies under MSRRA she might also be able to claim South Carolina as her state of legal residence along with her husband

For example the Virginia Department of Taxation Military Spouses Residency Relief Act webpage still outlines several situations in which it says taxes are owed to Virginia These Note for Person A If they work a nonmilitary job in Virginia they may have to file a tax return and pay tax in Virginia See Filing State Taxes When You re in the Military and Civilian Pay Earned by Active Duty Military for more details

Retired Military Finances 201 Remote Work And State Income Taxes C L

https://static.twentyoverten.com/5a4515738296d37425053dec/AovLz9mfFNV/State-Taxes.jpg

Fillable Form Chicago Income Tax Preparation Disclosure Form

https://upstatetaxp.com/wp-content/uploads/2020/01/2020-State-Corporate-Income-Tax-Rates-01-e1580164104530-1.png

https://www.tax.virginia.gov/military-tax-tips

Military personnel stationed inside or outside Virginia may be eligible to subtract up to 15 000 of military basic pay received during the taxable year provided they are on extended active duty for more than 90 days

https://www.militaryonesource.mil/financial-legal...

The spouse only pays taxes on income in their state of legal residency when they meet the above conditions The Veterans Auto and Education Improvement Act of 2022 further amended tax residency laws in the SCRA

Do Military Spouses Get Credit Card Annual Fees Waived YouTube

Retired Military Finances 201 Remote Work And State Income Taxes C L

Do Both Spouses Pay For A Divorce In Ohio

Fairfax County Budget Proposal Includes Raises For Teachers County

Arizona State Tax Guide Kiplinger

Military Members And Spouses Could Avoid State Income Taxes Thanks To

Military Members And Spouses Could Avoid State Income Taxes Thanks To

Hecht Group Everything You Need To Know About Paying Property Taxes

Military Spouses Face Many Challenges So It s Nice To Have Benefits To

Do Military Spouses Pay For Citizenship The 15 New Answer

Do Military Spouses Pay State Taxes In Virginia - Virginia Income Tax Deduction for Military Pay This deduction allows active military personnel to deduct their income from federal taxes on their Virginia state return Those earning less than 30 000 from base pay can deduct up to 15 000 Maximum subtraction is reduced by 1 for every 1 of income over 15 000