Do Non Plug In Hybrid Qualify For Tax Rebate Web 8 ao 251 t 2023 nbsp 0183 32 The idea in theory is quite simple per the IRS You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug

Web 17 janv 2023 nbsp 0183 32 January 17 2023 Posted by Find My Electric If you re reading this piece you ve probably already heard about the Federal EV Tax Credit However did you know that the 2022 credit isn t the same as the Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Do Non Plug In Hybrid Qualify For Tax Rebate

Do Non Plug In Hybrid Qualify For Tax Rebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/are-there-still-tax-credits-for-hybrid-vehicles-tax-walls-2.jpg

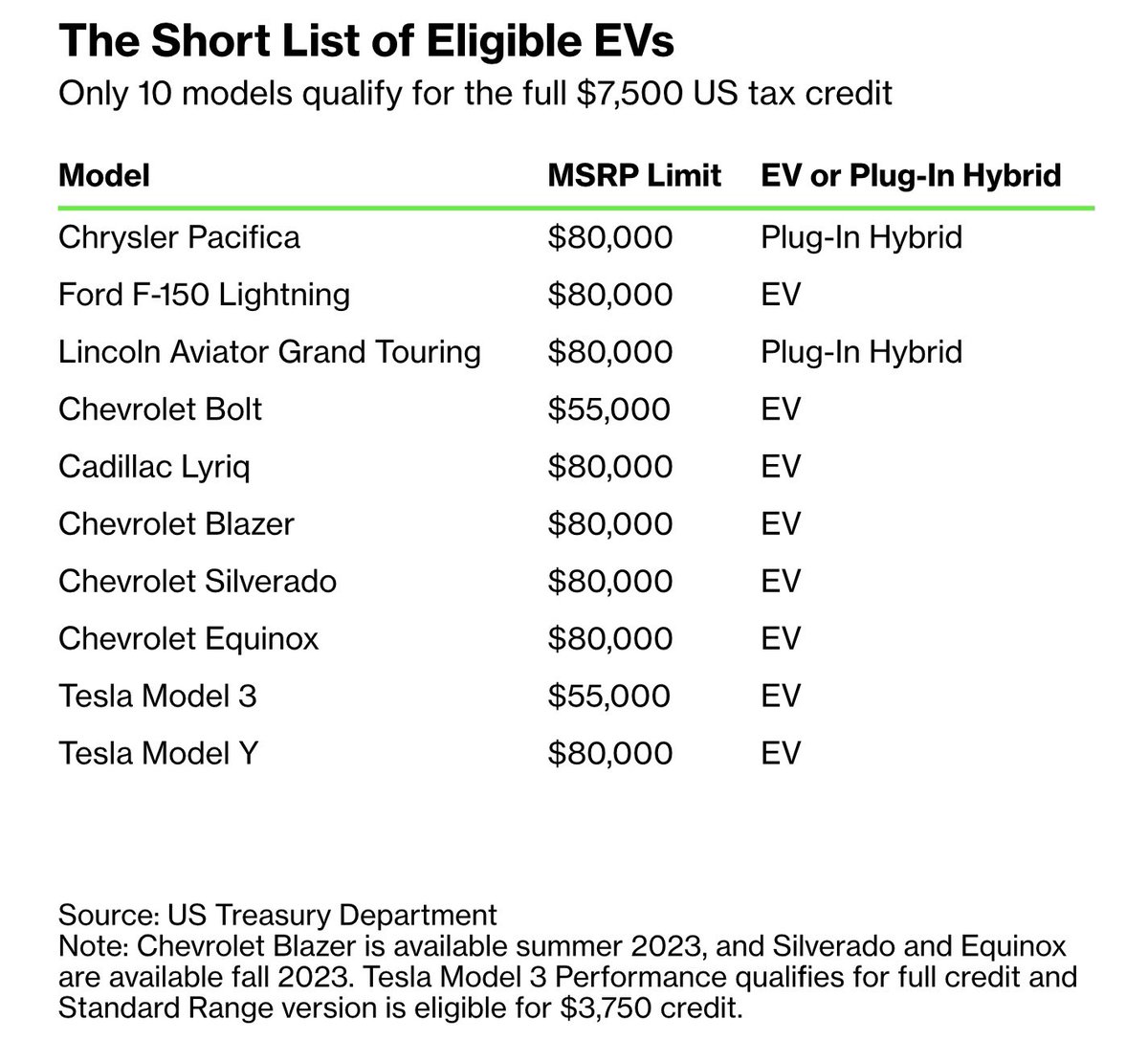

10 Electric And Plug in Hybrid Cars That Qualify For 7 500 Tax Cut

https://en.mogaznews.com/temp/resized/medium_2023-04-21-f759bfcbdd.jpg

10 Electric And Plug in Hybrid Cars Qualify For 7 500 Tax Cut

https://www.abdpost.com/images/haberler/2023/04/10-electric-and-plug-in-hybrid-cars-qualify-for-7500-tax-cut.jpg

Web Purchases made before 2023 don t qualify Who Qualifies You may qualify for a credit for buying a previously owned qualified plug in electric vehicle EV or fuel cell vehicle Web 17 oct 2022 nbsp 0183 32 If you re interested in an EV or a plug in hybrid and it qualifies for a tax credit today don t wait because it might not qualify next year But if you re considering a used EV it

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web 18 ao 251 t 2022 nbsp 0183 32 Electric and plug in hybrid vehicles previously eligible for up to 7 500 in tax credits through 2022 are no longer eligible because of the Inflation Reduction

Download Do Non Plug In Hybrid Qualify For Tax Rebate

More picture related to Do Non Plug In Hybrid Qualify For Tax Rebate

Rebates For Buying A Hybrid Car 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/hybrid-cars-may-not-save-you-money-good-money-sense-hybrid-car-gas.png

The Florida Hybrid Car Rebate Save Money And Help The Environment

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

Eclipse Cross Hybrid 350 Ch Pour La Peugeot 508 R Hybrid In Hybrid

https://i1.wp.com/media.motorbox.com/image/mitsubishi-eclipse-cross-2021/6/9/3/693021/693021-5x2-lg.jpg

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Web 5 sept 2023 nbsp 0183 32 The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid vehicles

Web 25 janv 2022 nbsp 0183 32 Things are a bit more complicated with plug in hybrids as the federal tax credit amounts for each model vary depending on the capacity of its battery pack Here s Web 17 juin 2023 nbsp 0183 32 Because of the new law there are a lot of cars out there that don t yet qualify and several that only qualify for a partial tax credit Here are all the vehicles

Tax Rebates For Toyota Avalon Hybrid Car 2022 Carrebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/tax-rebates-for-toyota-avalon-hybrid-car-2022-carrebate.jpg?resize=1536%2C1020&ssl=1

Electric Cars And Plug In Hybrids That Qualify For Tax Credits Under

https://s.yimg.com/ny/api/res/1.2/2nr6X6.u4k4awyzwK5VQTg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/en/autos.consumerreports.org/35d92f76a0ae501e26a8abf127816557

https://electrek.co/2023/08/08/which-electric-vehicles-still-qualify...

Web 8 ao 251 t 2023 nbsp 0183 32 The idea in theory is quite simple per the IRS You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug

https://www.findmyelectric.com/blog/ev-tax-cr…

Web 17 janv 2023 nbsp 0183 32 January 17 2023 Posted by Find My Electric If you re reading this piece you ve probably already heard about the Federal EV Tax Credit However did you know that the 2022 credit isn t the same as the

Will 2023 Honda Accord Hybrid Qualify For Tax Credit Drive Accord

Tax Rebates For Toyota Avalon Hybrid Car 2022 Carrebate Rebate2022

Does The RAV4 Hybrid Qualify For A Federal Tax Credit 2023

Which EVs Do And Don t Qualify For The New Tax Credits Hagerty Media

Here s Why Most EVs And Plug In Hybrids No Longer Qualify For Tax

2019 Ford Fusion First Look Seventh Year Itch FordRebates

2019 Ford Fusion First Look Seventh Year Itch FordRebates

Canadian Pricing For BMW 330e Hybrid Announced Qualifying For IZEV

10 Electric And Plug in Hybrid Cars That Qualify For 7 500 Tax Cut

Tesla New York On Twitter Only 10 Electric And Plug in Hybrid

Do Non Plug In Hybrid Qualify For Tax Rebate - Web 18 ao 251 t 2022 nbsp 0183 32 Electric and plug in hybrid vehicles previously eligible for up to 7 500 in tax credits through 2022 are no longer eligible because of the Inflation Reduction