Education Tax Rebate Ato Web Education Tax Refund Who is eligible A person who is entitled to receive Family Tax Benefit FTB Part A for a child undertaking primary or secondary school studies

Web Current arrangements Under Australia s income tax law a tax deduction is generally allowed for and limited to expenses incurred in gaining or producing assessable Web 1 janv 2013 nbsp 0183 32 The Education Tax Refund was a refundable tax offset which was available from the 2008 9 financial year It s purpose was to reimburse parents of school age

Education Tax Rebate Ato

Education Tax Rebate Ato

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-768x576.jpg

Manitoba NDP s Promise To Exclude Out of province Billionaires From

https://i.cbc.ca/1.6840931.1683858388!/fileImage/httpImage/image.jpg_gen/derivatives/16x9_620/wab-kinew-scrums-05112023.jpg

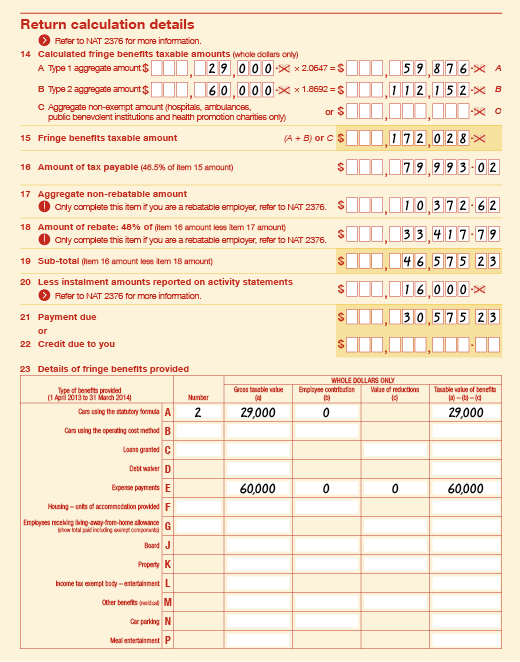

Rebatable Employers Australian Taxation Office

https://www.ato.gov.au/uploadedImages/Content/SME/Images/39720_05.jpg?n=5095

Web Self education expenses are expenses related to courses or workshops provided by a school college university or other training provider To be eligible for a tax deduction you must take this course to gain a formal Web 28 ao 251 t 2023 nbsp 0183 32 Can I claim my education as a tax rebate Arnavbemby I m new 29 Aug 2023 Hope you are doing well I have got a small question regarding my tax returns

Web Small businesses with an aggregated annual turnover of less than 50 million will be able to deduct an additional 20 of expenditure that is incurred for the provision of Web 3 avr 2023 nbsp 0183 32 Investment bonds and education bonds both have avenues for tax free access and they are tax paid investing What this means is that these bonds pay a

Download Education Tax Rebate Ato

More picture related to Education Tax Rebate Ato

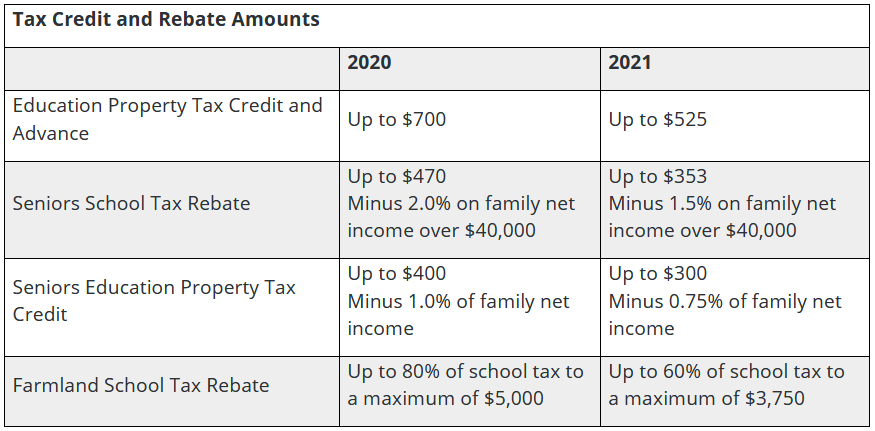

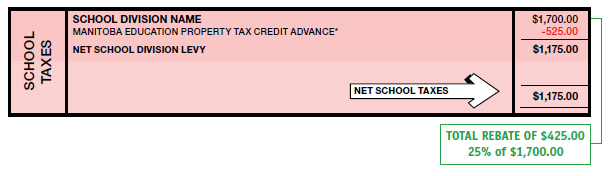

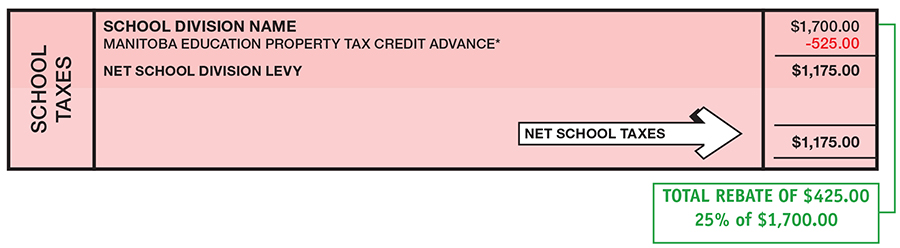

Provincial Education Property Tax Rebate Roll Out Rural Municipality

https://rmofstclements.com/wp-content/uploads/2021/04/image.png

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2023/01/Irish-Tax-Rebates-36-1.jpg?resize=727%2C1024&ssl=1

Education Property Tax Rebates Headline Manitoba Budget RealAgriculture

https://www.realagriculture.com/cdn-cgi/image/w=1920,h=1200,quality=70,fit=cover,f=auto,metadata=none/https://www.realagriculture.com/wp-content/uploads/2021/04/20210407_202448.jpg

Web 31 mars 2022 nbsp 0183 32 David Adams March 31 2022 Source Unsplash Christina wocintechchat Tech upgrades and digital skills training emerged as key points of the 2022 2023 federal budget thanks to two new tax Web Education Tax Refund If you re eligible you can claim the Education Tax Refund for eligible education spending This means you could get 50 back on a range of primary

Web 29 mars 2022 nbsp 0183 32 Tue 29 Mar 2022 04 56 EDT Last modified on Tue 29 Mar 2022 05 32 EDT Small businesses that spend on new technologies and training courses to upskill staff will Web The ATO will check how much was deducted from your salary and send you back a notice of assessment and your tax refund if you are eligible for it The easiest and most secure

Province Of Manitoba Education Property Tax

https://manitoba.ca/asset_library/en/edupropertytax/ept-banner.png

Education Rebate Income Tested

https://i.pinimg.com/originals/2f/ba/b9/2fbab97c42c295256188fa95c9fb2bbe.png

https://treasury.gov.au/.../3jj_MCD_Education_Tax_Refund…

Web Education Tax Refund Who is eligible A person who is entitled to receive Family Tax Benefit FTB Part A for a child undertaking primary or secondary school studies

https://treasury.gov.au/sites/default/files/2020-12/dp-c2020-1…

Web Current arrangements Under Australia s income tax law a tax deduction is generally allowed for and limited to expenses incurred in gaining or producing assessable

Changes To Educational Property Tax The Education Property Tax Rebate

Province Of Manitoba Education Property Tax

Province Of Manitoba Education Property Tax

Owners Of Pricey Properties Pocketed Big Bucks From Tax Cuts Promised

Foreign Income Worksheet Ato PINCOMEQ

Education Irish Tax Rebates

Education Irish Tax Rebates

Ato Tax Agent Portal New

Education Rebate Program Oleh SWITCH Cikgu El

More Tax Credits More Rebates Education Magazine

Education Tax Rebate Ato - Web 3 avr 2023 nbsp 0183 32 Investment bonds and education bonds both have avenues for tax free access and they are tax paid investing What this means is that these bonds pay a