Education Tax Refund 2021 Ato If you re claiming a deduction for self education expenses incurred before 1 July 2022 you may have to reduce your allowable self education expenses by 250 That is you may

We pre fill your tax return with work related self education expense information you uploaded from myDeductions Check them and add any work related The Education Tax Refund provides up to 50 back on a range of children s education expenses Refunds may be as much as 397 for every child at primary school and up to

Education Tax Refund 2021 Ato

Education Tax Refund 2021 Ato

https://i.ytimg.com/vi/BjxZ778WLNI/maxresdefault.jpg

IRS Tax Refund 2021 Update Tax Refund Delays Updated By Tax CPA

https://i.ytimg.com/vi/J1P0B01JxjQ/maxresdefault.jpg

IRS Tax Return 2021 Where Is Your Tax Refund 2021 How To Track Your

https://i.ytimg.com/vi/KI9R2GoScTM/maxresdefault.jpg

Firstly self education expenses are tax deductible they are not tax credits It will reduce your income by 20k so the tax benefit will be your marginal tax rate multiplied by 20k You can claim the following expenses in relation to your self education accommodation and meals if away from home overnight computer consumables course or tuition fees

Individuals may be eligible to claim deductions for a range of expenses incurred in earning their income including work related expenses such as travel clothing laundry home As teachers and school leaders in Australia begin to prepare their 2020 21 tax returns here s our annual Q A with the Australian Taxation Office ATO about what to keep in mind when calculating

Download Education Tax Refund 2021 Ato

More picture related to Education Tax Refund 2021 Ato

How To Claim Tax Refund In 2021 Claim Tax Refund From FBR updated

https://i.ytimg.com/vi/1NWn1CdDiLM/maxresdefault.jpg

Colorado Tax ReFUND 2020 Colorado Watershed Assembly

https://images.squarespace-cdn.com/content/v1/53f664ede4b032c1fade347d/1583455205411-AN2WDYDOEXNMDIRIQ69V/Publication1.jpg

Corporate Income Tax Rates Around The World 2014

https://taxfoundation.org/wp-content/uploads/2015/10/international1.jpg

You should claim the deductions in your income tax return for the same year the expenses were incurred if you didn t receive a refund So in terms of the flights you The Education Tax Refund ETR helps eligible families and independent students meet the cost of primary and secondary school education You can claim the ETR for education

Compulsory repayments How and when compulsory repayments of your study and training support loan are made through the income tax system Last updated As the new financial year sees more than 14 million taxpayers file their returns the Australian Taxation Office ATO is asking taxpayers to hold off lodging too

Average Tax Refund Up 11 In 2021

https://imageio.forbes.com/specials-images/imageserve/618050aee6c2ff7f06dbad91/0x0.jpg?format=jpg&width=1200

Tax Refund 2021 IRS Tax Refund Where s My Refund Status Update YouTube

https://i.ytimg.com/vi/4qE70nWlNm4/maxresdefault.jpg

https://www.ato.gov.au/individuals-and-families/...

If you re claiming a deduction for self education expenses incurred before 1 July 2022 you may have to reduce your allowable self education expenses by 250 That is you may

https://www.ato.gov.au/.../self-education-expenses

We pre fill your tax return with work related self education expense information you uploaded from myDeductions Check them and add any work related

When Will You Get Your 2021 Income Tax Refund

Average Tax Refund Up 11 In 2021

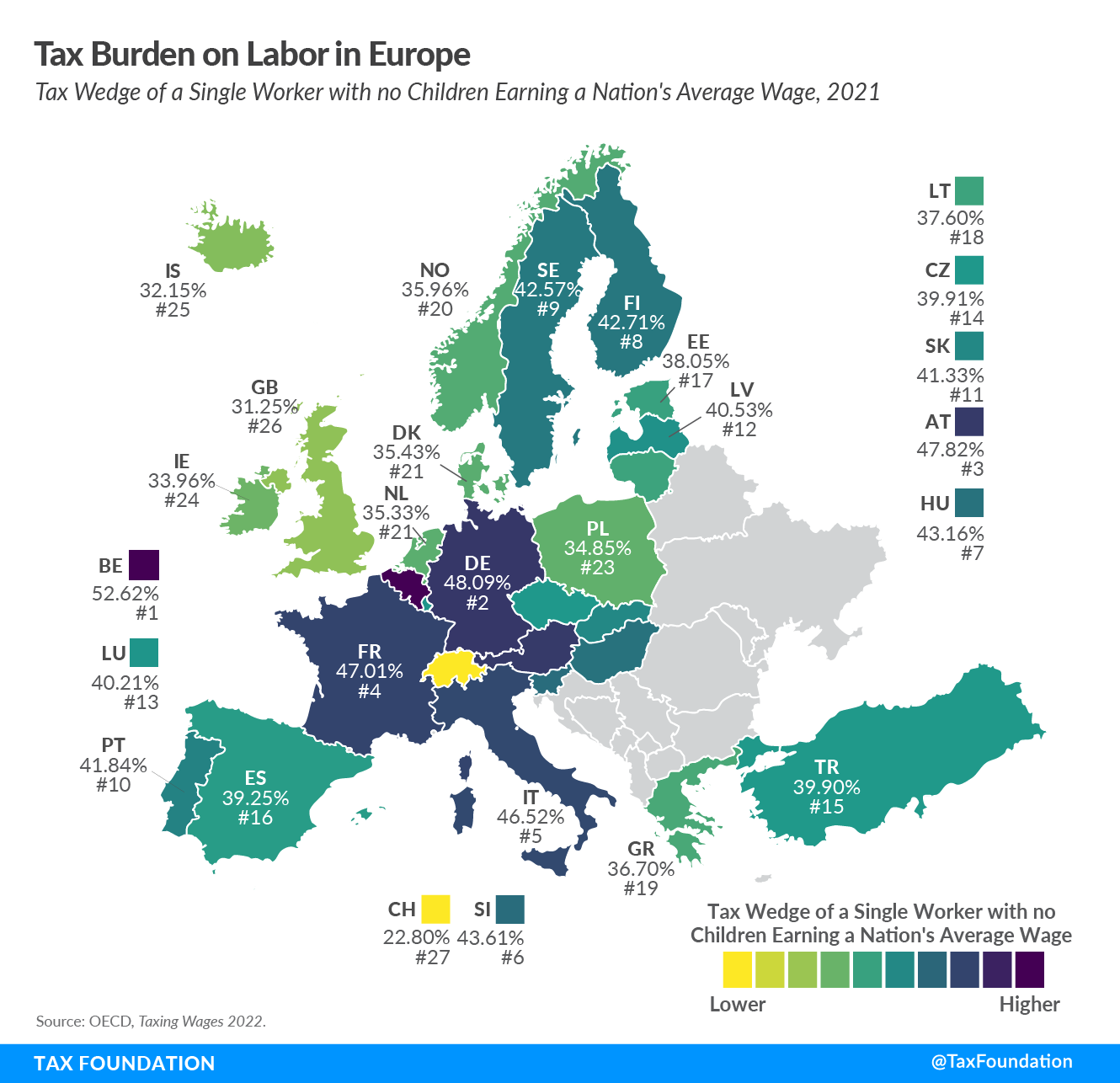

Europe Tax Burden On Labor Explored Tax Foundation

Here s The Average Tax Refund 2021 And How To Spend It

After IRS Tax Refund Delays Should You Bother To File In 2021 The

Exact Date IRS 2021 Tax Refunds Are Due Revealed In Calendar As Warning

Exact Date IRS 2021 Tax Refunds Are Due Revealed In Calendar As Warning

Where s My Refund Up As Well As All IRS Systems Refund Schedule 2022

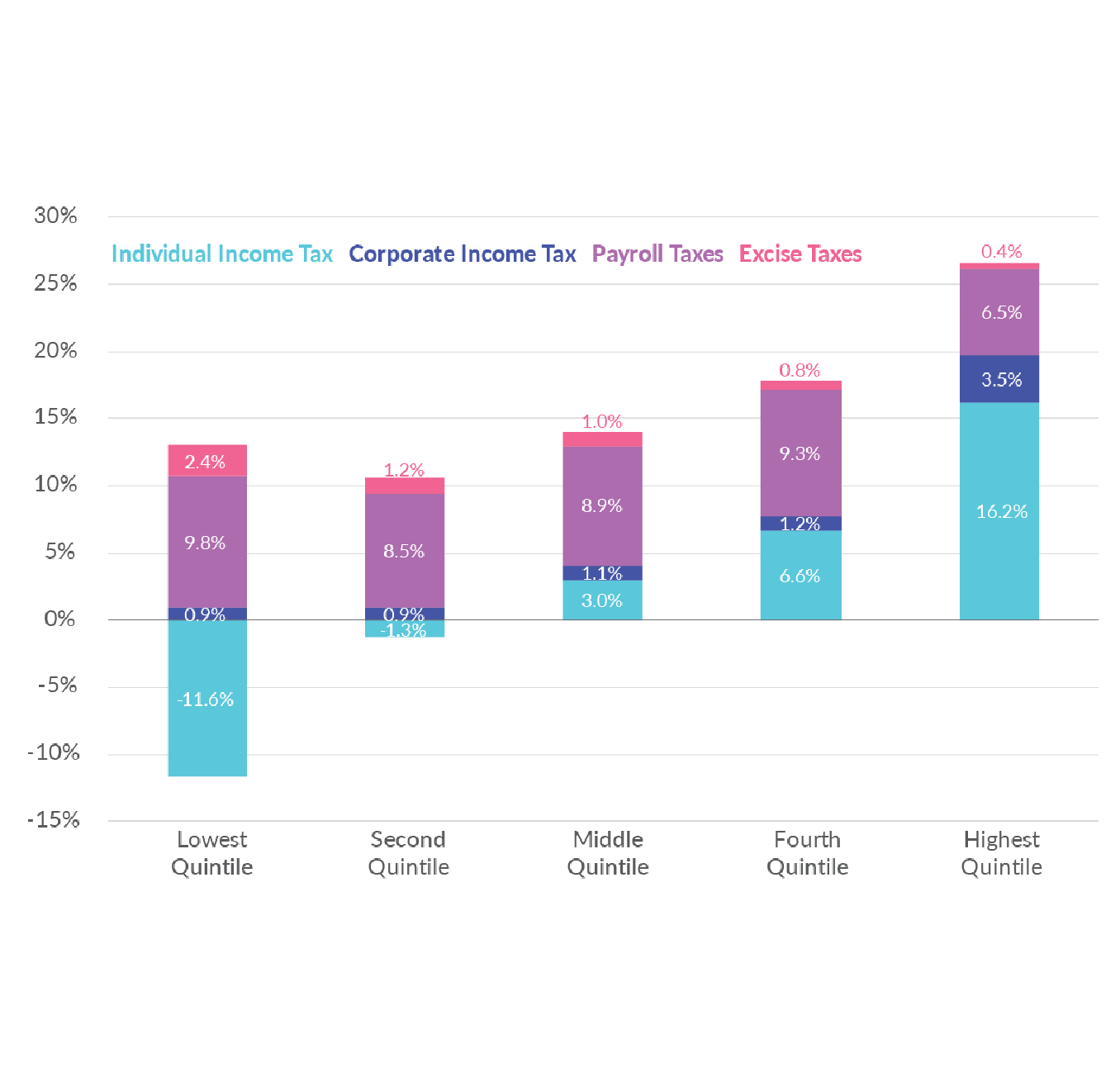

Federal Tax Rates By Income Group And Tax Source

Tax Refund Update 2022 Is The IRS Lying

Education Tax Refund 2021 Ato - If your son was upgrading his qualifications for his current employment for example upgrading from a university bachelor qualification to a Masters qualification then this