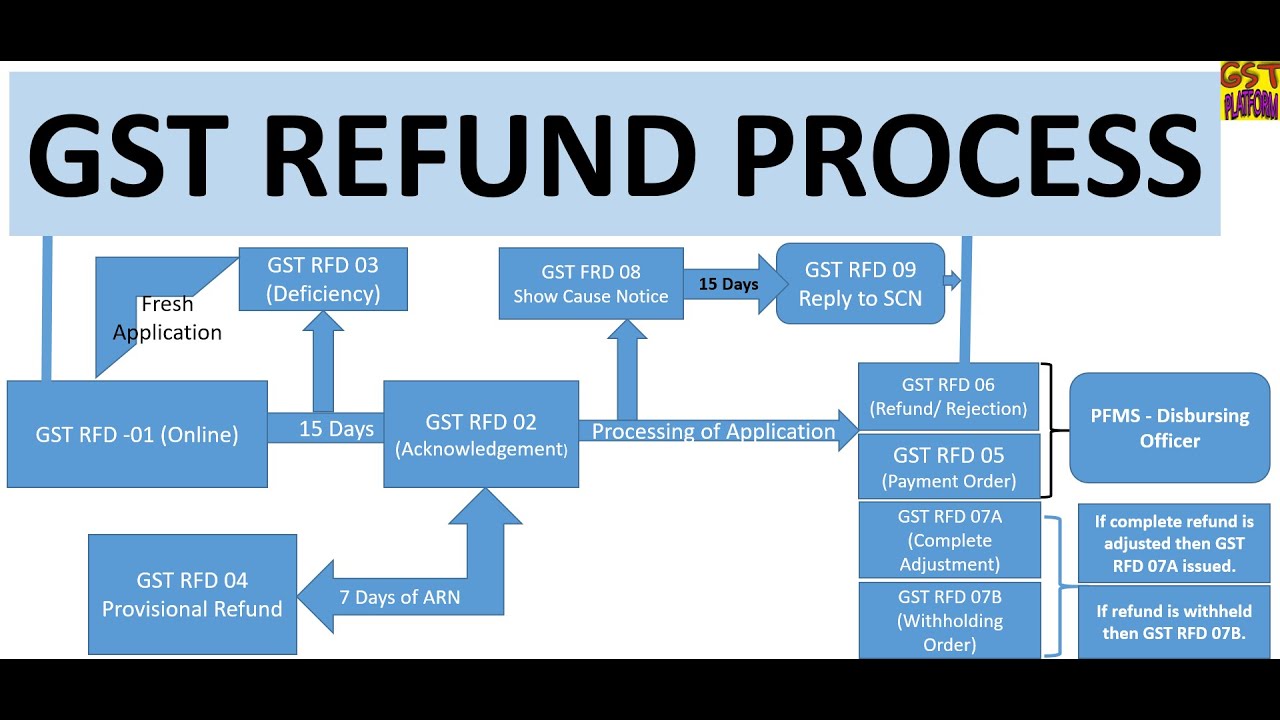

Do Refunds Have Gst The GST refund process requires the taxpayer to follow specific steps submit documents and declaration if required to the GST authorities for claiming a GST refund

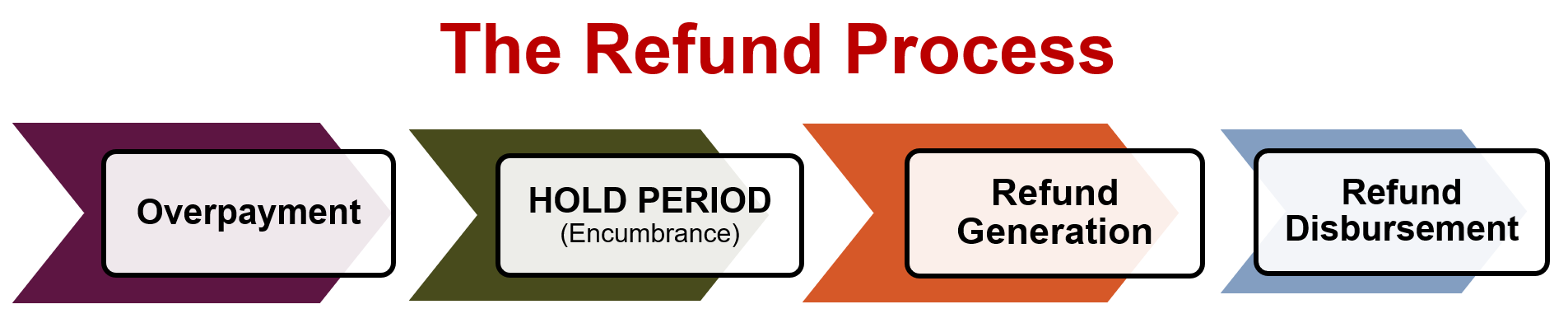

The GST Refund Process goes through three phases starting with submission of the refund request followed by processing of the application to finally confirmation of the refund The three phases are elaborated on below 1 Submitting a Refund Request The GST Refund Process begins when a taxpayer submits a refund request Claiming GST credits Report and pay GST amounts and claim GST credits by lodging a BAS or an annual GST return Last updated 19 June 2024 Print or Download You can claim a credit for any GST included in the price of any goods and

Do Refunds Have Gst

Do Refunds Have Gst

https://www.taxhelpdesk.in/wp-content/uploads/2021/02/Do-you-know-about-GST-Refunds.png

Businesses With Turnover Over Rs 2 Cr Can Start Filing GST Audit

https://www.thestatesman.com/wp-content/uploads/2019/04/GST.jpg

Refund Under GST Regime Accoxi

https://www.accoxi.com/media/3132/cases-of-refund-under-gst-regime.jpg

A GST refund is when your GST credits GST from your purchases are more than the amount of GST you owe GST from your sales As a GST registered business in Australia you must put aside the GST you collect to pay it to the ATO when it s due If you re registered for GST you can claim that back You do this by claiming a GST tax credit when lodging your business activity statement BAS The ATO will balance those credits against the GST you owe when working out your refund or bill learn more in working out your GST

You can claim GST on GST inclusive purchases even if the end product you sell is GST free How do I get my GST refund To get a GST refund for business simply submit your complete BAS statement to the ATO preferably through your accounting software or relying on your bookkeeper to see what kind of GST refund you ll receive GST refunds If you ve overpaid your GST for a taxable period you may receive a refund Filing your GST returns How to file GST returns and make payments when GST returns and payments are due Last updated 13 May 2024 Find out more about how to file your GST return and how to pay GST or get a refund

Download Do Refunds Have Gst

More picture related to Do Refunds Have Gst

KEY UNDERSTANDING ON GST REFUND Rajput Jain Associates

https://carajput.com/blog/wp-content/uploads/2016/10/GST-REFUND.jpg

GST Refund Key Points To Keep In Mind HSCO

https://hscollp.in/wp-content/uploads/2020/06/gst-refund.jpg

Exporter Blames Government For Not Getting GST Refunds SAG Infotech

https://blog.saginfotech.com/wp-content/uploads/2017/12/gst-refund.jpg

The amount of GST you claim input tax is subtracted from the amount of GST you charge output tax to calculate your tax to pay or GST refund What can be claimed Most of the time claiming GST is easy As a GST registered business you can claim back the GST you re charged on goods and services you buy and use in your taxable activity Current GST return filing requires that every month once GSTR 1 is filed to report Sales one must file GSTR 3B to report the ITC and make necessary GST Payment Also if a refund is required to be claimed the same can be done by filing relevant refund related forms

Refund is very important term under the GST for the person who is eligible to claim the refund and for the GST Authority who issues the refund order Both persons i e who claim the refund and who issues refund should have fully conversant with the provisions and law in regard of Refund under the GST The GST regime aims to simplify and standardize refund procedures through an automated tech driven mechanism for timely processing and disbursal of refunds This guide covers types of refund process documentation timelines and key aspects

No Refunds 9GAG

https://images-cdn.9gag.com/photo/aGExgjK_700b.jpg

KFC Delivery Cancellation Kfcsecretmenu info

https://img.kfcsecretmenu.info/does_kfc_do_refunds.png

https://cleartax.in › refund-process-under-gst

The GST refund process requires the taxpayer to follow specific steps submit documents and declaration if required to the GST authorities for claiming a GST refund

https://www.theknowledgeacademy.com › blog › gst-refund-process

The GST Refund Process goes through three phases starting with submission of the refund request followed by processing of the application to finally confirmation of the refund The three phases are elaborated on below 1 Submitting a Refund Request The GST Refund Process begins when a taxpayer submits a refund request

Refunds Corefy Merchant Documentation

No Refunds 9GAG

All You Need To Know About GST Refunds A Definitive Guide

CBIC Issued New Guidelines For GST Refunds TaxClue

Refunds Office Of Business And Finance

Refunds YouTube

Refunds YouTube

All You Need To Know About GST Refunds Vakilsearch

Exporters To Get Single Window Facility For GST Refunds SAG Infotech

GST Refunds For Risky Exporters Eligibility Criteria For Receiving

Do Refunds Have Gst - You can claim a refund if your net tax line 109 of your GST HST return for a reporting period is a negative amount Generally the CRA process a GST HST return in 2 weeks if you filed electronically 4 weeks if you filed a paper return