Do Used Ev Qualify For Tax Credit For qualified used EVs the dealer reports required information to you at the time of sale and to the IRS A used vehicle qualifies for tax credit only once in its lifetime A 2020 Nissan

Starting January 2024 people who buy qualified used electric cars from a dealership for less than 25 000 could be eligible for a tax credit of up to 4000 This guide and Used EV tax credit qualifications Qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Some

Do Used Ev Qualify For Tax Credit

Do Used Ev Qualify For Tax Credit

https://evtaxincentives.com/wp-content/uploads/2022/07/polstar-3.png

Does The Nissan Leaf Qualify For The EV Tax Credit

https://www.motorbiscuit.com/wp-content/uploads/2021/06/2021-Nissan-LEAF-SV-Plus.jpg?w=1200

These 28 Electric Cars Qualify For A Tax Credit The Plugin Report

https://pluginreport.com/wp-content/uploads/2020/11/which-electric-cars-qualify-for-a-tax-credit.jpg

April 3 2023 Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor

Who Qualifies for a Used EV Tax Credit Buyers must have a modified adjusted gross income AGI below 150 000 for joint filers 112 500 for a head of household and Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30

Download Do Used Ev Qualify For Tax Credit

More picture related to Do Used Ev Qualify For Tax Credit

Which EVs Qualify For New US Tax Credit Websites Offer Help

https://scx2.b-cdn.net/gfx/news/hires/2022/which-evs-qualify-for.jpg

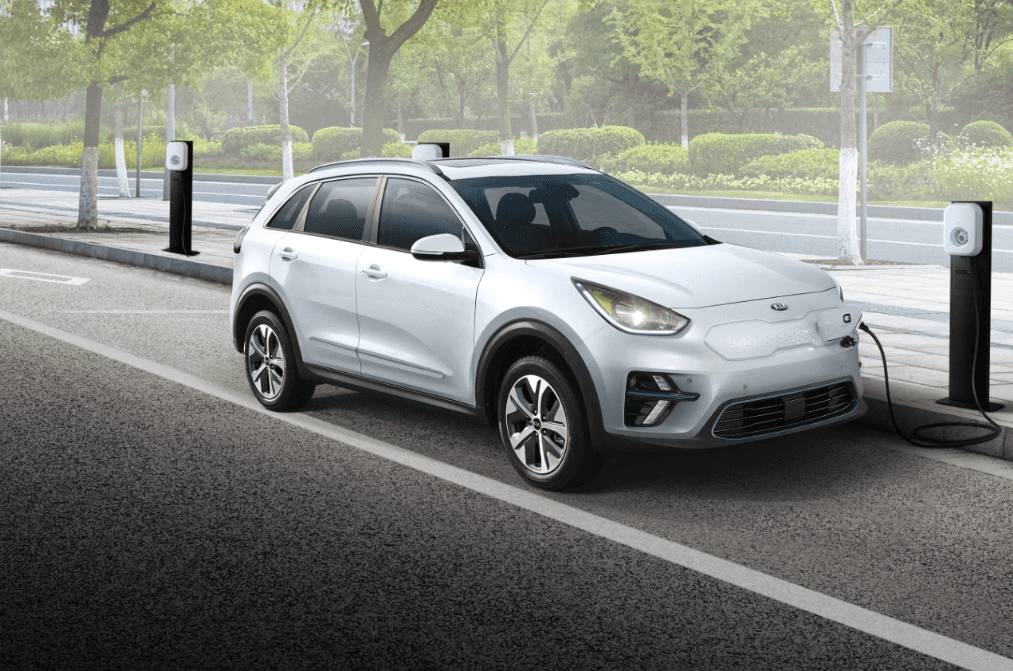

Does The Kia Niro EV Qualify For Tax Credit Electric Vehicle

http://di-uploads-pod12.dealerinspire.com/beavertonkiaredesign/uploads/2021/06/2020-kia-niro-ev-charging.png

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

Used EV Tax Credit Here are all the used EVs that qualify for a 4 000 tax credit Scooter Doll Mar 18 2024 12 50 pm PT 75 Comments January 1 2023 kicked off a fresh start So if your AGI was low enough in 2023 to qualify you can buy an EV in 2024 and get tax credits even if your 2024 income is too high Step 3 Go to a car dealership and buy an

The EV only qualifies for a tax incentive once in its lifetime Used buyers can only qualify for one EV tax credit every three years Individuals must meet income requirements The idea in theory is quite simple per the IRS You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel

List Of Electric Cars That Qualify For Federal Tax Credits

https://worldevnews.com/wp-content/uploads/2023/04/evs-qualify-for-federal-ev-tax-credit-1024x576.jpg

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

https://evadoption.com/wp-content/uploads/2021/08/Should-these-EVs-qualify-for-the-federal-EV-tax-credit.png

https://electrek.co/2024/03/18/here-are-all-the...

For qualified used EVs the dealer reports required information to you at the time of sale and to the IRS A used vehicle qualifies for tax credit only once in its lifetime A 2020 Nissan

https://www.recurrentauto.com/research/used-ev-tax-credits

Starting January 2024 people who buy qualified used electric cars from a dealership for less than 25 000 could be eligible for a tax credit of up to 4000 This guide and

Leased And Used Electric Vehicles Now Qualify For Federal Tax Credits

List Of Electric Cars That Qualify For Federal Tax Credits

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

How To Calculate Electric Car Tax Credit OsVehicle

Lexus Responds To EV Price Wars With Whopping RZ Discount CarBuzz

Tax Credits For Electric Vehicles Are About To Get Confusing The New

Tax Credits For Electric Vehicles Are About To Get Confusing The New

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

How To Qualify Almost Any EV For U S Tax Credit

Only Six EVs Will Qualify For The 7 500 Federal Tax Credit Starting

Do Used Ev Qualify For Tax Credit - Electric Vehicles Plug In Hybrids Qualifying for Federal Tax Credit Consumer Reports Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to