Do Veterans Have To Pay Property Taxes In Missouri This bill creates the Missouri Disabled Veterans Homestead Exemption which provides a tiered tax exemption system for veterans with disabilities The exemptions are

Consequently to qualify the applicant for such an exemption must 1 be a former prisoner of war and 2 a veteran of any branch of the armed forces of the United States or this state who 100 Disabled Veterans Our research and analysis uncovered 20 states with no property tax for 100 disabled veterans meaning eligible veterans are completely exempt from paying property taxes on their primary residence

Do Veterans Have To Pay Property Taxes In Missouri

Do Veterans Have To Pay Property Taxes In Missouri

https://img.hechtgroup.com/1663987909611.jpg

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-do.jpg

MI Disabled Veterans Do NOT Pay Property Taxes YouTube

https://i.ytimg.com/vi/AKl9wlGVGSc/maxresdefault.jpg

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year The credit is for a maximum of 750 for renters and Missouri Personal Property Tax Credit for 100 Disabled Veterans The Missouri Property Tax Credit gives credit to eligible resident Veterans who have a service connected 100 disability rating

Military retirement SBP benefits are tax free The Missouri Property Tax Credit Claim gives credit to some 100 VA disabled veterans for a portion of the real estate taxes or rent paid See all Mississippi veterans benefits Missouri Property Tax Exemption Missouri senior and resident homeowners with a 100 VA disability rating can receive a property tax credit for up to 1 100 Renters can receive

Download Do Veterans Have To Pay Property Taxes In Missouri

More picture related to Do Veterans Have To Pay Property Taxes In Missouri

Hecht Group Do Veterans Pay Property Taxes In Maryland

https://img.hechtgroup.com/1663513847654.jpg

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Tax Payment Westbrook ME

https://www.westbrookmaine.com/ImageRepository/Document?documentID=219

If you are a 100 percent service connected disabled veteran do not include VA payments OWNED AND OCCUPIED YOUR HOME THE ENTIRE YEAR If single is your total Several joint resolutions regarding personal property taxes for a population of Missouri veterans have been filed in 2022 HJR 73 HJR 86 and SJR 40 would extend a full tax exemption to all

Do disabled veterans pay property taxes in Missouri As a disabled veteran you might be eligible to receive credit up to 1 100 in tax exemption if you own property If you re a renter then the Veterans determined by the VA to be 100 disabled may be able to claim the Missouri Property Tax Credit to offset part of their annual real estate taxes or rent

Hecht Group Do Veterans Pay Property Taxes In Maryland

https://img.hechtgroup.com/1663513848747.jpg

Do Veterans Pay Property Taxes In Georgia YouTube

https://i.ytimg.com/vi/eQPuDnD1WXo/maxresdefault.jpg

https://senate.mo.gov › BTS_Web › Bill.aspx

This bill creates the Missouri Disabled Veterans Homestead Exemption which provides a tiered tax exemption system for veterans with disabilities The exemptions are

https://stc.mo.gov › faq

Consequently to qualify the applicant for such an exemption must 1 be a former prisoner of war and 2 a veteran of any branch of the armed forces of the United States or this state who

Do Veterans Pay Property Taxes State Specific Exemptions

Hecht Group Do Veterans Pay Property Taxes In Maryland

How The Disabled Veterans Property Tax Benefit Works YouTube

Property Tax Deadline In Missouri Nears

Gubernatorial Candidates Open To Lowering Eliminating Personal

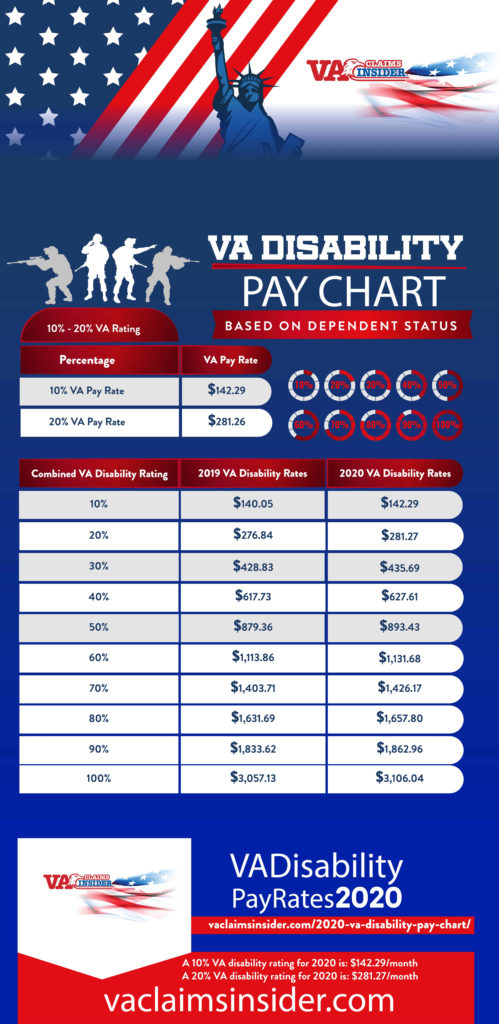

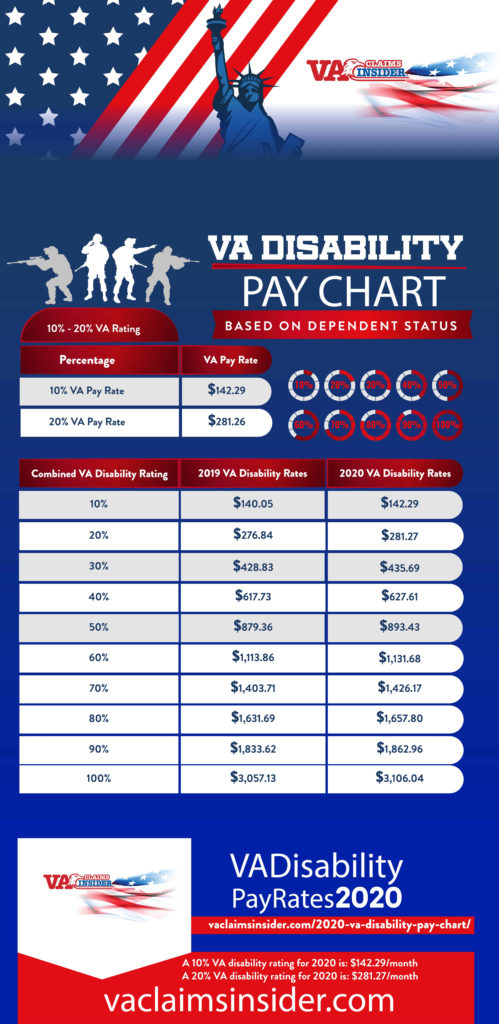

Military Medical Retirement Pay Chart 2020 Military Pay Chart 2021

Military Medical Retirement Pay Chart 2020 Military Pay Chart 2021

What Happens If You Don t Pay Property Tax J Hall Company

Nearly 100 Bills Filed To Reform Property Taxes In Missouri

Why Do Homeowners Have To Pay Property Taxes

Do Veterans Have To Pay Property Taxes In Missouri - Missouri Personal Property Tax Credit for Senior Citizens and 100 Disabled Veterans The Missouri Property Tax Credit gives credit to eligible resident senior citizens and Veterans with