Do Veterans Have To Pay Sales Tax On Vehicles Military members must pay sales tax on purchases just like everyone else What gets a little tricky is that the sales tax is based on and paid to the state in which

Sales tax Per M G L Chapter 64H Section 6 disabled veterans do not need to pay sales tax for one passenger vehicle or pick up truck It must be owned by the veteran Certain disabled veterans may be eligible for a Sales and Use Tax SUT exemption on purchased vehicles Veterans of the United States Armed Forces or the Virginia

Do Veterans Have To Pay Sales Tax On Vehicles

.png)

Do Veterans Have To Pay Sales Tax On Vehicles

https://www.utahpta.org/files/images/Screenshot (204).png

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

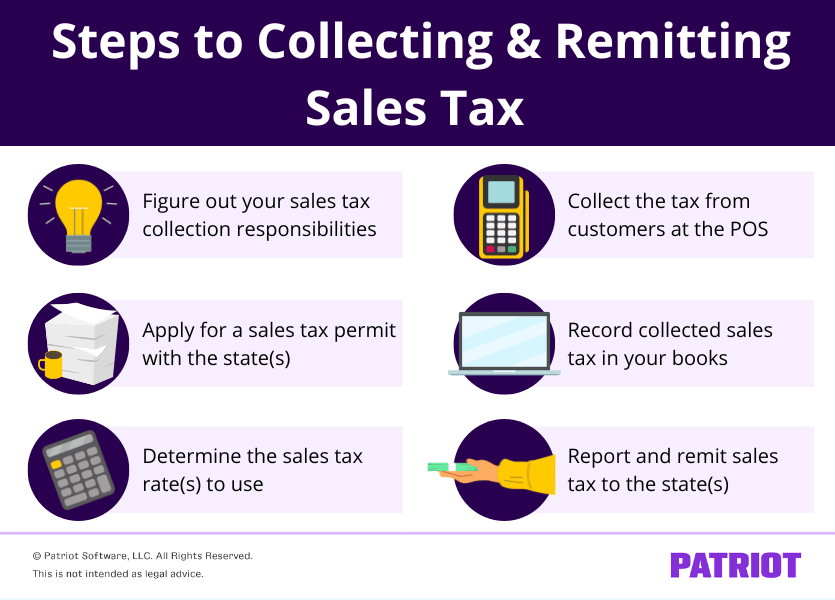

How To Pay Sales Tax For Online Business The Mumpreneur Show

https://www.patriotsoftware.com/wp-content/uploads/2022/12/Collecting-Remitting-sales-tax-1.png

While states that charge sales tax don t have blanket disabled veteran sales tax exemptions some states waive excise taxes registration and other fees for Georgia Sales Tax Exemption on Vehicles Purchased through U S Department of Veterans Affairs Grant A disabled Veteran who receives a VA grant for the purchase

Arkansas Gross Receipts or Gross Proceeds Tax Exemption Eligible disabled Veterans do not have to pay taxes on specially adapted vehicles or equipment that are purchased with Many states allow people with disabilities to qualify for a sales tax exemption when purchasing a vehicle Individuals with mobility issues paraplegics and disabled

Download Do Veterans Have To Pay Sales Tax On Vehicles

More picture related to Do Veterans Have To Pay Sales Tax On Vehicles

Do I Have To Pay Sales Tax On A Car That Was Gifted Nj

https://www.nj.com/resizer/QmHEAPW_Hg4_4odQUTnCU7ZaHdk=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/DTHQOAF5LJDPDJK2DI2XLWHOKQ.jpg

How To Pay Sales Tax For An Online Business In 2020 Selling On Etsy

https://i.ytimg.com/vi/ObeH5ohfhxU/maxresdefault.jpg

How Much Are Used Car Sales Taxes In Nevada PrivateAuto

https://privateauto.com/blog/content/images/2023/04/Blog-Post-Headers-2---2023-04-13T121043.315.jpg

Sales Tax Exemption for Vehicle Purchase Adaptation A disabled veteran who receives a VA grant for the purchase and special adapting of a vehicle is exempt from paying the Individuals Special tax considerations for veterans Disabled veterans may be eligible to claim a federal tax refund based on an increase in the veteran s

Learn more about the Oklahoma 100 Disabled Veteran Sales Tax Exemption Oklahoma 100 Disabled Veteran Motor Vehicle Tax Exemption Oklahoma offers a Motor Vehicle Excise Tax Starting July 1 2024 purchases of a motor vehicle by a Veteran having a 100 total service connected disability includes TDIU are exempt from the Motor Vehicle Sales

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Do American Small Businesses Have To Pay Sales Tax Quitalks

https://www.quitalks.com/wp-content/uploads/2020/08/pasted-image-0-3.png

.png?w=186)

https://www.military.com/paycheck-chronicles/2014/12/03/sales-tax-cars

Military members must pay sales tax on purchases just like everyone else What gets a little tricky is that the sales tax is based on and paid to the state in which

https://www.mass.gov/info-details/disabled-veteran...

Sales tax Per M G L Chapter 64H Section 6 disabled veterans do not need to pay sales tax for one passenger vehicle or pick up truck It must be owned by the veteran

Shutterstock 1930187015 1200x1200 jpg v 1684365662

Sales Tax By State Here s How Much You re Really Paying Sales Tax

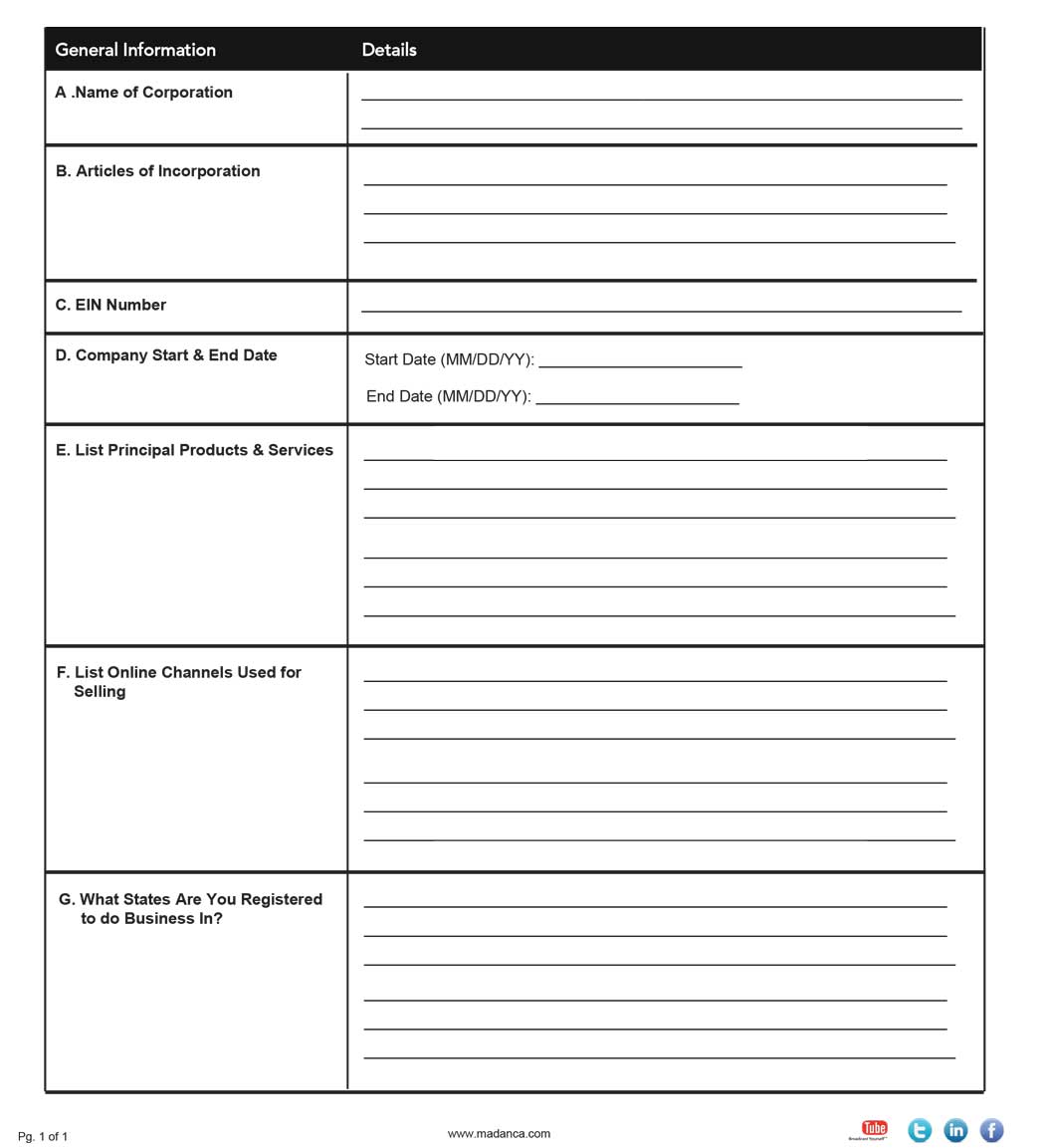

US Sales Tax Checklist Madan CA

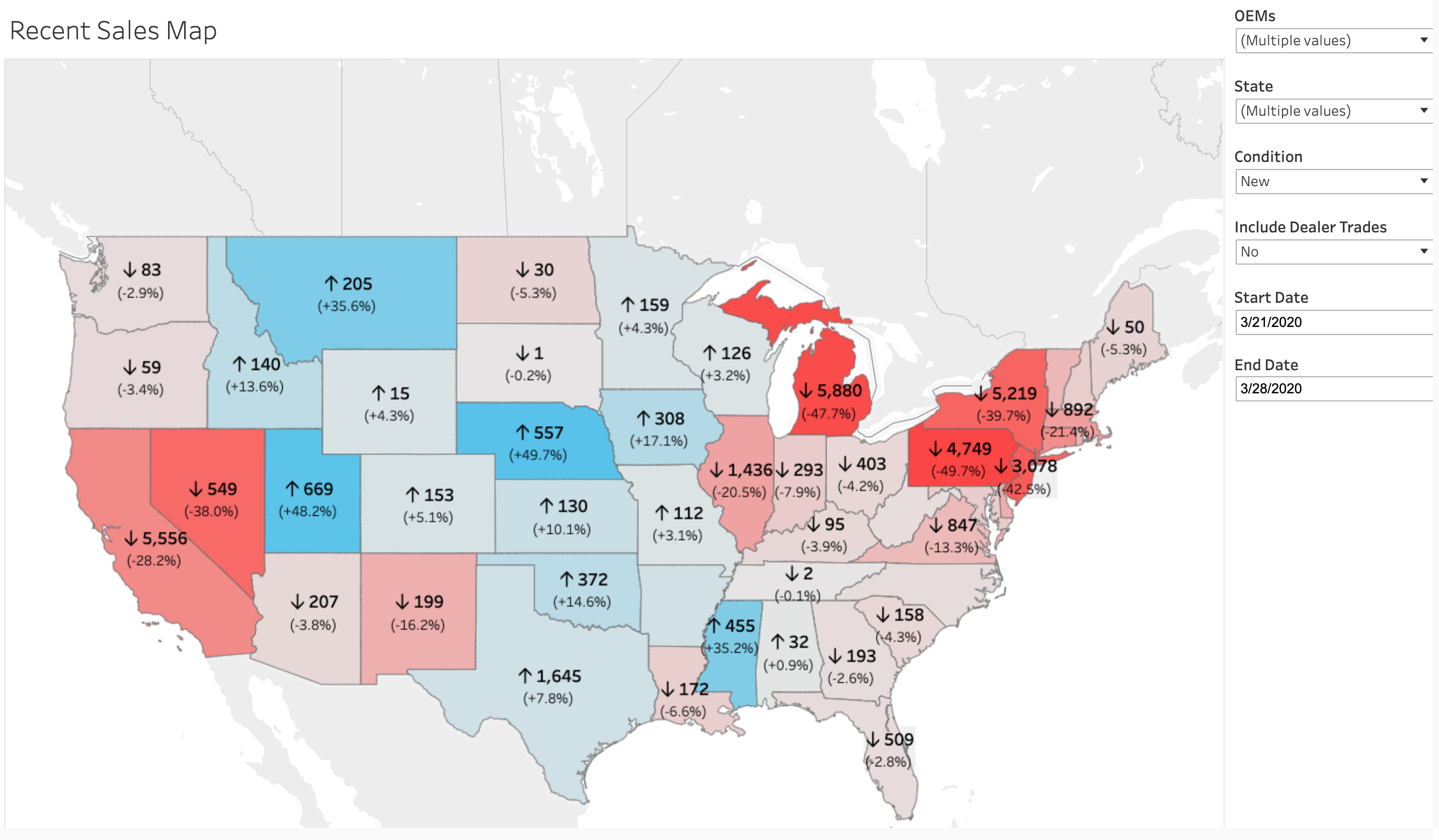

Data Analysis U S New Car Sales By State

10 States With The Lowest Sales Tax Rates In The U S Kiplinger

How To Increase The Value Of A Business By Paying More Taxes

How To Increase The Value Of A Business By Paying More Taxes

Oklahoma Tax Sales Tax Deeds YouTube

TaxHero Blog

Do I Have To Pay Sales Tax Hell Yes You Do YouTube

Do Veterans Have To Pay Sales Tax On Vehicles - Tennessee Tax Free Motor Vehicle Sales to Service Members Motor vehicles sold to certain U S Armed Forces service members and registered in Tennessee are exempt