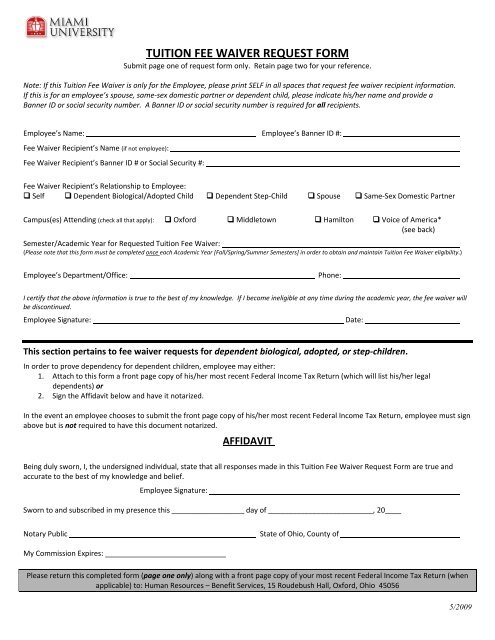

Rebate In Income Tax For Tuition Fees Web The tax benefits are limited to only the actual amount paid The tuition fees deduction under section 80C doesn t allow tax benefits on additional costs like hostel expenses

Web 13 f 233 vr 2023 nbsp 0183 32 You may be able to cut your tax bill by up to 2 500 if you re paying college tuition and you may even be eligible for tax credits that can help cover the cost of continuing education Web 27 janv 2023 nbsp 0183 32 In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post

Rebate In Income Tax For Tuition Fees

Rebate In Income Tax For Tuition Fees

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

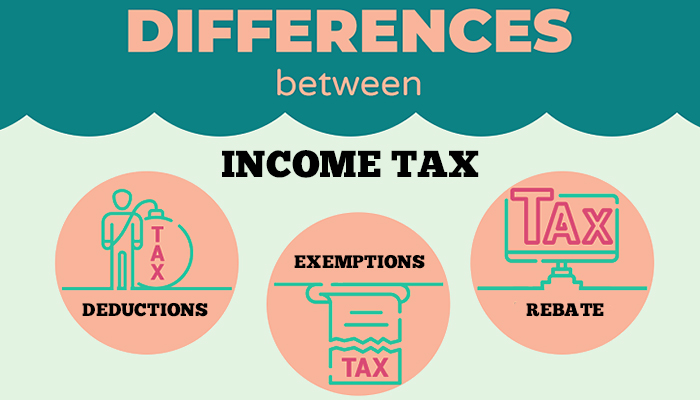

Difference Between Income Tax Deductions Exemptions And Rebate Plan

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

Income Tax Rebate Astonishingceiyrs

https://i.ytimg.com/vi/mw-erFuYboM/maxresdefault.jpg

Web 1 d 233 c 2022 nbsp 0183 32 The deduction is 0 2 000 or 4 000 depending on your Modified Adjusted Gross Income MAGI 4 000 deduction for MAGI of 65 000 or less 130 000 or less Web 14 juil 2022 nbsp 0183 32 The amount paid as tuition fees qualifies for tax benefit under section 80C up to a maximum limit of Rs 1 5 lakh per annum It means under income tax rules you are allowed

Web Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children Web 29 mars 2023 nbsp 0183 32 You can claim tax relief on tuition fees paid for Undergraduate course Postgraduate courses IT and foreign language courses You are not able to claim tax relief on Administration fees or

Download Rebate In Income Tax For Tuition Fees

More picture related to Rebate In Income Tax For Tuition Fees

No More Tuition Tax Rebate But More Money For Refugee Housing Coming

https://i.cbc.ca/1.4030187.1489783617!/cpImage/httpImage/image.jpg_gen/derivatives/16x9_620/mba-tory-agenda-20170316.jpg

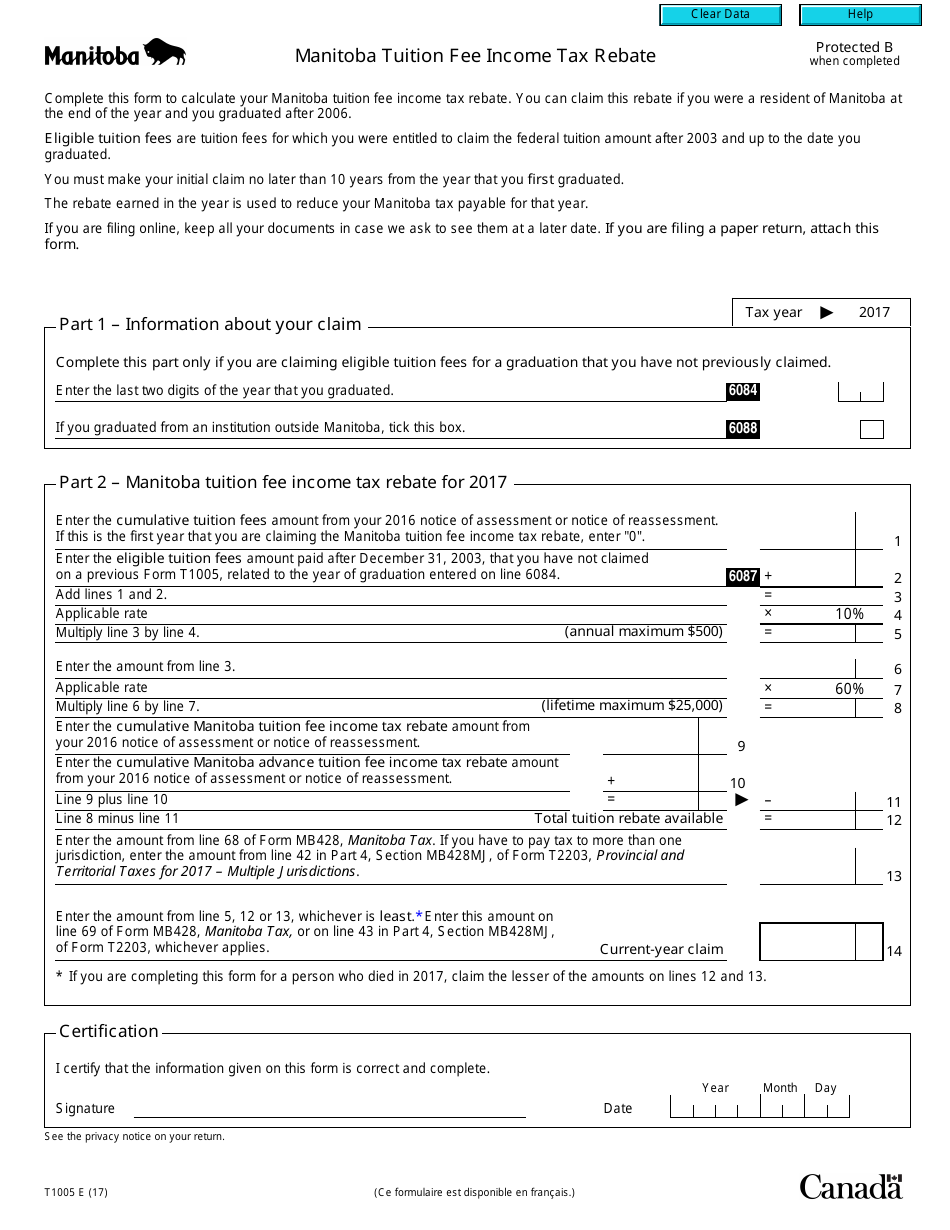

Form T1005 Download Fillable PDF Or Fill Online Manitoba Tuition Fee

https://data.templateroller.com/pdf_docs_html/1868/18689/1868960/form-t1005-manitoba-tuition-fee-income-tax-rebate-canada_print_big.png

Section 87A Of Income Tax Act Claim 12500 Income Tax Rebate For FY

https://www.aubsp.com/wp-content/uploads/income-tax-rebate.jpg

Web 24 mai 2023 nbsp 0183 32 The Tuition and Fees Deduction The deduction for tuition and fees expired on December 31 2020 However taxpayers who paid qualified tuition and fees in 2018 Web 13 mai 2022 nbsp 0183 32 The Consolidated Appropriations Act of 2021 shifted the deduction for qualified tuition and expenses to instead increase the income limitation on the lifetime learning credit enabling qualifying taxpayers to

Web 7 sept 2023 nbsp 0183 32 The new limits include an increase from 5 000 to 8 000 in the first 13 weeks of enrollment in a qualifying educational program full time studies and from 2 500 to Web 17 f 233 vr 2017 nbsp 0183 32 When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax benefit under

Rajesh Singh Chairman Of Kunwar s Global School Announces 25 Percent

https://images.hindustantimes.com/rf/image_size_630x354/HT/p2/2020/05/01/Pictures/_80052728-8b9f-11ea-8bae-d48e751bd032.jpg

Rebate U s 87A Of I Tax Act Income Tax

https://carajput.com/art_imgs/basic-understanding-of-rebate-us-87a-of-i-tax-act.jpg

https://khatabook.com/blog/tuition-fees-deduction

Web The tax benefits are limited to only the actual amount paid The tuition fees deduction under section 80C doesn t allow tax benefits on additional costs like hostel expenses

https://money.usnews.com/money/personal-fi…

Web 13 f 233 vr 2023 nbsp 0183 32 You may be able to cut your tax bill by up to 2 500 if you re paying college tuition and you may even be eligible for tax credits that can help cover the cost of continuing education

5 Rebate Income Tax YouTube

Rajesh Singh Chairman Of Kunwar s Global School Announces 25 Percent

Tuition Fee Income Tax Rebate YouTube

Tax Relief For Tuition Fees My Tax Rebate

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

TUITION FEE WAIVER REQUEST FORM

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Editable 5 Tuition Receipt Templates Pdf Free Premium Templates

Rebate In Income Tax For Tuition Fees - Web 10 sept 2018 nbsp 0183 32 B Tuition fees An individual is eligible to claim a tax deduction for tuition fees paid to any university college or other educational institution in India for two