Income Tax Rebate For Education Fees Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Web Courses that qualify for relief You may claim Course Fees Relief for the Year of Assessment YA 2023 if you have attended Any course of study seminar or conference Web Many taxpayers do not have a clear notion of how to apply for an education fee deduction in income tax Read more Best Tax Saving Plans High Returns Get Returns as high as

Income Tax Rebate For Education Fees

Income Tax Rebate For Education Fees

https://i.pinimg.com/originals/f7/f7/52/f7f752988740aa3845fc00fd89d85a79.jpg

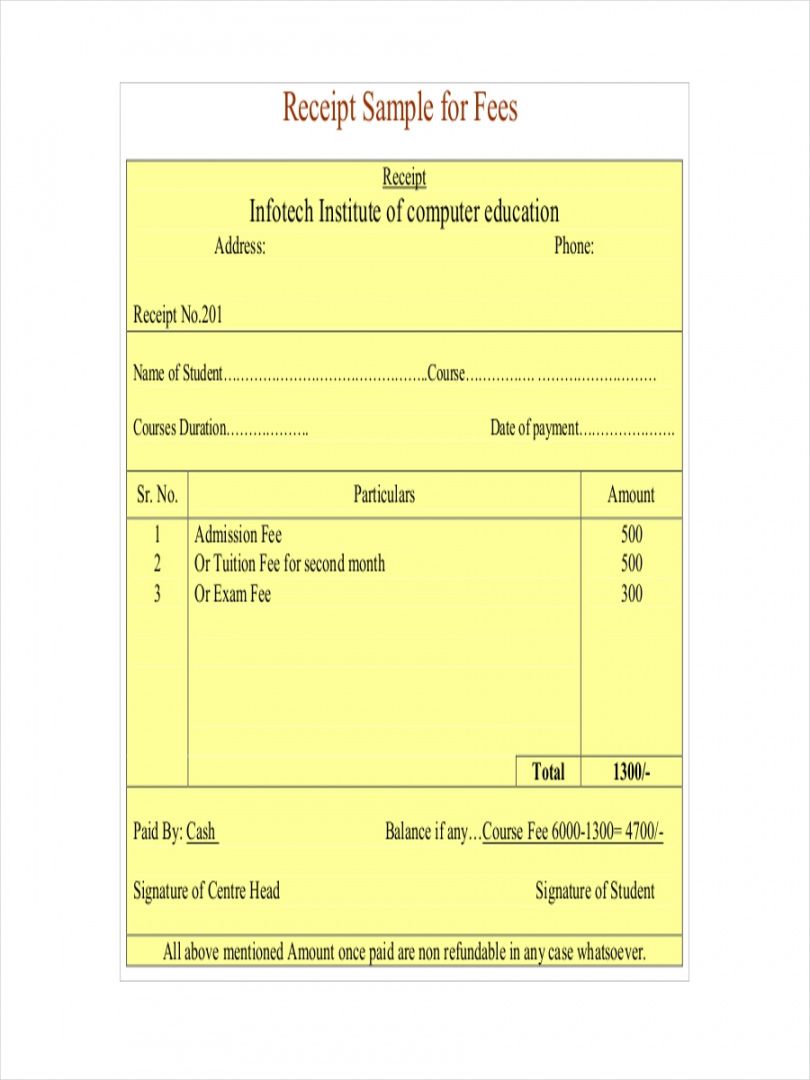

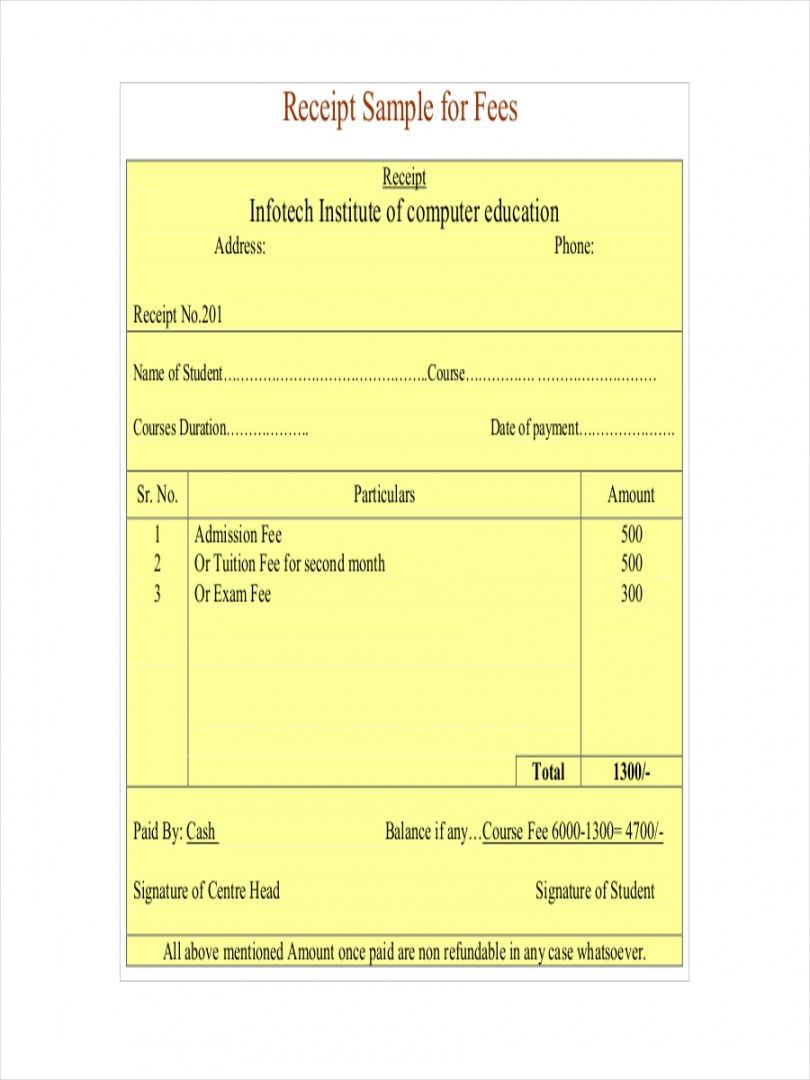

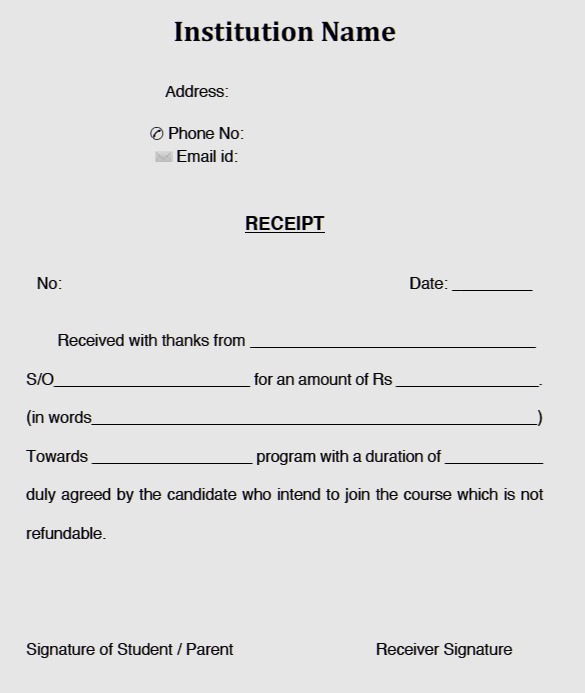

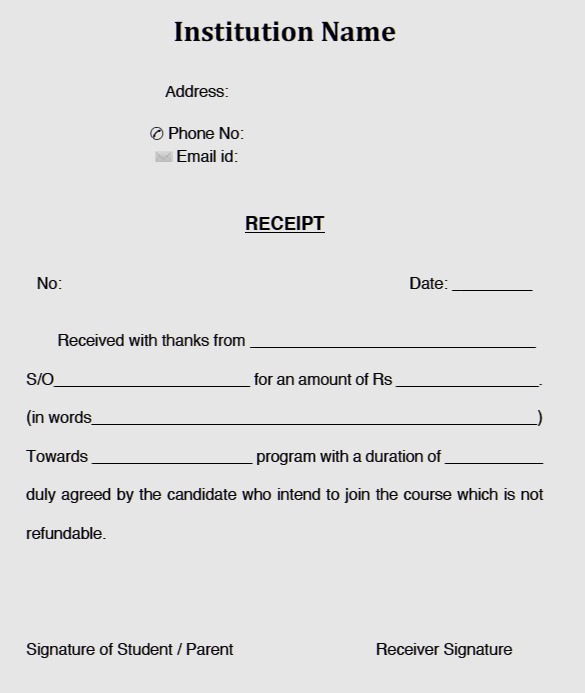

Tuition Fee Receipt Template EmetOnlineBlog

http://www.emetonlineblog.com/wp-content/uploads/2019/03/6-school-receipt-examples-samples-examples-tuition-fee-receipt-template-pdf.jpg

Excellent School Fee Receipt Template In Html Cheap Receipt Templates

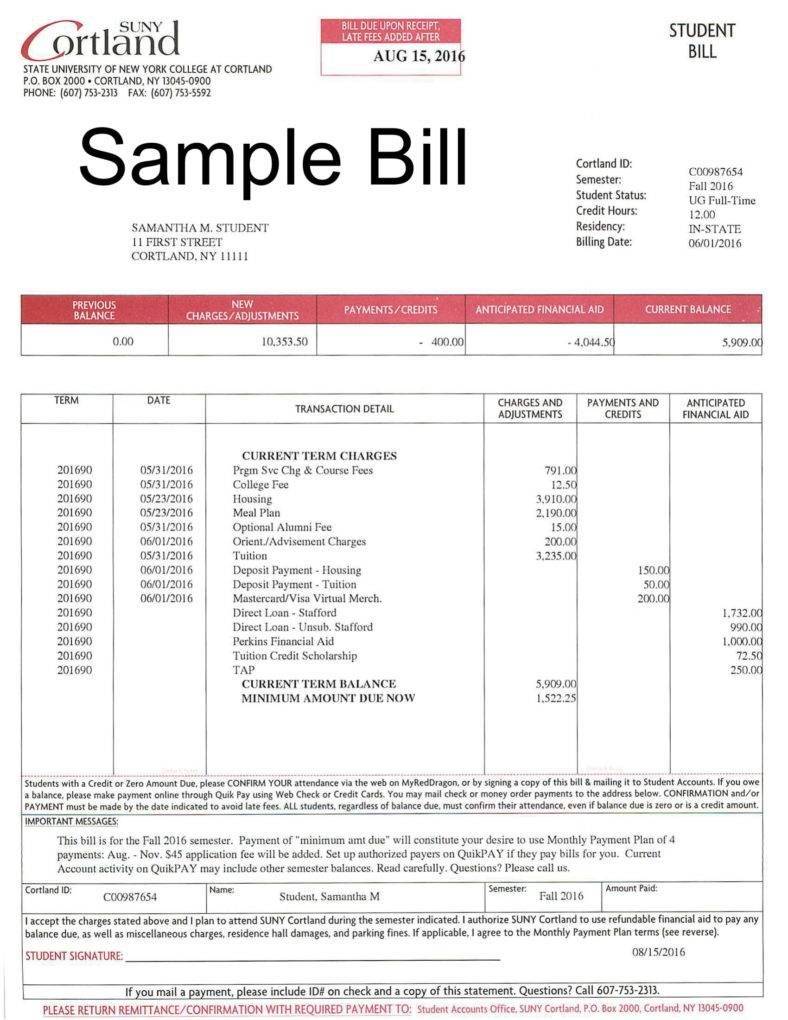

https://images.template.net/wp-content/uploads/2018/05/Sample-Tuition-Bill-Receipt-788x1020.jpg

Web Since the last Independent Schools Council ISC census carried out in 2021 school fees continued the steady upwards trend rising by 3 1 A day school may cost almost 163 15 000 per year per child depending on the area while a boarding school is likely to cost over 163 35 000 per year Web 15 mai 2023 nbsp 0183 32 The maximum amount you can claim is 7 000 per course per person per academic year Each claim is subject to a single disregard amount of 3 000 or 1 500

Web Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children Web 29 ao 251 t 2023 nbsp 0183 32 Tax Benefits for Education Information Center English Espa 241 ol You can use the IRS s Interactive Tax Assistant tool to help determine if you re eligible for

Download Income Tax Rebate For Education Fees

More picture related to Income Tax Rebate For Education Fees

Explore Our Example Of Tuition Fee Receipt Template Receipt Template

https://i.pinimg.com/originals/b5/8d/91/b58d9127751a3ec09910dd46c3257e99.jpg

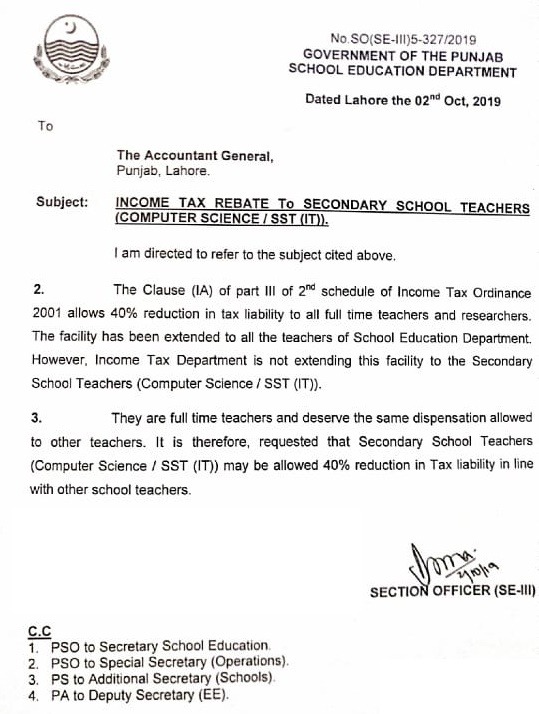

Income Tax Rebate 40 To All Teachers Of School Education Department

https://employeesportal.info/wp-content/uploads/2019/10/Income-Tax-Rebate-40-to-All-Teachers-of-School-Education-Department.jpg

Receipts Archives DSF

http://discountschoolforms.com/wp-content/uploads/2015/04/Tuition-Fee-Receipt_E-116.png

Web 27 juin 2018 nbsp 0183 32 The deduction on payments made towards tuition fee can be claimed up to Rs 150 000 Rs 1 00 000 upto A Y 2014 15 together with deduction in respect of Web Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity

Web 3 juil 2023 nbsp 0183 32 Qualified Education Expenses for Education Credits Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are Web 7 sept 2023 nbsp 0183 32 The new limits include an increase from 5 000 to 8 000 in the first 13 weeks of enrollment in a qualifying educational program full time studies and from 2 500 to

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2023/01/Irish-Tax-Rebates-36-1.jpg?resize=727%2C1024&ssl=1

Education Property Tax Rebate Continues In 2022 City Of Portage La

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-600x450.jpg

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web Courses that qualify for relief You may claim Course Fees Relief for the Year of Assessment YA 2023 if you have attended Any course of study seminar or conference

Pin On Tigri

More Tax Credits More Rebates Education Magazine

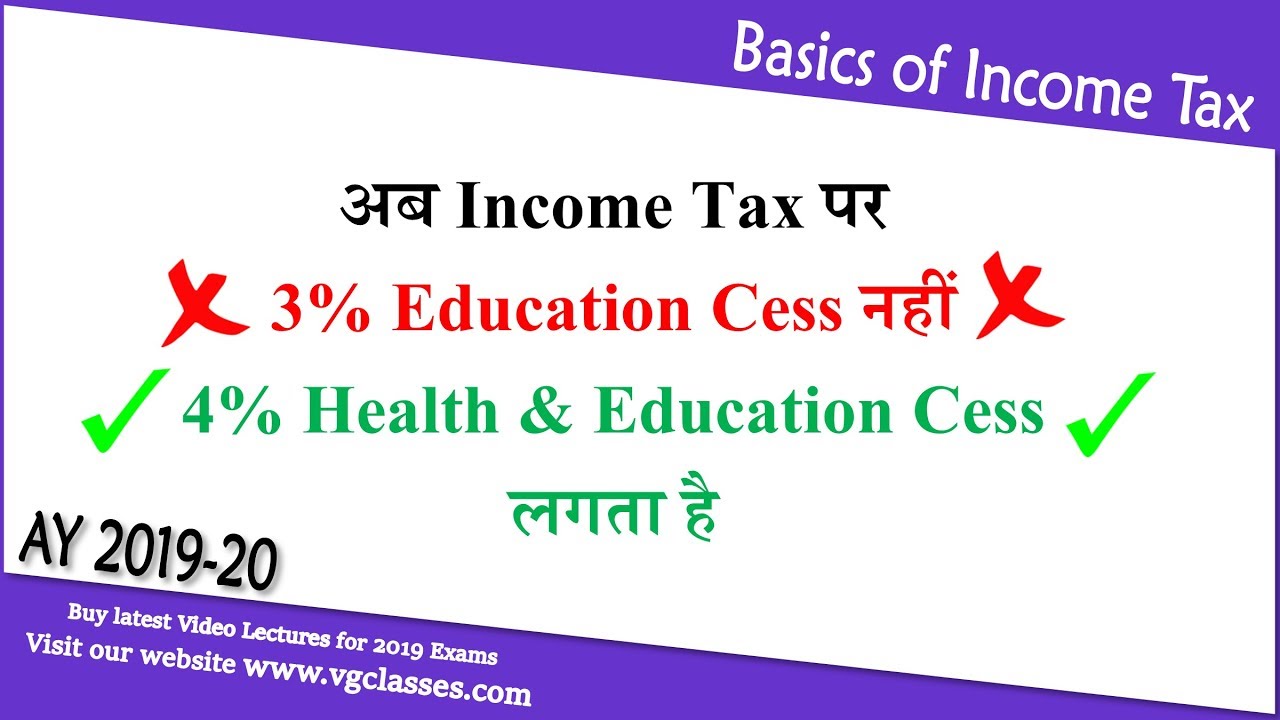

INCOME TAX REBATES FOR FY 20 21

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

DarronKeeran

DarronKeeran

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Health Education Cess Rebate U s 87A Marginal Relief Income Tax

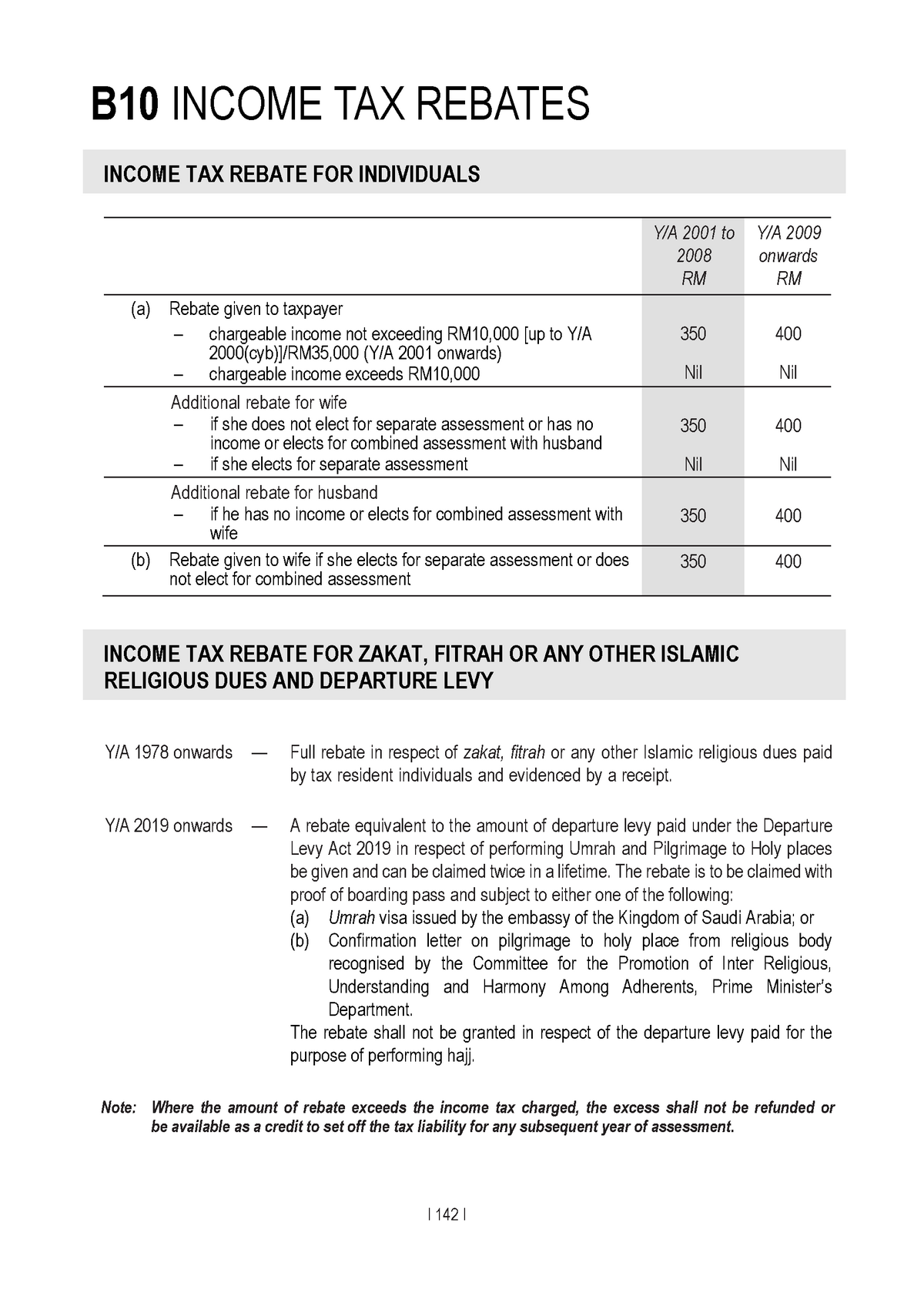

Additional Reading Income Tax Rebates Taxation Studocu

Income Tax Rebate For Education Fees - Web 29 ao 251 t 2023 nbsp 0183 32 Tax Benefits for Education Information Center English Espa 241 ol You can use the IRS s Interactive Tax Assistant tool to help determine if you re eligible for