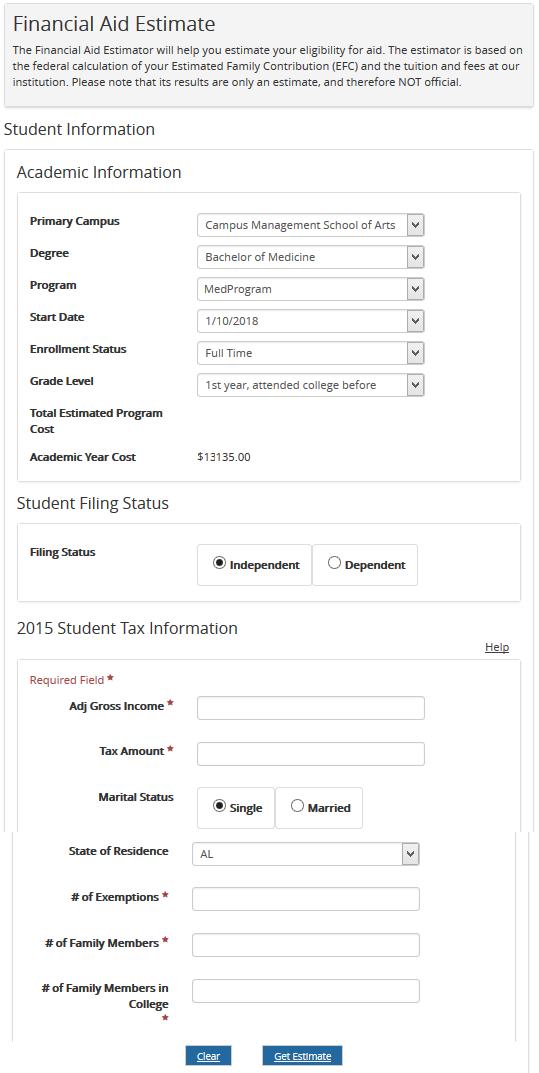

Do You Count Financial Aid As Income When Does Financial Aid Count as Income If you re a non degree student the full amount of any financial aid you receive excluding loans is always considered

However students often wonder whether financial aid counts as income According to the IRS scholarships and grants do not typically count as taxable FAFSA is the key to obtaining various types of federal financial assistance for college education Pell grant funds can be excluded from taxable income if used for

Do You Count Financial Aid As Income

Do You Count Financial Aid As Income

https://sfs.jhu.edu/wp-content/uploads/2022/11/types-of-aid_loans_JHU8968.jpg

Financial Aid West Shore Community College

https://www.westshore.edu/wp-content/uploads/2022/10/FinAid-scaled.jpg

What Do You Count On When Life Gets Tough YouTube

https://i.ytimg.com/vi/Nv6Rjn6cAWA/maxresdefault.jpg

Only certain college student financial aid forms count as income for government benefits such as food stamps and Medicaid Financial aid can include Federal Student Aid Loading

The FAFSA requires parents and students to report income from two years prior to the school year for which financial aid is being requested For example if you One question you may have is Federal Student Aid taxable Let s look at the tax consequences of some types of federal student aid loans Pell Grants and work study

Download Do You Count Financial Aid As Income

More picture related to Do You Count Financial Aid As Income

Understanding College Financial Aid Scholarship America

https://scholarshipamerica.org/wp-content/uploads/2023/07/decoding-financial-aid-ebook-cover.jpg

Understanding Your Financial Aid Award Use This Example As A Guide To

https://data.docslib.org/img/9992377/understanding-your-financial-aid-award-use-this-example-as-a-guide-to-your-financial-aid-award-letter.jpg

Morning Briefing Top Stories From The Straits Times On July 14 2023

https://static1.straitstimes.com.sg/s3fs-public/articles/2023/07/13/2023070356983385snapseed_4.jpg?VersionId=.nZ7noep1GZvZG.XXmb8_NScXtG072o4

Fortunately student loans aren t taxable so you don t report student loans as income on your tax return and you don t have to pay taxes on certain types of financial aid In general student loans aren t considered taxable income by the IRS Because they re loans you have to repay you don t need to report them

If it isn t an asset it will become income when you spend it For example you don t count a Roth IRA in your assets since it s a retirement account but if you take a distribution from Working before or during college could impact your expected family contribution and the amount of federal aid you are eligible to receive Learn how before

Does Workers Comp Count As Income

https://www.workerscomplawyerhelp.com/wp-content/uploads/2022/09/income_MWCL_Blog_1200-x-628.jpg

Do You Count Yards Or Money YouTube

https://i.ytimg.com/vi/sQ2aPNZ232I/maxresdefault.jpg

https://www.moneysolver.org/does-financial-aid-count-as-income

When Does Financial Aid Count as Income If you re a non degree student the full amount of any financial aid you receive excluding loans is always considered

https://www.affordablecollegesonline.org/financial-aid-questions

However students often wonder whether financial aid counts as income According to the IRS scholarships and grants do not typically count as taxable

Do You Count Your Money The Correct Way Ekta Kohli Lightsofeight

Does Workers Comp Count As Income

Financial Aid Appeal Letter Template Financial Aid Appeal Letter

What Are Monthly Income Mutual Funds

Financial Aid

Haze Anniversary July 2023 BangkokBeerGuide

Haze Anniversary July 2023 BangkokBeerGuide

3 Million Americans Live Outside The U S Working Immigrants

Financial Aid Vocab Cheat Sheet By Southernmissadmissions Issuu

Episode 35 What You Do Counts

Do You Count Financial Aid As Income - One question you may have is Federal Student Aid taxable Let s look at the tax consequences of some types of federal student aid loans Pell Grants and work study