Do You Get A Tax Credit For Buying A Used Electric Vehicle Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

Do You Get A Tax Credit For Buying A Used Electric Vehicle

Do You Get A Tax Credit For Buying A Used Electric Vehicle

https://cdn.osvehicle.com/do_you_get_a_tax_credit_for_buying_a_used_electric_vehicle.jpg

All You Need To Know About Electric Vehicle Tax Credits CarGurus

https://static.cargurus.com/images/article/2017/05/26/10/20/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-4169818146229685017-1600x1200.jpeg

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

https://i0.wp.com/juicedfrenzy.com/wp-content/uploads/2021/11/Depositphotos_186124840_S.jpg?w=1000&ssl=1

Starting January 2024 people who buy qualified used electric cars from a dealership for less than 25 000 could be eligible for a tax credit of up to 4000 This guide and lookup tool helps you figure out if a car you re interested in is eligible and if you qualify The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as chargers Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Tax credits are available for home chargers and associated energy storage each up to 1 000

Download Do You Get A Tax Credit For Buying A Used Electric Vehicle

More picture related to Do You Get A Tax Credit For Buying A Used Electric Vehicle

Wow You Can Get A Tax Credit For Buying A Used Electric Vehicle Cobb

https://www.cobbcpa.com/wp-content/uploads/2023/03/dcbel-nhEIkTjKJ3k-unsplash-1024x683.jpg

Can I Get A Tax Credit For Buying An EV In Georgia By Diminished Value

https://image.isu.pub/230313185741-9cb9f82d1558ab1873b333c765940ec4/jpg/page_1.jpg

EVs And Plug In Hybrids That Qualify For Tax Credits Consumer Reports

https://i.pinimg.com/originals/86/b7/bd/86b7bd3f4eb13684f847788f38a73b62.jpg

Federal EV tax credits in 2024 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the bank or the automaker s finance company can take a 7 500 tax Shoppers considering a used electric vehicle EV costing less than 25 000 could obtain up to a 4 000 tax credit The Clean Vehicle tax credit is available to buyers within certain

As part of the phasing in of the new tax and climate law Section 25E of the tax code was amended to include an allowance of a credit for a qualified buyer purchasing a used EV from a dealer to be eligible for a credit equal to the lesser of 4 000 or 30 of the sales price Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to 4 000 for used vehicles purchased from a dealer for 25 000 or less The amount equals 30 of purchased price with a maximum credit of 4 000

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

https://i0.wp.com/juicedfrenzy.com/wp-content/uploads/2021/11/Depositphotos_131877390_S.jpg?fit=1000%2C751&ssl=1

https://electrek.co/2024/03/18/here-are-all-the...

Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a

https://www.fueleconomy.gov/feg/taxused.shtml

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000

4 000 Tax Credit On A Used Electric Vehicle Learn How To Claim

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

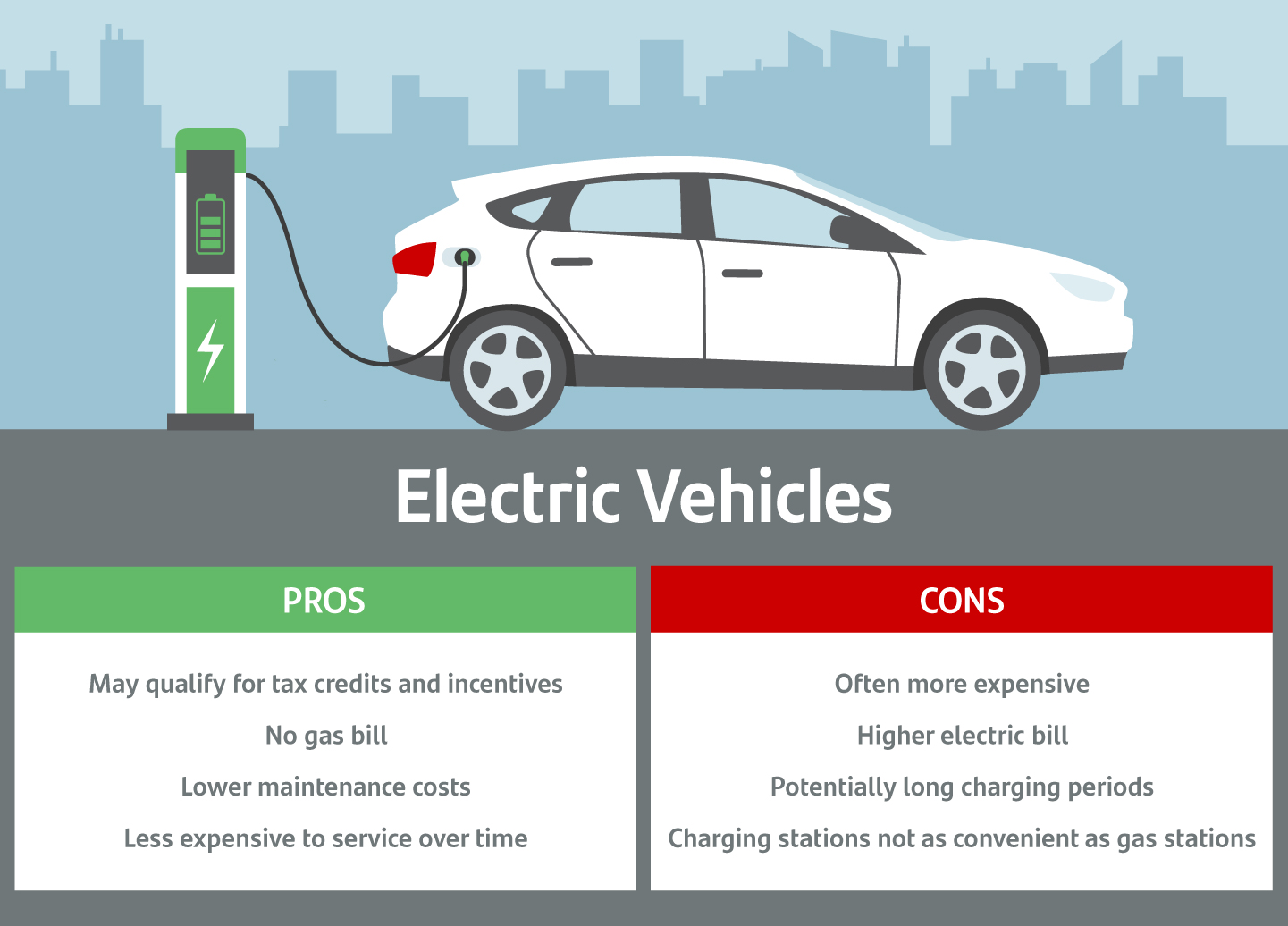

What To Consider Before Buying An Electric Vehicle Santander Consumer USA

The Ultimate Buying Used Cars Checklist Hawthorne Auto Square

What To Know Before Buying A Used Electric Car Cars

5 Negotiating Tips For Buying A Used Car

5 Negotiating Tips For Buying A Used Car

How Long To Keep Tax Returns 7 Questions To Consider Parent Portfolio

More Than Half Of Britons Want Second hand EV But Concerns Remain

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green

Do You Get A Tax Credit For Buying A Used Electric Vehicle - The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as chargers