Do You Get A Tax Credit For Charitable Donations Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the

To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have Charitable donations or contributions are potentially a tax saving opportunity Not only does the charity benefit but taxpayers enjoy tax savings by

Do You Get A Tax Credit For Charitable Donations

Do You Get A Tax Credit For Charitable Donations

https://i.ytimg.com/vi/swRobMRG4fw/maxresdefault.jpg

Understanding The Tax Credit For Charitable Donations Good Times

https://goodtimes.ca/wp-content/uploads/2019/11/Tax-credit-1.jpg

Charitable Contributions And How To Handle The Tax Deductions

https://growthmastery.net/wp-content/uploads/2017/11/form-1040.jpg

With your Giving Account at Fidelity Charitable you can become eligible for a charitable tax deduction and improve the world 7 charitable tax deduction questions are answered in our basic guide to help you Charitable contributions are generally tax deductible though there can be limitations and exceptions Eligible itemized charitable donations made in cash for

You can only deduct charitable contributions if you itemize your deductions Gifts of goods or money must be made to qualified tax exempt Generally you can claim a charitable donation on your taxes only if you itemize your deductions If your itemized deductions are greater than the standard

Download Do You Get A Tax Credit For Charitable Donations

More picture related to Do You Get A Tax Credit For Charitable Donations

Money Architect Financial Planning Russell Sawatsky The Benefits Of

https://moneyarchitect.ca/wp-content/uploads/2020/04/Blog-42.-Fed.Prov_.Terr_.-Donation-Tax-Credit-Rates.jpg

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)

Tax Deductions For Charitable Donations

https://www.thebalancemoney.com/thmb/Iv3JmDfVlOYV3g14ZuockNA4g9o=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif

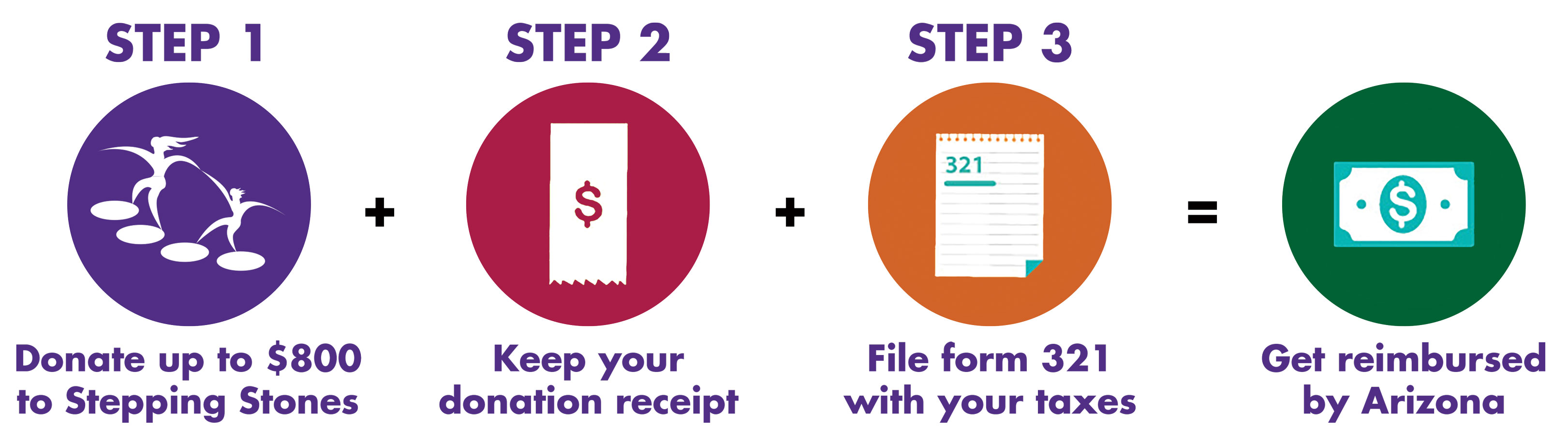

Keep Your State Taxes Local With A Charitable Tax Credit Stepping

https://steppingstonesaz.org/wp-content/uploads/2018/09/Tax-Credit-4-Steps-Transparent-CMYK.jpg

You generally must itemize your deductions to claim charitable contributions For your 2020 you can deduct up to 300 of donations per tax return if you take the standard The pandemic relief CARES Act allows taxpayers taking the standard deduction in 2021 up to a 600 deduction for qualified charitable donations

Taxpayers who itemize can generally claim a deduction for charitable contributions to qualifying organizations The deduction is typically limited to 20 to When you donate money to a qualifying public charity you can deduct up to 60 of your income alleviating your tax burden Here s what you need to know If you re

Arizona Charitable Tax Credit Donation

https://harvestcompassioncenter.org/wp-content/uploads/2020/01/maxresdefault.jpg

Charitable Giving

https://www.boomersblueprint.com/images/stories/charitable giving table.jpg

https://www.irs.gov/credits-deductions/individuals...

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the

https://money.usnews.com/money/personal-finance/...

To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have

Here s How To Get This Year s Special Charitable Tax Deduction

Arizona Charitable Tax Credit Donation

Claiming Charitable Donations When Filing A Tax Return Kalfa Law Firm

Charitable Tax Credits How Much Will You Get Back CanadaHelps

Charitable Donation Tax Credits YouTube

Investing Your Charitable Donations Credit Investing Charitable

Investing Your Charitable Donations Credit Investing Charitable

Tips On Tax Deductions For Donations

Bunching Up Charitable Donations Could Help Tax Savings

Norwegian Charitable Donations And Tax Credits For Donations Worldakkam

Do You Get A Tax Credit For Charitable Donations - With your Giving Account at Fidelity Charitable you can become eligible for a charitable tax deduction and improve the world 7 charitable tax deduction questions are answered in our basic guide to help you