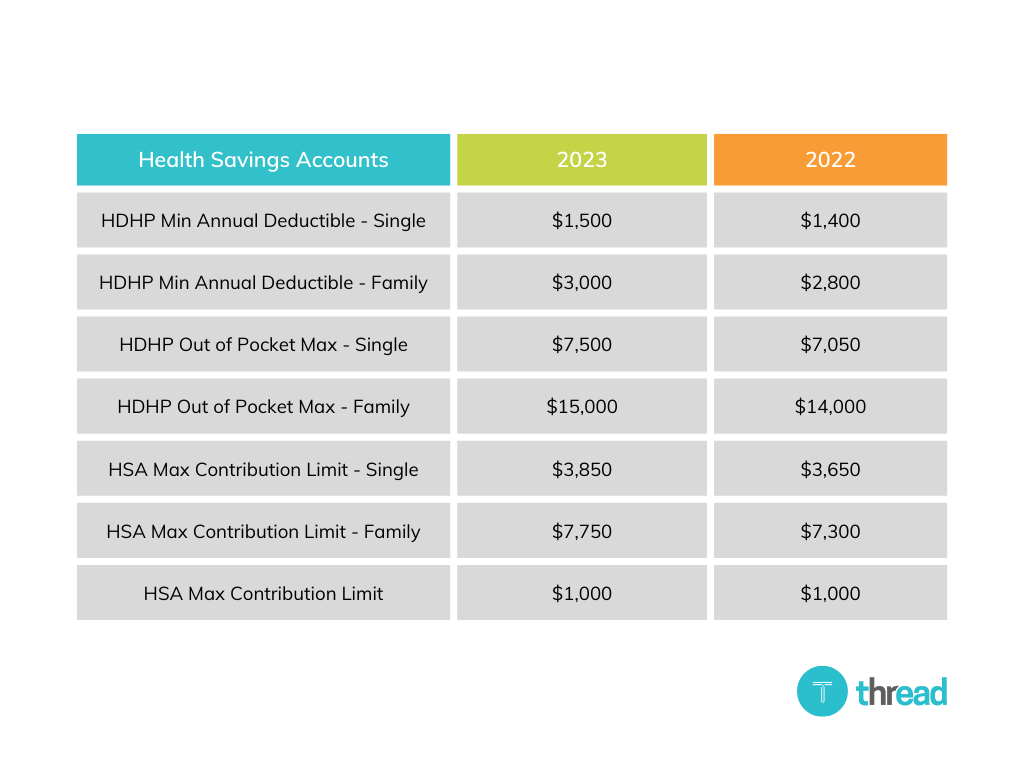

Do You Get A Tax Deduction For Hsa Contributions The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses

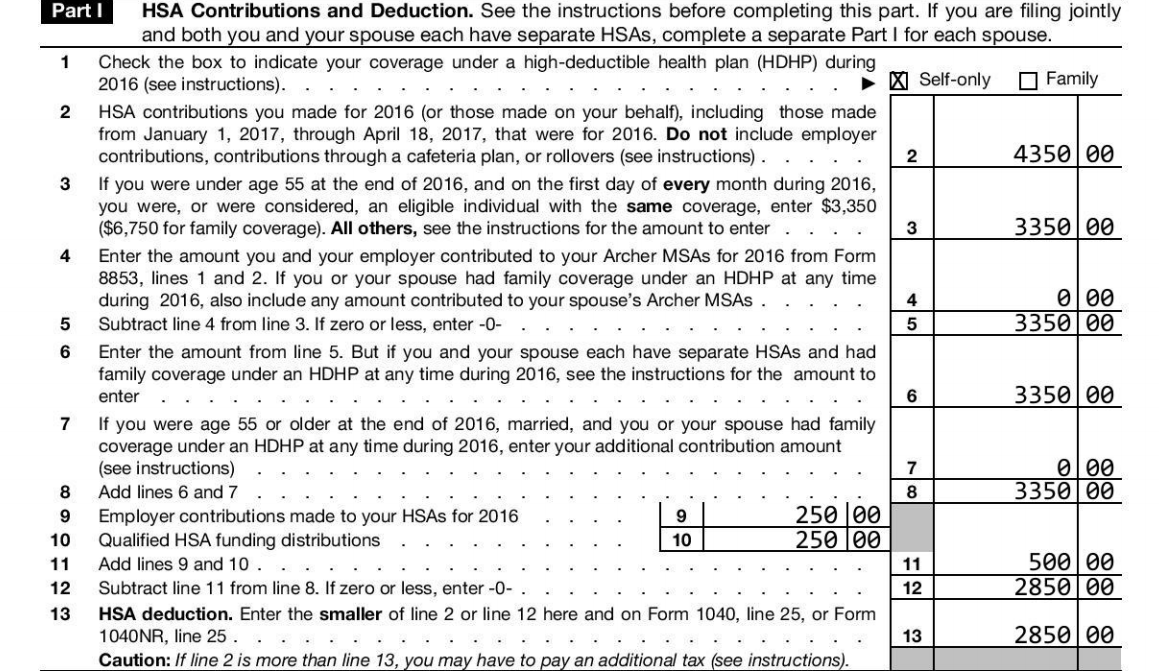

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded You won t get a tax deduction for your employer s contributions the amount your employer contributes will reduce what you can contribute for the year and

Do You Get A Tax Deduction For Hsa Contributions

Do You Get A Tax Deduction For Hsa Contributions

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=1536&name=HSA Contribution Limits Table.png

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

Texas Sales Tax Exemption Certificate PDF Form FormsPal

https://formspal.com/pdf-forms/other/texas-sales-tax-exemption-certificate/texas-sales-tax-exemption-certificate-preview.webp

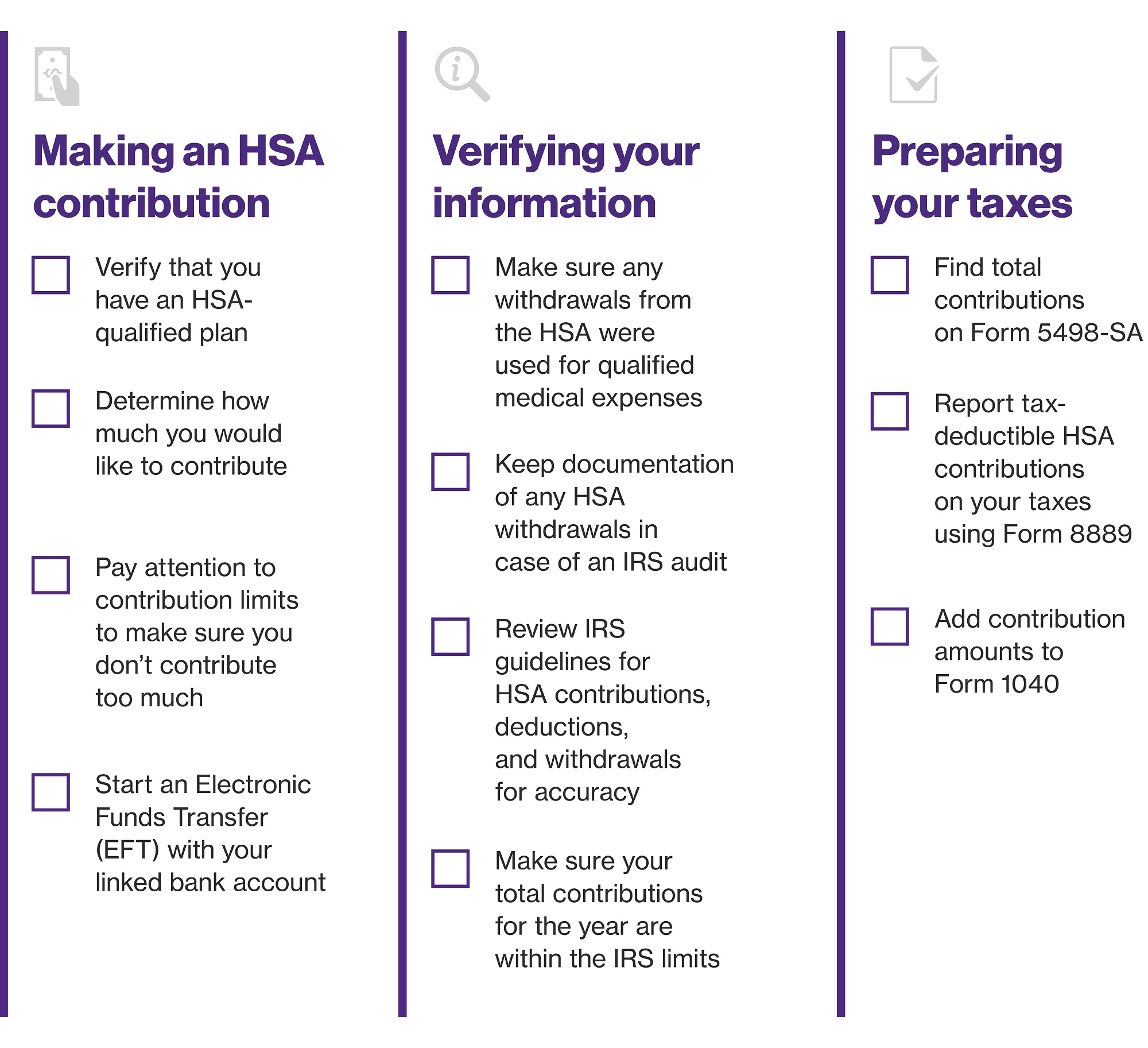

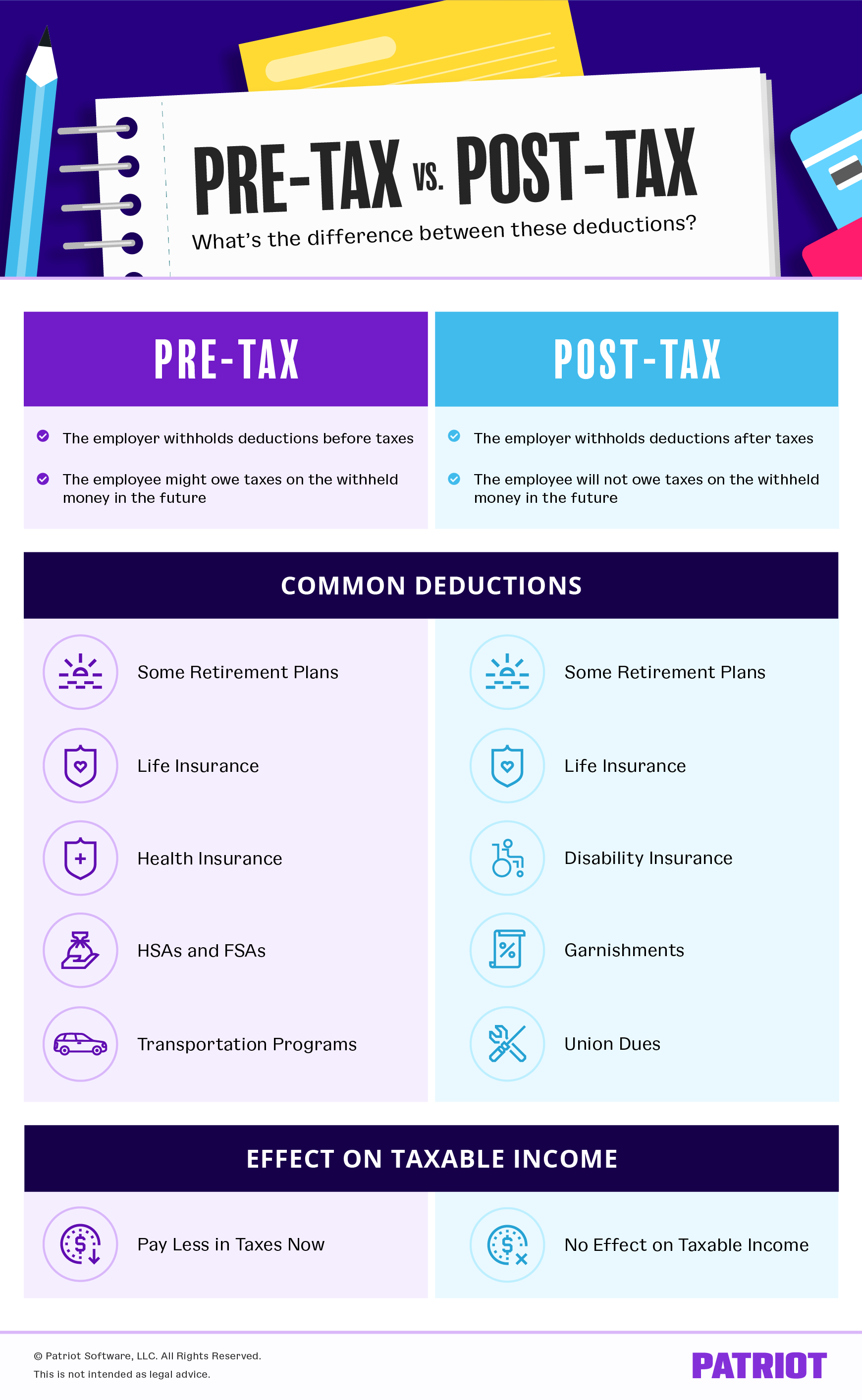

An HSA allows you to pay lower federal income taxes by making tax free deposits each year You can enroll in an HSA qualified high deductible health plan during open enrollment or a special If you re enrolled in this type of health plan you can make pre tax contributions to an HSA and consequently pay for qualified medical expenses tax free Making HSA contributions can help create

Contributions to an HSA are tax deductible For employer sponsored plans the contributions are deducted from paychecks If you re self employed the deductions can be taken when your No tax is levied on contributions to an HSA the HSA s earnings or distributions used to pay for qualified medical expenses An HSA while owned by an employee can be funded by the employee

Download Do You Get A Tax Deduction For Hsa Contributions

More picture related to Do You Get A Tax Deduction For Hsa Contributions

HSA Contribution Rules Car Insurance Guru

https://carinsuranceguru.org/wp-content/uploads/2022/06/hsa-contribution-rules.png

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

Tax Return Tax Deductions For Teachers

https://static.wixstatic.com/media/d1b86a_76f1149e9b0946ed9817a1c4038335bb~mv2.png/v1/fill/w_940,h_788,al_c,q_90,enc_auto/d1b86a_76f1149e9b0946ed9817a1c4038335bb~mv2.png

All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income Your contributions may be 100 percent tax deductible meaning contributions Yes HSA contributions may be tax deductible depending on how the funds are added to the account If you contribute money to your HSA through your paycheck you can not deduct the contribution on

In both cases there s no federal income tax on the HSA contributions and in most states there s no state income tax either However some HSA contributions are still subject to In short contributions to an HSA made by you or your employer may be claimed as tax deductions even if you don t itemize deductions on a Schedule A Form 1040

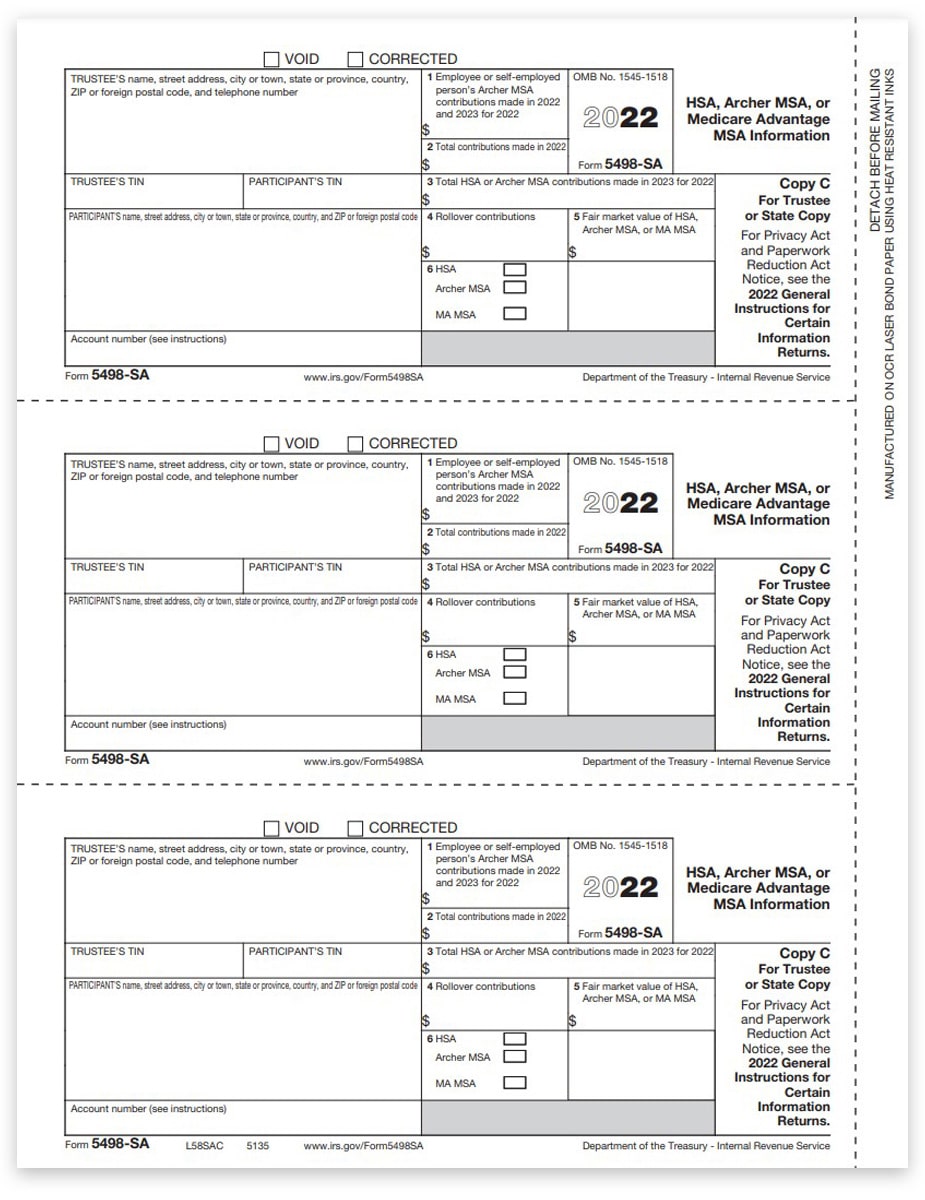

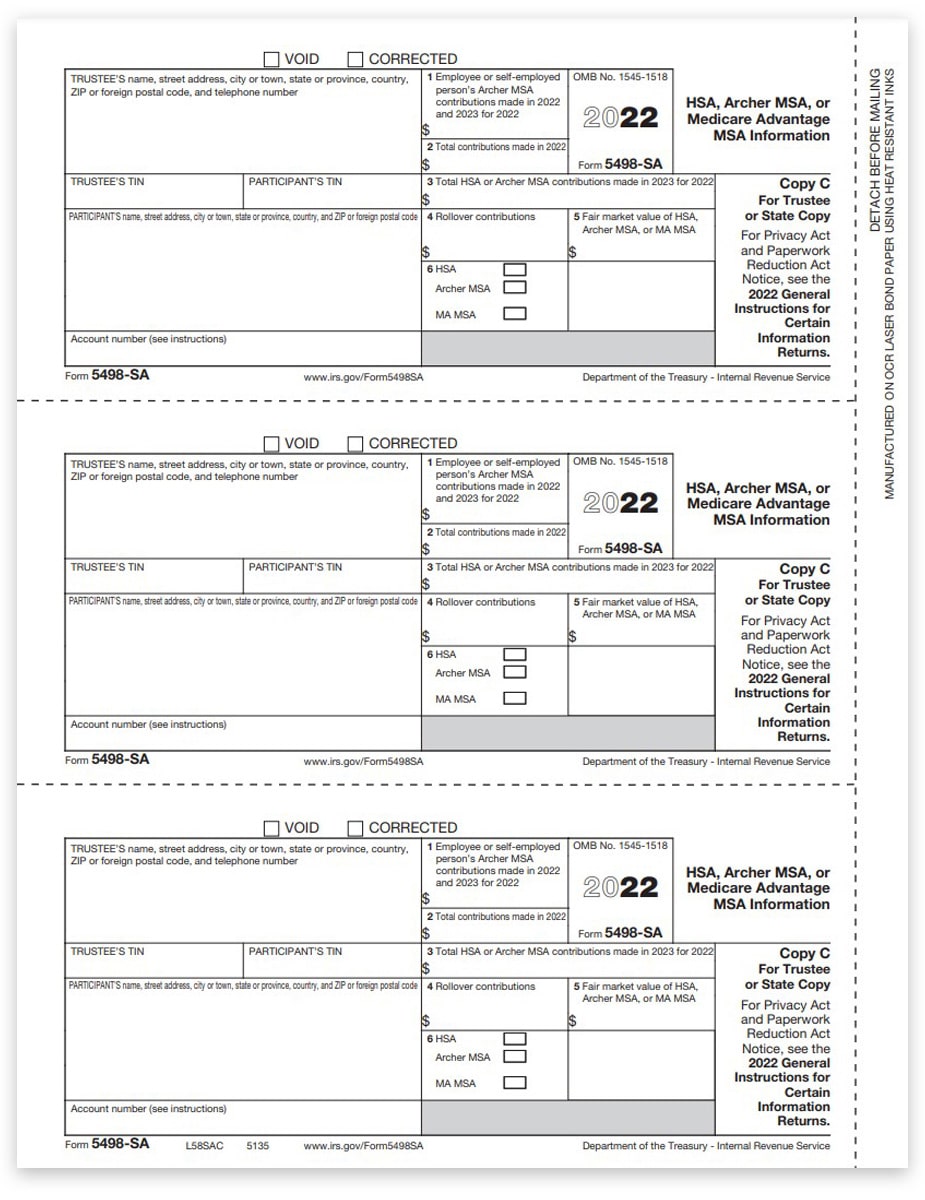

2023 Hsa Form Printable Forms Free Online

https://www.discounttaxforms.com/wp-content/uploads/2022/08/5498SA-Form-Copy-C-Trustee-State-L58SAC-FINAL-min.jpg

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

https://i.ytimg.com/vi/Bi4oWopz_UM/maxresdefault.jpg

https://www.nerdwallet.com/article/taxes/f…

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses

https://www.hrblock.com/tax-center/filing/...

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded

Form 8889 2023 Printable Forms Free Online

2023 Hsa Form Printable Forms Free Online

How To Save Tax Without Investing In India 2023 Coin Wall

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

HSA Form W 2 Reporting

Irs Hsa 2024 Contribution Limits Avis Kameko

Irs Hsa 2024 Contribution Limits Avis Kameko

2023 Form 8889 Printable Forms Free Online

Pre tax Vs Post tax Deductions What s The Difference

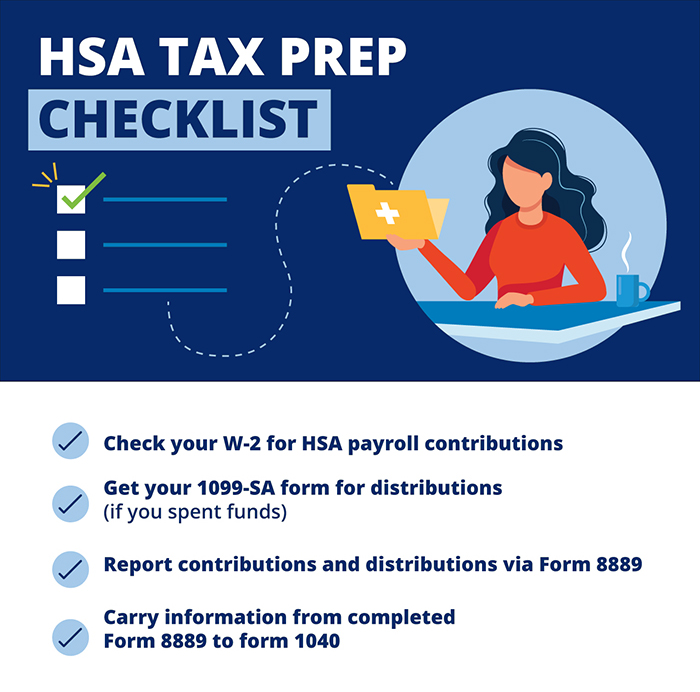

Your HSA And Your Tax Return 4 Tips For Filing First American Bank

Do You Get A Tax Deduction For Hsa Contributions - Contributions are tax free and you re not taxed on money used for qualifying medical expenses either An HSA is also a great tool for retirement savings even if those