Do You Get A Tax Form For Donating Plasma Most folks unless they have received a specific 1099 MISC tax form showing the amount you received do not include those token amounts on their returns nor do they have

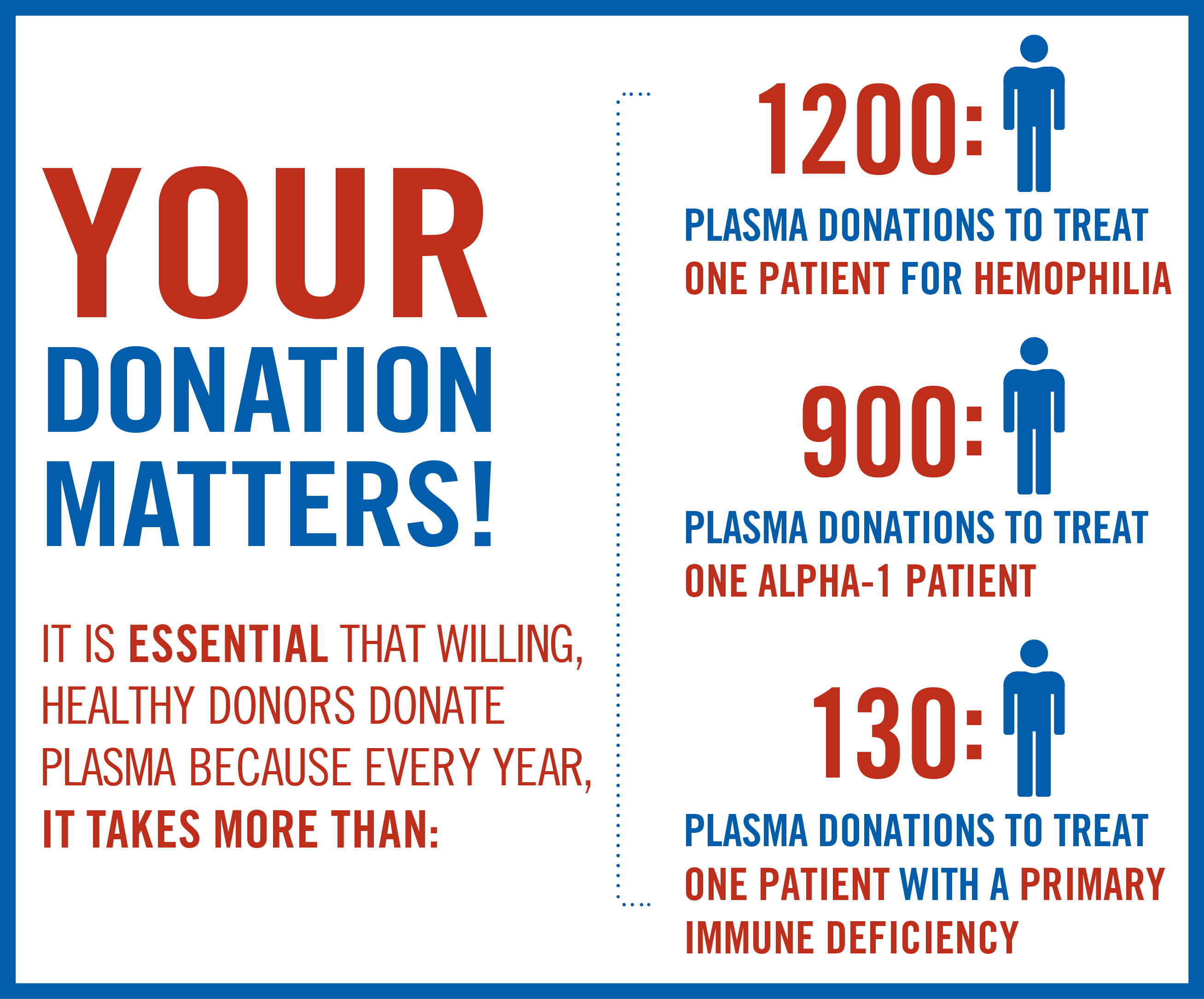

As a result donors must report their plasma earnings on tax returns Unlike charitable donations that may qualify for tax deductions plasma donation payments offer no When it comes time to file your tax return you ll need to report your plasma donation income as other income on Schedule 1 of Form 1040 This income will be subject to federal income tax and potentially state income

Do You Get A Tax Form For Donating Plasma

Do You Get A Tax Form For Donating Plasma

https://static1.reviewthisimages.com/wordpress/wp-content/uploads/2021/01/DonatingPlasma-e1610246562722.jpg

Is Donating Plasma For Money Worth It Thales Learning Development

https://img.thales-ld.com/1665404697187.jpg

Donating Plasma Your Common Questions Answered Hospitality Health ER

https://hher24.com/wp-content/uploads/2022/01/shutterstock_414209803-scaled.jpg

According to IRS guidelines any income not explicitly exempted by law is taxable Plasma donation compensation is not exempt so donors must report it even if they do not When it comes to reporting income from plasma donation on your tax return this income should be reported on Schedule 1 Form 1040 specifically on line 8 labeled Other income This

When it comes to reporting income from plasma donation on your tax return this income should be reported on Schedule 1 Form 1040 specifically on line 8 labeled Other Yes if you donate plasma and receive compensation for it you are required to pay taxes on that income The Internal Revenue Service IRS considers plasma donation payments as taxable income similar to earnings

Download Do You Get A Tax Form For Donating Plasma

More picture related to Do You Get A Tax Form For Donating Plasma

What s The Difference Between Accounting Profit And Taxable Profit

https://flamingo-accounting.co.uk/wp-content/uploads/2020/01/piggy-2889044_1920.jpg

Benefits Of Donating Plasma ABO Plasma

https://aboplasma.com/wp-content/uploads/2022/04/Benefits-of-Donating-Plasma.png

Plasma Donation Benefits Guide Facts Health Care Reform

https://www.healthcarereformmagazine.com/wp-content/uploads/2019/02/Plasma-Donation-2.jpg

Plasma donation centers are required by law to provide you with a Form 1099 MISC detailing the total compensation you received throughout the tax year This form should be filed along with your other tax documents when They get paid for donating plasma so when tax time rolls around here s what you need to know about donating plasma and paying taxes Yes donating plasma is taxable You must pay taxes on income that you earn by

As a general matter the money you receive for donating plasma is taxable income That income must be reported on your tax returns whether or not you get a 1099 from the However BioLife is not required to issue IRS form 1099s That said we recommend that you report your income from plasma donation on your federal and if applicable state income tax

Its Time To Prepare Your Taxes Read My Blog Post Here Http www

https://i.pinimg.com/originals/61/b6/2d/61b62d6b05ac657484a5c60ae6de517d.jpg

How Much Do You Get For Donating Plasma Government Grants News

https://www.startgrants.com/wp-content/uploads/2016/03/Blood-Plasma-Donation.jpg

https://ttlc.intuit.com › community › tax-credits...

Most folks unless they have received a specific 1099 MISC tax form showing the amount you received do not include those token amounts on their returns nor do they have

https://accountinginsights.org › is-plasma-donation...

As a result donors must report their plasma earnings on tax returns Unlike charitable donations that may qualify for tax deductions plasma donation payments offer no

How Much Do You Get Paid To Donate Blood Plasma

Its Time To Prepare Your Taxes Read My Blog Post Here Http www

Plasma Donation Reddircom Get The Best Advice And Tips Right Away

Plasma Donation Restarts In The UK For The First Time In More Than 20

Who Donating Plasma

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

Do You Get A Tax Form For Paid Online Surveys YouTube

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

First Person To Donate Plasma After Receiving Plasma For COVID NHS

Do You Get A Tax Form For Donating Plasma - According to IRS guidelines any income not explicitly exempted by law is taxable Plasma donation compensation is not exempt so donors must report it even if they do not