Do You Get A Tax Refund For Paying Tuition The American opportunity tax credit and the lifetime learning credit can help offset education costs by reducing the amount of tax they owe If the American opportunity tax credit

The credit phases out above these income levels and up to 40 can be refundable The LLTC can provide a credit of up to 2 000 per tax return for an unlimited number of years for any qualifying degree or non degree course You may be able to cut your tax bill by up to 2 500 if you re paying college tuition and you may even be eligible for tax credits that can help cover the cost of continuing education

Do You Get A Tax Refund For Paying Tuition

Do You Get A Tax Refund For Paying Tuition

https://www.cardrates.com/wp-content/uploads/2020/02/Best-Credit-Cards-for-Paying-Tuition.jpg

What To Do When You Get A Tax Bill For A Home You No Longer Own The

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/GISYYJSZ5YI6RGEJA66MCMT7JM.jpg&w=1200

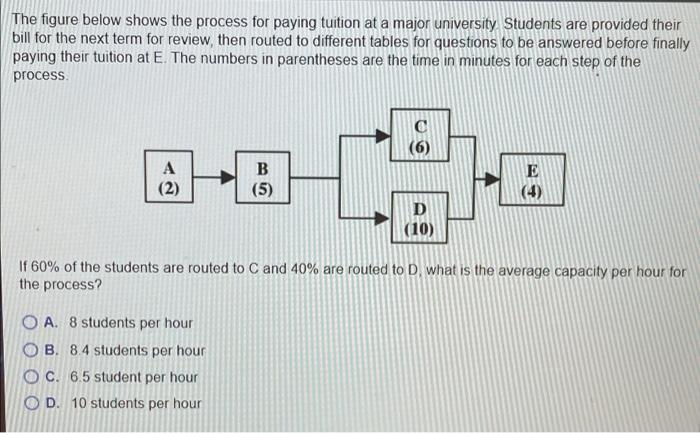

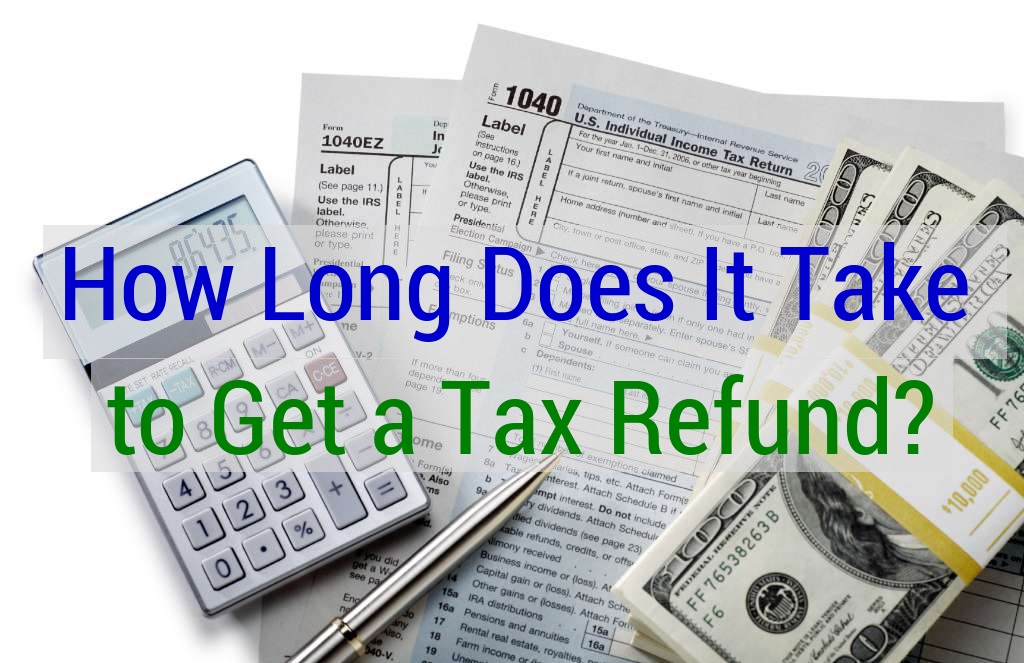

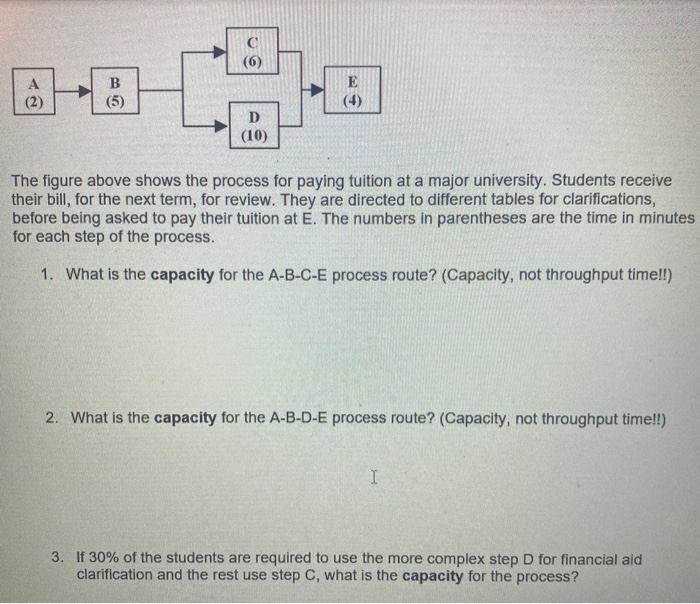

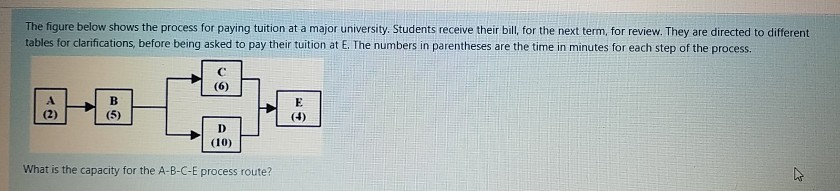

Solved Figure 51 10 Figure Shows Process Paying Tuition Major

https://media.cheggcdn.com/media/073/073b3610-ef99-4ea7-ad6e-356d70b58896/phppL7v01.png

The AOTC is a tax credit worth up to 2 500 per year for an eligible college student It is refundable up to 1 000 If you are a college student filing your own return you may claim this credit a maximum of four times i e once The American Opportunity Tax Credit is a credit of up to 2 500 toward expenses for eligible students in the first four years of earning a degree If your credit pays your taxes down to zero you also can get a refund of up to

A tax filer can claim a tuition tax credit for money spent on your college expenses only if you re listed as a dependent on that person s tax form If you aren t listed as a dependent on another File with H R Block to get your max refund Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified

Download Do You Get A Tax Refund For Paying Tuition

More picture related to Do You Get A Tax Refund For Paying Tuition

How Long Does It Take To Get A Tax Refund Where s My Refund Tax

https://refundtalk.com/wp-content/uploads/2019/01/How-long-does-it-take-to-get-a-tax-refund.jpg

Where s My Refund AR Arkansas Where Is My US Tax Refund

https://whereismyustaxrefund.com/wp-content/uploads/2021/07/wheres-my-refund-ar-scaled.jpg

The Figure Below Shows The Process For Paying Tuition Chegg

https://media.cheggcdn.com/study/fe8/fe8afe93-c8fa-4082-83c0-6115d687ad4a/image

This interview will help you determine if your education expenses qualify for a tax benefit Information you ll need Filing status Student s enrollment status Your adjusted gross You only can claim a tuition and fees deduction for qualified education expenses not refunded when a student withdraws The Lifetime Learning Credit LLC offers up to

There are several options for deducting college tuition and textbooks on your federal income tax return including the American Opportunity Tax Credit Lifetime Learning If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive

Brochure On Google Docs Donation Letter Lettering Tax Refund

https://i.pinimg.com/736x/f2/ae/bd/f2aebde9c4c9bf23c76d4a0fcaa5b663.jpg

Solved 6 B 5 E 4 2 D 10 The Figure Above Shows The Chegg

https://media.cheggcdn.com/study/8df/8df14125-c793-4cfe-9cdc-e35fa30a2e68/image.png

https://www.irs.gov › newsroom › college-students...

The American opportunity tax credit and the lifetime learning credit can help offset education costs by reducing the amount of tax they owe If the American opportunity tax credit

https://turbotax.intuit.com › tax-tips › c…

The credit phases out above these income levels and up to 40 can be refundable The LLTC can provide a credit of up to 2 000 per tax return for an unlimited number of years for any qualifying degree or non degree course

Authorization Letter For Third Party Payment Authorization Letter For

Brochure On Google Docs Donation Letter Lettering Tax Refund

The Figure Below Shows The Process For Paying Tuition At A Major

2022 Standard Deduction Amounts Are Now Available Kiplinger

P60 Time Get A Tax Refund Today

Ejercicio 1 Rodolfo D Trabajo De Ingenieria Usando Como Gu a El

Ejercicio 1 Rodolfo D Trabajo De Ingenieria Usando Como Gu a El

Why Do You Get A Tax Refund YouTube

Why Is My Federal Refund Lower Than Last Year The Daily CPA

Free Promissory Note Template Word Business Mentor

Do You Get A Tax Refund For Paying Tuition - 2024 College Tuition Tax Deductions Depending on your financial situation you can claim up to 4 000 in tax deductions Here are tax credits and deductions to claim in 2024