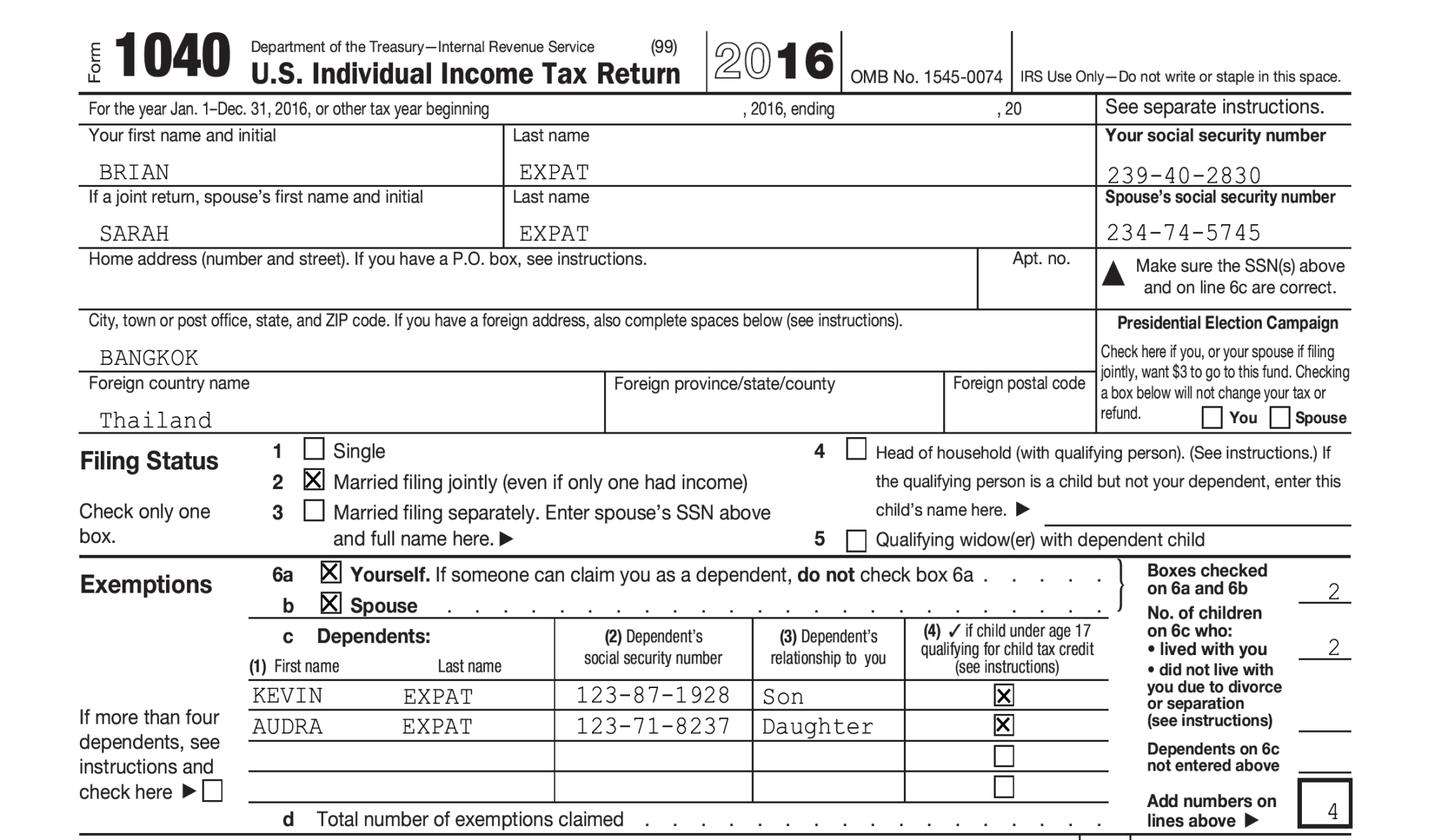

Do You Get A Tax Return For Having A Child A dependent is a qualifying child or relative who relies on you for financial support To claim a dependent for tax credits or deductions the dependent must meet specific

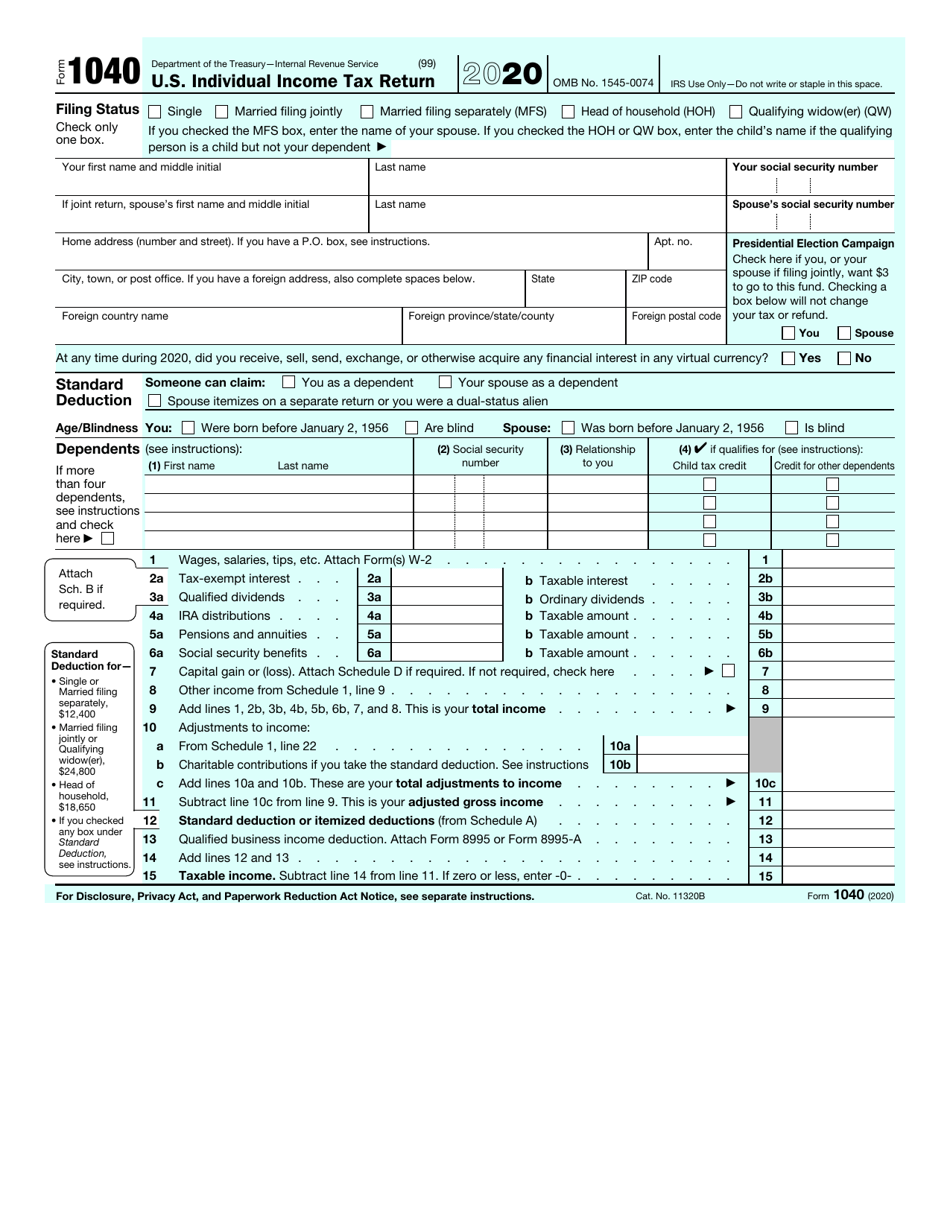

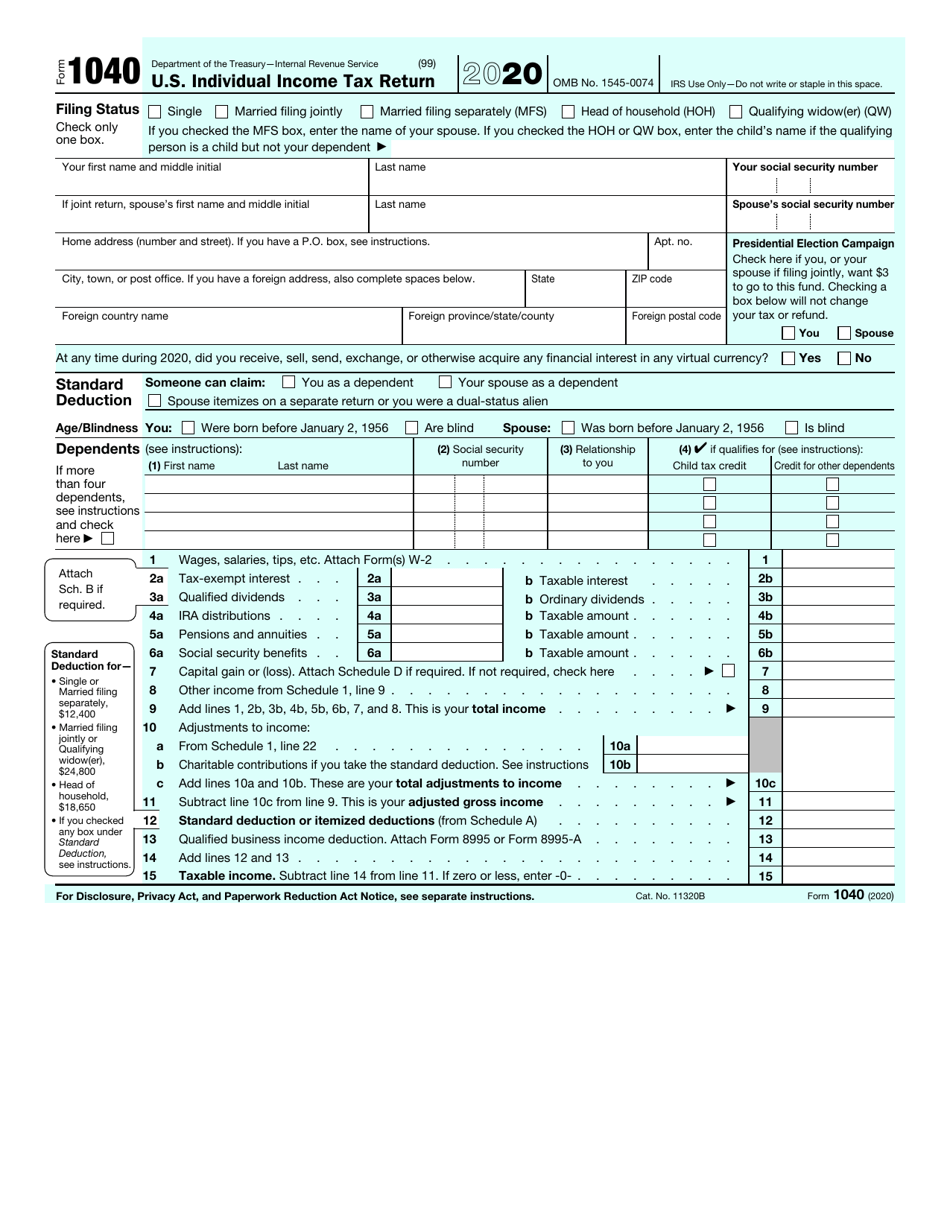

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 If you can claim someone as a dependent deductions like the earned income tax credit EITC and child tax credit will lower your tax bill Learn which you can claim

Do You Get A Tax Return For Having A Child

Do You Get A Tax Return For Having A Child

https://i.pinimg.com/originals/61/b6/2d/61b62d6b05ac657484a5c60ae6de517d.jpg

Tax Return Preparation Complete Guide 2022 Jasim Uddin Rasel

https://taxpertbd.com/wp-content/uploads/2021/09/Tax-Return-Preparation-Cover-1324x2048.jpg

Where s My Refund Bill Brooks CPA

https://www.billbrookscpa.com/wp-content/uploads/2019/03/tax-return.jpg

The Child Tax Credit CTC is the most well known tax benefit of having a new baby The CTC includes a 2 000 tax credit per child only 1 700 of which is refundable Even if your client s baby is born or adopted later in the The child tax credit is partially refundable you can receive up to 1 700 as a refund on your 2024 tax return up from 1 600 the previous year

Taxpayers who claim at least one child as their dependent on their tax return may be eligible for the Child Tax Credit For help figuring out if a child qualifies for this credit By having a child you may now be eligible to claim the Child Tax Credit the Additional Child Tax Credit the Earned Income Tax Credit and the Child and Dependent Care

Download Do You Get A Tax Return For Having A Child

More picture related to Do You Get A Tax Return For Having A Child

Tax Return FAQ

https://www.apexaccountants.tax/wp-content/uploads/2022/09/FAQ-1536x806.png

Does Your Child Need To File A Tax Return FeeOnlyNews

https://www.financialsymmetry.com/wp-content/uploads/FSI-Blog-Post-3.13.23.png

Years To File An Amended Tax Return H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2019/01/How-many-years-to-file-an-amended-tax-return-1080x675.jpg

The short answer is that if you did not work in 2022 you will not receive an income tax refund based on having dependent children The rules for getting the child tax credit on a The Child Tax Credit CTC is the most well known tax benefit of having a new baby The CTC includes a 2 000 tax credit per child only 1 700 of which is refundable

If you had a baby in 2020 you have tax deductions and credits available If you added a child to your family your taxes may be a little different The child tax credit provides up to 2 000 in federal tax credits for each qualifying child you claim on your tax return To qualify for the full 2 000 credit your annual income

All About The Online E filing Income Tax Returns CA Rajput

https://carajput.com/blog/wp-content/uploads/2015/11/E-filing-Income-Tax-Returns-1536x895.jpg

Is Your Child Eligible For A 500 Economic Impact Payment Henssler

https://www.henssler.com/wp-content/uploads/2020/09/090320-TaxTip.jpg

https://www.irs.gov › credits-deductions › individuals › dependents

A dependent is a qualifying child or relative who relies on you for financial support To claim a dependent for tax credits or deductions the dependent must meet specific

https://www.irs.gov › credits-deductions › individuals › child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812

Tax Return Clipboard Image

All About The Online E filing Income Tax Returns CA Rajput

Let s Get Ready For Taxes

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Do It Yourself Online Tax Return Prepare Taxes On The Internet And E

What To Do If You Get A Tax Lien On Your House

Free Online Tax Forms Printable Printable Templates

Free Online Tax Forms Printable Printable Templates

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

100 OFF US Income Tax Preparation IRS Tutorial Bar

A COMPREHENSIVE GUIDE FOR INCOME TAX RETURN FILLING

Do You Get A Tax Return For Having A Child - It depends on several factors including your income filing status and the number of children you have In this guide we ll explore the child tax refund dependent care credit