Do You Get A Tax Write Off For Working From Home Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home

Can you claim work from home tax deductions If you re an employee you can claim certain job related expenses as a tax deduction but only for tax years prior to 2018 For tax year 2018 and on unreimbursed In most cases you can only claim a tax deduction for your home office if If you work remotely but receive a W 2 from an employer then you don t qualify for the tax break

Do You Get A Tax Write Off For Working From Home

Do You Get A Tax Write Off For Working From Home

https://www.bankrate.com/2018/11/16152533/5-Pet-related-tax-write-offs.jpg?auto=webp&optimize=high&crop=16:9

Do You Get A Tax Form For Paid Online Surveys YouTube

https://i.ytimg.com/vi/coQMiaCVAZs/maxresdefault.jpg

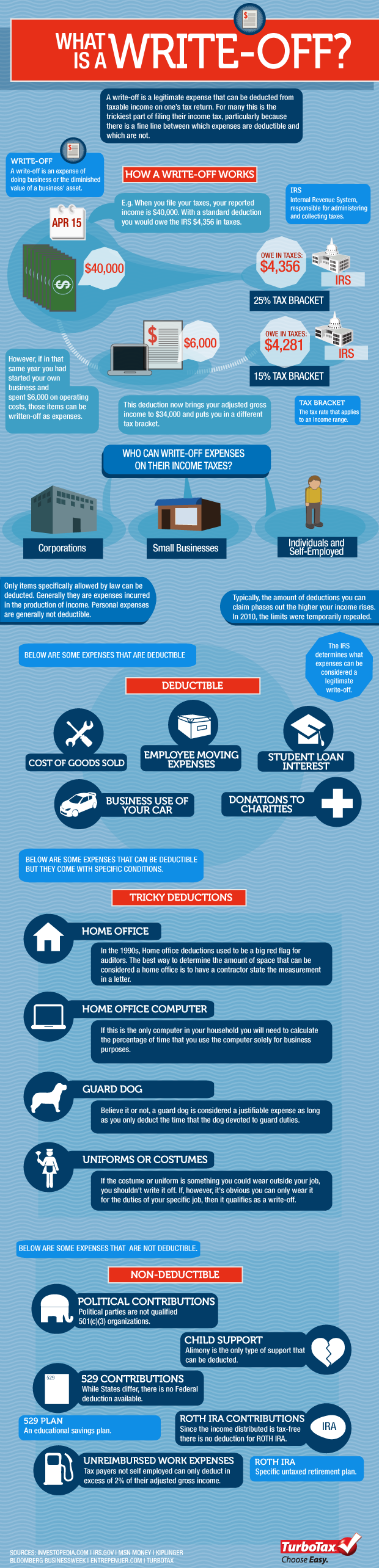

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

http://blog.turbotax.intuit.com/wp-content/uploads/2010/12/writeoff.png

If I m an employee and my job is fully remote and I have working from home can I deduct my work from home expenses Although there has been an increase in Whether you can claim a home office deduction depends on how you re employed Traditional employees earning W 2 income generally are not eligible for the home office

Even if you are fully remote working for an employer disqualifies you from receiving the home office tax write off However you still have options Eligibility for this Although remote or hybrid work was still prevalent in 2024 employees cannot deduct home office expenses from their taxes like they used to be able to The Tax Cuts and

Download Do You Get A Tax Write Off For Working From Home

More picture related to Do You Get A Tax Write Off For Working From Home

Tax Write Off For Home Office YouTube

https://i.ytimg.com/vi/pL-o-1S9nao/maxresdefault.jpg

What Can I Write Off On My Taxes Business Tax Deductions Tax Write

https://i.pinimg.com/736x/7b/c1/62/7bc1625611a14e807cd121199d0cb313.jpg

How Do I Write Off Taxes For Goodwill Donations Safe Smart Living

https://i.pinimg.com/736x/7b/0f/1a/7b0f1a8d132d2965f8ee88849e5aa73b.jpg

Self employed people can generally deduct office expenses on Schedule C Form 1040 whether or not they work from home This write off covers office supplies postage Can you write off your internet if you work from home Short answer It depends on whether you re working for yourself or for an employer If you re a freelancer a small

What Can You Write off on Your Taxes If You Work from Home Most W 2 employees who work from home can t write off anything work related when filing taxes in With your home office you may be able to claim a deduction on your taxes However there are some stipulations as to who actually qualifies for this If you are self

See The Tax Write offs You Can Receive For Your Vehicle And How To

https://i.pinimg.com/originals/53/34/7c/53347cf685d90ab73bb841fef2e5763d.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://help.taxreliefcenter.org/wp-content/uploads/2018/08/Tax-Relief-Center-10-Taxes-You-Can-Write-Off-When-You-Work-From-Home-20180725.jpg

https://smartasset.com › taxes › work-from-home-tax...

Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home

https://turbotax.intuit.com › tax-tips › jobs-and...

Can you claim work from home tax deductions If you re an employee you can claim certain job related expenses as a tax deduction but only for tax years prior to 2018 For tax year 2018 and on unreimbursed

When Can You File Taxes In 2023 Kiplinger

See The Tax Write offs You Can Receive For Your Vehicle And How To

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

:max_bytes(150000):strip_icc()/write-off-4186686-FINAL-2-7eaa5af39eec457e898ccf77a0f6a4b9.png)

Can You Write Off Transaction Fees Leia Aqui Are Transaction Costs

Is Rental Property A Tax Write Off Morris Invest

What Is A Tax Write Off And Can I Take One Credit Karma

What Is A Tax Write Off And Can I Take One Credit Karma

Is Rental Property A Tax Write Off Artofit

EOFY SALE 150 000 Tax Write Off PCMadness Technology Services

Tax Write Off For Car Donation Tax Write Off For A Junk Car Donation 2021

Do You Get A Tax Write Off For Working From Home - Whether you can claim a home office deduction depends on how you re employed Traditional employees earning W 2 income generally are not eligible for the home office