Do You Get Tax Rebate For Buying Solar Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation

Web 7 ao 251 t 2023 nbsp 0183 32 A dollar for dollar reduction of the income tax you owe a tax credit can reduce the amount of tax you owe or increase your tax refund They also differ from Web 14 mars 2023 nbsp 0183 32 No The solar tax credit can save you money on your tax bill but the amount of your credit can t exceed the total amount you owe That s because the credit is nonrefundable in tax

Do You Get Tax Rebate For Buying Solar

Do You Get Tax Rebate For Buying Solar

https://i.pinimg.com/originals/2a/b8/14/2ab814871ec51f6c0c811affc8287602.png

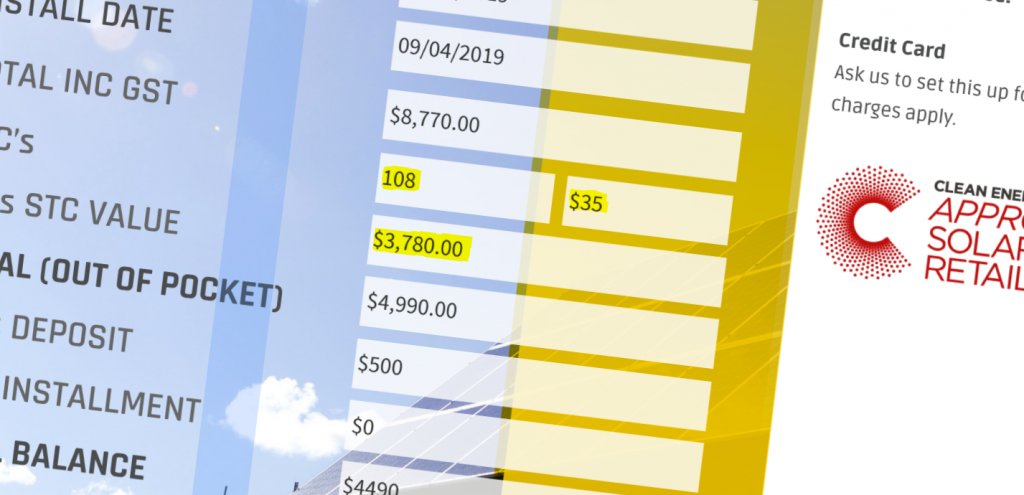

Your MAXIMUM Solar Rebate Perth WA Subsidy Ultimate Guide

https://perthsolarwarehouse.com.au/wp-content/uploads/2019/04/Solar-Panels-Perth-WA-Rebate-PSW-1024x495.png

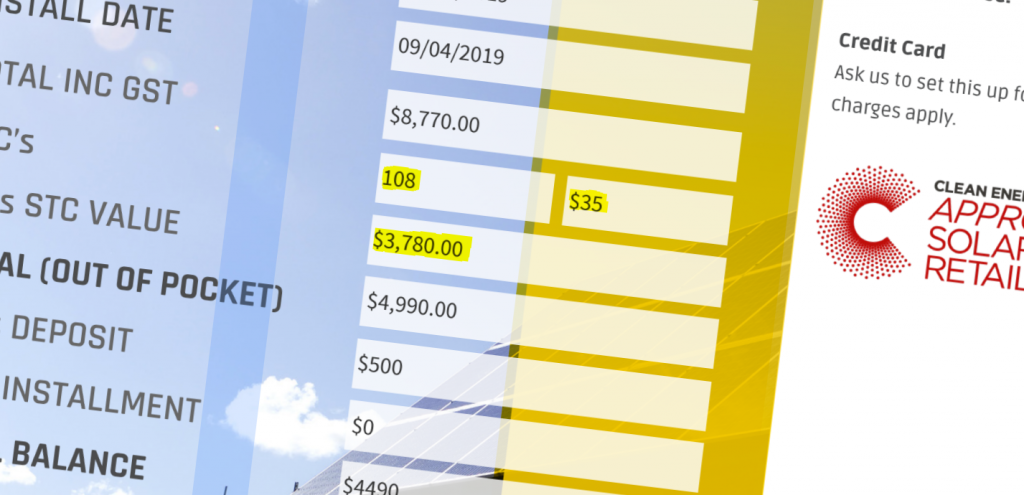

Texas Solar Power For Your House Rebates Tax Credits Savings

https://solarpowerrocks.com/wp-content/uploads/2016/12/tx-header-image.png

Web 12 mai 2023 nbsp 0183 32 Solar rebates Battery storage rebates and incentives Manufacturer rebates Solar renewable energy certificates SRECs Performance based incentives PBIs Solar loans and grants for rural Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Download Do You Get Tax Rebate For Buying Solar

More picture related to Do You Get Tax Rebate For Buying Solar

2019 Texas Solar Panel Rebates Tax Credits And Cost

https://www.solarpowerrocks.com/wp-content/uploads/2018/12/TX-rebates-ring.png

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

https://blog.solarinstallguru.com/wp-content/uploads/2016/12/Federal_Solar_Tax_Credit_and_solar_rebates_Can_Slash_Solar_Panel_Installation_Cost_by_30_to_80_Percent.png

Minnesota Solar Power For Your House Rebates Tax Credits Savings

https://i.pinimg.com/originals/f0/5a/d4/f05ad428174c29968441de8b94bc2bab.png

Web 1 sept 2023 nbsp 0183 32 Absolutely The signing of the Inflation Reduction Act put into immediate effect the 30 Residential Clean Energy Credit which applies to the cost of solar equipment and labor including battery storage This Web 10 mars 2023 nbsp 0183 32 A 30 tax credit is now available until the end of 2032 for residential solar installations The federal solar tax credit was set to expire at the end of 2024 with some

Web 9 ao 251 t 2023 nbsp 0183 32 The tax credit rolls over year after year should the taxes you owe amount to less than the credit you earn The tax credit does not get applied to your tax refunds Web 6 juin 2023 nbsp 0183 32 The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

The Truth About The Solar Rebate SAE Group

https://web.archive.org/web/20190329204324/https://saegroup.com.au/wp-content/uploads/2015/07/Rebate-end1.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state

Web 7 ao 251 t 2023 nbsp 0183 32 A dollar for dollar reduction of the income tax you owe a tax credit can reduce the amount of tax you owe or increase your tax refund They also differ from

Colorado Solar Power For Your House Rebates Tax Credits Savings

Solar Tax Credits Rebates Missouri Arkansas

Solar Panel Rebate How It Works And How To Get It

California Home Solar Power Rebates Tax Credits Savings

2018 Guide To Ohio Home Solar Incentives Rebates And Tax Credits

California Home Solar Power Rebates Tax Credits Savings

California Home Solar Power Rebates Tax Credits Savings

The Solar Rebates Ending Make The Most Of It While You Can

Solar Power Incentives Rebates And Tax Credits Canada 2018

How To Get Solar Incentives And Rebates Suntrica

Do You Get Tax Rebate For Buying Solar - Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of