How Much Tax Rebate On Solar The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe Credit cards

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system

How Much Tax Rebate On Solar

How Much Tax Rebate On Solar

https://esichub.com/wp-content/uploads/2017/04/How-much-is-my-tax-rebate.jpg

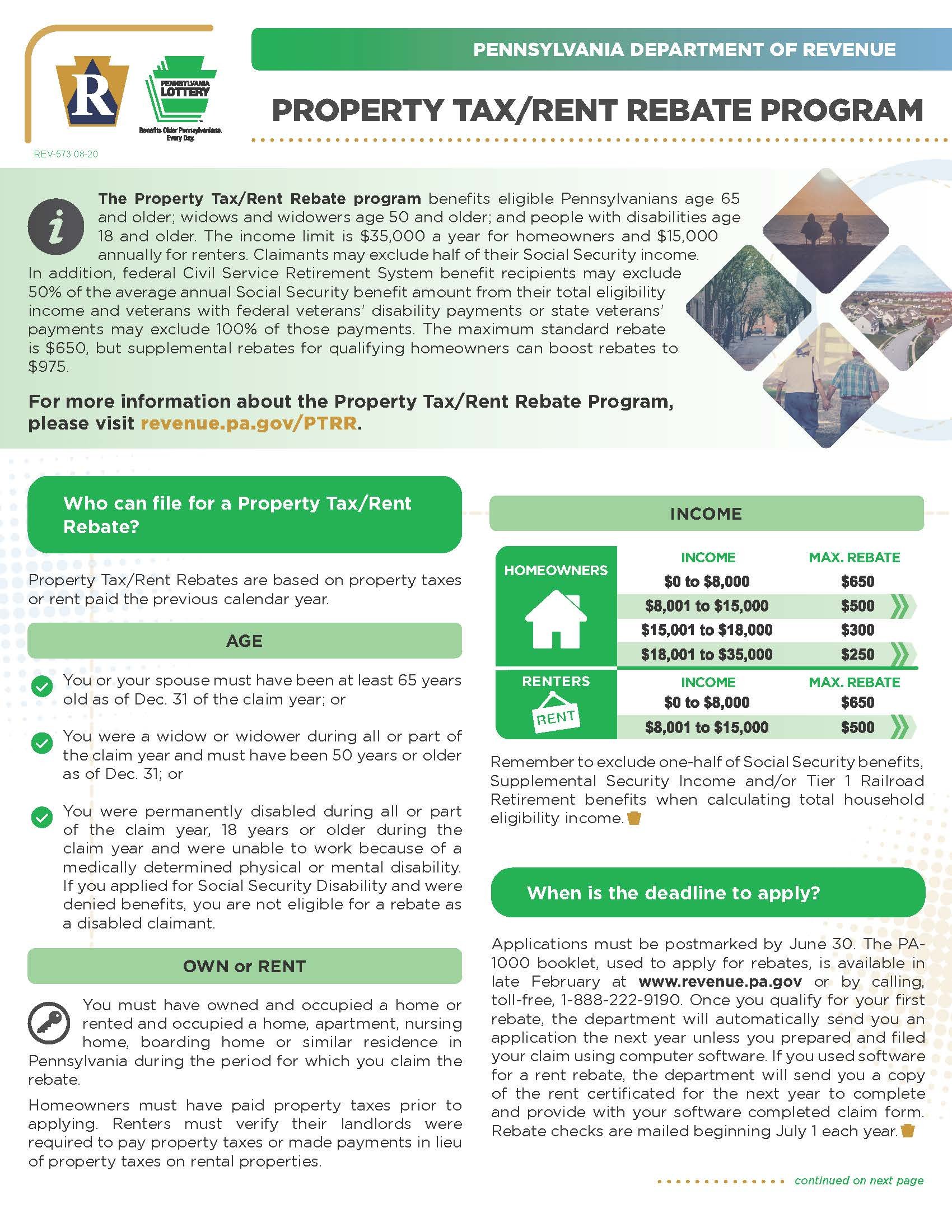

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

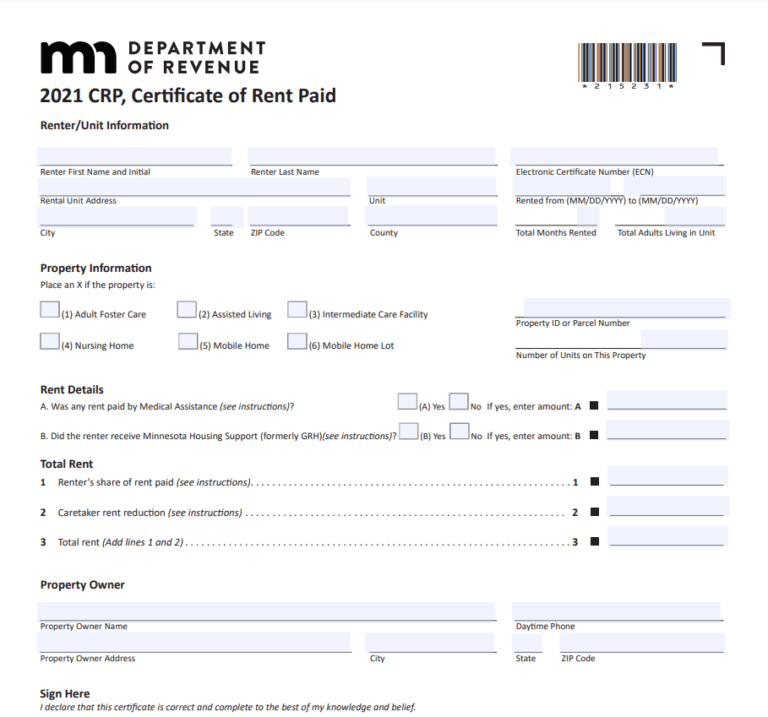

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Fill-Out-Rent-Rebate-Form-768x717.png

25 000 gross cost x 0 30 30 tax credit 7 500 Residential Clean Energy Credit In order to receive this credit you need to claim it on your taxes for the year the system was deemed operational The solar tax credit equals 30 of solar installation costs in 2024 The average solar installation costs around 20 000 and the typical tax credit value is about 6 000 The total value of the solar tax credit will depend

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of

Download How Much Tax Rebate On Solar

More picture related to How Much Tax Rebate On Solar

Section 87A Income Tax Rebate

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

https://www.gannett-cdn.com/-mm-/eec6fd4cafba6c9b20fad3b0475b2dc4dc63a0e1/c=0-50-534-350/local/-/media/2016/08/26/CherryHill/B9323547732Z.1_20160826160035_000_GJMFFHGDT.3-0.jpg?width=3200&height=1680&fit=crop

Holiday Home Tax How Much Will You Make Trident Holiday Homes

https://blog.tridentholidayhomes.ie/wp-content/uploads/2021/03/Eamonn-Fylnn-TaxAssistWicklow-1536x1109.jpg

The credit can apply to a vacation home but only for the percentage of the tax year that you spend there The residential solar At 30 the tax credit is worth 7 500 for a 25 000 solar system effectively knocking the price down to 17 500 The credit was previously at 26 for systems installed in 2022 and scheduled to step

The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

Tax Slabs Under The New And Old Tax Regimes In FY 2023 24

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18oVmT.img?w=1200&h=800&m=4&q=81

Employer Monthly Schedule Payroll Tax Deposit Due February 15 2023

https://pasfirm.com/wp-content/uploads/2022/09/blog-calendar-employment-taxes-0215.jpg

https://www.nerdwallet.com/article/taxes/sol…

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe Credit cards

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a

Hecht Group Does Pennymac Pay Property Taxes

Tax Slabs Under The New And Old Tax Regimes In FY 2023 24

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

How To Increase The Chances Of Getting A Tax Refund CherishSisters

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Bud Light Beer Rebate Form 2023 How To Claim Validity And All You

Bud Light Beer Rebate Form 2023 How To Claim Validity And All You

2023 Residential Clean Energy Credit Guide ReVision Energy

A Lifetime Of Tax How Much Tax Will The Average Canadian Pay Over

Council Tax Rebate Energy

How Much Tax Rebate On Solar - The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your