Do You Get Tax Relief On Pension Contributions Self Employed Verkko 30 syysk 2023 nbsp 0183 32 At Moneyfarm we add tax relief at source for the basic rate 25 uplift So if you contribute 163 32 000 this will be automatically uplifted to 163 60 000 The tax relief will count towards your

Verkko If you re self employed you won t have an employer adding money to your pension in this way But there are still some tax breaks it s important to not miss out on For Verkko 7 tammik 2023 nbsp 0183 32 Higher and additional rate self employed taxpayers get extra tax relief on their pension contributions You ll have already received 25 extra on your

Do You Get Tax Relief On Pension Contributions Self Employed

Do You Get Tax Relief On Pension Contributions Self Employed

https://contentservices.appthebusiness.com/wp-content/uploads/2022/09/Pension_Contributions-980x653.jpg

Tax Relief On Pension Contributions Gooding Accounts

https://www.goodingaccounts.co.uk/app/uploads/2022/07/bench-g836200001_1920.jpg

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

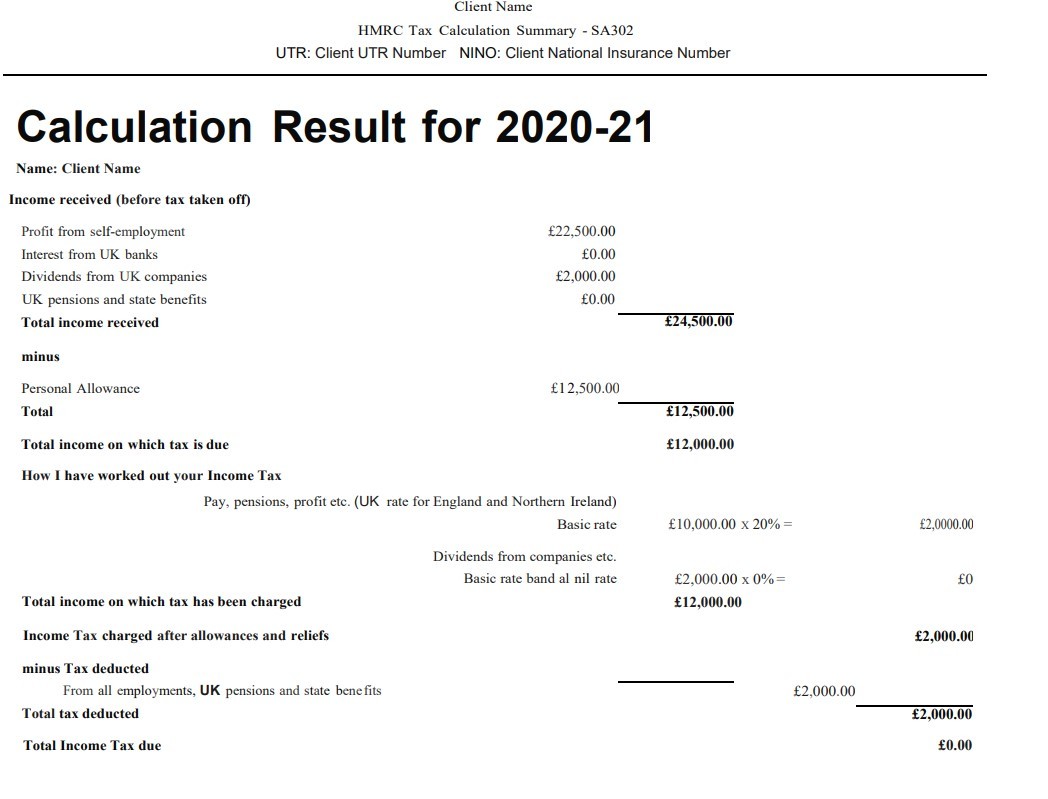

Verkko 12 toukok 2016 nbsp 0183 32 You can claim tax relief on your Self Assessment return for contributions you make towards registered pension schemes From HM Revenue amp Verkko 9 tammik 2023 nbsp 0183 32 You can add regular contributions or make ad hoc payments into your self employed pension and your pension provider will claim tax relief and add it to

Verkko 15 jouluk 2022 nbsp 0183 32 If you are paying into a pension as self employed you are eligible for tax relief on your contributions Your pension provider will automatically claim Verkko 24 hein 228 k 2023 nbsp 0183 32 You might not get contributions from your employer but you will still get tax relief on contributions This is an instant uplift on what you put in As a

Download Do You Get Tax Relief On Pension Contributions Self Employed

More picture related to Do You Get Tax Relief On Pension Contributions Self Employed

Claiming Tax Relief On Personal Contributions

https://s3.studylib.net/store/data/008863819_1-2f6094913014d745c3da18091a1e8c10-768x994.png

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

https://smallbizaccounts.co.uk/wp-content/uploads/2020/03/shutterstock_1387425773-scaled.jpg

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

Verkko Home Pensions amp retirement Tax and pensions Tax relief on pension contributions There are two ways you can get tax relief on your pension contributions If you re Verkko 12 jouluk 2023 nbsp 0183 32 If you re employed If you re paying into a workplace pension scheme organised by your employer and are earning under 163 50 270 you won t need to declare your pension contributions on

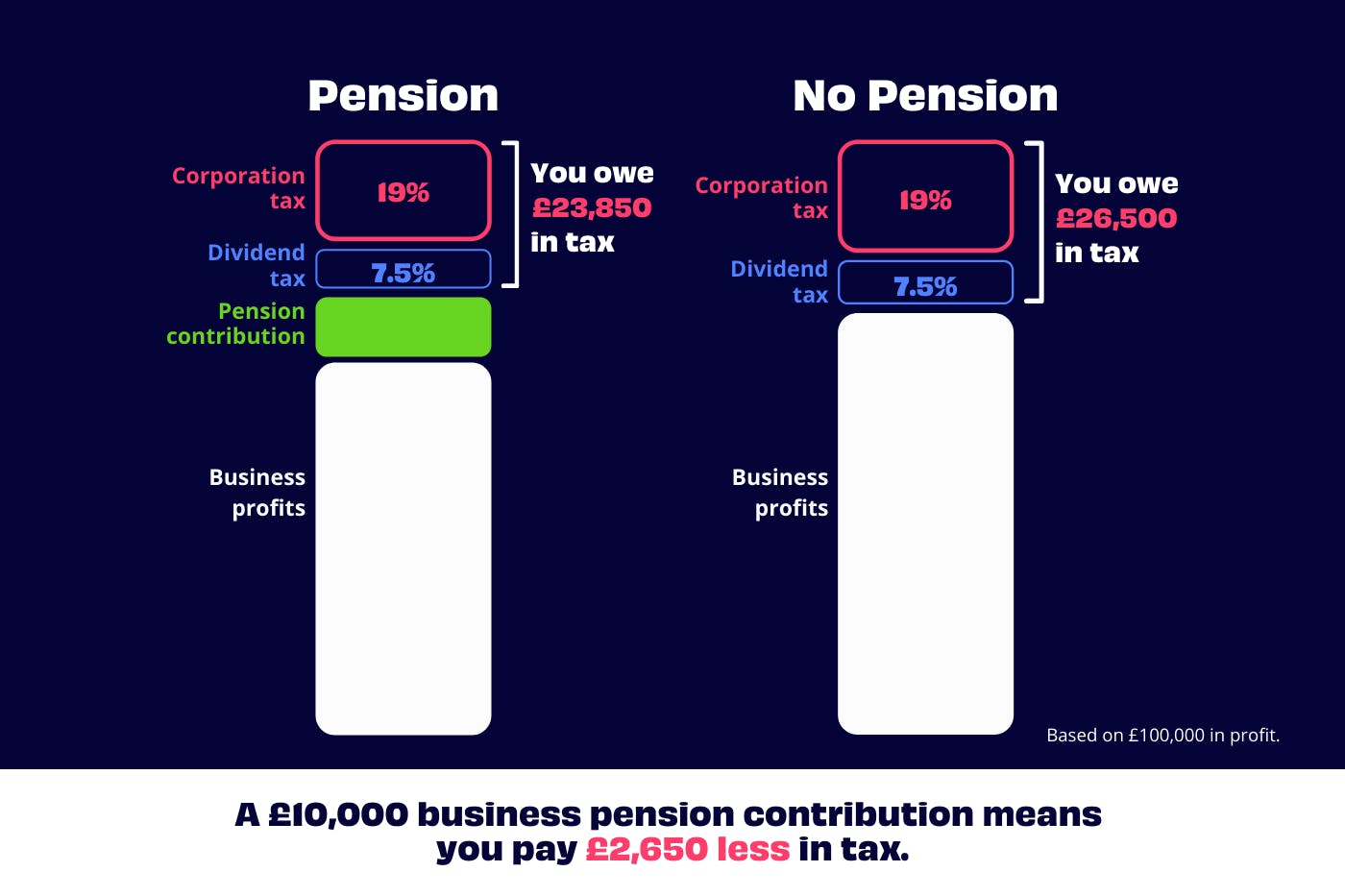

Verkko 3 huhtik 2023 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate Verkko 22 tammik 2021 nbsp 0183 32 The government tops up your self employed pension pot with tax relief when you contribute The concept of tax relief isn t always clear so let s break

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

https://www.thompsontarazrand.co.uk/wp-content/uploads/2018/05/2015-12-17-223313-1.jpg

TidyCloud Tax Relief On Pension Contributions

https://www.tidycloud.co.uk/wp-content/uploads/2022/05/Tax-Relief-on-Pension-Contributions-1024x576.jpg

https://blog.moneyfarm.com/en/investing-101/…

Verkko 30 syysk 2023 nbsp 0183 32 At Moneyfarm we add tax relief at source for the basic rate 25 uplift So if you contribute 163 32 000 this will be automatically uplifted to 163 60 000 The tax relief will count towards your

https://www.moneyhelper.org.uk/.../pensions-for-self-employed-people

Verkko If you re self employed you won t have an employer adding money to your pension in this way But there are still some tax breaks it s important to not miss out on For

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

A Consultation On Pensions Tax Relief Provisio Wealth

Self Employed Pension Tax Relief Explained Penfold Pension

How To Access Your SA302 s And Tax Year Overviews As Income Proof For

SIPP Tax Relief Calculator Tax Relief On Pension Contributions

SIPP Tax Relief Calculator Tax Relief On Pension Contributions

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

Maximise Tax Relief For 2020 Via Pension Contributions

What Is Pension Tax Relief Moneybox Save And Invest

Do You Get Tax Relief On Pension Contributions Self Employed - Verkko 12 toukok 2016 nbsp 0183 32 You can claim tax relief on your Self Assessment return for contributions you make towards registered pension schemes From HM Revenue amp