Do You Get Taxed On Hsa Investments If you contribute to an HSA or take a distribution you need to complete and file IRS Form 8889 with your tax return You have until April 15 2024 to make

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses The maximum amount you can A health savings account HSA is a tax advantaged way to save for qualified medical expenses HSAs pair with an HSA eligible health plan Because it offers potential tax

Do You Get Taxed On Hsa Investments

Do You Get Taxed On Hsa Investments

https://www.benefittitle.com/wp-content/uploads/2022/01/115600450_m-1536x1018.jpg

Why Does My Bonus Get Taxed So Much And What Can I Do YouTube

https://i.ytimg.com/vi/RtxJwFQA3sY/maxresdefault.jpg

How To Calculate Find Social Security Tax Withholding Social

https://i.ytimg.com/vi/q342U65tAgA/maxresdefault.jpg

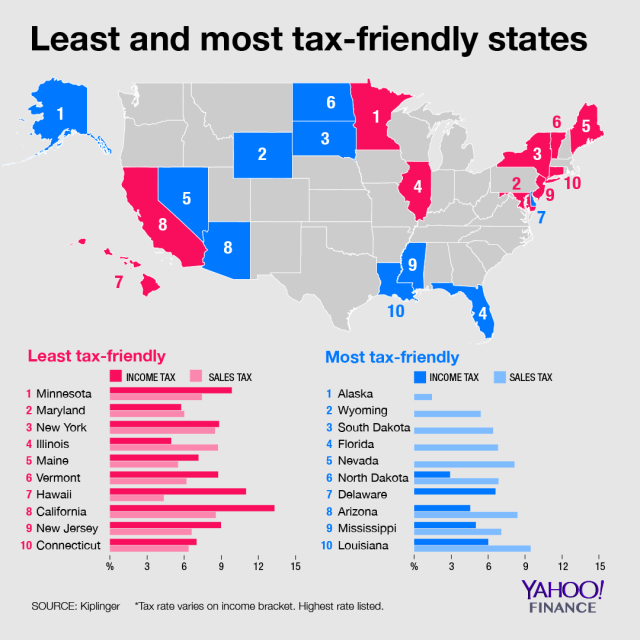

Your earnings from investments won t be taxed You benefit from the first two tax advantages even if you don t invest your HSA money However if you do invest your No Investment earnings including dividends are not considered taxable income Distributions from your HSA that are used for qualified health care expenses are tax

That s because your HSA has 3 key tax advantages 1 You don t pay federal income tax on contributions When you invest a portion of your balance you aren t taxed on the earnings as it grows 2 Paying You re not taxed when you put money into your HSA The money in your HSA grows tax free You re not taxed when you take money out to pay for medical

Download Do You Get Taxed On Hsa Investments

More picture related to Do You Get Taxed On Hsa Investments

Do You Pay Taxes On Casino Winnings Minimum Requirements YouTube

https://i.ytimg.com/vi/DMaXS8BMJP4/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBMgQyh_MA8=&rs=AOn4CLDnDVUJZCgmoLyX6Trv_fLkkHCK4g

What Is A Health Savings Account HSA HSA Search

https://www.hsasearch.com/wp-content/uploads/hsavsretirementaccounts-1024x660.png

Yo Dawg We Herd U Like Taxes So We Put Taxes On Your Taxed Income So

https://i.kym-cdn.com/photos/images/facebook/001/729/853/65b

Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible or if made through payroll The ability to use an HSA as a tax favored investment vehicle depends on two things First when a medical bill falls due the taxpayer must be capable of paying it with funds outside the HSA The

How does my Health Savings Account affect my taxes A Health Savings Account HSA is a way to save money to pay for medical expenses and costs Contributions are tax free Key Points HSA distributions are tax free when used for IRS approved medical expenses Distributions for non medical purposes are typically subject to taxes

Home English Blog Do You Get The Meaning

http://www.albany.edu/uas/files/Logo_Get.png

As A Canadian Minimum Wager I Pay 3 Out Of 15 I Earn Per Hour Into

https://qph.cf2.quoracdn.net/main-qimg-f45a74f5d516883ccd034c372c9c67da-pjlq

https://www.fidelity.com/.../hsa-tax-form

If you contribute to an HSA or take a distribution you need to complete and file IRS Form 8889 with your tax return You have until April 15 2024 to make

https://www.nerdwallet.com/article/taxe…

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses The maximum amount you can

Do You Pay Taxes On Money Market Accounts Leia Aqui What Are The

Home English Blog Do You Get The Meaning

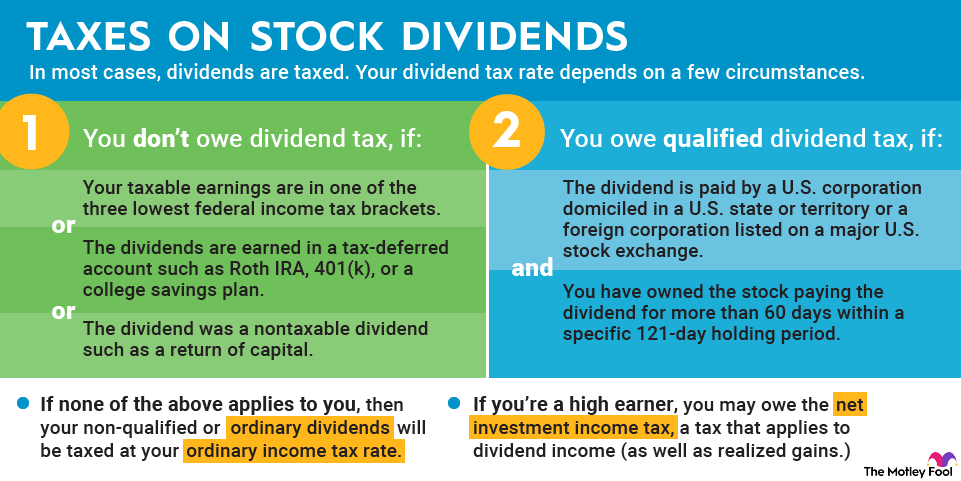

The Most And Least Tax friendly US States

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Tax Rates By Country Chart SexiezPicz Web Porn

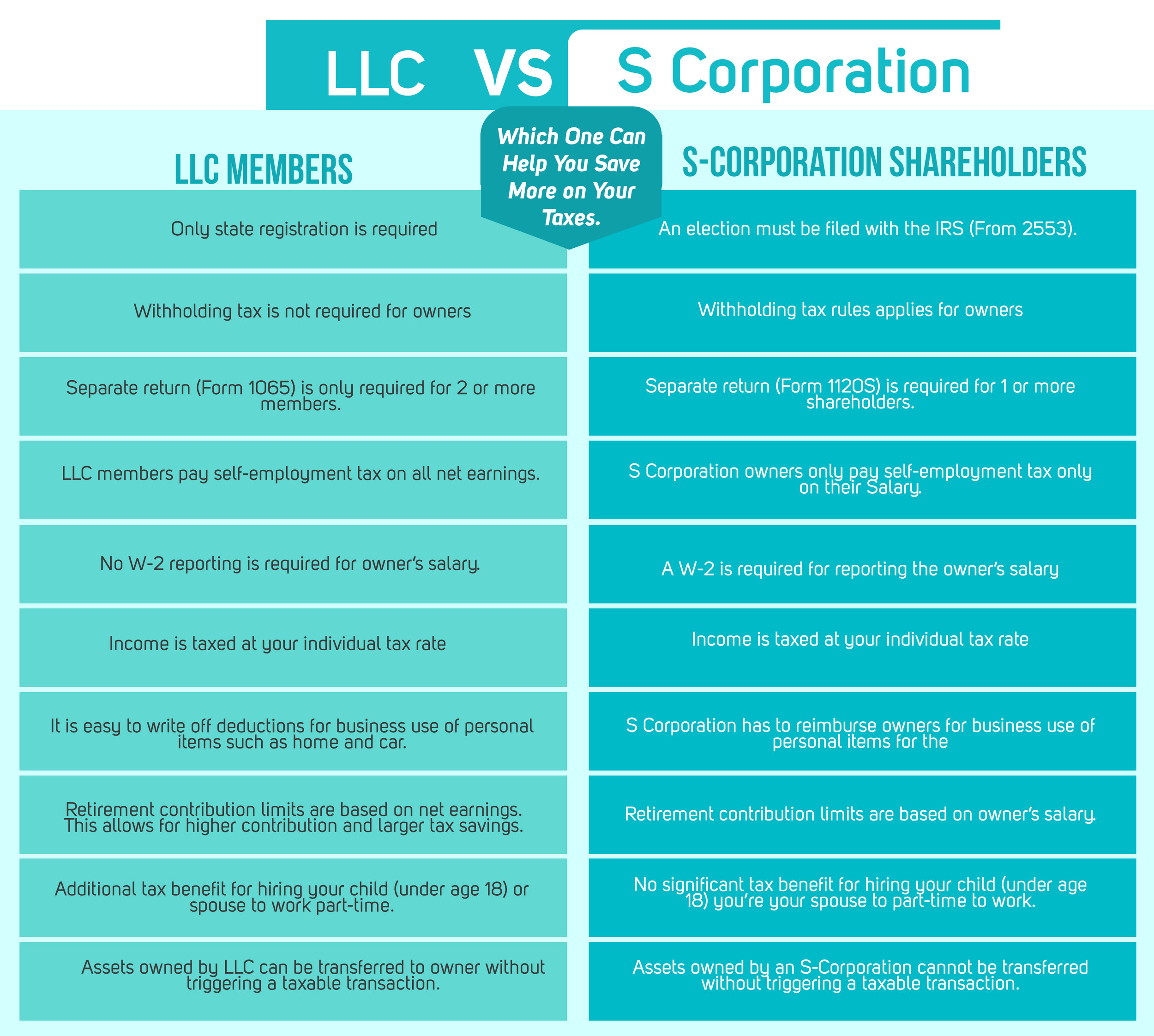

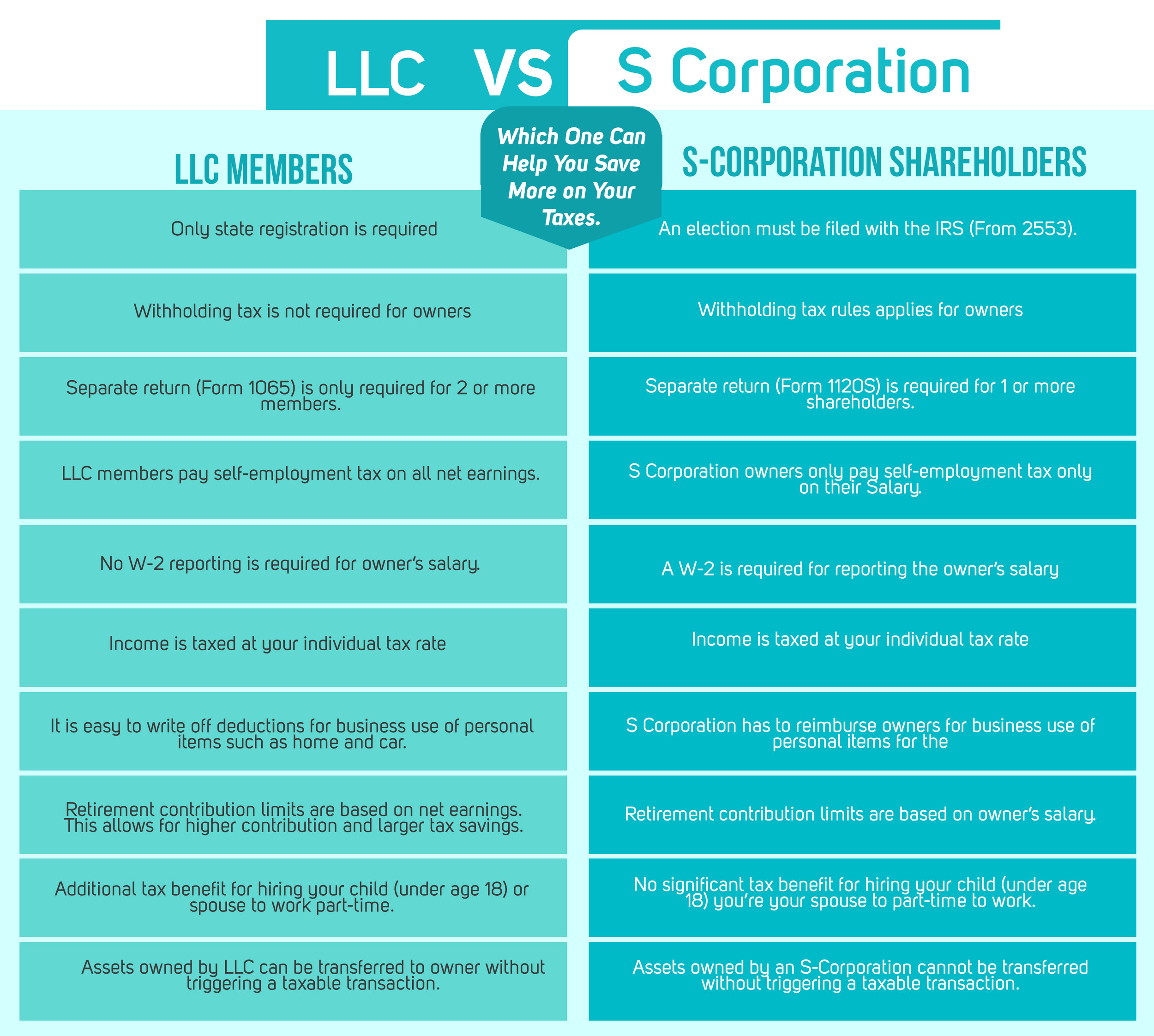

LLC Vs S Corporation Which One Can Save You More On Your Taxes RBA

LLC Vs S Corporation Which One Can Save You More On Your Taxes RBA

Do You Get Taxed On Lottery Winnings YouTube

Investment Accounts When Do I Get Taxed Personal Finance Club

The Pros And Cons Of A Health Savings Account HSA

Do You Get Taxed On Hsa Investments - No Investment earnings including dividends are not considered taxable income Distributions from your HSA that are used for qualified health care expenses are tax