Do You Have To Claim Student Loan Interest On Taxes The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

It allows you to deduct up to 2 500 in interest paid from your taxable income Payments on federal student loans were paused from March 2020 until October 2023 If The Student Loan Interest Deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest up to

Do You Have To Claim Student Loan Interest On Taxes

Do You Have To Claim Student Loan Interest On Taxes

https://www.wiztax.com/wp-content/uploads/2022/08/Student-Loans-Tax-Debt_m-scaled.jpeg

Can You Deduct Student Loan Interest On Your Tax Return Abdo

https://abdosolutions.com/wp-content/uploads/2023/09/Student-Loan-Interest-Social2.jpg

Student Loan Interest Deduction Eligibility Income Limits

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj0fd5sxfUAOtXc83pXvnzXRFVljgUJWTqcV7GMJ8vXIbDv7gZKJUlffJ1GQRUS3OsRBgiVfB6piKl8AZ4zQooik_kaPSDra6Ox8hBqgp2k9WBhhV0LqAs3uM43Wh6wst2F6igPhZh8uG2UwH7sD9WR0LpEEwEWTll4fdH6kfD__ZdPoc2xyT1muTmD/s808/SLD2.jpg

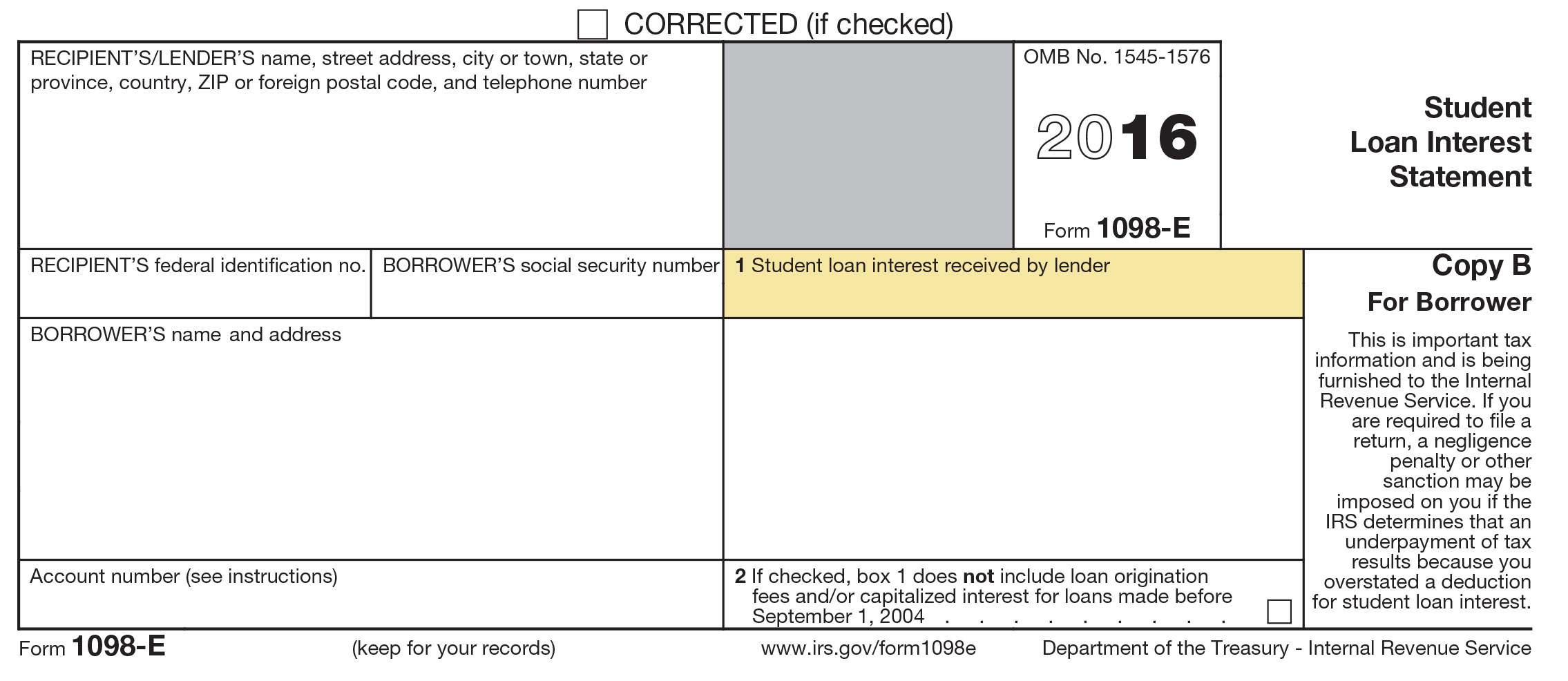

Student loan interest deduction lets you claim those interest payments when you file your taxes If you paid more than 600 in interest this year you ll receive a form 1098 E If you made federal student loan payments in 2023 you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return This is known as a student loan

Key Takeaways If you include student loan interest in you tax deductions you can lower your tax bill Up to 2 500 of student loan interest can be tax deductible each Key Takeaways If you took out an educational loan for yourself your spouse or your dependent you may be able to deduct the interest you paid on your taxes The

Download Do You Have To Claim Student Loan Interest On Taxes

More picture related to Do You Have To Claim Student Loan Interest On Taxes

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

https://s28637.pcdn.co/wp-content/uploads/2017/01/2016-1098-E.jpg

Can I Claim Student Loan Interest Deduction

https://cdn.collegeraptor.com/wp/wp-content/uploads/2022/02/15070832/pause-on-student-loan-payments.jpg

Education Loan Interest Calculator JasdeepAfrahim

https://i.pinimg.com/originals/1b/cc/67/1bcc67408a4e90ad1369ee8585bf4934.jpg

The answer is yes In fact federal student loan borrowers could qualify to deduct up to 2 500 of student loan interest per tax return per tax year You can claim the student The largest amount you can claim for a student loan interest deductible is 2 500 for 2023 and remains the same in 2024 but that is limited by your income

If you have student loans don t forget about them at tax time Student loans can impact your federal income tax return in several ways from reducing your If you paid student loan interest last year you could qualify for a tax deduction worth up to 2 500 You won t receive that money back as a refund since the

Student Loan Interest Deduction 2013 PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-2013-1024x576.jpg

Do You Have To Claim Student Loans On Taxes MoneyLion

https://moneylion.nyc3.cdn.digitaloceanspaces.com/wp-content/uploads/2022/05/26222851/Do-you-have-to-claim-student-loans-on-taxes-750x375.jpg

https://www.forbes.com/advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

https://www.nerdwallet.com/article/loans/student...

It allows you to deduct up to 2 500 in interest paid from your taxable income Payments on federal student loans were paused from March 2020 until October 2023 If

How To Claim Student Loan Forgiveness Do This To Receive Bidens

Student Loan Interest Deduction 2013 PriorTax Blog

How To Claim Student Loan Tax Deductions And Education Credits TheStreet

Student Loan Cancellation Congress Proposes 0 Interest Rates For

How To Get The Student Loan Interest Deduction NerdWallet

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

Do You Have To Claim Student Loans On Your Taxes Fox Business

Do You Have To Secure A Loan To Start A Business Be Prepared

Education Loan Interest Calculator JasdeepAfrahim

Do You Have To Claim Student Loan Interest On Taxes - Student loan interest deduction lets you claim those interest payments when you file your taxes If you paid more than 600 in interest this year you ll receive a form 1098 E