Do You Have To Pay Tax On Pension Payments Web 13 Mai 2022 nbsp 0183 32 How Pension Income Is Taxed Learn what to expect in taxes if you receive a pension in retirement By Rachel Hartman Reviewed by Emily Brandon May 13 2022 at 2 56 p m It s important

Web The main difference between pensions in level 1 level 2vs pensions in level 3 is taxation Level 1 level 2 offer tax benefits in the contribution phase Pension level 3 offers tax benefits in the payout phase in retirement Pension level 3 Web If you took your pension on or after 6 April 2023 you ll pay Income Tax on some or all of the lump sum if it is more than 25 of the standard lifetime allowance

Do You Have To Pay Tax On Pension Payments

Do You Have To Pay Tax On Pension Payments

https://topfinancialsecrets.com/wp-content/uploads/2023/03/Pay-Tax-on-Pension.jpg

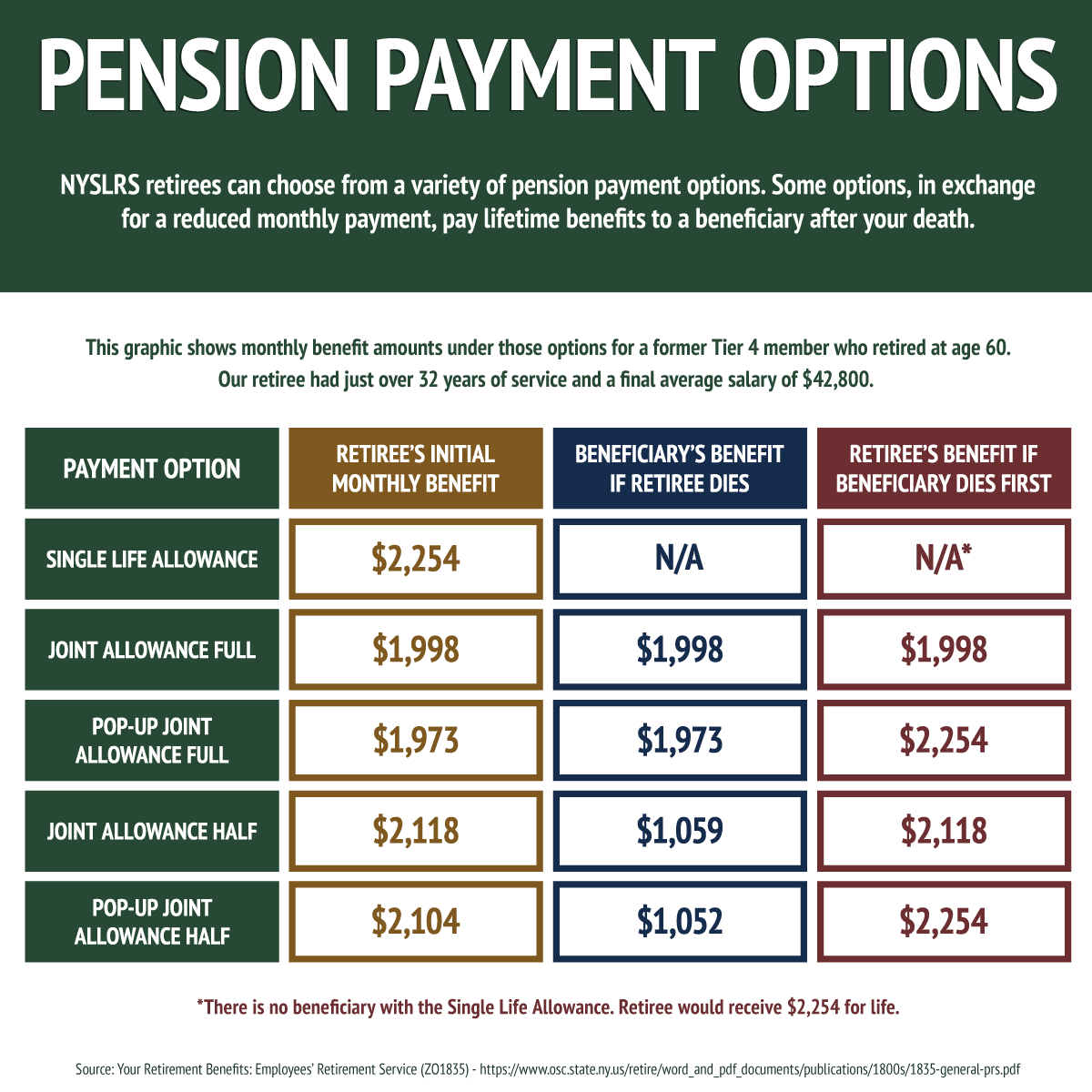

Pension Payment Options Archives New York Retirement News

http://www.nysretirementnews.com/wp-stuff/uploads/2018/09/pension_payment_options.png

Do You Pay Income Tax On Pension Benefits

https://image2.slideserve.com/3720551/why-do-we-pay-taxes1-l.jpg

Web You might have to pay Income Tax at a higher rate if you take a large amount from your pension You could also owe extra tax at the end of the tax year Web If you do not wish to submit a tax return you can also have the tax office assess the tax on your behalf You can find more information about this subject on the following page Forms return to top Telefon 49 395 44222 47000 Fax 49 395 44222 47100 E Mail

Web If a taxpayer receives such a request he or she is obligated to submit a tax return For questions please contact please enclose the letter you received on your pension a passport copy and your green card Finanzamt Neubrandenburg Neustrelitzer Str 120 17033 Neubrandenburg Web 11 Dez 2023 nbsp 0183 32 Do you pay tax on your pension Yes income from pensions is taxed like any other kind of income You have a personal allowance 163 12 570 for the 2023 24 tax year on which you pay no income tax Then you pay 20 tax on income of between 163 12 571 to 163 50 270 before higher rate tax of 40 kicks in

Download Do You Have To Pay Tax On Pension Payments

More picture related to Do You Have To Pay Tax On Pension Payments

Do Beneficiaries Pay Tax On Pension

https://taxsaversonline.com/wp-content/uploads/2022/07/Do-Beneficiaries-Pay-Tax-On-Pension-1.jpg

Choosing Your Pension Payment Option New York Retirement News

https://www.nysretirementnews.com/wp-stuff/uploads/2017/06/pension-payment-options.png

Do You Pay Tax On Pension A Retirement Tax Guide

https://www.fourwealthmanagement.co.uk/wp-content/uploads/2019/09/Tax-when-retired.jpg

Web Since 1 January 2005 new rules have applied to the taxation of pensions Pensioners who are resident abroad are also affected by this Neubrandenburg Tax Office is responsible for individuals whose place of residence or habitual abode is not in Germany but who receive pension payments from Germany Web Ask your employer about your pension scheme rules In most automatic enrolment schemes you ll make contributions based on your total earnings between 163 6 240 and 163 50 270 a year before tax

Web 23 Aug 2023 nbsp 0183 32 Regardless of whether you opt to take your pension income in a lump sum or in monthly payments it s good to have a tax strategy Unless you contributed to your pension the entirety of your pension income will be taxable at your regular income tax rate In other words if your pension income all comes from money your employer Web 4 Mai 2022 nbsp 0183 32 When you start a pension you can choose to have federal and state taxes withheld from your monthly checks The goal is to withhold enough taxes that you won t owe much money when you file your tax return You don t want to get a large refund either unless you like lending money to Uncle Sam

Income Tax And Your Pension Payment YouTube

https://i.ytimg.com/vi/UZ-BIs3eolM/maxresdefault.jpg

Do You Pay Tax On Pension Income 2023

https://www.annuityexpertadvice.com/wp-content/uploads/What-is-Pension-Income.png

https://money.usnews.com/money/retirement/aging/articles/how-pension...

Web 13 Mai 2022 nbsp 0183 32 How Pension Income Is Taxed Learn what to expect in taxes if you receive a pension in retirement By Rachel Hartman Reviewed by Emily Brandon May 13 2022 at 2 56 p m It s important

https://perfinex.de/pension-system-in-germany-explained

Web The main difference between pensions in level 1 level 2vs pensions in level 3 is taxation Level 1 level 2 offer tax benefits in the contribution phase Pension level 3 offers tax benefits in the payout phase in retirement Pension level 3

Do Beneficiaries Pay Tax On Pension

Income Tax And Your Pension Payment YouTube

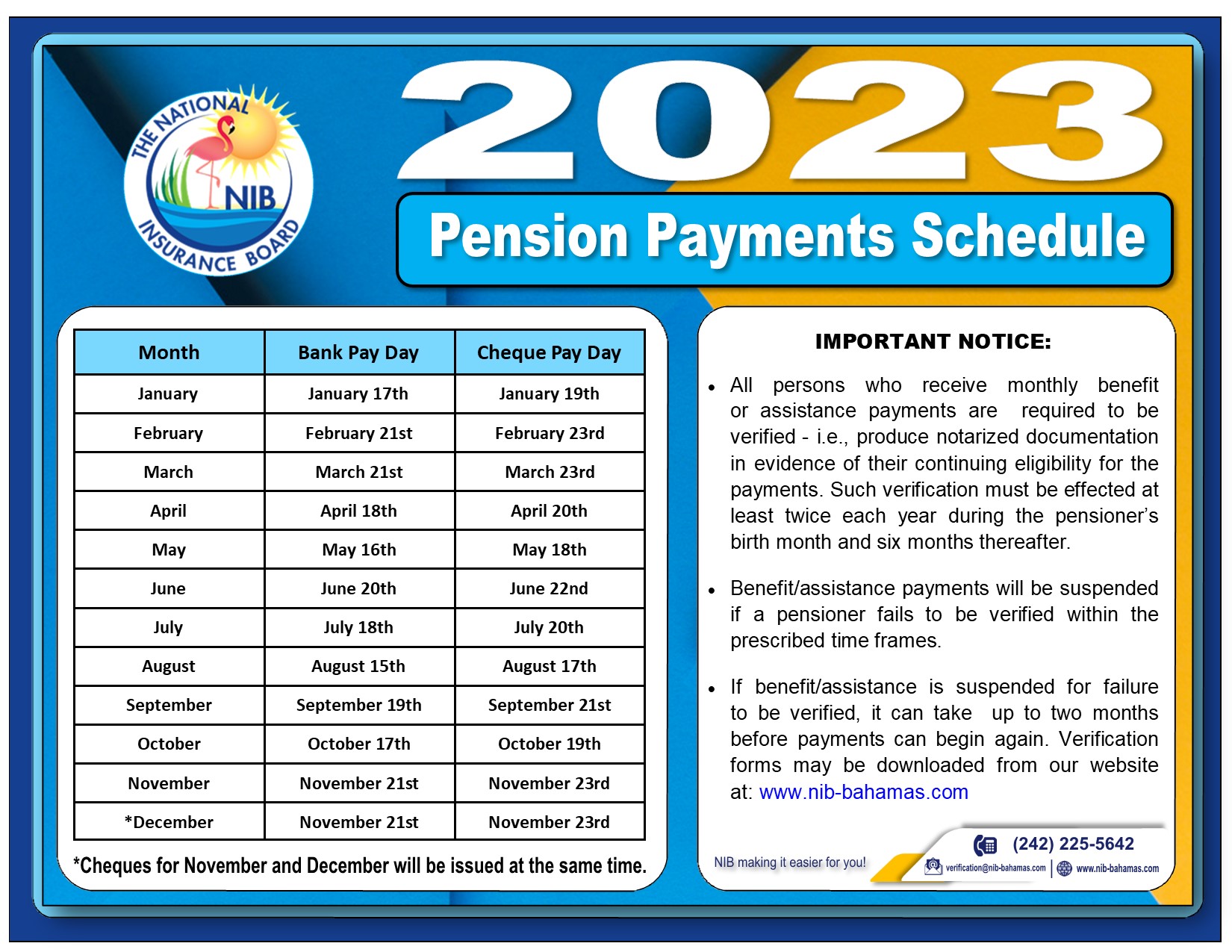

NIB News 2023 Pension Payments Schedule

Updated 2021 Pension Payment Schedule

Transition To Retirement Tax Your Guide To Tax On TTR Pensions

INCOME TAX ON PENSION HOW TO CALCULATE TAX ON PENSION IS PENSION

INCOME TAX ON PENSION HOW TO CALCULATE TAX ON PENSION IS PENSION

Pay At T Business Bill Online Customer Service SavePaying

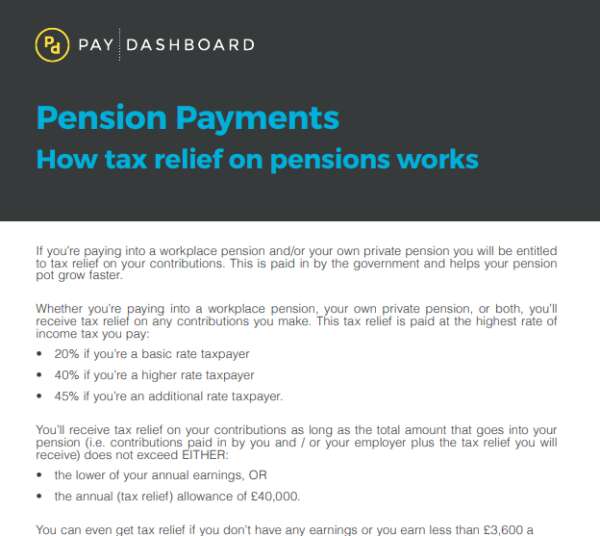

Understanding Pension Payments Pay Dashboard

Minimum Pension Payment Planning

Do You Have To Pay Tax On Pension Payments - Web If a taxpayer receives such a request he or she is obligated to submit a tax return For questions please contact please enclose the letter you received on your pension a passport copy and your green card Finanzamt Neubrandenburg Neustrelitzer Str 120 17033 Neubrandenburg