Do You Have To Pay Taxes On High Interest Savings Account So if you had a high yield savings account in 2023 that paid an APY of 5 25 and you got a 200 bonus for opening the account you d pay taxes on the interest earned at 5 25

To be clear you re never taxed on your contributions to any high yield account only on your earnings But if you take advantage of a cash bonus offer for opening a new high yield account You can t avoid federal income tax on high yield savings account interest if you earn more than 10 but it is possible to avoid tax on other types of savings accounts However avoiding

Do You Have To Pay Taxes On High Interest Savings Account

Do You Have To Pay Taxes On High Interest Savings Account

https://i.pinimg.com/originals/7d/3c/61/7d3c61b3028155c1d427037a46533517.png

4 Highest Paying Banks Of 2020 Best High Yield Savings Accounts YouTube

https://i.ytimg.com/vi/-F7Xh9kCjxQ/maxresdefault.jpg

Common Financial Myths Don t Give Away Too Much Money Or You ll Owe

https://static.twentyoverten.com/5d695e18001fda1ab1b4e561/QaD68MrqIUUQ/cropped/ekaterina-shevchenko-ZLTlHeKbh04-unsplash.jpg

Depending on how much money you make you can expect to pay between 10 to 37 on savings account interest in taxes These are the federal income tax rates and tax brackets for 2023 The IRS considers that 40 of interest to be taxable income So you would need to report those earnings on your tax return In fact any interest earned on your savings whether through a

Interest earned on savings accounts is taxable at ordinary income tax rates With a few exceptions interest earned on savings is taxable in the year when it becomes available to The higher your savings account balance the more interest will accrue and the more tax you ll have to pay Tax Rates on Interest From Savings Savings account interest will be taxed at the same marginal income tax rate as the rest of your earned income

Download Do You Have To Pay Taxes On High Interest Savings Account

More picture related to Do You Have To Pay Taxes On High Interest Savings Account

How To Choose The Best High interest Savings Account Money Community

https://img.choice.com.au/-/media/a60e6999d2a5496b909fce82a12b4cf3.ashx

4 Best High Interest Savings Accounts For 2020 In 2020 High Interest

https://i.pinimg.com/736x/75/02/5d/75025db127351cc9ebd0551fb82f98a2.jpg

5 High Yield Savings Accounts To Store Your Money Invest It In

https://investitin.com/wp-content/uploads/2020/02/6757871357_4246b6a836_k.jpg

1w 3 min read Yes you will have to pay taxes on the interest earned from your high yield savings account How to pay taxes on high yield savings account You ll calculate the taxes you owe for savings account interest on the annual tax return you file on tax day unless you got

But even if you don t get a 1099 INT you re still required to report and pay taxes on your interest income despite it being a small amount In that case you ll need to log into your Interest earned on high yield savings accounts is taxed as earned income and must be reported to the IRS If you earn at least 10 in interest your financial institution will report your earnings to the IRS on Form 1099 INT Earnings of less than 10 should still be reported on your tax return

Do You Pay Taxes On A High yield Savings Account

https://assets2.cbsnewsstatic.com/hub/i/r/2023/03/28/25871c73-c641-4660-9c1f-a401185ac113/thumbnail/620x413/2d265a8d68fb9f268991fcae36a9e825/do-i-have-to-pay-taxes-on-my-high-yield-savings-account.jpg

Top 10 High Yield Savings Accounts Ranked By APY February 2023

https://i.ytimg.com/vi/VQ3CDhCnOF0/maxresdefault.jpg

https://www.usnews.com/banking/articles/do-you-pay...

So if you had a high yield savings account in 2023 that paid an APY of 5 25 and you got a 200 bonus for opening the account you d pay taxes on the interest earned at 5 25

https://www.businessinsider.com/personal-finance/...

To be clear you re never taxed on your contributions to any high yield account only on your earnings But if you take advantage of a cash bonus offer for opening a new high yield account

You Can Pay Your Taxes With Credit Card But Should You

Do You Pay Taxes On A High yield Savings Account

Tax On Interest Earned How Much Do You Pay RateCity

10 Banks Which Pay High Interest Rates On Savings Accounts YouTube

How Much Interest Is Your Savings Account Earning Savings Account

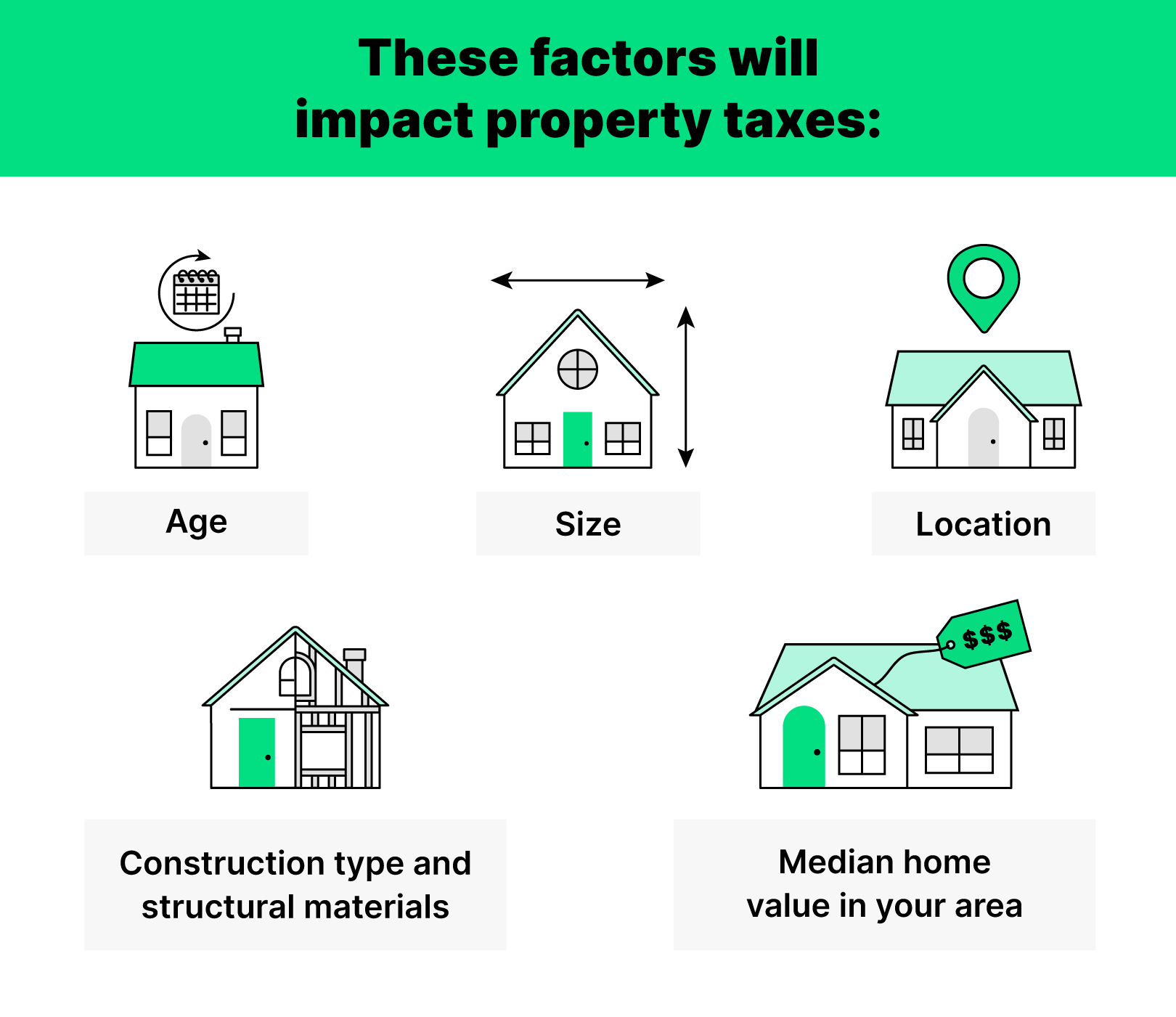

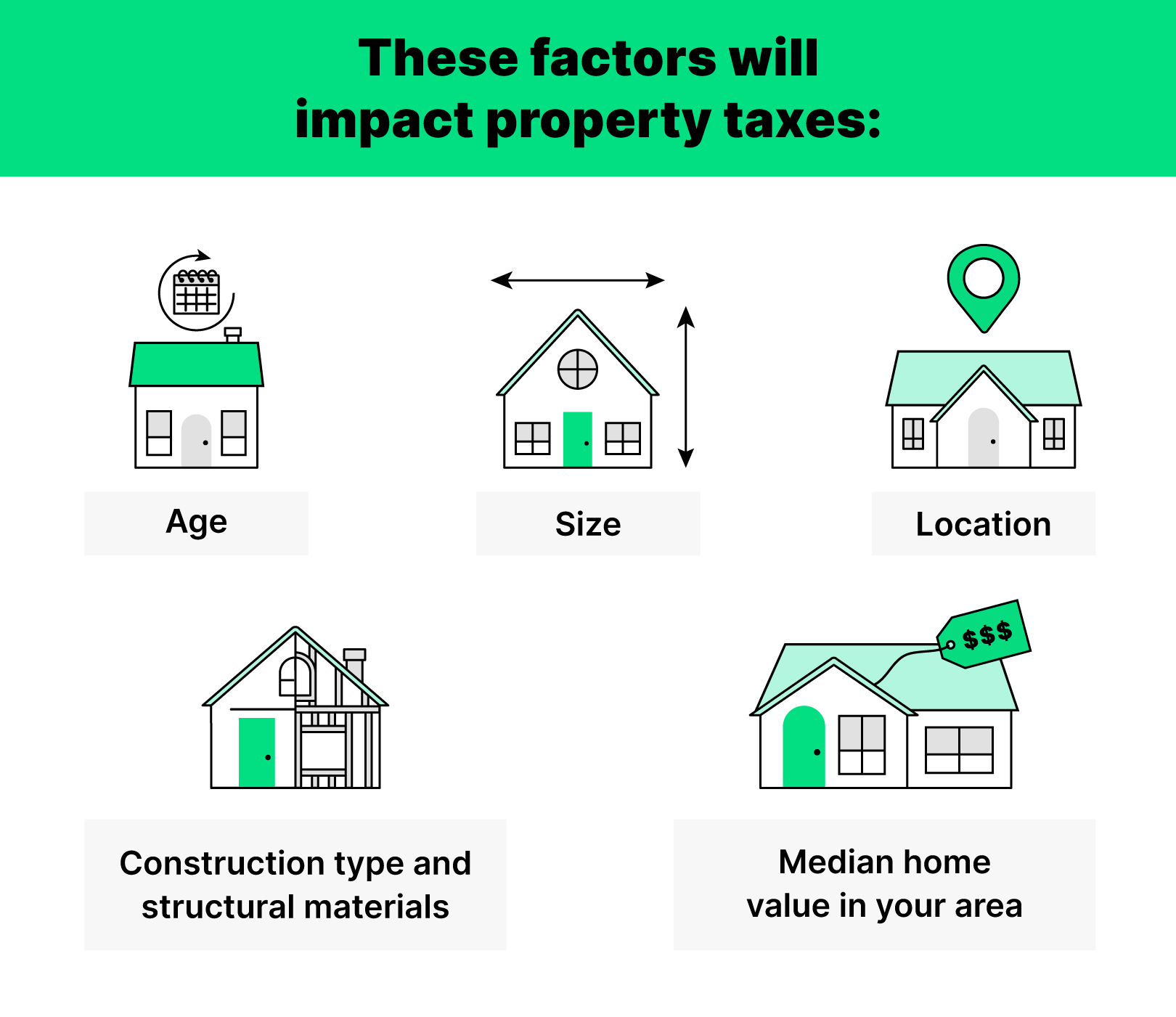

Your Guide To Property Taxes Hippo

Your Guide To Property Taxes Hippo

Why We Pay Taxes In South Africa Greater Good SA

Do I Have To Pay Taxes On Virtual Currency If My Profit Is Less Than

Make Money By Paying More Taxes Buy Or Sell A Business Fast Results

Do You Have To Pay Taxes On High Interest Savings Account - You ll pay taxes at your regular rate the year interest is earned whether or not you withdraw from the account You can avoid paying taxes on interest with the help of certain