Do You Have To Pay Taxes On Ibotta Typically no Ibotta Cashback is technically a rebate that takes the purchase price of the product down This isn t considered taxable income usually at least not in Massachusetts

The short answer to this kind of question is no Rebates in general are not taxable income to an individual taxpayer unless that person first took a tax deduction for the cost of Receiving a refund for a product or service which you have already paid for is not taxable income and is not reported on a tax return

Do You Have To Pay Taxes On Ibotta

Do You Have To Pay Taxes On Ibotta

https://stophavingaboringlife.com/wp-content/uploads/2020/11/tax-time-1536x1086.jpeg

Do I Need To Pay Taxes The Minimum Income To File Taxes

https://www.taxslayer.com/blog/wp-content/uploads/2018/09/do-i-make-enough-to-pay-taxes-e1605639489394-2048x1154.jpg

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

https://www.gannett-cdn.com/-mm-/2836aaa5a122ccfaf3f251ad914b02ff84c86c72/c=0-103-2128-1305/local/-/media/2017/04/03/USATODAY/USATODAY/636268502332211071-GettyImages-495699718.jpg?width=3200&height=1680&fit=crop

If you must make a purchase with the card in order to obtain the cash back the IRS considers it a non taxable rebate Answers are correct to the best of my ability but do Do you pay taxes on Ibotta Nope Ibotta will not send you any tax forms because the cash back you receive is considered coupons How do you get 20 on Ibotta

The only reason you would need to report ibotta earnings as Taxable Income is if you made over 600 in friend referrals alone Which you would have to report even if you got the money Ibotta and Fetch have helped me earn cash back on my grocery purchases for years now According to an Ibotta commercial that I saw the average user earns 150 cash back in a year By shopping with the strategy

Download Do You Have To Pay Taxes On Ibotta

More picture related to Do You Have To Pay Taxes On Ibotta

Earn Less Than 75 000 A Year You Might Not Have To Pay Taxes The

https://nationalinterest.org/sites/default/files/main_images/%2475000 Taxes.jpg

Do I Have To Pay Taxes On My Checking Account Millennial Money

https://millennialmoney.com/wp-content/uploads/2021/04/Do-I-Have-to-Pay-Taxes-on-My-Checking-Account.jpg

Do You Pay Taxes On A High yield Savings Account

https://assets1.cbsnewsstatic.com/hub/i/r/2023/03/28/25871c73-c641-4660-9c1f-a401185ac113/thumbnail/1240x826/dbd7d7851c2f56dc58c48f0456f572ec/do-i-have-to-pay-taxes-on-my-high-yield-savings-account.jpg

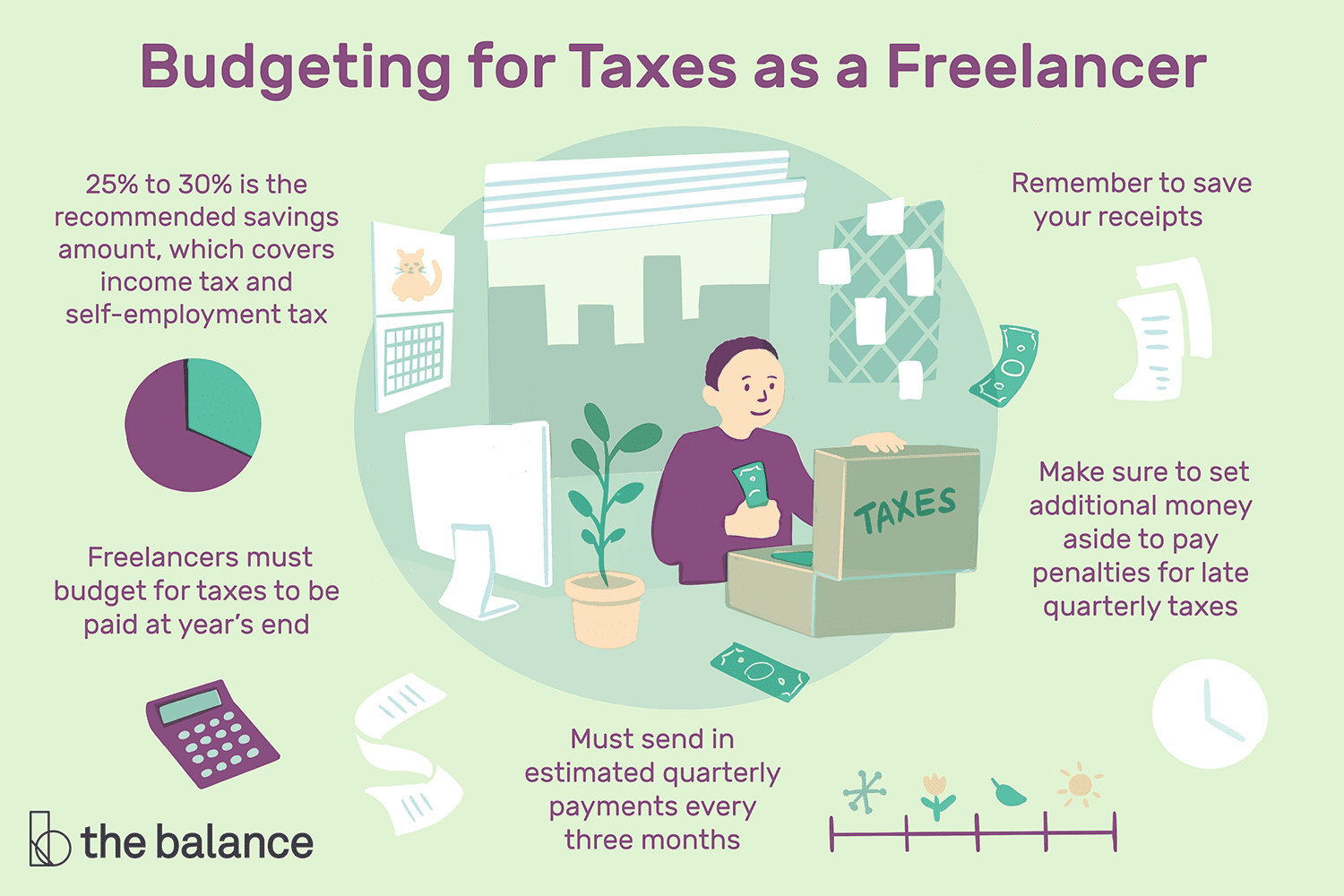

Once you ve selected your preferred payment method and have at least 20 in your account navigate to the Withdraw Cash or Gift Cards section of the app Follow the prompts to initiate the withdrawal process Business credit card rewards are not taxable However you can t claim tax deductions on business expenses if you use rewards to pay for these expenses

One way to save big on groceries and other essentials over time is by earning cash back through an app like Ibotta You simply download the app or install the browser extension claim offers shop as normal and earn cash Ibotta is an affiliate partner for over 2 000 retail stores restaurants convenience stores movie theaters pet stores and drug stores If you either shop through the Ibotta portal

What We Would Give Up To Never Have To Pay Taxes

https://images.radio.com/aiu-media/usatsi-14104186-168384843-lowres-8836470d-6817-4af7-b0b6-b202abb81b77.jpg

How To Not Pay Taxes YouTube

https://i.ytimg.com/vi/k8dXGnFUKqg/maxresdefault.jpg

https://www.reddit.com › ibotta › comments › taxes_on_cashback

Typically no Ibotta Cashback is technically a rebate that takes the purchase price of the product down This isn t considered taxable income usually at least not in Massachusetts

https://ttlc.intuit.com › community › business-taxes › ...

The short answer to this kind of question is no Rebates in general are not taxable income to an individual taxpayer unless that person first took a tax deduction for the cost of

How To Increase The Value Of A Business By Paying More Taxes

What We Would Give Up To Never Have To Pay Taxes

Who Pays Federal Taxes Source

How To Legally Never Pay Taxes Again YouTube

Let s Talk About Taxes SoundGirls

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or

10 Things You Didn t Know You Had To Pay Taxes On Money

Do I Have To Pay Taxes On My Share mp4 On Vimeo

Why Do I Have To Pay Taxes

Do You Have To Pay Taxes On Ibotta - The only reason you would need to report ibotta earnings as Taxable Income is if you made over 600 in friend referrals alone Which you would have to report even if you got the money