Tax Rebate Ppi Web 27 avr 2023 nbsp 0183 32 You normally have four years from the end of the tax year in which the overpayment arose to claim a refund So if you received your PPI refund in 2022 23 you have until 5 April 2027 to submit a claim If the

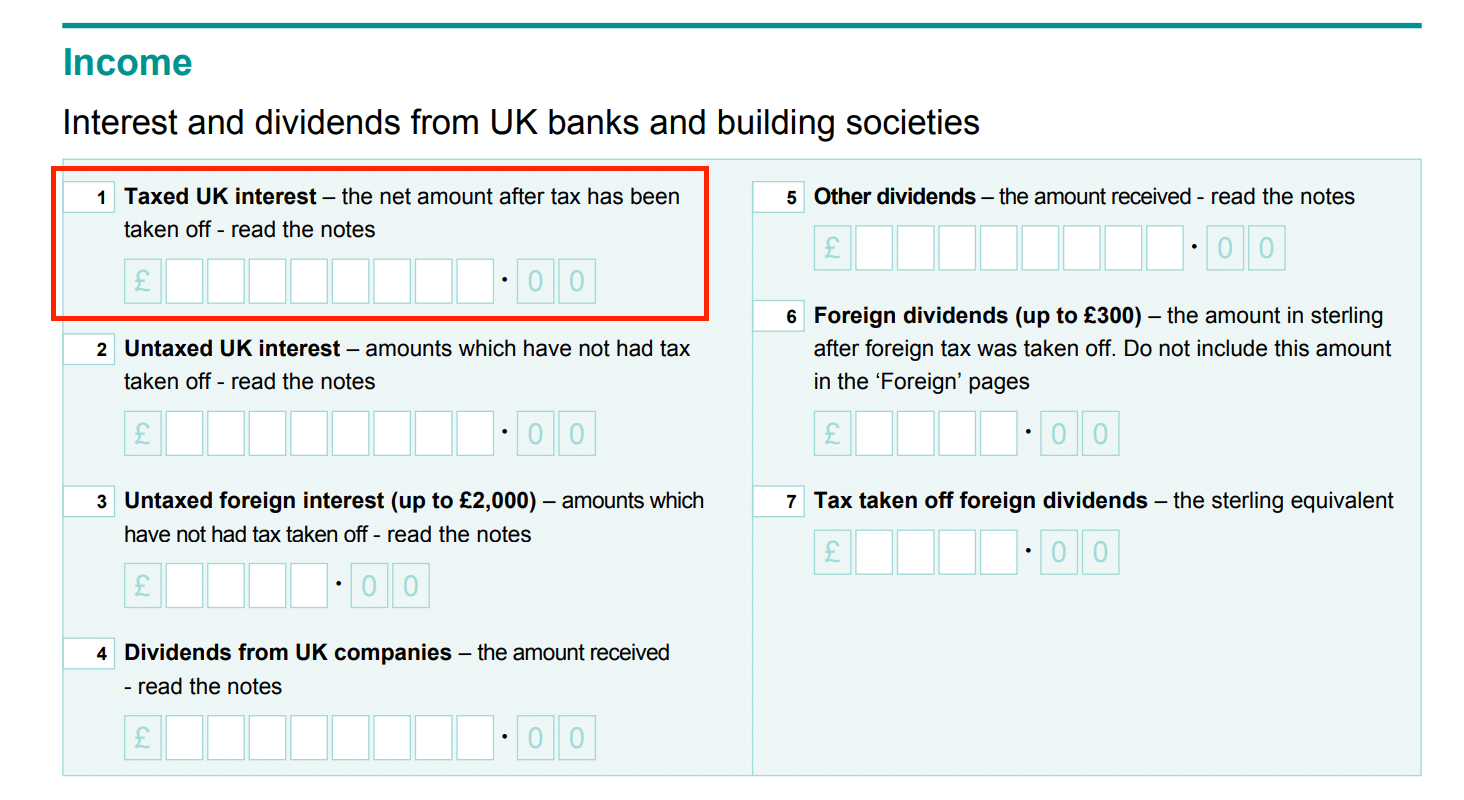

Web The tax deducted from a PPI refund is at a rate of 20 which means for every 163 100 of PPI refund interest received a 163 20 tax deduction is automatically charged The value of Web 3 avr 2023 nbsp 0183 32 Once HMRC have received and processed Patrick s form he should get a refund of 163 94 being the 163 80 of tax withheld on his PPI interest as he can use the Personal Savings Allowance against all his

Tax Rebate Ppi

Tax Rebate Ppi

https://i.ibb.co/WnX8rVX/This-is-Roger.png

HMRC PPI Tax Refund In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/07/PNG.png

PPI Tax Rebate YouTube

https://i.ytimg.com/vi/Xb6wIF73ltc/maxresdefault.jpg

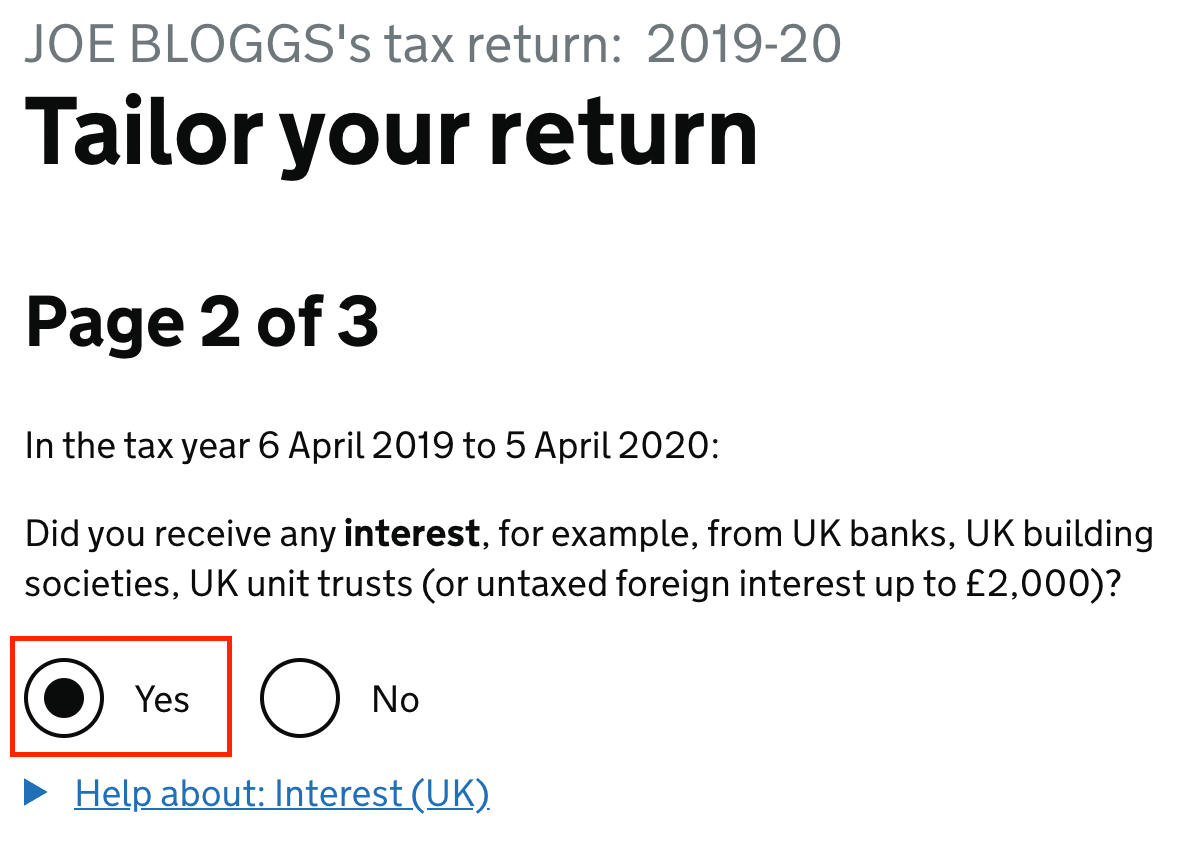

Web 3 f 233 vr 2023 nbsp 0183 32 The HMRC Tax Refund Form R40 PPI is a tool for individuals in the UK who believe that they have been taxed on their personal pension income at the incorrect rate By completing the form and submitting it to Web 30 mars 2022 nbsp 0183 32 In December my neighbour was notified by HM Revenue and Customs that she was entitled to a rebate of 163 324 for the tax year 2020 2021 and that a cheque was

Web This PPI refund calculator will work out which tax free allowances you are entitled to based on your circumstances and calculate an estimate of how much you have overpaid How Web 3 nov 2021 nbsp 0183 32 You can only reclaim PPI tax going back four tax years as well as the current one So as we re now in the 2021 22 tax year that means the furthest you can claim

Download Tax Rebate Ppi

More picture related to Tax Rebate Ppi

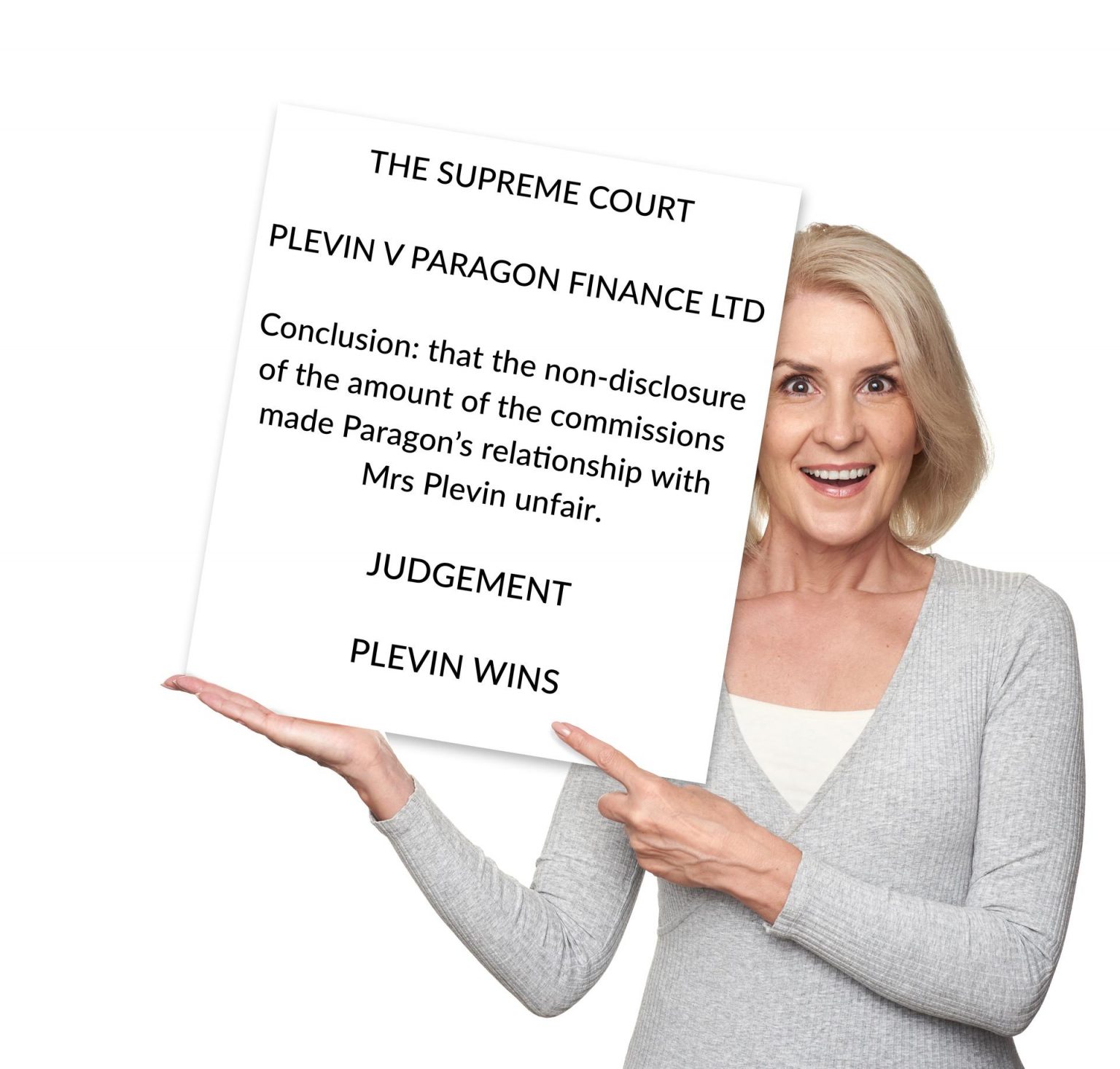

Claim Your PPI Tax Rebate Your Claim Matters

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/07/women-with-banner-1-1536x1466.jpg

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

PPI Tax Rebate Page 2 MoneySavingExpert Forum

https://us-noi.v-cdn.net/6031891/uploads/editor/eo/m6cbfsgn8cbg.jpg

Web If you have received a payment protection insurance PPI payout you may be entitled to a tax refund on the amount that was deducted In some cases tax may have been taken Web If you have had a successful claim from your lender s for Mis Sold Payment Protection Insurance PPI since April 2016 there is a high chance that you are entitled to a rebate

Web 1 juin 2021 nbsp 0183 32 How long does it take to receive a tax rebate on a PPI pay out Claim Today If you have received a PPI or payday loan refund or any other type of affordability refund Web 11 mai 2023 nbsp 0183 32 Income Tax Guidance Claim a refund of Income Tax deducted from savings and investments English Cymraeg Apply for a repayment of tax on your savings interest

Can I Claim Ppi Back From My Catalogue

http://ambertax.com/wp-content/uploads/P60-form-1.jpg

Had A PPI Payout After 2016 Here s Some Good News In 2021 Life

https://i.pinimg.com/originals/1d/5f/ac/1d5fac2b6f3f3c1d49d50f6b2edcba55.png

https://www.litrg.org.uk/tax-guides/tax-basics/…

Web 27 avr 2023 nbsp 0183 32 You normally have four years from the end of the tax year in which the overpayment arose to claim a refund So if you received your PPI refund in 2022 23 you have until 5 April 2027 to submit a claim If the

https://www.taxrebateservices.co.uk/tax-guides/ppi-tax-rebate

Web The tax deducted from a PPI refund is at a rate of 20 which means for every 163 100 of PPI refund interest received a 163 20 tax deduction is automatically charged The value of

Martin Lewis How To Reclaim Tax On Your PPI Payout Martin Lewis

Can I Claim Ppi Back From My Catalogue

How To Declare A PPI Refund On Your Tax Return PPI Rebates

How To Declare A PPI Refund On Your Tax Return PPI Rebates

Reclaim My PPI Tax BL8 2AD Bury Unit 30 Albion St B2B Company

Have You Paid Excessive Tax On Your PPI Refund Instant Bazinga

Have You Paid Excessive Tax On Your PPI Refund Instant Bazinga

Illinois Tax Rebate Tracker Rebate2022

2007 Tax Rebate Tax Deduction Rebates

What Are The Best Ways To Manage Tax Rebates

Tax Rebate Ppi - Web PPI Tax Allowance Calculator will help you estimate the amount of tax you can claim back on PPI refunds Find our how much money you may be owed