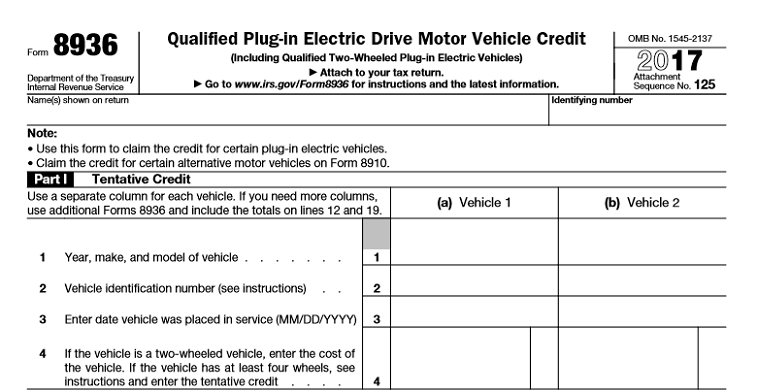

Irs Tax Rebate Electric Car Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web 12 avr 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you

Irs Tax Rebate Electric Car

Irs Tax Rebate Electric Car

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Tax Rebates On New Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/electric-car-tax-credits-and-rebates-charged-future-1.jpeg

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit Web The Inflation Reduction Act made several major changes to the tax credit There is a price cap on qualifying EVs For passenger cars the manufacturer s suggested retail price or

Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Download Irs Tax Rebate Electric Car

More picture related to Irs Tax Rebate Electric Car

Tax Rebates For Electric Cars Michigan 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/michigan-increases-taxes-to-fund-road-repairs-hybrids-and-electrics-1-scaled.jpg

Government Rebates Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/are-there-government-rebates-for-electric-cars-2022-carrebate-3.jpg

Tax Rebates For Electric Cars Michigan 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/michigan-increases-taxes-to-fund-road-repairs-hybrids-and-electrics.jpg

Web 31 mars 2023 nbsp 0183 32 A tax credit of up to 7 500 to buy an electric car is about to undergo a major change again The Inflation Reduction Act a major climate law passed last summer dramatically reworked an Web Tesla TSLA O said on Wednesday the Model 3 rear wheel drive credit will be reduced as a result of the guidance The government will publish by April 18 a revised list of

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

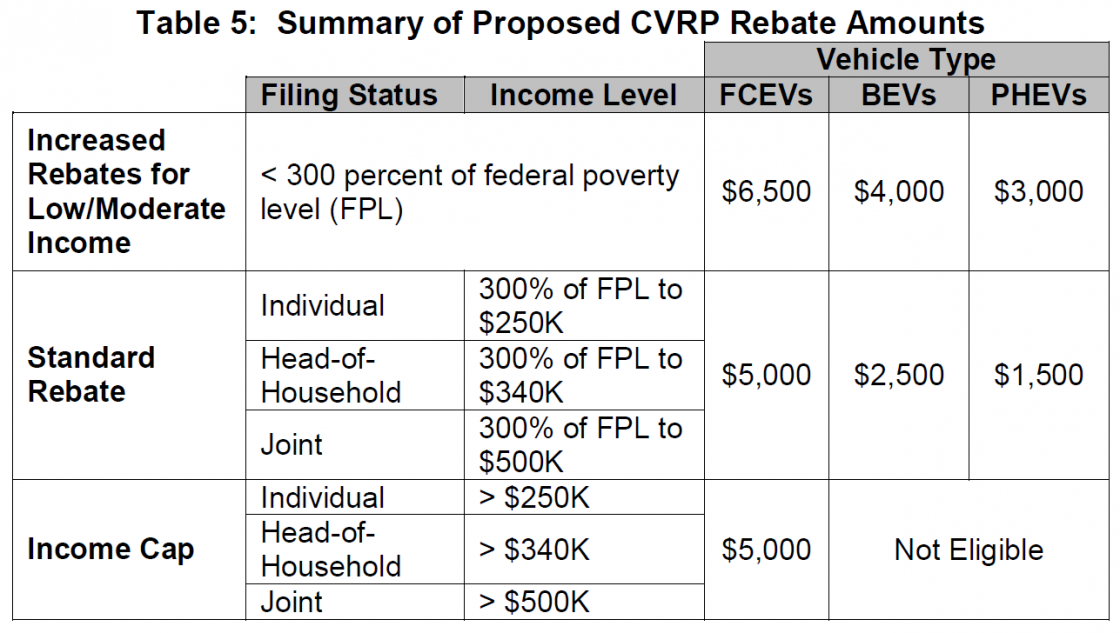

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

Washington Electric Car Tax Rebate 2023 Carrebate Californiarebates

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/washington-electric-car-tax-rebate-2023-carrebate.jpeg?resize=1536%2C1152&ssl=1

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.irs.gov/newsroom/heres-what-taxpayers-need-to-know-to...

Web 12 avr 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell

Ca Electric Car Rebate Income Limit ElectricRebate

Electric Car Tax Rebate California ElectricCarTalk

Electric Car Rebates Canada 2021

Delaware Electric Car Tax Rebate Printable Rebate Form

What Is The Tax Rebate For Electric Cars 2023 Carrebate

What Electric Vehicle Rebates Can I Get RateGenius

What Electric Vehicle Rebates Can I Get RateGenius

Southern California Edison Rebates For Electric Cars 2022 Carrebate

What Is The Tax Rebate For Electric Cars 2023 Carrebate

Electric Car Rebates Washington State 2023 Carrebate

Irs Tax Rebate Electric Car - Web 25 ao 251 t 2022 nbsp 0183 32 If you meet the income requirements and buy a qualifying vehicle you must claim the electric vehicle EV tax credit on your annual tax filing for 2022 and 2023