Do You Have To Pay Taxes On Savings Bond Interest When you ll have to pay taxes on Treasury issued savings bonds typically depends on the type of bond involved and how long you hold the bond The Treasury gives you two options According to the Treasury Department

Owners can wait to pay the taxes when they cash in the bond when the bond matures or when they relinquish the bond to another owner Alternatively they may pay the If your total taxable interest for the year is more than 1500 you must complete Schedule B Form 1040 Interest and Ordinary Dividends and attach it to your Form 1040 SR

Do You Have To Pay Taxes On Savings Bond Interest

Do You Have To Pay Taxes On Savings Bond Interest

https://cdn.thepennyhoarder.com/wp-content/uploads/2022/12/03143722/taxes-savings-account-final-1-1024x683.jpg

Common Financial Myths Don t Give Away Too Much Money Or You ll Owe

https://static.twentyoverten.com/5d695e18001fda1ab1b4e561/QaD68MrqIUUQ/cropped/ekaterina-shevchenko-ZLTlHeKbh04-unsplash.jpg

How Do I Look Up A Savings Bond Serial Number Dollar Keg

https://cdn-blog.supermoney.com/wp-content/uploads/2022/09/series-ee-savings-bond-1024x445.jpg

So you ll want to be aware of a few things when it comes to cash out your U S savings bonds and taxes You will have to pay federal income tax on your savings bonds but you When cashing in savings bonds you DO have to pay taxes on the interest Before you freak out make sure you grasp the full meaning of that sentence You pay taxes on the INTEREST ONLY not on the amount you get

So if you received 125 in interest on a high yield savings account in 2023 you re required to pay taxes on that interest when you file your federal tax return Most people can earn some interest from their savings without paying tax Your allowances for earning interest before you have to pay tax on it include You get these allowances each tax

Download Do You Have To Pay Taxes On Savings Bond Interest

More picture related to Do You Have To Pay Taxes On Savings Bond Interest

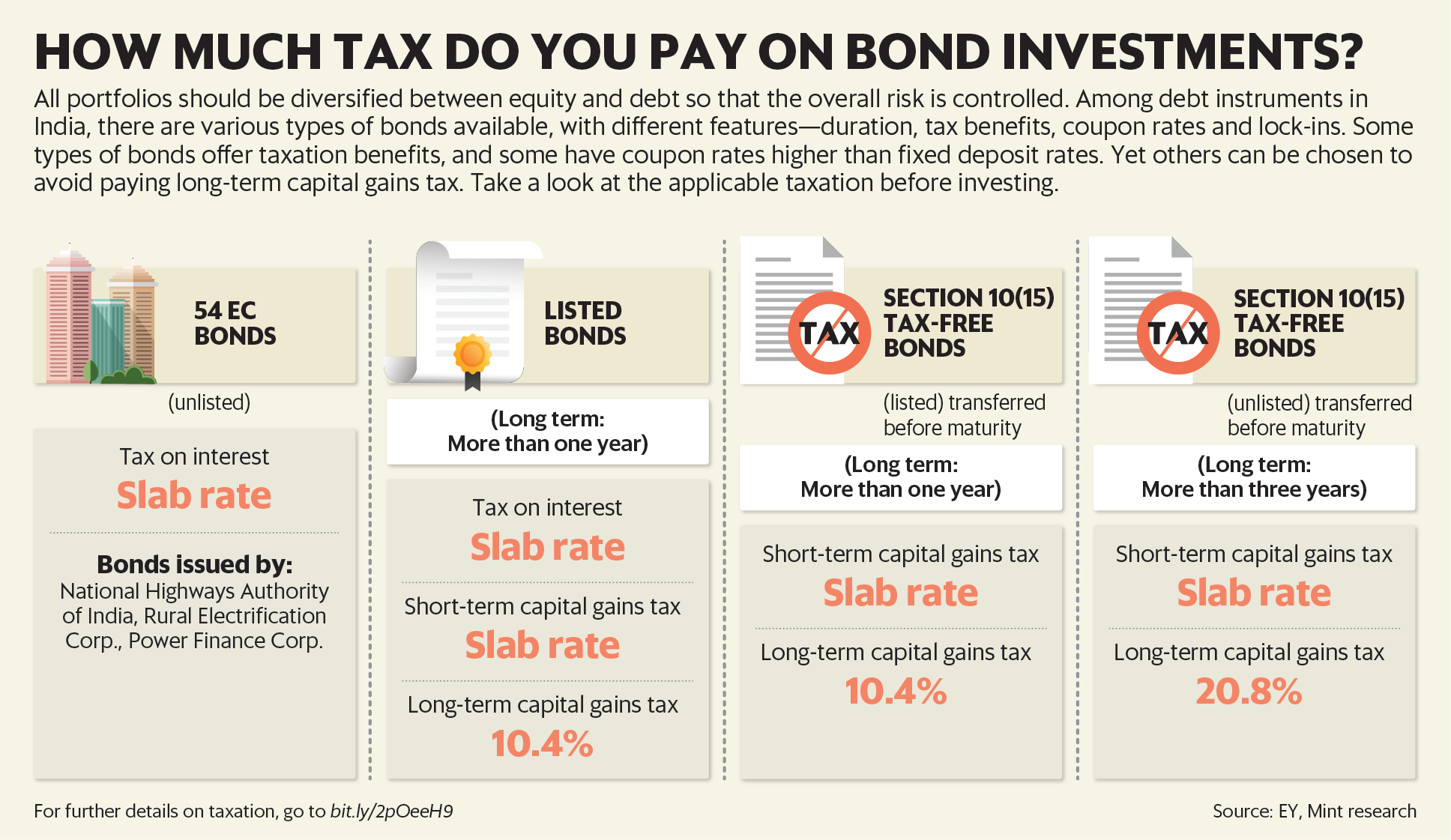

How Much Tax Do You Pay On Bond Investments Mint

https://images.livemint.com/img/2021/08/17/original/bond_1629217589500.png

How Do Savings Bonds Work Clever Girl Finance

https://www.clevergirlfinance.com/wp-content/uploads/2020/12/How-to-savings-bonds-work.jpg

You Can Pay Your Taxes With Credit Card But Should You

https://www.gannett-cdn.com/-mm-/e6fc938b703a3aefb17e10ece8094955d629fbcd/c=0-167-3862-2349/local/-/media/2016/03/21/USATODAY/USATODAY/635941795874671933-ThinkstockPhotos-464263169.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

There are three main types of savings and investment income on which you may have to pay tax interest from savings income from dividends and income from life insurance investments NS I premium bonds National Savings You don t have to pay state or local income tax on them You can choose not to pay federal income tax on them until you cash them or they mature whichever is first Under certain

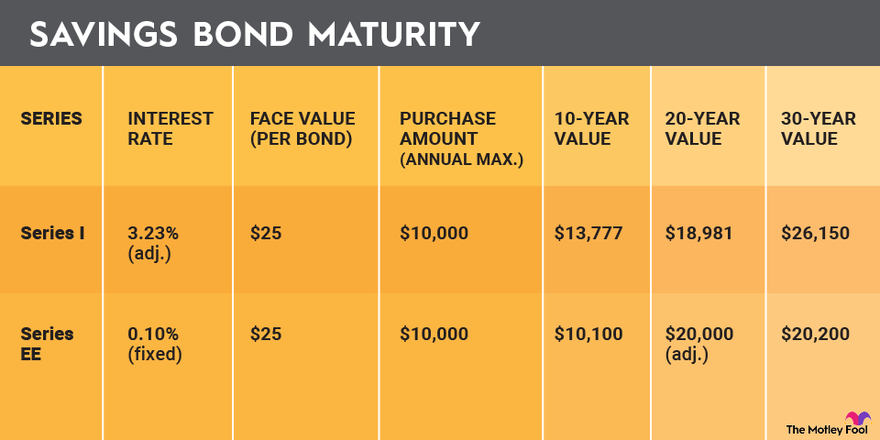

The interest rate on a Series I savings bond changes every 6 months based on inflation The rate can go up The rate can go down If you use the money for qualified Yes you are required to pay federal income taxes on the interest earned by inherited series I savings bonds The interest is taxed in the year it is earned and must be

Tax On Interest Earned How Much Do You Pay RateCity

https://production-content-assets.ratecity.com.au/20190809122359/savings.jpg

Do I Have To Pay Taxes On Virtual Currency If My Profit Is Less Than

https://www.gooooodlife.com/wp-content/uploads/2021/10/Do-I-have-to-pay-taxes-on-virtual-currency-if-my-profit-is-less-than-200000-yen-1024x576.png

https://smartasset.com/taxes/how-can-i …

When you ll have to pay taxes on Treasury issued savings bonds typically depends on the type of bond involved and how long you hold the bond The Treasury gives you two options According to the Treasury Department

https://www.investopedia.com/ask/answers/111314/...

Owners can wait to pay the taxes when they cash in the bond when the bond matures or when they relinquish the bond to another owner Alternatively they may pay the

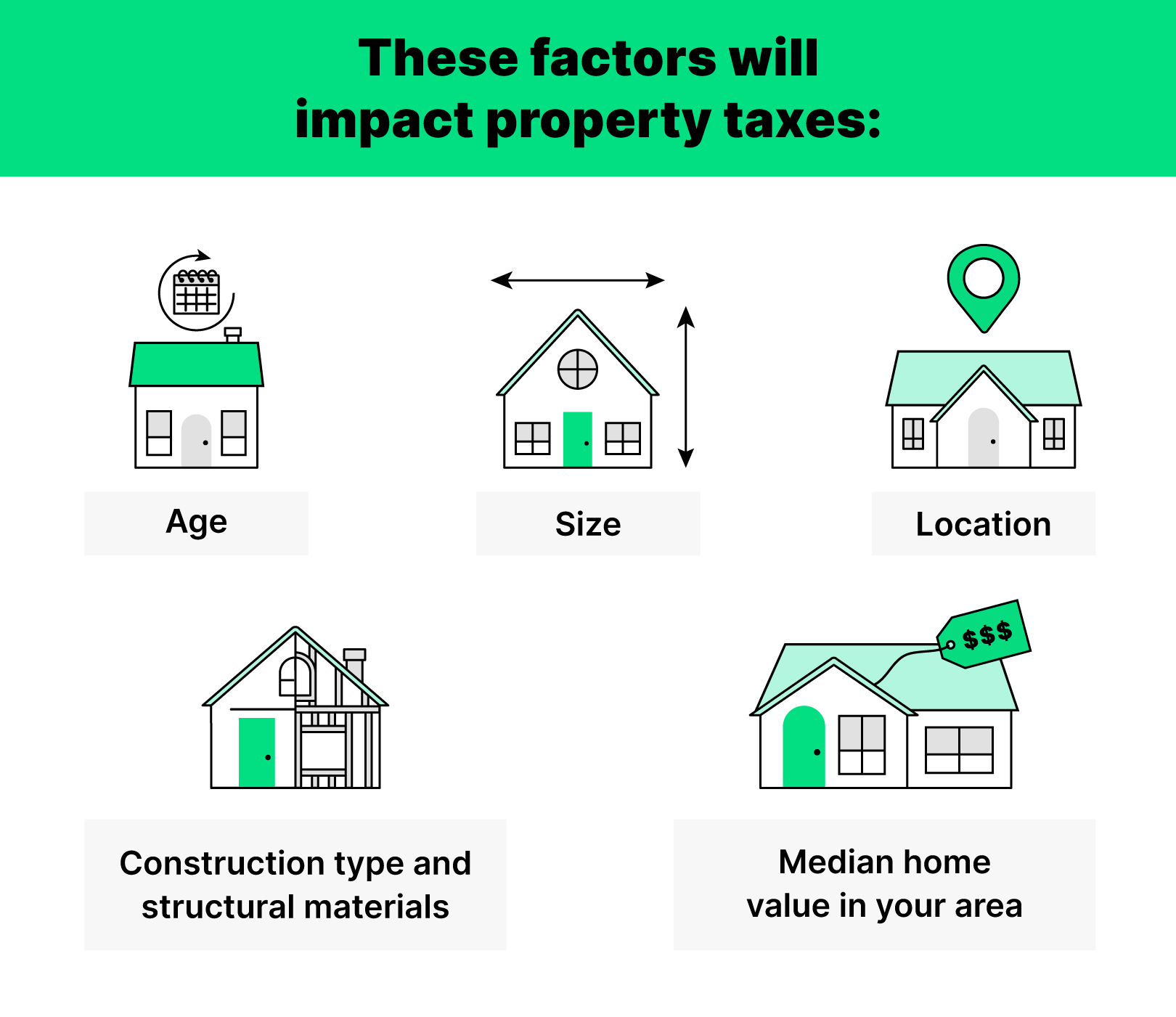

Your Guide To Property Taxes Hippo

Tax On Interest Earned How Much Do You Pay RateCity

How To Find Out What A Savings Bond Is Worth Faultconcern7

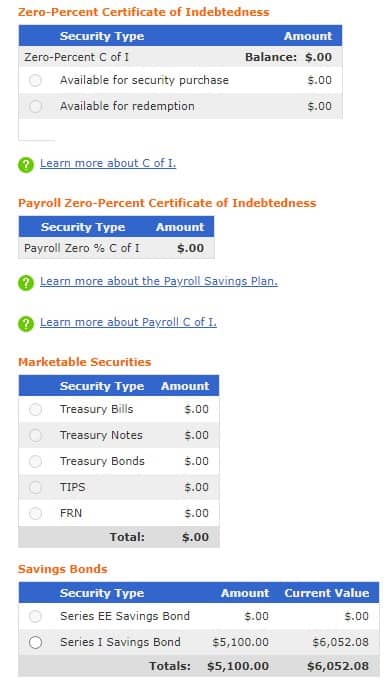

Savings Bond

What Is A Financial Product

Do I Have To Pay Taxes On A 10 000 Inheritance Keystone Law Firm

Do I Have To Pay Taxes On A 10 000 Inheritance Keystone Law Firm

Pin On Saving

How To Redeem A Savings Bonds Without Paying Taxes Finance Zacks

How Do I Pay Taxes On My I Bond Interest Nj

Do You Have To Pay Taxes On Savings Bond Interest - So if you received 125 in interest on a high yield savings account in 2023 you re required to pay taxes on that interest when you file your federal tax return