File Renters Rebate Mn Web e File your 2022 Minnesota Homestead Credit and Renter s Property Tax Refund return Form M1PR using eFile Express Most calculations are automatically performed for you Eliminate errors before submitting your

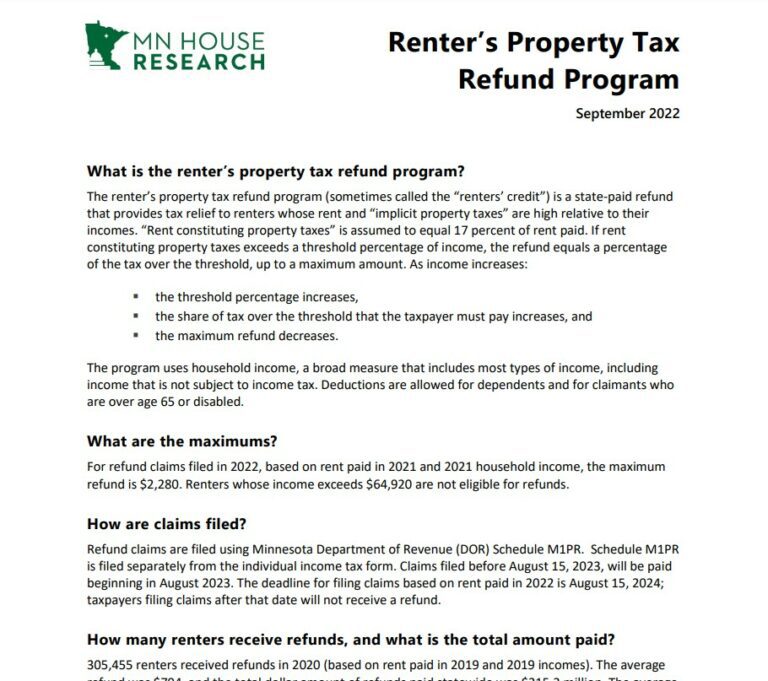

Web 2 Do I qualify You may be eligible for a refund based on your household income see pages 8 and 9 and the property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 69 520 Web For refund claims filed in 2021 based on rent paid in 2020 and 2020 household income the maximum refund is 2 210 Renters whose income exceeds 62 960 are not eligible for refunds How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR

File Renters Rebate Mn

File Renters Rebate Mn

https://www.rentersrebate.net/wp-content/uploads/2023/05/how-to-file-my-renters-rebate-rentersrebate-23.jpg

Renters Rebate 2022 Mn RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/how-to-file-minnesota-property-tax-refund-12.png?fit=530%2C749&ssl=1

Form For Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/free-7-sample-rent-rebate-forms-in-pdf-22.jpg?fit=585%2C430&ssl=1

Web 10 juil 2023 nbsp 0183 32 You filed one of the following returns by December 31 2022 2021 Form M1 Minnesota Individual Income Tax 2021 Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Your 2021 adjusted gross income line 1 of Form M1 or Form M1PR was 150 000 or less for married joint filers Web St Paul MN 55145 0020 You should get your refund within 90 days after August 15 You can get your refund up to 30 days earlier if you file electronically and do the following things File by April 30th if you own your home File by July 31st if you rent or own a mobile home Choose direct deposit option This means the money will be put

Web For refund claims filed in 2022 based on rent paid in 2021 and 2021 household income the maximum refund is 2 280 Renters whose income exceeds 64 920 are not eligible for refunds How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR Web 17 nov 2022 nbsp 0183 32 Minnesota Department of Revenue reminds homeowners renters and tenants to file for property tax refunds by the August 15 deadline The refund season lasts for two years Homeowners and renters who meet income requirements may claim up to 700 in property taxes Renters who request a refund usually receive 654

Download File Renters Rebate Mn

More picture related to File Renters Rebate Mn

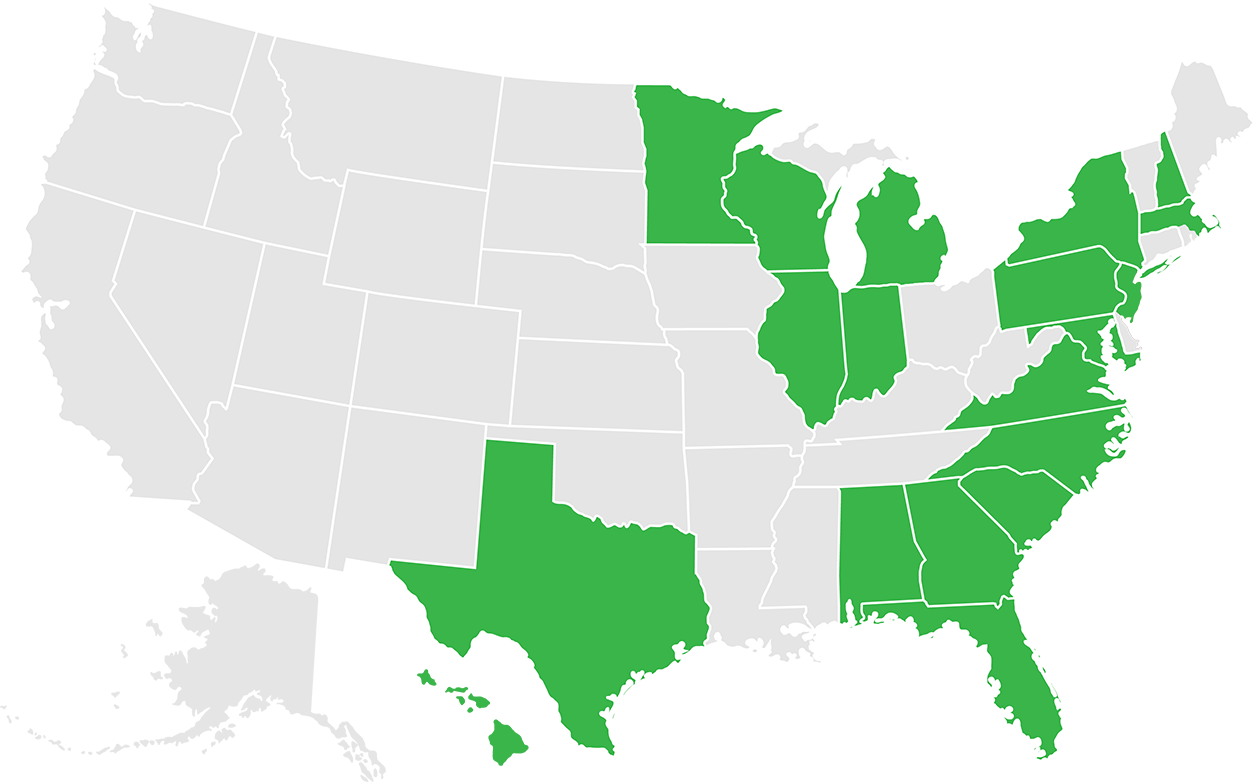

Where Is My Renters Rebate Minnesota Pureanduniquedesigns

https://clovered.com/wp-content/uploads/2021/01/state-landing-map.png

Where s My Renters Rebate Check Mn RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/where-is-my-renters-rebate-minnesota-pureanduniquedesigns-24.jpg?resize=548%2C1024&ssl=1

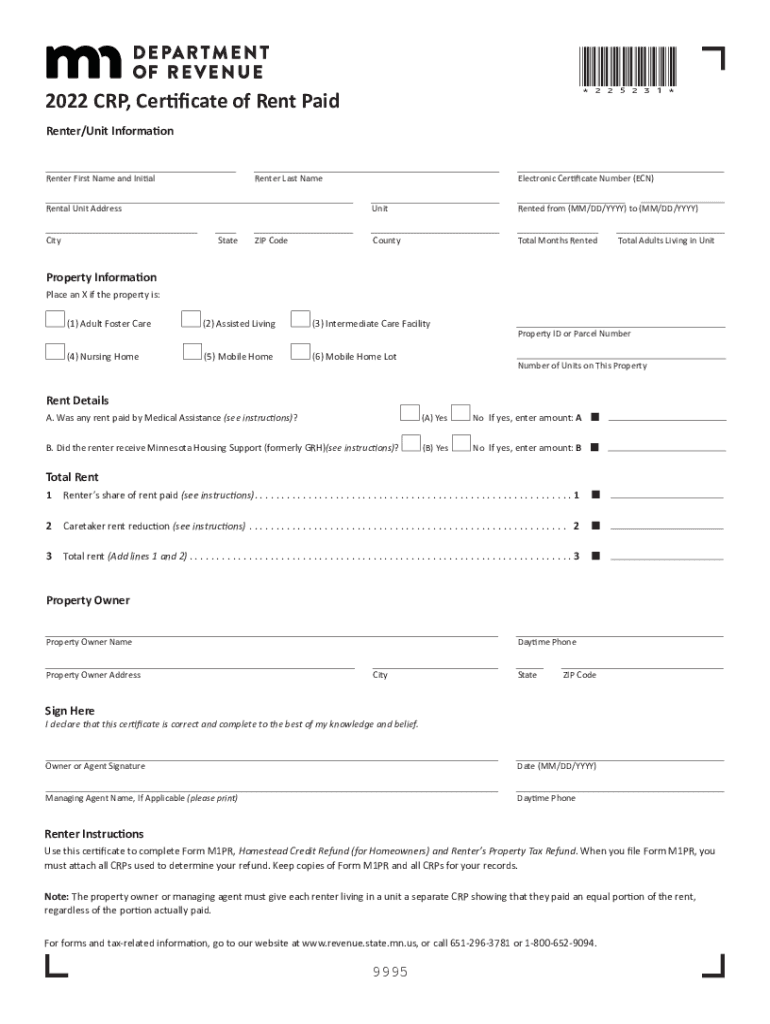

2014 Form MN DoR CRP Fill Online Printable Fillable Blank PdfFiller

https://www.rentersrebate.net/wp-content/uploads/2022/10/2014-form-mn-dor-crp-fill-online-printable-fillable-blank-pdffiller-5.png

Web 7 juin 2019 nbsp 0183 32 The form M1PR needs to be mailed in with your renter s certificate since you already filed your return you can go to the following website for instructions amp the form http www revenue state mn us individuals prop tax refund Pages Renters Property Tax Refund aspx Web St Paul MN 55145 0020 You should get your refund within 90 days after August 15 2020 You can get your refund up to 30 days earlier if you file electronically and do the following things 173 File by April 30th if you own your home File by July 31st if you rent or own a mobile home 173 Choose direct deposit option This means the

Web 6 janv 2023 nbsp 0183 32 Minnesota renters can file for a refund by submitting Form M1PR and a Certificate of Rent Paid which your landlord should have given you in January Additional income earned from sources other than tax can be declared To find out if you qualify for a refund visit the Department of Revenue s website Web 8 mai 2023 nbsp 0183 32 Minnesota renters can file for a refund by submitting Form M1PR and a Certificate of Rent Paid which your landlord should have given you in January You can also declare any additional income from nontaxable sources To find out if you qualify for a refund visit the Department of Revenue s website

How To File My Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/renters-rebate-sample-form-edit-fill-sign-online-handypdf.png

Minnesota Property Tax Refund Fill Out And Sign Printable PDF

https://www.signnow.com/preview/513/825/513825734/large.png

https://efile-express.com/mn_m1pr.htm

Web e File your 2022 Minnesota Homestead Credit and Renter s Property Tax Refund return Form M1PR using eFile Express Most calculations are automatically performed for you Eliminate errors before submitting your

https://www.revenue.state.mn.us/sites/default/files/2023-06/…

Web 2 Do I qualify You may be eligible for a refund based on your household income see pages 8 and 9 and the property taxes or rent paid on your primary residence in Minnesota Regular Property Tax Refund Income Requirements If you are and You may qualify for a refund of up to A renter Your total household income is less than 69 520

Mn Renters Rebate 2022 Booklet RentersRebate

How To File My Renters Rebate RentersRebate

Enews Updates January 28 2022 Senator Devlin Robinson RentersRebate

Minnesota Renters Rebate 2023 Printable Rebate Form

When Can I Expect My Renters Rebate MN YouTube

Fill Free Fillable Minnesota Department Of Revenue PDF Forms

Fill Free Fillable Minnesota Department Of Revenue PDF Forms

Renters Rebate Form Fill Out Sign Online DocHub

Dana Efficiency Maine RentersRebate

Renters Rebate Sample Form Free Download RentersRebate

File Renters Rebate Mn - Web 5 oct 2022 nbsp 0183 32 How To File Renters Rebate Online Mn For Free Renting your Minnesota home could qualify you for the MN Renters Rebate This property tax refund provides needed financial assistance to Minnesota families Before you submit your application there are many things you need to know