Do You Have To Report Casino Winnings On Taxes You re required to report all gambling winnings including the fair market value of noncash prizes you win as other income on your tax return You can t subtract the cost of a wager from your winnings However

The IRS requires U S citizens to report all gambling winnings as income whether or not they receive a W2 G Winnings from gambling lotteries and contests must be reported as Other Gambling taxes You have to report all your winnings Whether it s 5 or 5 000 from the track an office pool a casino or a gambling website all gambling winnings must be reported

Do You Have To Report Casino Winnings On Taxes

Do You Have To Report Casino Winnings On Taxes

https://c1.staticflickr.com/3/2057/2258531624_80d2564abb_b.jpg

How Much Gambling Winnings Are Taxable

https://claudemoraes.net/wp-content/uploads/2021/05/How-Much-Gambling-Winnings-Are-Taxable.png

How To Report Gambling Winnings Losses To The IRS

https://ayarlaw.com/new-site/wp-content/uploads/2021/09/shutterstock_605058941-1024x682.jpg

However you can only deduct your loss up to the amount you report as gambling winnings So you should keep An accurate diary of your gambling winnings and losses Documentation of your gambling activity that can be Generally if you receive 600 or more in gambling winnings the payer is required to issue you a Form W 2G If you have won more than 5 000 the payer may be required to withhold 28 of

If you win at a sportsbook or casino they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount 600 on sports 1 200 on slots and 5 000 on poker When reporting your gambling winnings on form W 2G federal taxes are withheld at a rate of 24 even if you fail to give the payer a tax identification number Remember taxes are due on winnings whether they

Download Do You Have To Report Casino Winnings On Taxes

More picture related to Do You Have To Report Casino Winnings On Taxes

Do I Have To Report Gambling Winnings NIELSEN LAW GROUP

http://www.nielsenlawgroup.net/wp-content/uploads/2015/04/do-i-have-to-report-gambling-winnings.jpg

Do I Have To Report Casino Winnings To IRS Shalfei blog

https://i.ytimg.com/vi/uwfODJPn6dU/maxresdefault.jpg

Do You Pay Taxes On Casino Winnings Minimum Requirements YouTube

https://i.ytimg.com/vi/DMaXS8BMJP4/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBMgQyh_MA8=&rs=AOn4CLDnDVUJZCgmoLyX6Trv_fLkkHCK4g

If you had any gambling wins in 2023 you should report the full winnings on your tax return in 2024 claiming it as gambling income on line 8 of Form 1040 Schedule 1 The full amount of your gambling winnings for the year must be reported on Line 21 of Form 1040 However if you itemize deductions on your tax return and claim losses up

You re required to report all of your gambling winnings as income on your tax return even if you end up losing money overall You may receive a Form W 2G Certain Gambling Winnings and Information you ll need Your and your spouse s filing status Amount of your gambling winnings and losses Any information provided to you on a Form W 2G The tool is

A Guide To Properly Managing Your New Casino Winnings

https://sacgames.org/wp-content/uploads/2020/07/Casino-Winnings.jpg

Do You Have To Pay Tax On Gambling Winnings Nz

https://mobislot9.weebly.com/uploads/1/3/5/7/135744610/799854862.jpg

https://turbotax.intuit.com/tax-tips/job…

You re required to report all gambling winnings including the fair market value of noncash prizes you win as other income on your tax return You can t subtract the cost of a wager from your winnings However

https://www.investopedia.com/form-w-…

The IRS requires U S citizens to report all gambling winnings as income whether or not they receive a W2 G Winnings from gambling lotteries and contests must be reported as Other

How To Document Gambling Losses For Irs Cleverph

A Guide To Properly Managing Your New Casino Winnings

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

Highest Casino Gambling Taxes In The US Casino Winnings State Tax

Do You Have To Pay Tax Selling On Etsy UK Salary Tax Calculator

Do You Have To Pay Taxes On Casino Winnings Scholarly Open Access 2024

Do You Have To Pay Taxes On Casino Winnings Scholarly Open Access 2024

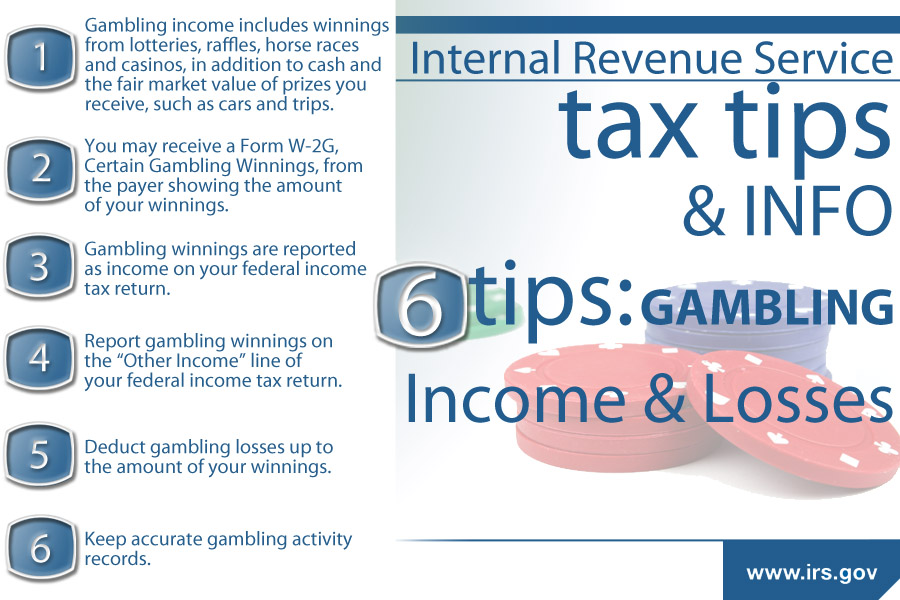

6 Tips On Gambling And Income Taxes Don t Play The IRS For A Sucker

Vaccine Lottery Taxes On Lottery Winnings Tax Fans

Do You Pay Taxes On Casino Winnings 22 Countries Explained

Do You Have To Report Casino Winnings On Taxes - If you win at a sportsbook or casino they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount 600 on sports 1 200 on slots and 5 000 on poker