Do You Have To Report Hsa Distributions On Taxes HSA distributions taken to pay for eligible medical expenses are not taxable but they still must be reported to the Internal Revenue Service IRS

Distributions from HSAs and MSAs that are not used for qualified medical expenses are subject to income tax and an additional 20 tax When filing taxes you You can receive distributions from an HSA even if you are not currently eligible to have contributions made to the HSA However any part of a distribution not used to pay

Do You Have To Report Hsa Distributions On Taxes

Do You Have To Report Hsa Distributions On Taxes

https://www.zbpforms.com/wp-content/uploads/2016/09/1099SA-Form-Copy-C-Trustee-Payer-State-LSAC-FINAL-min.jpg

How To Complete IRS Form 8889 For Health Savings Accounts HSA YouTube

https://i.ytimg.com/vi/f0ldHvce_24/maxresdefault.jpg

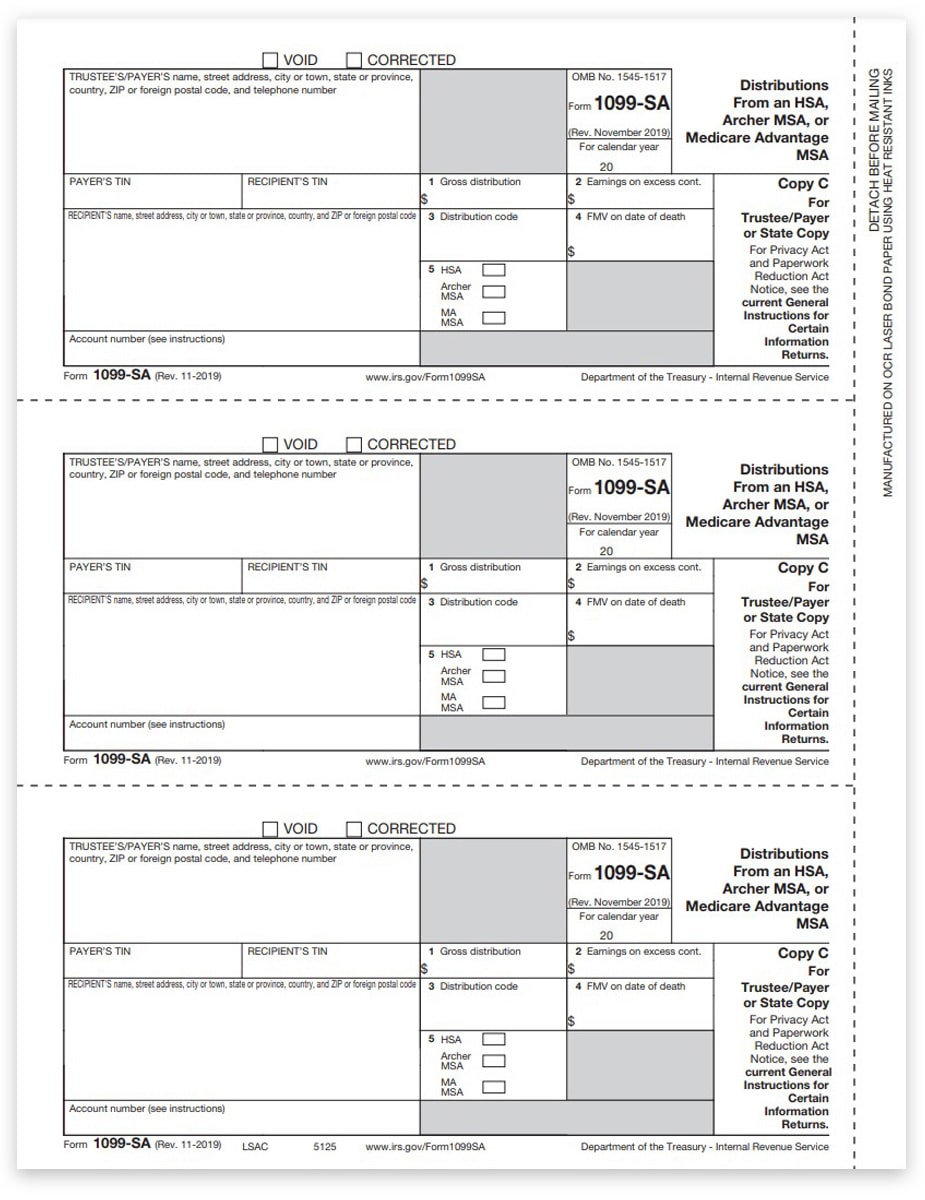

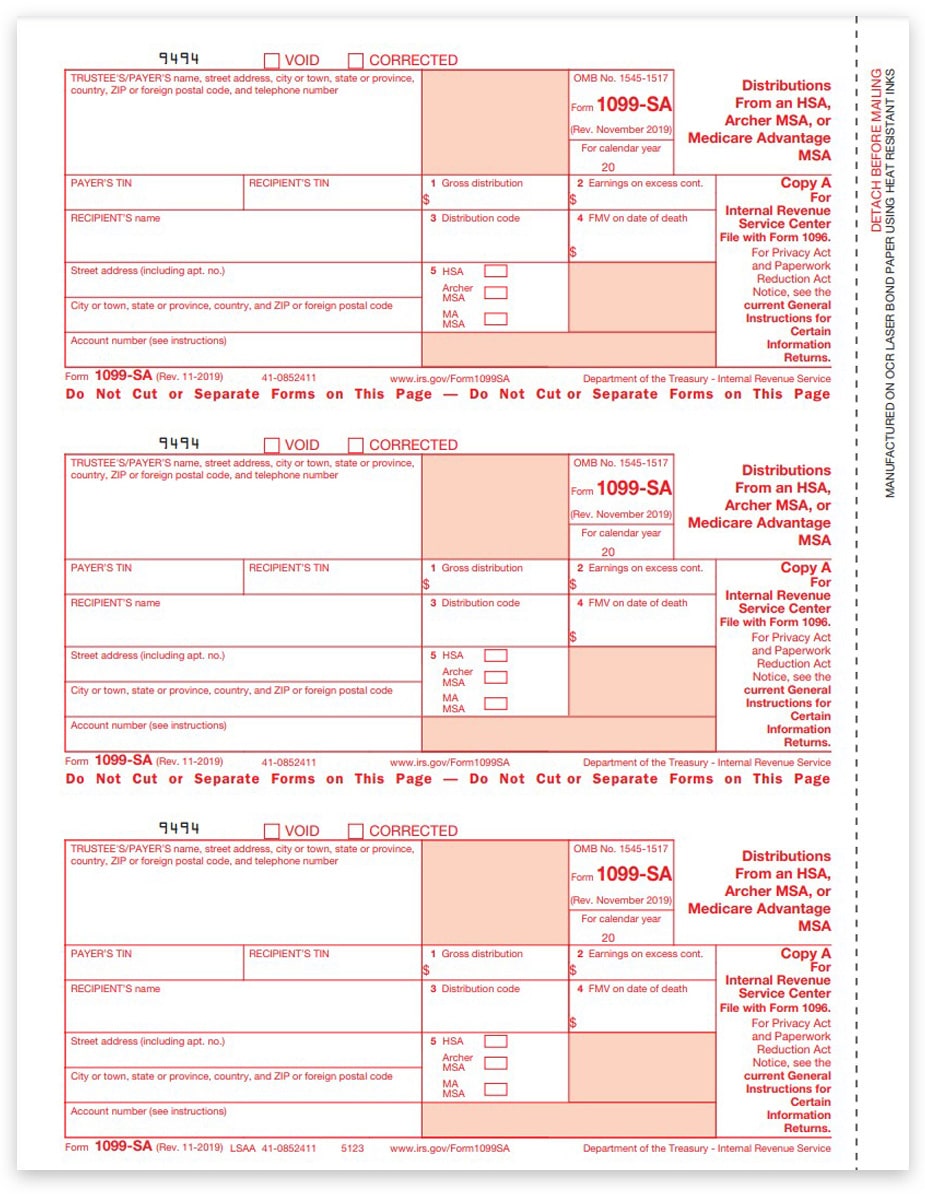

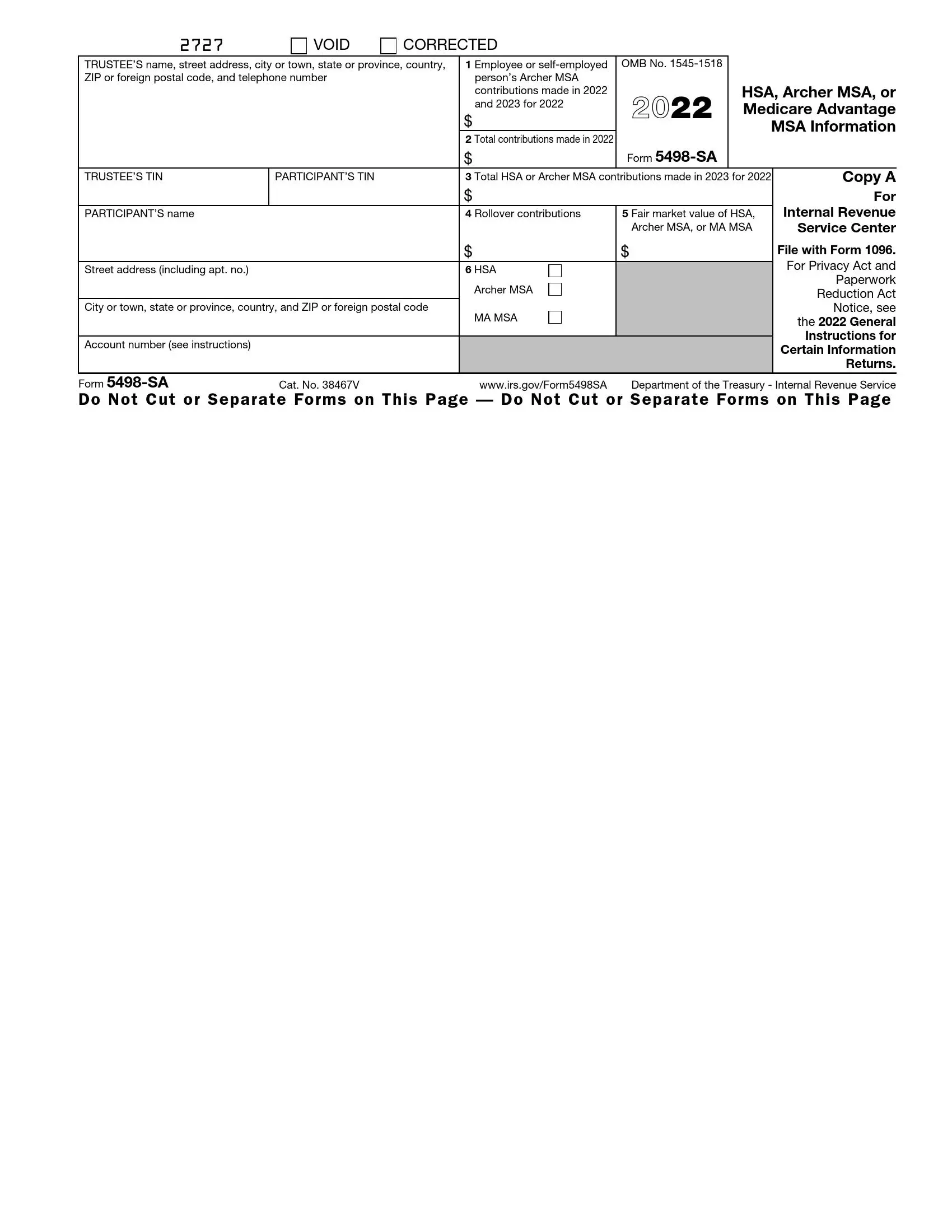

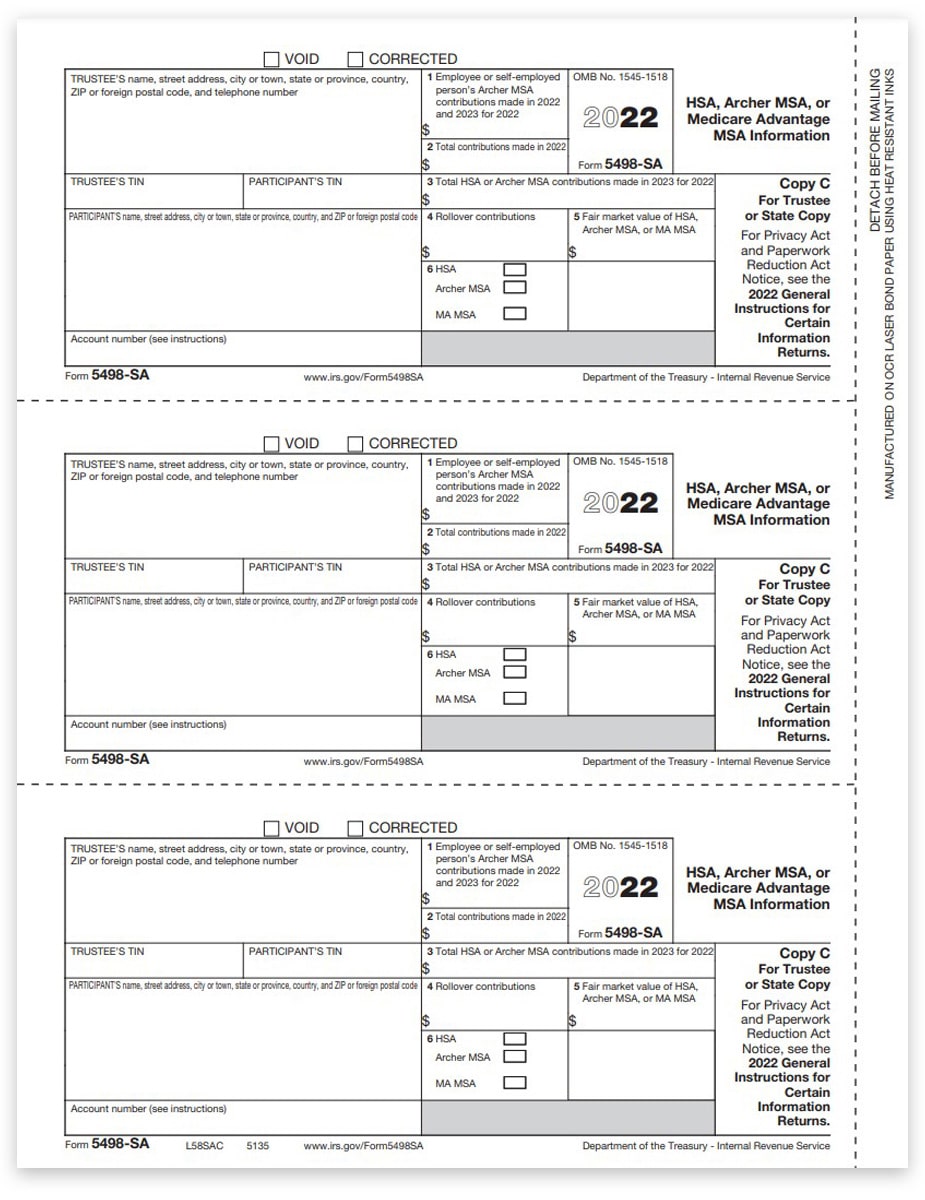

1099SA Tax Forms For MSA Or HSA Distributions IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1099SA-Form-Copy-A-Federal-Red-LSAA-FINAL-min.jpg

What HSA information do I need to report on my taxes When you file your tax return you have to report any withdrawals you made during the year also known as You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for

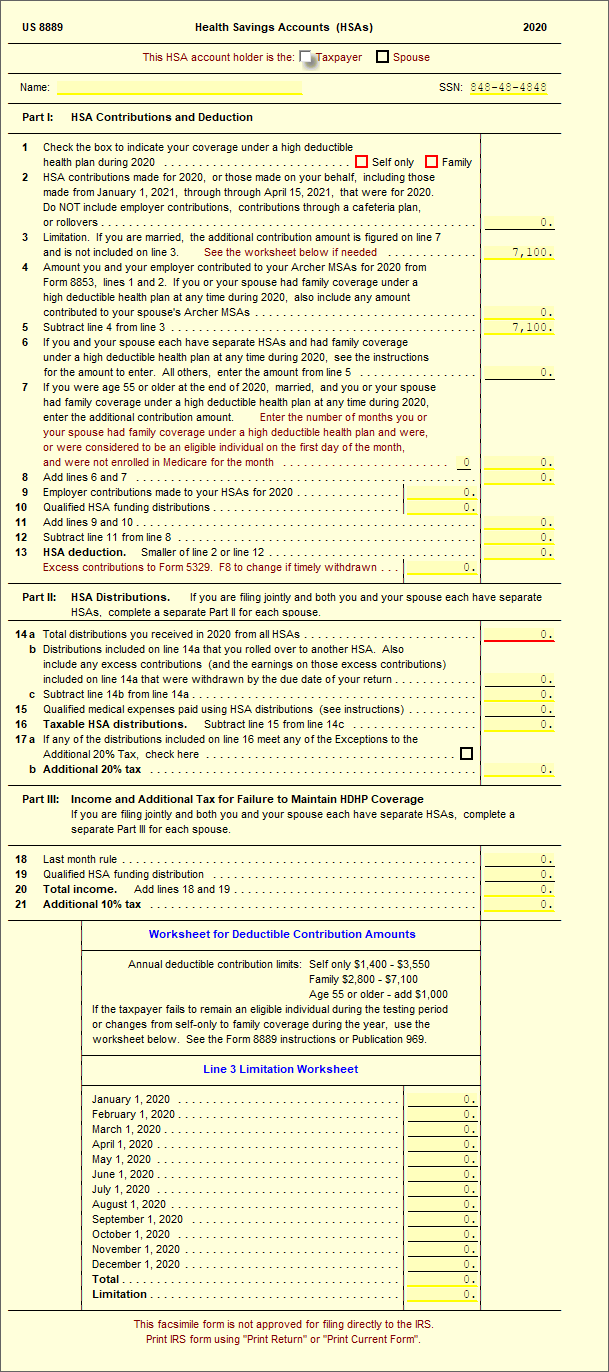

If you have a health savings account HSA you must report both contributions to it and distributions from it to the Internal Revenue Service IRS You as the account holder You must file IRS Form 8853 Archer MSAs and Long Term Care Insurance Contracts or Form 8889 Health Savings Accounts HSAs with your Form 1040 or 1040 SR tax return forms to report a

Download Do You Have To Report Hsa Distributions On Taxes

More picture related to Do You Have To Report Hsa Distributions On Taxes

HSA Tax Forms What Do You Need And How Do You File GoodRx

https://images.ctfassets.net/4f3rgqwzdznj/2w1Igi4KRvAG1dC0q8HyMQ/a8b8966574ea1a1be6f12c9e4f02391c/woman_reviewing_paperwork_1357264739.jpg

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

8889 Health Savings Accounts HSAs UltimateTax Solution Center

https://support.ultimatetax.com/hc/article_attachments/4407002058263/8889.png

You must report distributions from your HSA on IRS Form 8889 You will receive a separate 1099 SA for each type of distribution made during the tax year The five distribution ANSWER Employees with HSAs must file a Form 8889 Health Savings Accounts HSAs as an attachment to Form 1040 for any year in which they make or receive HSA contributions including

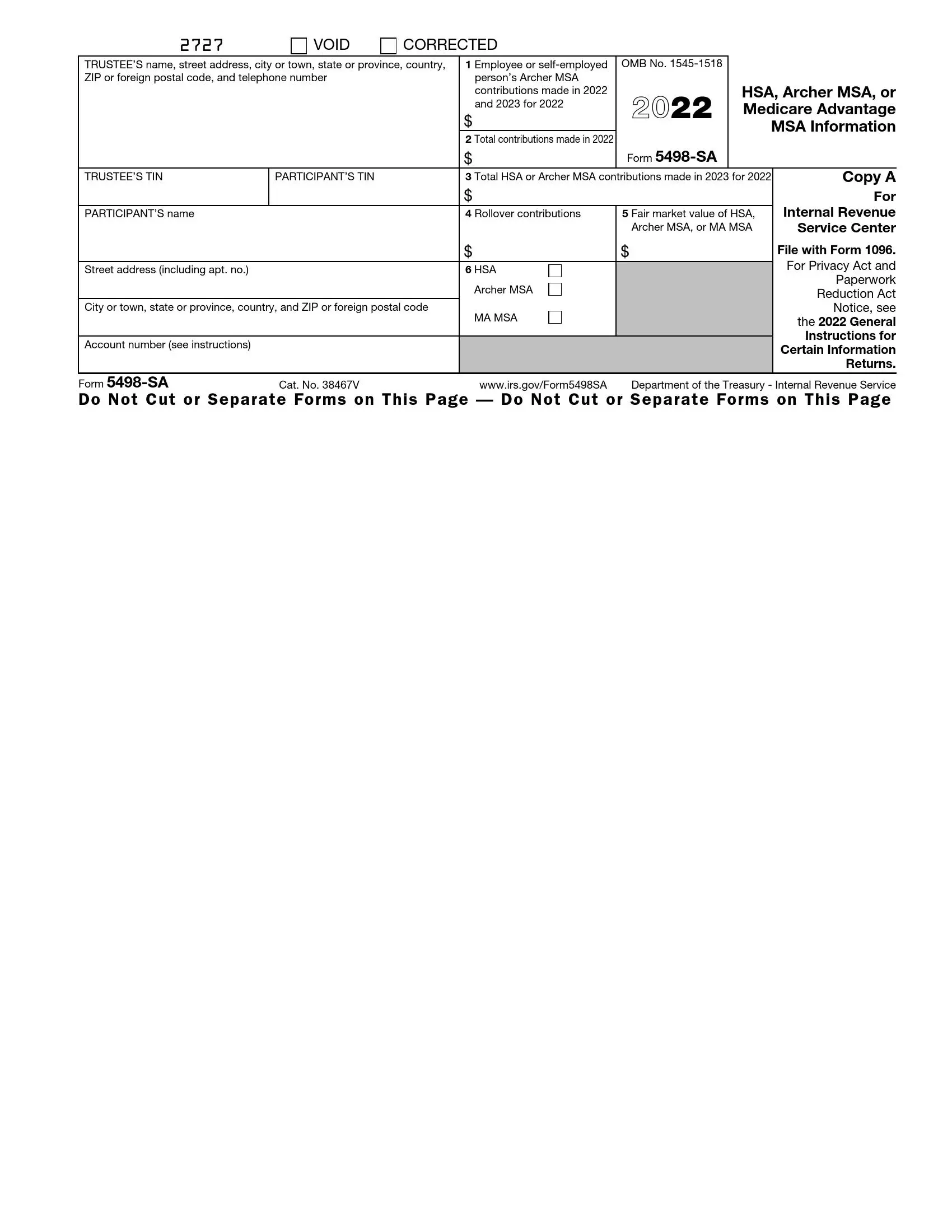

The financial institution that has your HSA or MSA will send you Form 1099 SA if you make contributions or receive distributions from HSAs MSAs and MA Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded

IRS Form 5498 SA Fill Out Printable PDF Forms Online

https://formspal.com/wp-content/uploads/2022/01/irs-form-5498-sa-2022-preview.webp

Selecting The Correct IRS Form 1099 R Box 7 Distribution Codes Ascensus

http://static1.squarespace.com/static/59c529e3cd0f689fe65fe62d/59c53ff3cd39c39d4b3ce369/639a1e57ee683d6837a3922d/1671109478175/2022+1099R+with+callout+1000px.jpg?format=1500w

https://www.fool.com/retirement/plans/hsa/distributions

HSA distributions taken to pay for eligible medical expenses are not taxable but they still must be reported to the Internal Revenue Service IRS

https://turbotax.intuit.com/tax-tips/health-care/...

Distributions from HSAs and MSAs that are not used for qualified medical expenses are subject to income tax and an additional 20 tax When filing taxes you

What You Need To Know About Health Savings Accounts HSAs

IRS Form 5498 SA Fill Out Printable PDF Forms Online

HSA Contributions Deadline Hasn t Passed Yet But Act Soon Kiplinger

2023 Hsa Form Printable Forms Free Online

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

Finra Political Contribution Limits 2022

Finra Political Contribution Limits 2022

How Much Can You Put In Hsa 2024 Donni Natividad

IRS Courseware Link Learn Taxes

Taxes News Latest Taxes Tips Deductions Reports And Updates

Do You Have To Report Hsa Distributions On Taxes - Form 8889 is used to report how your HSA will affect your taxes Here s what it covers Your HSA eligibility Total contributions made to your HSA by you and or