Do You Have To Report Rebates On Taxes Web 15 oct 2021 nbsp 0183 32 You re probably familiar with all the different credit card companies offering cash back rewards or even those mail in rebate offers you receive on certain goods But if you think you need to report these rewards on your tax return you ll be happy to know

Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking Web The IRS may be taxing rebates points and rewards and sending out 1099s How the IRS interprets taxing rebates points and rewards can be confusing at best For example

Do You Have To Report Rebates On Taxes

Do You Have To Report Rebates On Taxes

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Tips To Finding Tax Rebates Without The Hassle

https://cdn.techgyd.com/tax-rebate.jpg

Web 11 mars 2023 nbsp 0183 32 The IRS acted quickly however announcing a week later that taxpayers in many states quot will not need to report these payments quot But as always with the IRS it s Web 10 f 233 vr 2023 nbsp 0183 32 On Friday the IRS said that for the most part taxpayers won t have to report the rebates on their tax returns quot During a review the IRS determined it will not

Web 5 juin 2019 nbsp 0183 32 Per the IRS cash rebates from a dealer or manufacturer for an item you buy generally not taxable If you received a 1099 K it reflects gross income received for this Web 8 f 233 vr 2023 nbsp 0183 32 Federal taxation will depend on federal law and the stated purpose for each rebate according to the Wall Street Journal Stimulus payments related to Covid 19 relief were not taxable but it s

Download Do You Have To Report Rebates On Taxes

More picture related to Do You Have To Report Rebates On Taxes

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

Tax Rebate Or Tax Refund Are You Entitled QuickRebates

https://www.quickrebates.co.uk/fileadmin/user_upload/Tax_Rebate_FB.png

Web You may get more if you have qualifying children What if i Don t neeD to file Even if you have little income and don t normally file a return you may need to take a special step to Web 26 janv 2023 nbsp 0183 32 Most Americans start to receive their first tax forms in late January or early February and you ll be required to file your final tax returns no later than April 18 2023

Web 10 f 233 vr 2023 nbsp 0183 32 How Do I Report State Tax Rebates February 17th 2023 Web 24 juil 2023 nbsp 0183 32 February 13th update On Friday evening the IRS announced that rebates in most states would not be taxed but that payments from Georgia Massachusetts South

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-791x1024.png

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

https://turbotax.intuit.com/tax-tips/irs-tax-return/video-are-cash...

Web 15 oct 2021 nbsp 0183 32 You re probably familiar with all the different credit card companies offering cash back rewards or even those mail in rebate offers you receive on certain goods But if you think you need to report these rewards on your tax return you ll be happy to know

https://donotpay.com/learn/are-rebates-taxable

Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking

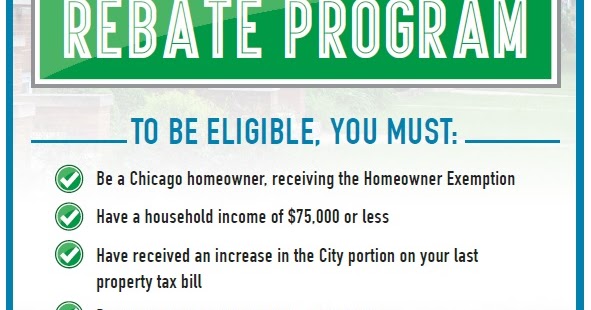

Uptown Update Property Tax Rebate Program Open Through November

What Is The Recovery Rebate Credit CD Tax Financial

Federal Tax Rate On Salary Of 23000 Federal Salary Guide And Info

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Tax Rebate Service No Rebate No Fee MBL Accounting

The Homeowners Guide To Tax Credits And Rebates

The Homeowners Guide To Tax Credits And Rebates

How Do I Claim The Recovery Rebate Credit On My Ta

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Residents Can File Property Tax Rent Rebate Program Applications Online

Do You Have To Report Rebates On Taxes - Web 6 juin 2019 nbsp 0183 32 Ibotta is a grocery store cashback app Essentially you submit a receipt amp Ibotta processes a manufacturer coupon for you 90 of the rebates can t be stacked