Do You Pay Gst On Farm Equipment As a general rule farmers typically do not charge GST HST on their sales but do pay GST HST on their regular purchases However there are several exceptions

According to the Canadian Revenue Agency CRA any agricultural business that exceeds 30 000 in annual sales of GST HST taxable goods and services Supplies of farm goods and services subject to GST 5 or HST 13 or 15 include crop dusting contract work including field clearing tilling harvesting done by one

Do You Pay Gst On Farm Equipment

Do You Pay Gst On Farm Equipment

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to GST-BAS_whatx2.1646877577000.png

GST Business Loan Loan Against GST Returns Lendingkart

https://media.lendingkart.com/wp-content/uploads/2021/12/GST-Business-Loan-1024x538.jpg

Impact Of GST On Personal Loan

https://navi.com/blog/wp-content/uploads/2022/07/gst-on-personal-loan.jpg

Zero rated equipment must be used for farming and must also meet certain design criteria or specifications concerning size capacity or power Where the criteria or It is crucial that farmers file consistently for income tax and GST to prove they are not a hobby farm If HST GST weren t enough of a pain when are you on the

Supplies of farm goods and services subject to GST 5 or HST 13 or 15 include crop dusting contract work including field clearing tilling and harvesting done by one For the most part farming businesses are generally not involved in the making of GST exempt supplies As mentioned before there are several rules in

Download Do You Pay Gst On Farm Equipment

More picture related to Do You Pay Gst On Farm Equipment

Property Sales In Vancouver British Columbia Do You Pay GST

https://www.thewesthavengroup.com/wp-content/uploads/2020/10/GSTischargedonthesaleofnewhomesinB.C.-980x653.jpg

Tips GST ABBS News Resources

https://www.resources.myabbs.com.au/wp-content/uploads/2020/03/Reataurant-Tips.webp

Do You Pay GST When You Buy A House In Alberta YouTube

https://i.ytimg.com/vi/jzVSwVPfSJE/maxresdefault.jpg

Generally agricultural equipment is not subject to GST however lease payments are GST paid on a lease payment can be recouped via an input tax credit Vendors and purchasers should ensure they understand the tax implications before signing the deal While most sales of used residential housing are exempt from GST HST commercial real

FARM USE EQUIPMENT AND OTHER ITEMS This bulletin outlines the Retail Sales Tax exemptions allowed on farm implements and machinery repair parts for such farm Answer Yes the GST HST applies to the sale of your farmland to your neighbour regardless of whether he chooses to use it in his farming business or for his personal use

Common GST Questions Accountants Are Asked About Property Do You Pay

https://i.ytimg.com/vi/dx8A9wx8dWg/maxresdefault.jpg

GST Packed Items GST On Packed Curd Paneer From Monday The Economic

https://img.etimg.com/thumb/msid-92884576,width-1070,height-580,imgsize-4900,overlay-economictimes/photo.jpg

https://www.bakertilly.ca/en/btc/publications/farm...

As a general rule farmers typically do not charge GST HST on their sales but do pay GST HST on their regular purchases However there are several exceptions

https://fbc.ca/blog/when-should-you-collect-gst-hst

According to the Canadian Revenue Agency CRA any agricultural business that exceeds 30 000 in annual sales of GST HST taxable goods and services

Flavoured Milk Is Not Milk But A Drink Containing Milk So Pay 12 GST

Common GST Questions Accountants Are Asked About Property Do You Pay

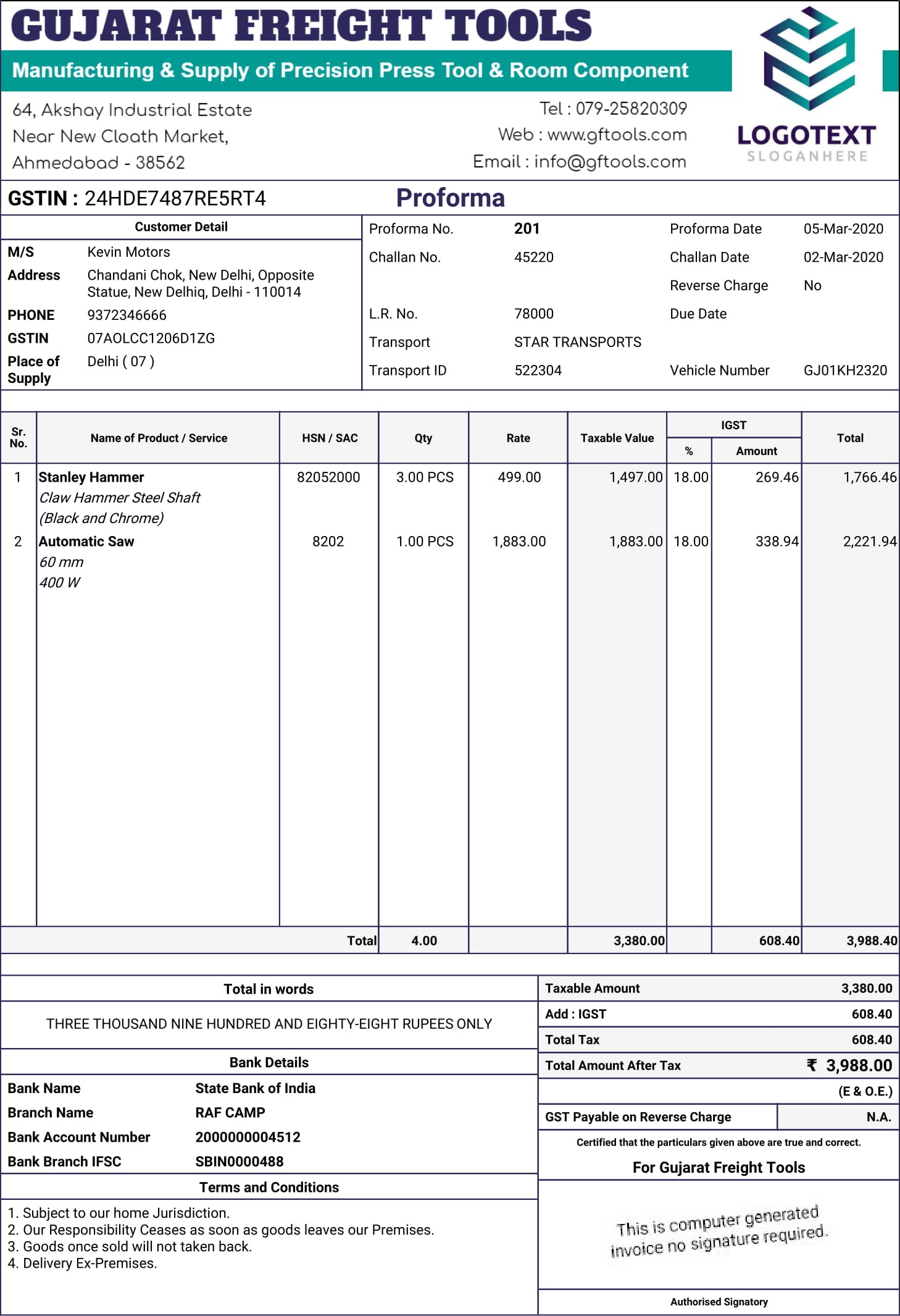

GST Proforma Invoice Format In India 100 Free GST Billing Software

Benefits Of Getting A GST Business Loan IIFL Finance

A Complete Guide On GST Rate On Food Items Ebizfiling

Deere Company Rallies On Farm Equipment Boom Bullish Outlook

Deere Company Rallies On Farm Equipment Boom Bullish Outlook

What Are The Steps To Pay GST Online

A Complete Guide On GST Rate For Apparel Clothing And Textile Products

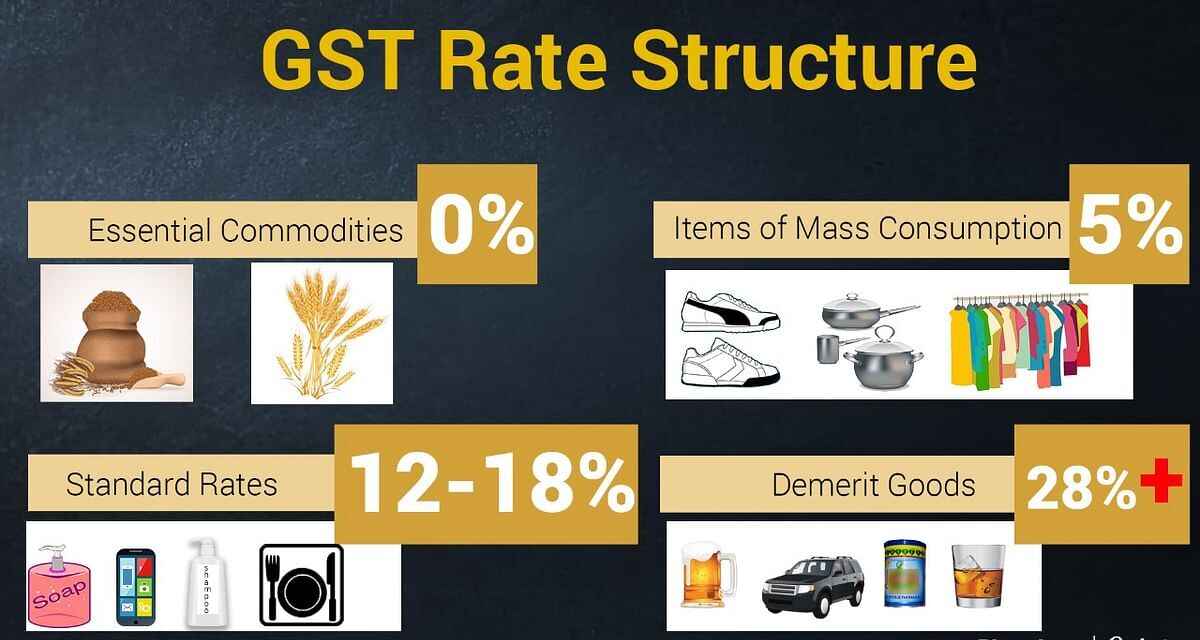

All About GST Slabs Rates Regal Finserv

Do You Pay Gst On Farm Equipment - For the most part farming businesses are generally not involved in the making of GST exempt supplies As mentioned before there are several rules in