Do You Pay Tax On Placement Year Income Tax and National Insurance You may be paid a salary while on your work placement Everyone must pay income tax and National Insurance on their earnings once their income

Do I have to pay income tax during my industrial year Yes But depending on what you are earning the amount you have to pay may not be very large and may even be zero You will If you are on a paid placement you will have to pay Income Tax and National Insurance on earnings that are over your personal allowance This includes international students Tax

Do You Pay Tax On Placement Year

Do You Pay Tax On Placement Year

https://oneclicklife.com.au/wp-content/uploads/2022/11/students-tax-01.jpg

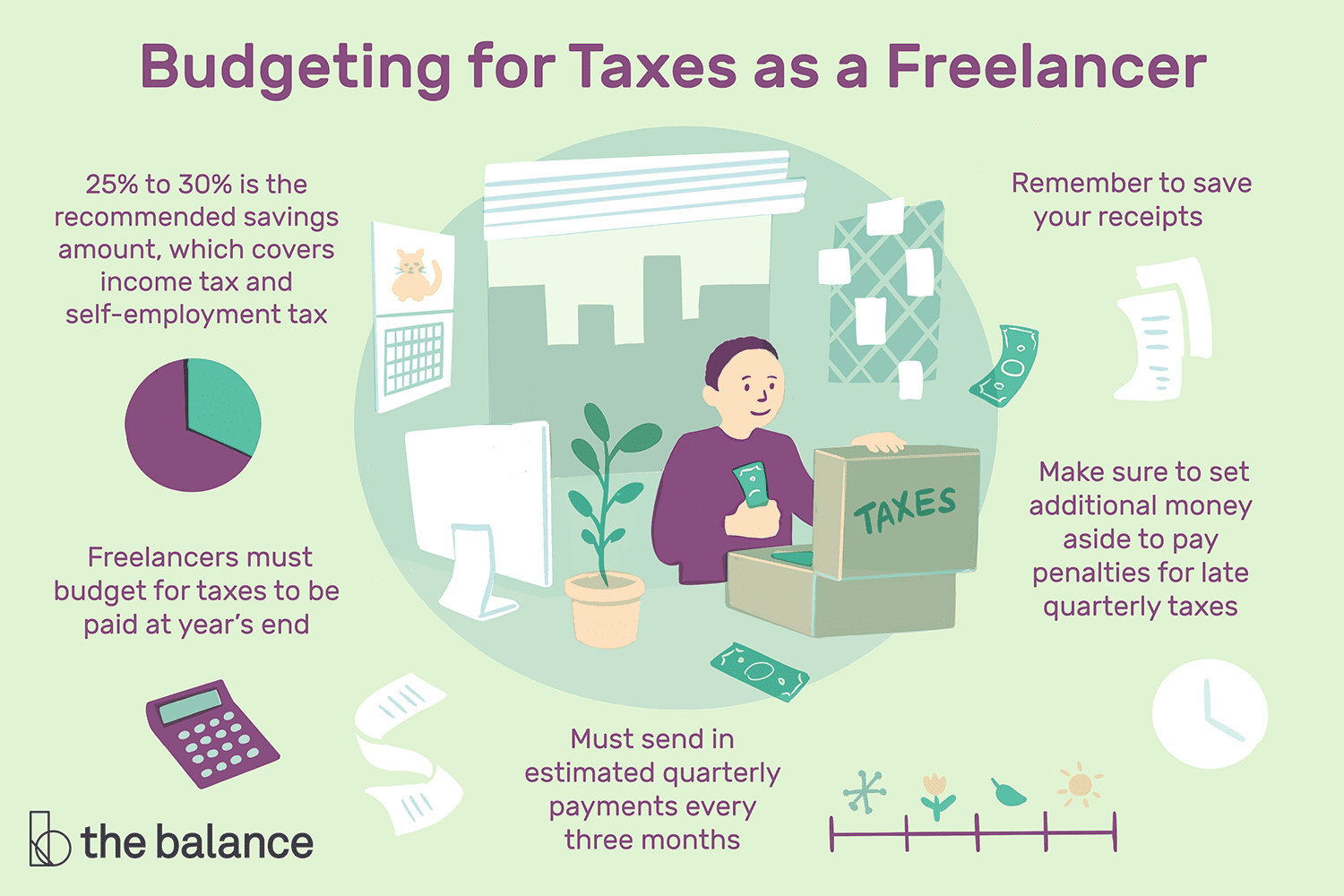

6 Improvements For Filing Your Freelance Taxes Next Year

https://i0.wp.com/www.smartbizpractices.com/wp-content/uploads/2015/04/Tax.jpg?resize=2000%2C1200&ssl=1

Do You Pay Your Employees A Salary Integrated HR

https://www.humanresourcing.com.au/wp-content/uploads/2020/09/iStock-1168563407.jpg

It is unlikely that you will earn more than 7 475 between the start of the 2012 2013 tax year and the end of your placement i e April 6th 2012 31st July 2012 so you won t have to pay any Anyone know if a student who is on a 12 month working placement as part of a Sandwich Course is liable to pay council tax on a rented property or are they still exempt

I m currently on a placement year and having looked round it seems that placement students are exempt from council tax as long as it is part of their course i e doing a sandwich It is worth noting however that an academic year spans two tax years a tax year starts on 6 April and finishes on the following 5 April and while on your placement you will be

Download Do You Pay Tax On Placement Year

More picture related to Do You Pay Tax On Placement Year

How To Pay Tax On ETF Askaboutmoney The Irish Consumer Forum

https://www.askaboutmoney.com/attachments/1675291820909-png.7211/

Let s Talk About Taxes SoundGirls

https://soundgirls.org/wp-content/uploads/2021/05/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png

Do You Pay Tax On A Property Investment Ep154

https://onproperty.com.au/wp-content/uploads/2014/05/OP154small.jpg

Everyone pays income tax once they are earning above their tax threshold even if you are on placement The earnings allowance the amount you have to earn before you start paying tax At HMRC we offer industrial placements for students currently studying a degree in IT computer science design web design or business These placements are paid and typically last around 9 12

Students who go on a placement year or work part time during university also often do so over a period that spans two tax years tax years run from April to April This can confuse things a bit in the eyes of HMRC His You will pay a reduced tuition fee for the year you are on placement This fee covers the support you will receive during your placement year and your continued access to university support

Do You Need To Pay Tax On Your Social Security Benefits Social

https://i.pinimg.com/736x/f4/c8/af/f4c8af6ec6c89343d8afcc0ad9a54b53.jpg

Do YOU Pay TAXES Watch This Video Plus INSTITUTIONAL DOMINANCE Of

https://i.ytimg.com/vi/omfIYDbveOo/maxresdefault.jpg

https://www.westminster.ac.uk › study › fees-and...

Income Tax and National Insurance You may be paid a salary while on your work placement Everyone must pay income tax and National Insurance on their earnings once their income

https://www.aber.ac.uk › ... › IY › docs › Tax_situation.pdf

Do I have to pay income tax during my industrial year Yes But depending on what you are earning the amount you have to pay may not be very large and may even be zero You will

Do I Have To Pay Tax On Gifts A Guide For Influencers Studio Legal

Do You Need To Pay Tax On Your Social Security Benefits Social

How To Legally Never Pay Taxes Again YouTube

Do You Pay Tax If Your Business Makes A Loss Tax Walls

Do You Pay Tax On A Transfer Of Equity SAM Conveyancing

Do You Pay Tax On Negatively Geared Properties Ep255 YouTube

Do You Pay Tax On Negatively Geared Properties Ep255 YouTube

/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Do You Pay Capital Gains On Primary Residence

How Much Tax Do You Pay For 100 Worth Of Petrol Popular pics

Aussies Won t Pay Tax On 750 COVID 19 Disaster Payments PM

Do You Pay Tax On Placement Year - Tax and National Insurance If you re doing a paid placement you are not exempt from paying taxes You can find out more about the latest UK Income Tax and Personal Allowances here