Rebate Credit Irs Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 1 janv 2023 nbsp 0183 32 Selon votre situation vous pouvez b 233 n 233 ficier d une d 233 duction d une r 233 duction d imp 244 t ou d un cr 233 dit d imp 244 t sur les revenus 2022

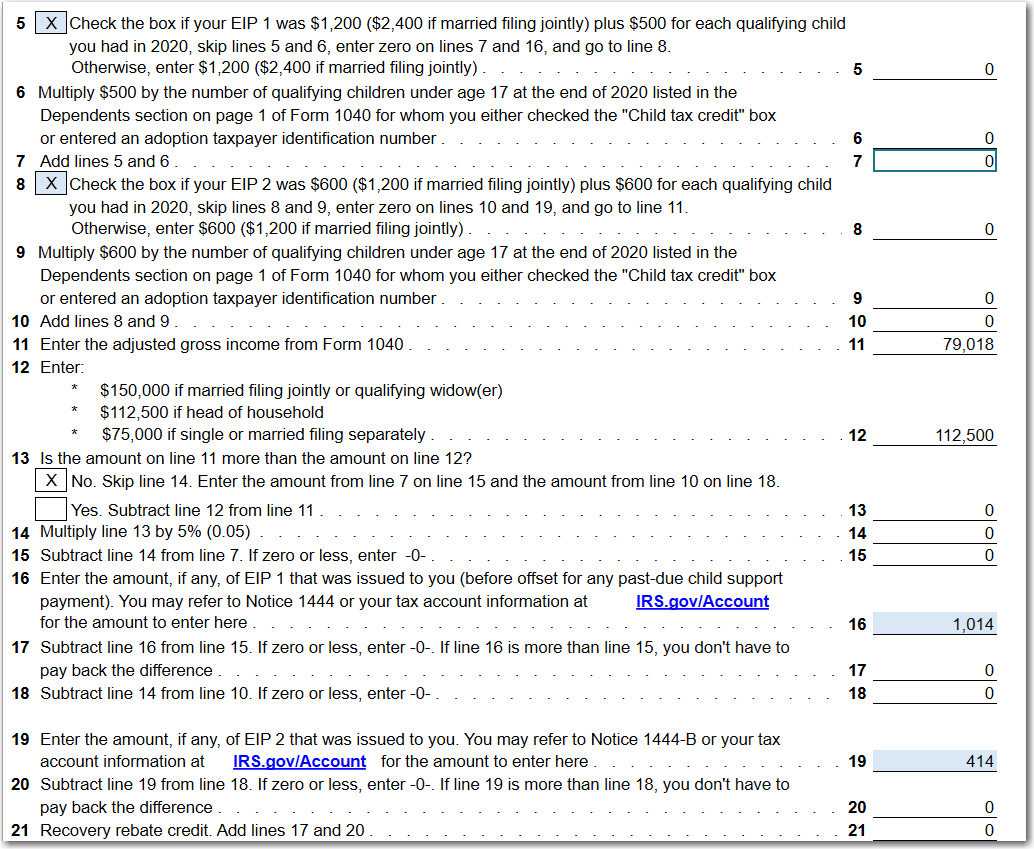

Rebate Credit Irs

Rebate Credit Irs

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-2.png

Taxes Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-3.png?w=696&h=696&crop=1&ssl=1

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Web 13 janv 2022 nbsp 0183 32 The 2021 Recovery Rebate FAQ topics are Topic A General Information Topic B Claiming the Recovery Rebate Credit if you aren t required to file a 2021 tax Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 8 juin 2023 nbsp 0183 32 V 233 rifi 233 le 08 juin 2023 Direction de l information l 233 gale et administrative Premi 232 re ministre Vous b 233 n 233 ficiez d une r 233 duction ou d un cr 233 dit d imp 244 t Certains de Web 10 d 233 c 2021 nbsp 0183 32 You should complete the Recovery Rebate Credit Worksheet or use tax preparation software to determine if you may claim the Recovery Rebate Credit on your

Download Rebate Credit Irs

More picture related to Rebate Credit Irs

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/recovery-rebate-credit-worksheet-atx-line-30-covid-19-atx-community.jpg

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

What If I Did Not Receive Eip Or Rrc Detailed Information

https://stimulusmag.com/wp-content/uploads/2022/12/what-is-the-irs-recovery-rebate-credit.jpg

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Web The IRS will not calculate and correct your entry if you enter 0 or leave the line blank for the Recovery Rebate Credit Instead the IRS will treat your entry of 0 or blank as your Web Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alproject

https://i1.wp.com/i.pinimg.com/736x/c3/94/0a/c3940a59fd831b4f8791ab4c5f3d2f90.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-f...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Federal Recovery Rebate Credit Recovery Rebate

What Is The Recovery Rebate Credit CD Tax Financial

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Irs Recovery Rebate Credit For College Students IRSUKA Recovery Rebate

Recovery Rebate Credit Worksheet Example Studying Worksheets

Rebate Credit Irs - Web 8 juin 2023 nbsp 0183 32 V 233 rifi 233 le 08 juin 2023 Direction de l information l 233 gale et administrative Premi 232 re ministre Vous b 233 n 233 ficiez d une r 233 duction ou d un cr 233 dit d imp 244 t Certains de