Education Loan Tax Rebate India Web 4 avr 2017 nbsp 0183 32 80E education loan deduction is a tax incentive given to people who avail education loan for higher studies This deduction is

Web What is section 80E Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a Web 28 juin 2019 nbsp 0183 32 Education loans do not only help you in higher studies in India or overseas it also helps you save a lot of taxes Section 80E provides a tax deduction on the

Education Loan Tax Rebate India

Education Loan Tax Rebate India

https://images.moneycontrol.com/static-mcnews/2021/03/Edu-loan-Mar-18.png

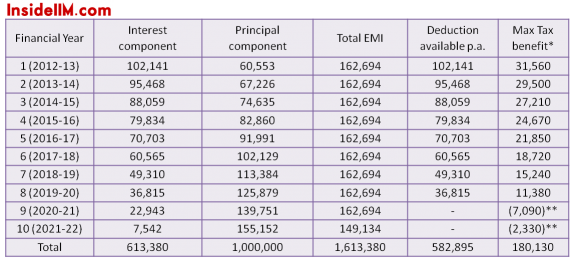

Education Loan Tax Deduction Benefits Tax Benefits On Educational Loans

https://financegradeup.com/wp-content/uploads/2020/03/Education-Loan-Tax-Deduction.jpg

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

https://i1.wp.com/frugaling.org/wp-content/uploads/2014/01/StudentLoan1098-E.jpg

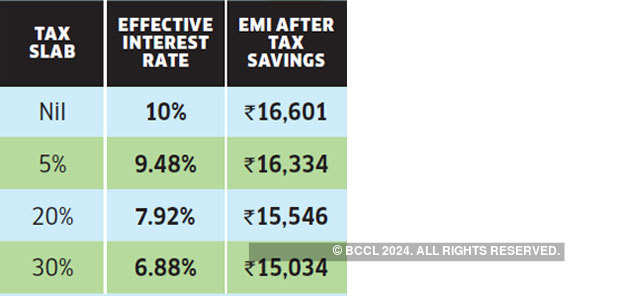

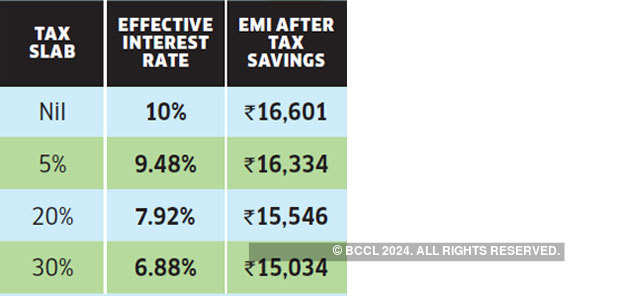

Web 16 f 233 vr 2021 nbsp 0183 32 Yes a loan for education is one of the easiest and quickest ways to finance higher studies You are eligible for tax benefits on education loan provisioned by the Web Total tax rebate The amount of Income Tax an individual can save by availing of iSMART Education Loan from ICICI Bank The amount of rebate will vary for different tax slabs

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is Web Tax Benefits for Education Loans Education Loans Tax Benefits Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan

Download Education Loan Tax Rebate India

More picture related to Education Loan Tax Rebate India

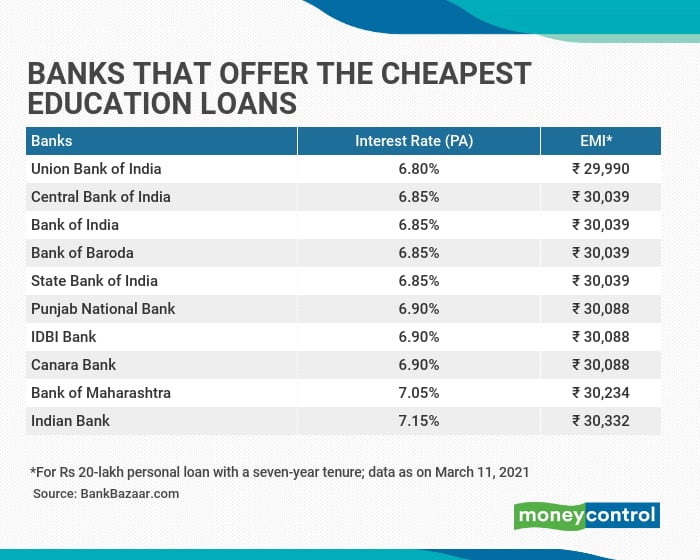

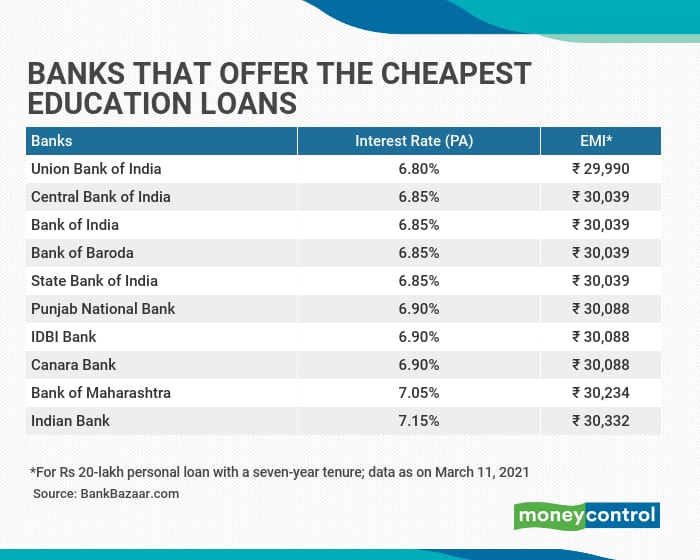

Bank Of India Education Loan Interest Rate 2018 Loan Walls

https://qph.fs.quoracdn.net/main-qimg-910f623c7943bf54aecb7026973d4fae

All You Need To Know About Tax Benefits On Education Loan Interest

https://backend.insideiim.com/wp-content/uploads/2012/11/tax_benefit_education_loan_India_PrinceDoshi_insideiim-e1353474232240.png

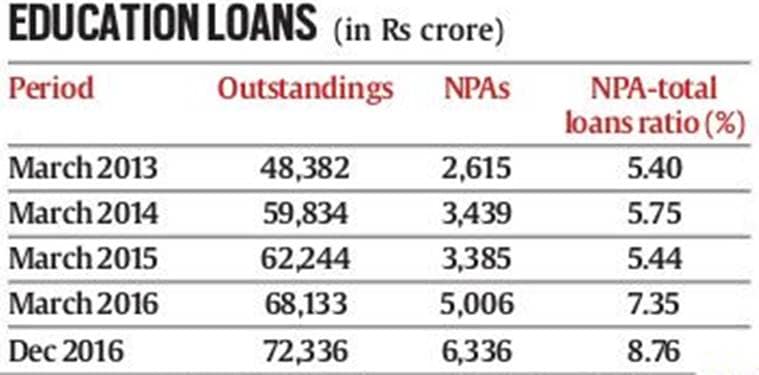

142 Per Cent Rise In Bad Education Loans In 3 Years Business News

https://images.indianexpress.com/2017/07/education-loan.jpg

Web 12 janv 2023 nbsp 0183 32 The Government of India wished to provide a tax deduction on the interest component of an education loan availed for higher studies For this purpose Section Web If you intend to take a loan for pursuing higher studies in India or abroad you can claim a deduction under section 80E of the Income Tax Act 1961 which caters specifically to

Web 10 ao 251 t 2023 nbsp 0183 32 Yes you can claim an education loan deduction on your interest for any loan taken for the education of your spouse parents and children The tax rebate on Web Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate

Education Loan Tax Benefits How Education Loan Can Help Your Child

https://img.etimg.com/photo/msid-65449820/education-loan-tax-benefit.jpg

Tax Benefits On Repayment Of Education Loan Under Section 80E Kartik

https://www.cakartikmjain.com/wp-content/uploads/2020/06/education-loan-tax-benefits.jpg

https://cleartax.in/s/section-80e-deduction-inte…

Web 4 avr 2017 nbsp 0183 32 80E education loan deduction is a tax incentive given to people who avail education loan for higher studies This deduction is

https://www.etmoney.com/blog/education-loa…

Web What is section 80E Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a

Tax Benefits Under Chapter VI A Of Section 80E For Educational Loans

Education Loan Tax Benefits How Education Loan Can Help Your Child

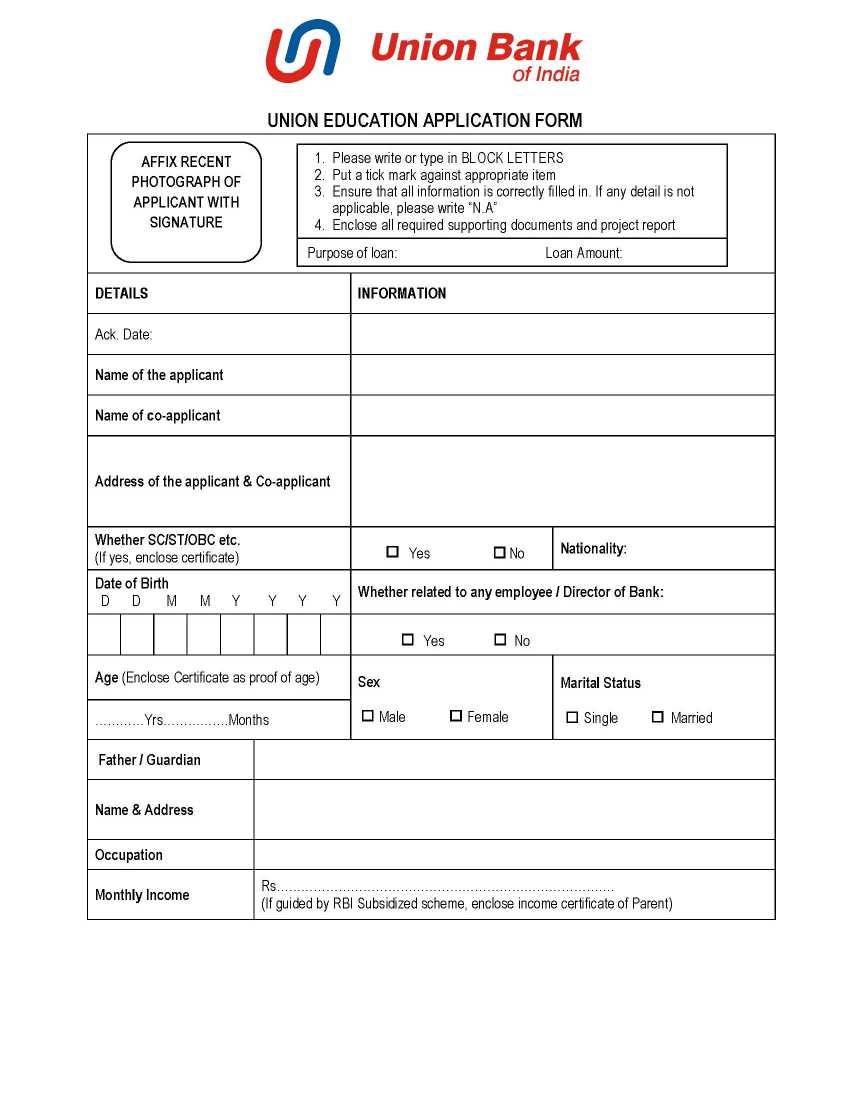

Union Bank Of India Education Loan Online Application Form 2023 2024

What Does Rebate Lost Mean On Student Loans

EDUCATION LOAN 03 17 2020 Fill And Sign Printable Template Online

All You Need To Know About SBI Education Loans Education Student

All You Need To Know About SBI Education Loans Education Student

Best Education Loan In India Quora How To Find Student Loans Quora

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

How Can You Find Out If You Paid Taxes On Student Loans

Education Loan Tax Rebate India - Web Tax Benefits for Education Loans Education Loans Tax Benefits Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan