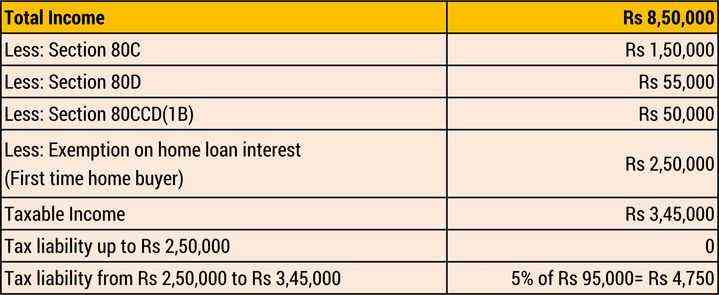

Home Loan Interest Rebate On Income Tax Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less Web The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions

Home Loan Interest Rebate On Income Tax

Home Loan Interest Rebate On Income Tax

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh

Web 26 oct 2021 nbsp 0183 32 The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b The new tax structure introduced in Budget 2020 does away with 70 odd tax deductions Web 13 janv 2023 nbsp 0183 32 For example if you got an 800 000 mortgage to buy a house in 2017 and you paid 25 000 in interest on that loan during 2022 you probably can deduct all 25 000 of that mortgage interest on

Download Home Loan Interest Rebate On Income Tax

More picture related to Home Loan Interest Rebate On Income Tax

Home Loan Interest Rebate On Home Loan Interest In Income Tax

https://3.bp.blogspot.com/-o4djNyyA8DU/T2P0RGOd-fI/AAAAAAAAAys/XWfuzicFqlk/w1200-h630-p-k-no-nu/Untitled.gif

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements You filed an IRS form 1040 and itemized your deductions The mortgage Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

Web Section 80C Deductions under this section can help you with tax benefits of up to Rs 1 5 lakhs on the principal amount Section 24 Under this section you are allowed to enjoy Web Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You

Form 12BB New Form To Claim Income Tax Benefits Rebate

https://www.relakhs.com/wp-content/uploads/2016/05/Income-Tax-Deduction-home-loan-interest-payment-form-12bb-home-loan-lender-details-pic.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Form 12BB New Form To Claim Income Tax Benefits Rebate

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

Oct 2016 Best Home Loan Interest Rates In 2016

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Rising Home Loan Interests Have Begun To Impact Homebuyers

Interim Budget 2019 20 The Talk Of The Town Trade Brains

DEDUCTION UNDER SECTION 80C TO 80U PDF

Home Loan Interest Rebate On Income Tax - Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021