Recovery Rebate Credit For 2023 If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2023 is the last year to get all the stimulus checks you might have missed It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS Either way you win

Recovery Rebate Credit is part of the Covid 19 Economic Relief program The credit makes it possible for those who didn t receive Economic Impact Payments also known as stimulus payments to claim their missing money Furthermore if you didn t file taxes for 2020 and missed out on the first and second stimulus checks of 1 200 and 600 respectively you can claim a Recovery Rebate Credit by filing a 2020

Recovery Rebate Credit For 2023

Recovery Rebate Credit For 2023

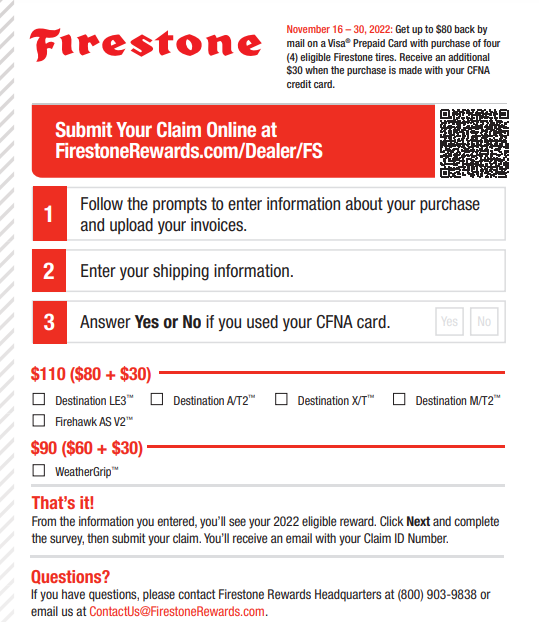

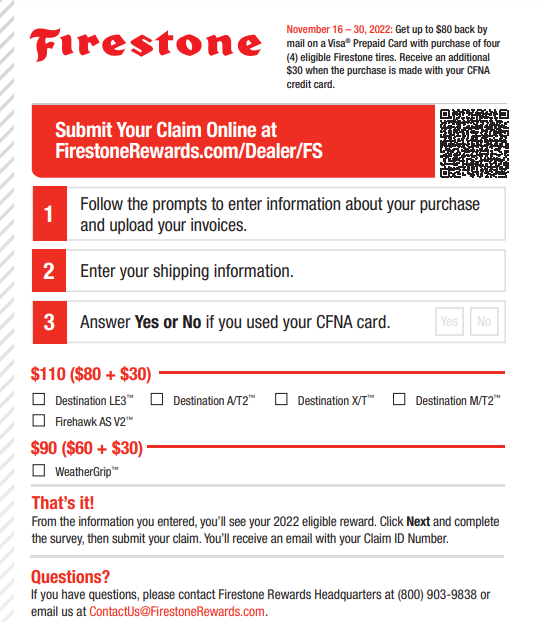

https://www.recoveryrebate.net/wp-content/uploads/2023/02/firestone-rebates-2023-printable-rebate-form.png

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/strategies-to-maximize-the-2021-recovery-rebate-credit-18.png

2023 Recovery Rebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/recovery-rebate-credit-2023.jpg?resize=980%2C551&ssl=1

The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if Your EIP 2 was less than 600 1 200 if married filing jointly plus 600 for IRS reminds eligible 2020 and 2021 non filers to claim Recovery Rebate Credit before time runs out Nov 17 2023 WASHINGTON The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable The payment will be sent to the bank account listed on the taxpayer s 2023 tax return or to the address of record An IRS letter will be sent to the taxpayer receiving these 2021 Recovery Rebate Credit payments If the taxpayer closed their bank account since filing their 2023 tax return taxpayers do not need to take any action

Download Recovery Rebate Credit For 2023

More picture related to Recovery Rebate Credit For 2023

2023 Recovery Rebate Credi Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2022-2023-credits-zrivo-5.jpg

Recovery Rebate Credit Qualifications 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2023-12.jpg

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-updates-recovery-rebate-credit-and-eip-guidance-scott-m-aber-cpa-pc-6.jpg

You must file your tax returns to receive the Recovery Rebate Credit However if you have not yet filed your 2021 tax returns you can still get the refund if you file and claim the credit by the Most eligible people already received their stimulus payments and are not eligible to claim a credit Recovery Rebate Credit To claim it you must file a tax return even if you otherwise are not required to file a tax return Your Recovery Rebate Credit will be included in your tax refund

[desc-10] [desc-11]

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

What Is The Recovery Rebate Credit 2023 Detailed Information

https://stimuluscheckadvisor.com/wp-content/uploads/2022/12/what-is-the-recovery-rebate-credit-2023-1024x576.jpg

https://taxconnections.com › a-guide-to-recovery...

If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2023 is the last year to get all the stimulus checks you might have missed It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS Either way you win

https://1040abroad.com › blog › dont-miss-out-a-guide...

Recovery Rebate Credit is part of the Covid 19 Economic Relief program The credit makes it possible for those who didn t receive Economic Impact Payments also known as stimulus payments to claim their missing money

Recovery Rebate Credit Married In 2023 Recovery Rebate

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Intoxalock Rebate Form 2023 Printable Rebate Form Rebate2022

2023 Recovery Rebate Form Recovery Rebate

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

Recovery Rebate Credit Child Born In 2023 Recovery Rebate

Recovery Rebate Worksheet 2023 Form Recovery Rebate

2023 Rebate Recovery Worksheet Recovery Rebate

Recovery Rebate Credit For 2023 - The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if Your EIP 2 was less than 600 1 200 if married filing jointly plus 600 for