Do You Pay Tax On Ppi Refunds You can only reclaim PPI tax going back four tax years as well as the

Published 11 May 2023 Last updated 30 January 2024 See all updates Get emails The tax is calculated on the year that you received the payout not the year you took out the PPI so if it was on 6 April 2016 or later you can reclaim the tax you ve paid You

Do You Pay Tax On Ppi Refunds

Do You Pay Tax On Ppi Refunds

https://www.income-tax.co.uk/wp-content/uploads/2022/03/Do-I-have-to-pay-tax-selling-on-Etsy-scaled.jpeg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Student Tax Deductions One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/11/students-tax-01.jpg

It is reported that most people don t need to pay the tax on their PPI refund interest Tax may have been deducted at source from the interest element of a payment

Interest from savings or payment protection insurance PPI income from a life or Opinion By Martin Lewis 20 24 6 Apr 2019 Updated 11 53 28 May 2020 Bookmark If you re one of the millions of people who ve shared in the 34billion of PPI repaid so far you may

Download Do You Pay Tax On Ppi Refunds

More picture related to Do You Pay Tax On Ppi Refunds

Your Tax Payments On Account Explained Clear Vision Accountancy

https://clearvisionaccountancygroup.co.uk/wp-content/uploads/2022/04/Email-Tax-POAs.png

Treasury Bond Vs Bank CD Rates Adjusting For State And Local Income

https://www.mymoneyblog.com/wordpress/wp-content/uploads/2022/07/cd_vs_ust1.gif

Should I Reduce My Payments On Account MYVO

https://myvo.ltd/wp-content/uploads/2020/12/tax-668604-scaled.jpg

Yet unlike savings which are now paid without any tax taken off PPI pay outs still automatically have 20 tax deducted before you received it So if like most people you haven t Unfortunately you aren t able to reclaim tax on PPI payouts received before April 6 th 2016 as you are only able to go back four years including the current year so the 5 th of April 2016 is the current cut off

In the case that the PPI settlement was paid after September 2013 the Yet unlike savings which are now paid without any tax taken off PPI payouts still

/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Do You Pay Capital Gains On Primary Residence

https://www.thebalance.com/thmb/lvhxPeyMxhqcJnlGx8nV8-iFFeo=/1500x1000/filters:fill(auto,1)/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png

Should I Move To Low Rate Accounts To Avoid Paying Savings Tax

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1iGH0G.img?w=1908&h=1146&m=4&q=68

https://www.dailyrecord.co.uk/lifestyle/money/...

You can only reclaim PPI tax going back four tax years as well as the

https://www.gov.uk/guidance/claim-a-refund-of...

Published 11 May 2023 Last updated 30 January 2024 See all updates Get emails

What Are The Dividend Tax Rates In The UK TaxScouts

/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Do You Pay Capital Gains On Primary Residence

How Much Tax Do You Pay On Forex Trading

How To Pay Tax On ETF Askaboutmoney The Irish Consumer Forum

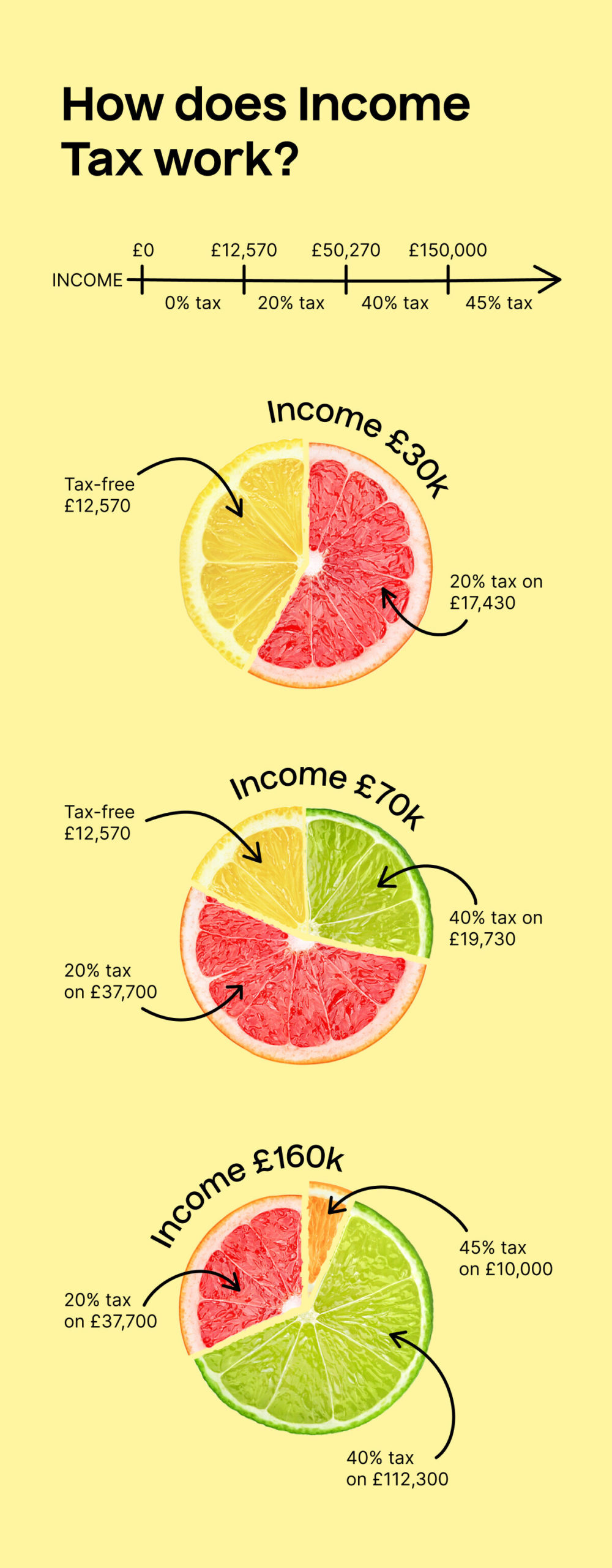

How Much Can You Earn Before Paying Income Tax

How Do You Pay Off Aggressively Debt Leia Aqui What Are The 3 Biggest

How Do You Pay Off Aggressively Debt Leia Aqui What Are The 3 Biggest

Have You Paid Excessive Tax On Your PPI Refund Instant Bazinga

Poster Calling For Annual Tax Payment Pay Taxes Vector Image

Do You Pay Tax On A Property Investment Ep154

Do You Pay Tax On Ppi Refunds - Most people paid too much tax on their PPI refunds Enter a few details about your