Do You Pay Tax On Private Pension Payments You may have to pay Income Tax at a higher rate if you take a large amount from a private pension You may also owe extra tax at the end of the tax year If your private

You pay tax when you take money out of a pension Limits to your tax free contributions You usually pay tax if savings in your pension pots go above 100 of your earnings in a Do you pay tax on your pension Yes income from pensions is taxed like any other kind of income You have a personal allowance 12 570 for the 2023 24 tax year on which you pay no income tax Then you pay 20 tax on income of between 12 571 to 50 270 before higher rate tax of 40 kicks in

Do You Pay Tax On Private Pension Payments

Do You Pay Tax On Private Pension Payments

https://dinhcuchauau.net.vn/wp-content/uploads/2019/12/2.jpg

![]()

Save Money On Overtime Payments With The Fluctuating Work Week

https://2.bp.blogspot.com/-TOhGgJrGL2I/Wpfxz25369I/AAAAAAAAjps/8BNHisbLXX4bagJCswc7VIDc1MI_g818wCLcBGAs/s1600/rawpixel-com-552391-unsplash.jpg

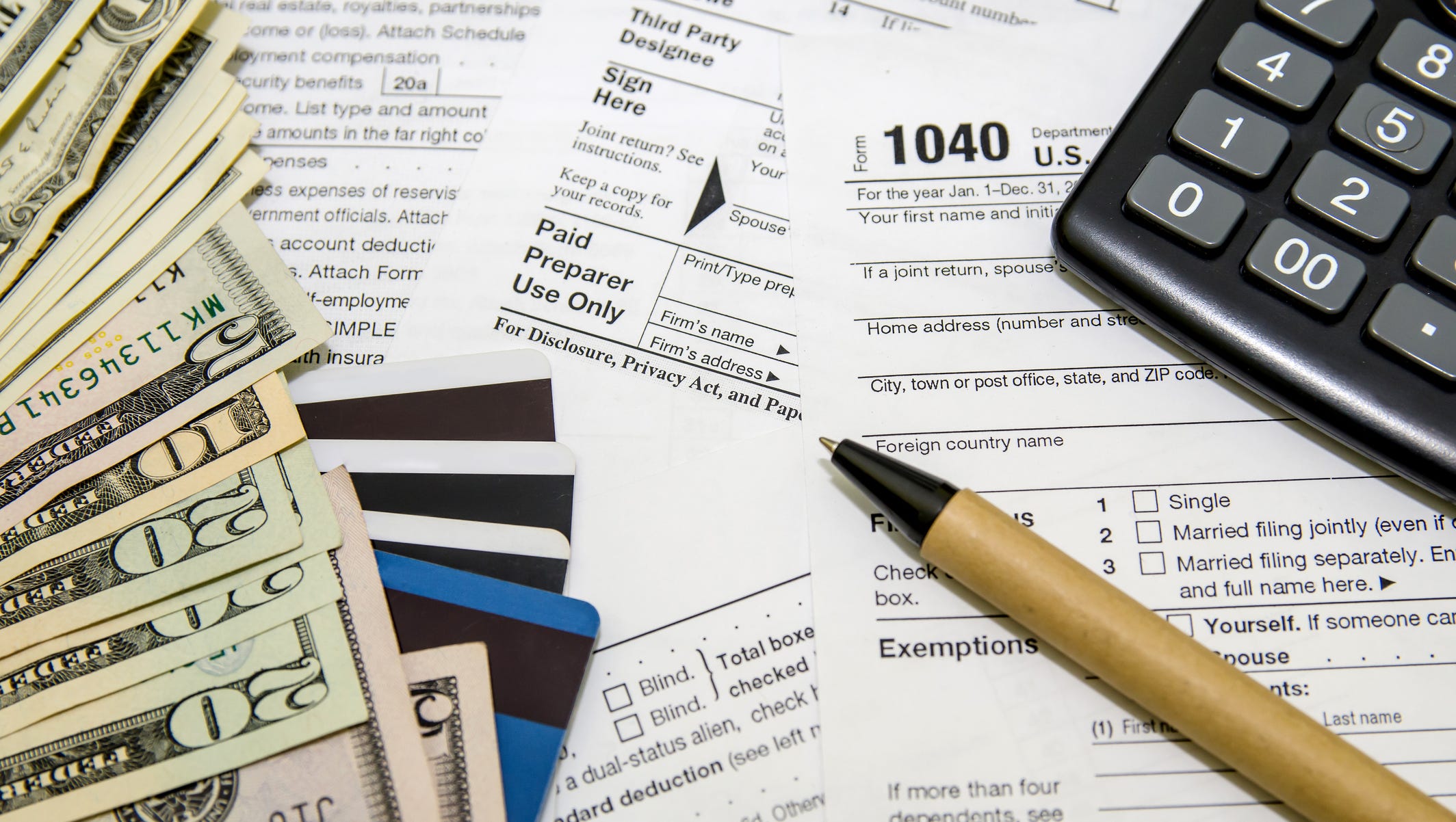

When Is It Worth It To Pay Taxes With A Credit Card

https://www.gannett-cdn.com/-mm-/2836aaa5a122ccfaf3f251ad914b02ff84c86c72/c=0-103-2128-1305/local/-/media/2017/04/03/USATODAY/USATODAY/636268502332211071-GettyImages-495699718.jpg?width=2128&height=1202&fit=crop&format=pjpg&auto=webp

Tax on pension income is collected as tax on employment income pension providers deduct income tax through the Pay As You Earn PAYE system before making pension payments but many pensioners have to fill in a tax return each year to ensure that the correct amount of tax is paid May 13 2022 at 2 56 p m Getty Images It s important to understand the tax implications when you start receiving pension income Some companies and government organizations provide a

Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax How do I pay tax on my private pensions Income you receive from private pensions either directly from an employer s pension scheme or from annuities bought with your pension funds is paid with tax already deducted via PAYE

Download Do You Pay Tax On Private Pension Payments

More picture related to Do You Pay Tax On Private Pension Payments

Hidden Benefits Putting Your Family On The Payroll For Tax Purposes

http://www.nxtgennexus.com/wp-content/uploads/2017/08/Taxes_stock-1080x675.jpg

Do You Pay Your Employees A Salary Integrated HR

https://www.humanresourcing.com.au/wp-content/uploads/2020/09/iStock-1168563407.jpg

Top 1 Pay Nearly Half Of Federal Income Taxes

https://image.cnbcfm.com/api/v1/image/102558054-538528619.jpg?v=1532564324

Pension lump sum withdrawal tax calculator Calculate how much tax you ll pay when you withdraw a lump sum from your pension in the 2022 23 and 2021 22 tax years When you re 55 or older you can withdraw some or all of your pension pot even if you re not yet ready to retire The first 25 of the withdrawal is tax free the remainder is The Standard Personal Allowance is 12 570 2023 24 This means you re able to earn or receive up to 12 570 in the 2023 24 tax year 6 April to 5 April and not pay any tax This is called your Personal Allowance If you earn or receive less than this you re a non taxpayer

In England pensions tax relief is paid at the highest rate of income tax that you pay determined by your income So either basic rate 20 higher rate 40 or additional rate 45 This means that if basic rate taxpayers pay 80 into a pension it will be topped up to 100 through the tax relief at 20 Introduction In general income you get from pensions is taxable This page explains how income from pensions is taxed When you retire you may get part of your pension as a lump sum There is tax relief on lump sums at retirement Occupational pensions Occupational pensions are taxable

Tax Burdens 7 States With The Highest Income Tax

https://www.gannett-cdn.com/-mm-/3eb9009c1a9366e33a28c376eca11ea26824544a/c=0-44-580-370/local/-/media/2017/10/09/USATODAY/usatsports/MotleyFool-TMOT-868f711c-taxes_large.jpg?width=3200&height=1680&fit=crop

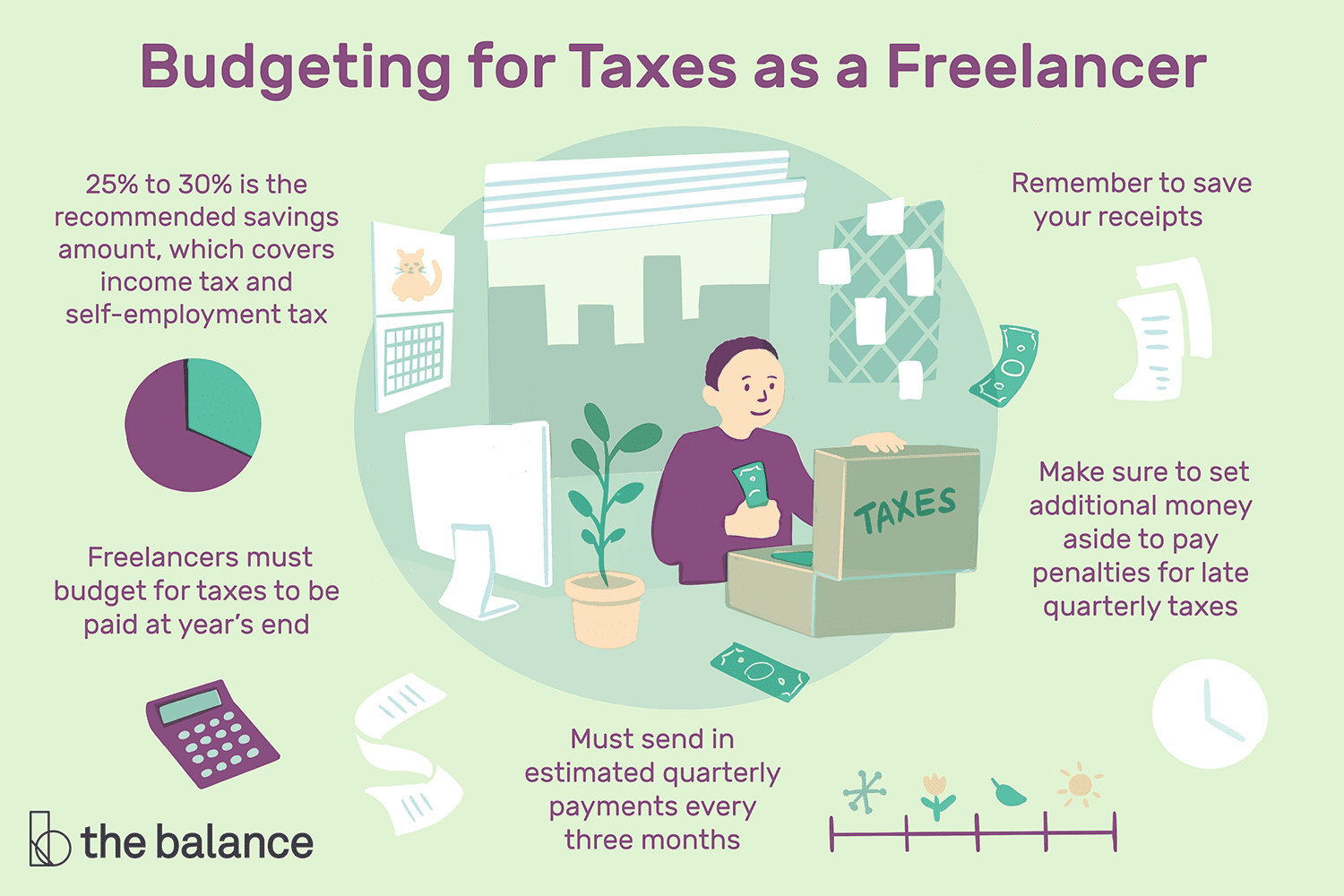

Let s Talk About Taxes SoundGirls

https://soundgirls.org/wp-content/uploads/2021/05/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png

https://www.gov.uk/tax-on-pension

You may have to pay Income Tax at a higher rate if you take a large amount from a private pension You may also owe extra tax at the end of the tax year If your private

https://www.gov.uk/tax-on-your-private-pension

You pay tax when you take money out of a pension Limits to your tax free contributions You usually pay tax if savings in your pension pots go above 100 of your earnings in a

INPRS PERF Pension Payment Dates

Tax Burdens 7 States With The Highest Income Tax

Beware Of Hidden Taxes In Retirement

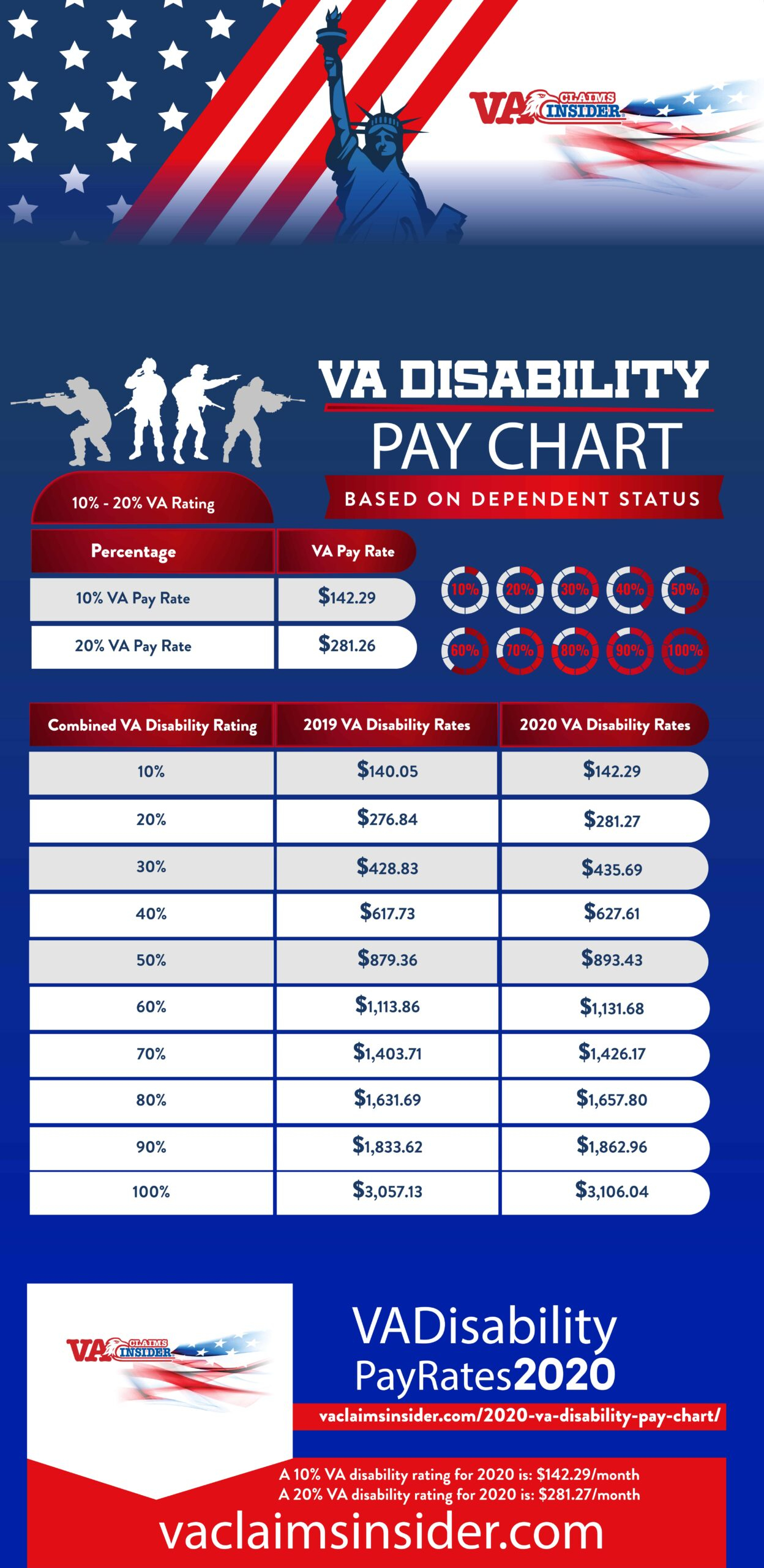

VA Disability Payment Increase VA Disability Rates 2021

Do YOU Pay TAXES Watch This Video Plus INSTITUTIONAL DOMINANCE Of

Do You Pay Tax On A Transfer Of Equity SAM Conveyancing

Do You Pay Tax On A Transfer Of Equity SAM Conveyancing

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Do You Pay Capital Gains On Primary Residence

Pension Payments What Tax Relief Is Available Accotax

Do You Pay Tax On Private Pension Payments - How do I pay tax on my private pensions Income you receive from private pensions either directly from an employer s pension scheme or from annuities bought with your pension funds is paid with tax already deducted via PAYE