Do You Pay Tax On Retirement Income Web 7 Juni 2023 nbsp 0183 32 Retirement income from tax deferred 401 k s or Traditional IRAs is taxable as is pension annuity amp Social Security income Roth IRA income usually isn t taxable

Web 31 Juli 2022 nbsp 0183 32 Up to 85 of your Social Security benefits may be taxable depending on your total income and your filing status Distributions from 401 k and traditional IRA accounts are generally taxable Web Taxation of Retirement Income Taxation of Social Security Benefits Many older Americans are surprised to learn they might have to pay tax on part of Taxes on Pension Income You have to pay income tax on your pension and on withdrawals from any tax deferred Taxes on IRAs and 401 k s Once

Do You Pay Tax On Retirement Income

Do You Pay Tax On Retirement Income

https://www.retirementnewsdailypress.com/wp-content/uploads/2021/12/Do-you-pay-tax-and-NI-on-pension.png

Do You Pay Tax On Pension A Retirement Tax Guide

https://www.fourwealthmanagement.co.uk/wp-content/uploads/2019/09/Tax-when-retired.jpg

At What Rate Do You Pay Tax On Dividends Retirement Income

https://retirementincome.net/wp-content/uploads/2016-tax-tables.png

Web In Germany pension income is taxed at the same level as income from employment Ultimately this means that pensioners benefit from the same tax free allowances as workers Tax rates range from 0 to 45 depending on your income but no tax is payable on the first 9 744 19 488 for a married couple You can learn how to calculate your Web Since 2005 pensioners living abroad who draw retirement income from Germany within the meaning of 167 22 No 1 Sentence 3a of the German Income Tax Act have generally been subject to limited income tax liability 167 49 Sec 1 No 7 of the German Income Tax Act As of 2009 certain retirement income drawn from Germany within the meaning of

Web 23 Feb 2020 nbsp 0183 32 Assuming you have income in retirement you will be subject to at least some income taxes in your golden years Web 31 Mai 2022 nbsp 0183 32 How To Estimate Taxes in Retirement Social Security Income You probably won t pay any taxes in retirement if Social Security benefits are your only source IRA and 401 k Withdrawals Withdrawals from tax deferred retirement accounts are taxed at ordinary income tax rates Pension Income Most

Download Do You Pay Tax On Retirement Income

More picture related to Do You Pay Tax On Retirement Income

At What Rate Do You Pay Tax On Dividends Retirement Income

https://i0.wp.com/www.retirementincome.net/wp-content/uploads/at_what_rate_do_you_pay_tax_on_dividends.jpg?fit=1200%2C900&ssl=1

Will You Pay Taxes On Retirement Income You Decide

https://imageio.forbes.com/blogs-images/hollymagister/files/2014/10/Taxes-on-Retirement-Income-e1414633690735.png?format=png&width=1200

Where Do Americans Take Their Retirement Income Tax Foundation

https://files.taxfoundation.org/20170113143213/RetirementIncome.png

Web 22 Feb 2023 nbsp 0183 32 The U S tax laws consider most forms of retirement income fair game including Social Security benefits pensions and withdrawals from your 401 k s and traditional IRAs And unless you Web 20 Dez 2023 nbsp 0183 32 David Kindness Fact checked by Vikki Velasquez When you withdraw funds from your 401 k or take distributions you begin to enjoy the income from this retirement saving mainstay and face

Web 1 Nov 2022 nbsp 0183 32 With some proactive tax planning you can drastically reduce the taxes you will owe on your retirement income You might even be able to increase your tax free retirement income Taxes On Social Web 31 M 228 rz 2023 nbsp 0183 32 Sometimes the answer is zero you owe no taxes In other cases you owe income tax on the money you withdraw You can even owe an additional penalty if you withdraw funds before age

How To Minimize Tax On Retirement Income The Wellings

https://www.mywellings.com/wp-content/uploads/2022/04/Wellings-Blog-How-to-minimize-tax-on-retirement-income.2-1400x700.jpg

What Are The Best Sources Of Retirement Income Springwater Wealth

https://springwaterwealth.com/wp-content/uploads/2021/04/Retirement-Income-1080x675.jpeg

https://www.nerdwallet.com/.../is-retirement-income-taxable

Web 7 Juni 2023 nbsp 0183 32 Retirement income from tax deferred 401 k s or Traditional IRAs is taxable as is pension annuity amp Social Security income Roth IRA income usually isn t taxable

https://www.investopedia.com/articles/retirement/12/will-you-pay-taxes...

Web 31 Juli 2022 nbsp 0183 32 Up to 85 of your Social Security benefits may be taxable depending on your total income and your filing status Distributions from 401 k and traditional IRA accounts are generally taxable

Do You Pay Tax On The State Pension Rules Explained Personal Finance

How To Minimize Tax On Retirement Income The Wellings

At What Rate Do You Pay Tax On Dividends Retirement Income

Every State With A Progressive Tax Also Taxes Retirement Income

Tips To Minimize Tax On Your Retirement Income

The Tax Bite On Retirement Income May Surprise Retirees Putnam Wealth

The Tax Bite On Retirement Income May Surprise Retirees Putnam Wealth

Retirement Planning Calculator Excel Early Retirement

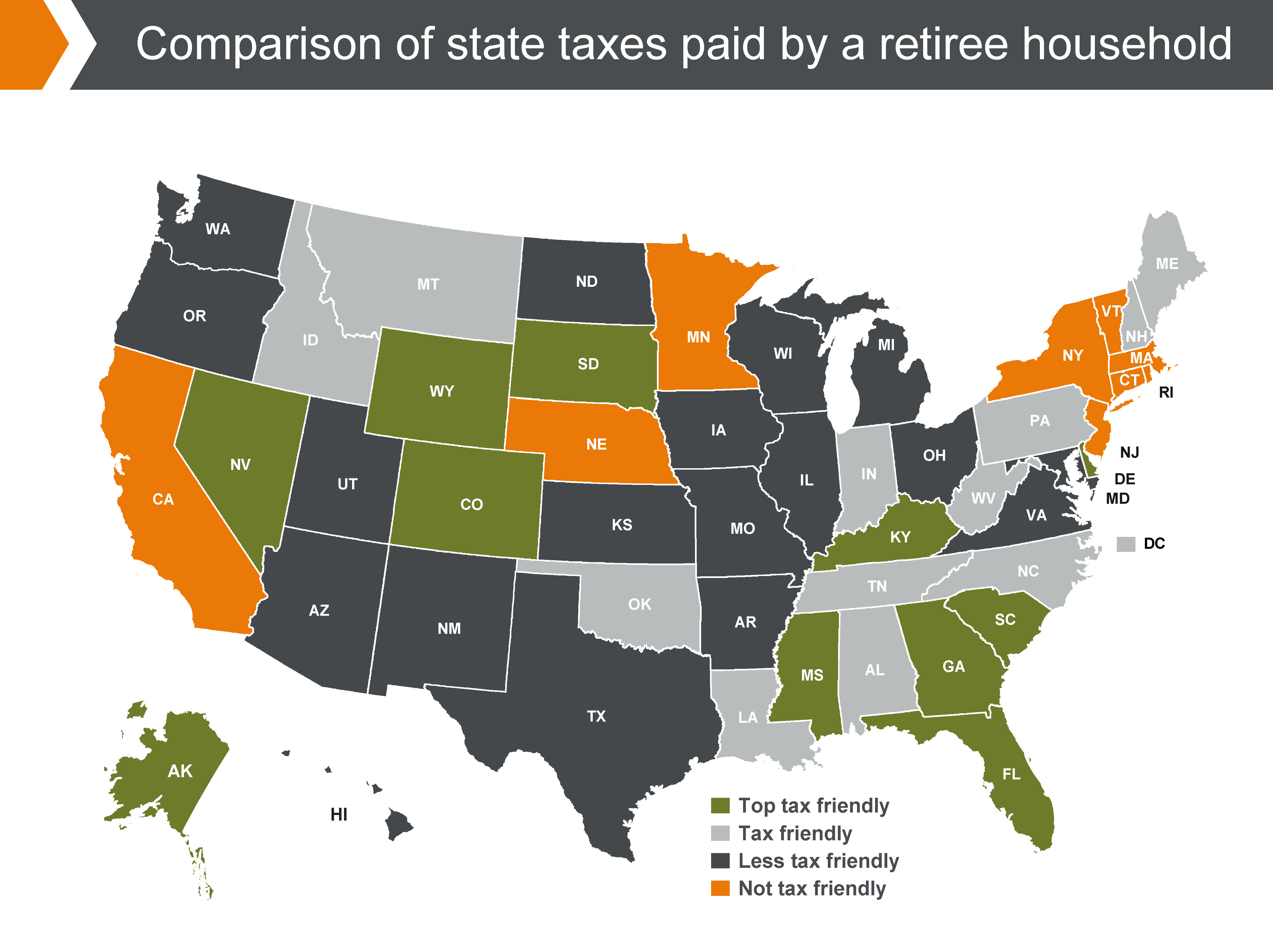

Retiring These States Won t Tax Your Distributions

States With The Highest and Lowest Taxes For Retirees Money

Do You Pay Tax On Retirement Income - Web 13 Feb 2023 nbsp 0183 32 Not all retirement accounts are taxed the same In fact you don t have to pay any taxes on withdrawals from Roth IRAs and Roth 401 k plans Your after tax contributions allow you to receive funds tax free in retirement as long as you have owned the account for at least five years You can expect to pay taxes though on any tax