Do You Pay Taxes On Rebates Web rebates taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered

Web 27 mars 2023 nbsp 0183 32 If too much tax was deducted at source or you qualified for tax reductions and credits you will receive a refund It will be paid on the date indicated on the notice Web 22 d 233 c 2021 nbsp 0183 32 When coupons or certificates are accepted by retailers as a part of the selling price of any taxable item the value of the coupon or certificate is excludable from

Do You Pay Taxes On Rebates

Do You Pay Taxes On Rebates

https://www.mytaxrebate.ie/wp-content/uploads/2020/10/How-It-Works-Webpage-Content-Final-Resized.png

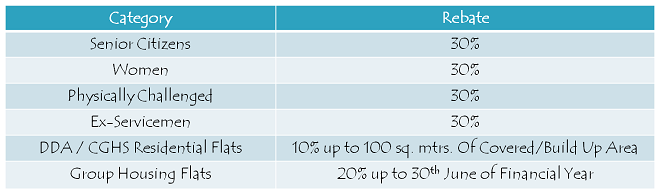

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Hecht Group Who Is Responsible For Commercial Property Taxes In

https://img.hechtgroup.com/do_you_pay_tax_on_commercial_property.aspx

Web 1 d 233 c 2022 nbsp 0183 32 The eligibility requirements for tax rebates vary widely but generally taxpayers do not have to wait until they file next year s tax return to receive payment In many cases your tax rebate check isn t directly Web 5 mai 2022 nbsp 0183 32 Key Takeaways Whether credit card rewards are taxable as income depends on how the rewards are received If earned through the use of the card like a cash back

Web 11 f 233 vr 2021 nbsp 0183 32 Stimulus payments aren t taxable but they could indirectly affect what you pay in state income taxes in a handful of states where federal tax is deductible against Web 11 mars 2023 nbsp 0183 32 Taxes Do You Have to Pay Taxes on a State Stimulus or Rebate Check from Last Year At least 22 states gave residents money back last year but only a few

Download Do You Pay Taxes On Rebates

More picture related to Do You Pay Taxes On Rebates

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Business Office Taxes

http://www.svpanthers.org/cms/lib/PA02203711/Centricity/Domain/14/PropertyTaxRebate_2018.jpg

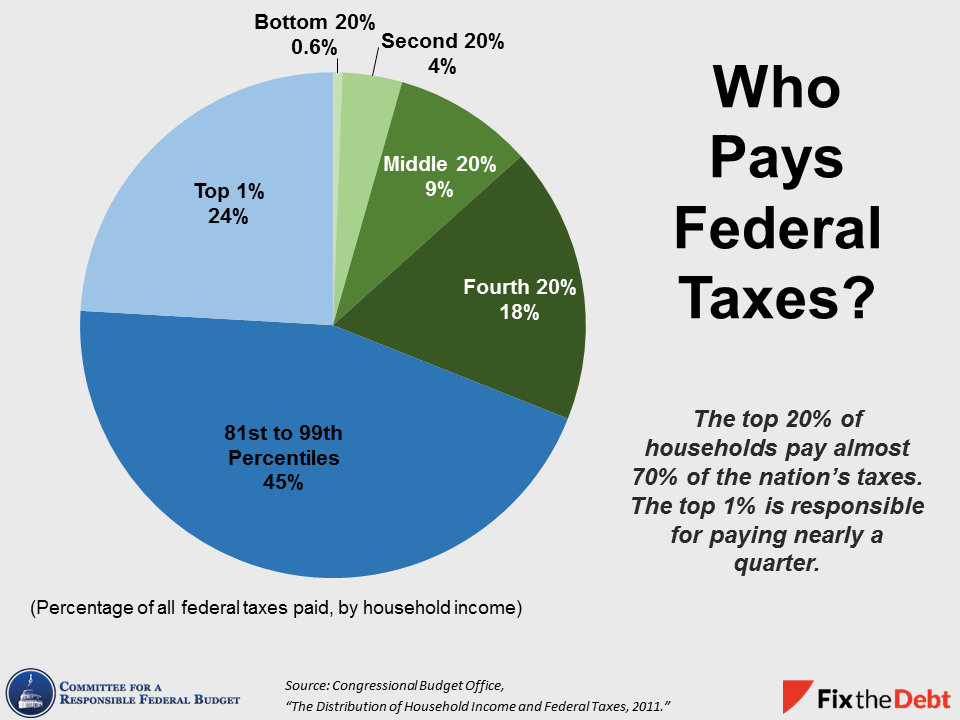

Media Elon Musk Offers To Buy Twitter Page 195 ChiefsPlanet

https://crfb.org/sites/default/files/3-whopaysfederaltaxes.png

Web Are sales taxes calculated before or after a rebate or incentive is applied The short answer is it depends on the state Please see What Fees Should You Pay for detailed Web 6 juin 2019 nbsp 0183 32 The short answer to this kind of question is no Rebates in general are not taxable income to an individual taxpayer unless that person first took a tax deduction

Web So what this means is if you purchase a car for 25 000 and there is a 3 000 cash back rebate you will be taxed on the full 25 000 before the rebate is subtracted In a state Web 29 mai 2022 nbsp 0183 32 The rebate payment is not subject to tax E A retailer buys products from either a wholesaler or the manufacturer of products Retail sales of these products are

Cryptoasset And NFT Regulation Litigation And Tax Sterling law

https://sterling-law.co.uk/wp-content/uploads/2023/02/na-cryptocurrency-tax-guide.jpg

Tips To Finding Tax Rebates Without The Hassle

https://cdn.techgyd.com/tax-rebate.jpg

https://donotpay.com/learn/are-rebates-taxable

Web rebates taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered

https://www.impots.gouv.fr/international-particulier/methods-payment

Web 27 mars 2023 nbsp 0183 32 If too much tax was deducted at source or you qualified for tax reductions and credits you will receive a refund It will be paid on the date indicated on the notice

Onlyfans FAQ 2022 All Your Onlyfans Questions ANSWERED

Cryptoasset And NFT Regulation Litigation And Tax Sterling law

Taxes On Social Security Benefits YouTube Social Security Benefits

MCD Property Tax Calculating Tax Online Payment Past Payment

Do You Pay Taxes On Reinvested Dividends

Do You Pay Taxes On Your Car Every Year At Hal McInerney Blog

Do You Pay Taxes On Your Car Every Year At Hal McInerney Blog

Do You Pay Taxes On A Settlement

Do You Pay Tax On Loan Notes Note Brokering

When Do You Pay Taxes On Stocks TaxesTalk

Do You Pay Taxes On Rebates - Web 5 mai 2022 nbsp 0183 32 Key Takeaways Whether credit card rewards are taxable as income depends on how the rewards are received If earned through the use of the card like a cash back