Do You Pay Uk Tax On Overseas Rental Income You may need to pay UK Income Tax on your foreign income such as wages if you work abroad foreign investment income for example dividends and savings interest rental income on

Find out whether you need to pay tax on your UK income while you re living abroad non resident landlord scheme tax returns claiming relief if you re taxed twice personal allowance of You will need to pay tax on rental income gained by renting out a property in the UK Tax may also be liable on gains made when selling residential property in the United Kingdom HM Revenue and Customs will class you as a non resident landlord if you live abroad for 6 months or more per year

Do You Pay Uk Tax On Overseas Rental Income

Do You Pay Uk Tax On Overseas Rental Income

https://i.ytimg.com/vi/9BuupuadmeU/maxresdefault.jpg

How Much Tax Do You Pay In The U K Guidelines

https://www.expatustax.com/wp-content/uploads/2023/03/How-much-tax-do-you-pay-UK.jpg

Do You Pay Tax When You Sell Your House UK AccountingFirms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/08/Do-You-Pay-Tax-on-Selling-Your-House-in-the-UK.png

UK residents are taxed on overseas property rental income in the same way as income from a property located in the UK The first 1 000 of rental property income may be tax free because of the property allowance for UK income tax If you live and pay tax in the UK you must tell HMRC about any rental income you receive from any overseas properties you own This guide explains what you need to do

If you re an expat earning income from property or land that you rent out in the UK often it s subject to UK Income Tax Much depends on how much rental income and other income you receive If the overseas country in which you live taxes your UK income you may be able to claim tax relief in the UK to avoid being taxed twice but only if that country has a double taxation agreement with the UK

Download Do You Pay Uk Tax On Overseas Rental Income

More picture related to Do You Pay Uk Tax On Overseas Rental Income

HOW MUCH TAX DO YOU PAY ON STOCKS YouTube

https://i.ytimg.com/vi/QLHnSnJ-abU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgQSgvMA8=&rs=AOn4CLA3pyWPITGLVQFyo7v4tbZotShRZg

How Much TAX Do You Pay UK Income Tax Explained In shorts YouTube

https://i.ytimg.com/vi/TVvQNWTj9f0/maxresdefault.jpg

How Much Income Tax Do You REALLY Pay UK Taxes Explained YouTube

https://i.ytimg.com/vi/fV6UEYIqBDM/maxresdefault.jpg

If you are a UK tax resident you will be required to pay tax on any income and gains made in the UK as well as abroad For those who are not considered to be UK residents all UK income and gains will be subject to UK taxation but any foreign earnings will be exempt You would pay UK tax on the overseas rental income as follows UK rental income covered by personal allowance so no tax due Overseas rental income 10 000 less 2 570 balance of personal allowance 7 430 at 20 1 486 fully covered by the 1 800 overseas tax paid

Rental income from UK residential property when you live overseas is subject to UK Income Tax rules while making a profit a gain from selling UK property or land can also mean you owe Capital Gains Tax Under UK tax law a person who is resident ordinarily resident and domiciled in the UK is liable to UK tax on income arising anywhere in the world regardless of whether it is remitted to the UK This rule applies equally to rent derived from letting property overseas

![]()

Web3 Tax The Complete Guide Cointracking

https://cointracking.info/wp-content/uploads/2023/03/Full-Service-Dark.png

Do You Pay Your Employees A Salary Integrated HR

https://www.humanresourcing.com.au/wp-content/uploads/2020/09/iStock-1168563407.jpg

https://www.gov.uk/tax-foreign-income

You may need to pay UK Income Tax on your foreign income such as wages if you work abroad foreign investment income for example dividends and savings interest rental income on

https://www.gov.uk/tax-uk-income-live-abroad

Find out whether you need to pay tax on your UK income while you re living abroad non resident landlord scheme tax returns claiming relief if you re taxed twice personal allowance of

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

Web3 Tax The Complete Guide Cointracking

Tax Burdens 7 States With The Highest Income Tax

Tax On Overseas Property Which

When Do You Pay Your Accountant Paris Accounting Corp

How Much Tax Do You Pay On Your Equity Investments Mint

How Much Tax Do You Pay On Your Equity Investments Mint

Top 1 Pay Nearly Half Of Federal Income Taxes

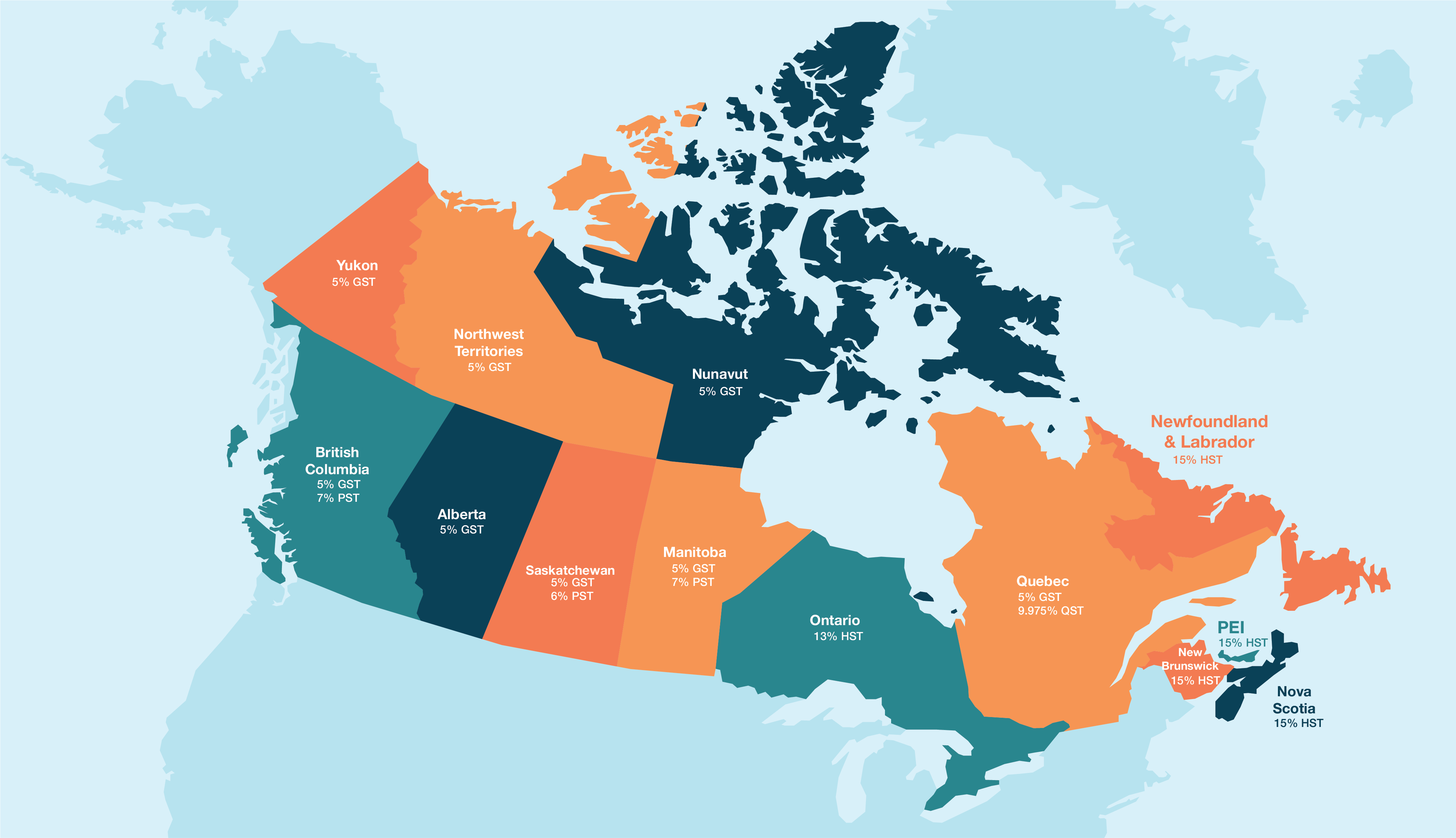

Canadian Sales Tax Registration Requirements Crowe Soberman LLP

Do YOU Pay TAXES Watch This Video Plus INSTITUTIONAL DOMINANCE Of

Do You Pay Uk Tax On Overseas Rental Income - If you re an expat earning income from property or land that you rent out in the UK often it s subject to UK Income Tax Much depends on how much rental income and other income you receive