Does A New Gas Furnace Qualify For Tax Credit Furnaces Natural Gas Oil Tax Credits This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work Oil furnaces or hot water boilers can alternately qualify if they 1 meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer for use with fuel blends at least 20 percent of the volume of which consists of an eligible fuel or 2 if placed in service after December 31 2026 achieves an annual fuel efficiency rate

Does A New Gas Furnace Qualify For Tax Credit

Does A New Gas Furnace Qualify For Tax Credit

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Lexus Responds To EV Price Wars With Whopping RZ Discount CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/1156000/300/1156312.jpg

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed property from 2022 through 2032 Key Takeaways The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential Clean Energy Credit provides tax credits for the purchase of qualifying equipment including solar wind geothermal and fuel cell technology

The 25C credit has an annual cap of 1 200 except heat pump Up to 600 each for a qualified air conditioner or gas furnace Up to 2 000 with a qualified heat pump heat pump water heater or boiler There are no income requirements for this tax credit and it cannot be combined with other federal programs Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

Download Does A New Gas Furnace Qualify For Tax Credit

More picture related to Does A New Gas Furnace Qualify For Tax Credit

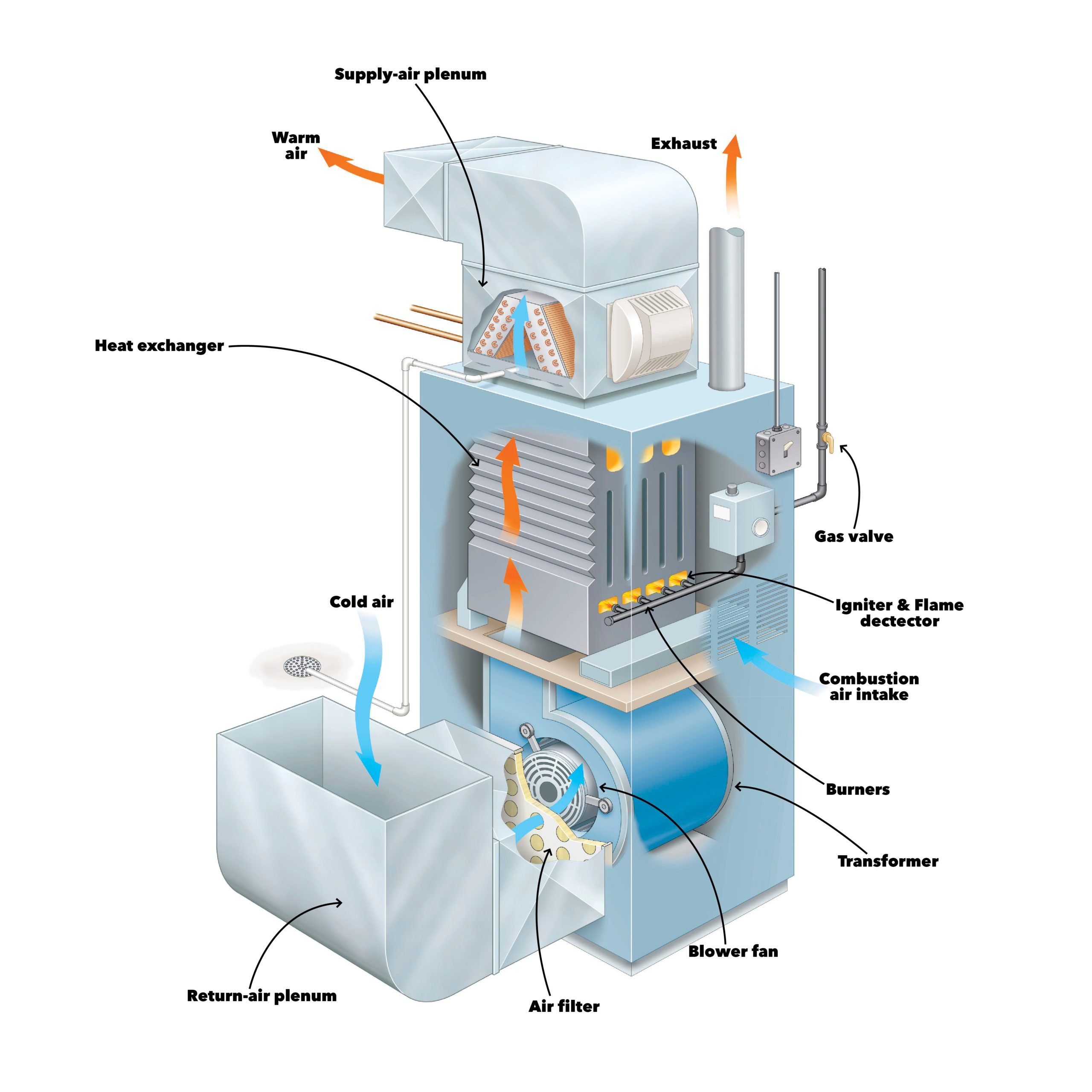

How Does A Gas Furnace Work The Family Handyman

https://www.familyhandyman.com/wp-content/uploads/2021/01/Furance-Illustration_AS-scaled.jpg

Ev Car Tax Rebate Calculator 2024 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

You can earn 30 of the project cost or a maximum of 600 credit for installing a qualified gas furnace ENERGY STAR certified gas furnaces with AFUE at or above 97 are eligible Tax Credits for Other Energy Efficient Home Improvements The inflation Reduction Act IRA includes tax credits that reward homeowners for purchasing qualifying high efficiency HVAC systems including furnaces ACs heat pumps fans and more Published January 3 2023

The amended Energy Efficient Home Improvement Credit which begins in 2023 and extends through 2032 increases the tax credits as high as 600 for qualified air conditioner or gas furnace and up to 2000 for qualified heat pump heat pump water heater or boiler You may be eligible for the maximum credit every year you make qualifying improvements until 2032 to be claimed by 2033 tax season Upgrading to a high efficiency gas furnace like the Lennox Elite Series EL297V makes you eligible for the Energy Efficient Home Improvement Credit delivering comfort and savings

Most Efficient Natural Gas Furnaces Buying Recommendations

https://www.remodelingcosts.org/wp-content/uploads/2017/08/gas-furnace-installation.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

https://www.energystar.gov › about › federal-tax...

Furnaces Natural Gas Oil Tax Credits This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim

https://www.irs.gov › newsroom › irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

These Electric Cars Qualify For The EV Tax Credits

Most Efficient Natural Gas Furnaces Buying Recommendations

New Furnace Cost Gas Furnace Replacement Vs Repair 2019

Possible Problems With Gas Furnace Heat Exchanger YouTube

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions

.jpg)

Does The Ac Use Gas Or Electricity

.jpg)

Does The Ac Use Gas Or Electricity

Compact Gas Furnace JLC Online

Calgary Alberta Canada Sep 21 2020 A Home Goodman High Efficiency

Lennox Furnace Pilot Light Keeps Going Out Shelly Lighting

Does A New Gas Furnace Qualify For Tax Credit - Key Takeaways The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential Clean Energy Credit provides tax credits for the purchase of qualifying equipment including solar wind geothermal and fuel cell technology